bedo

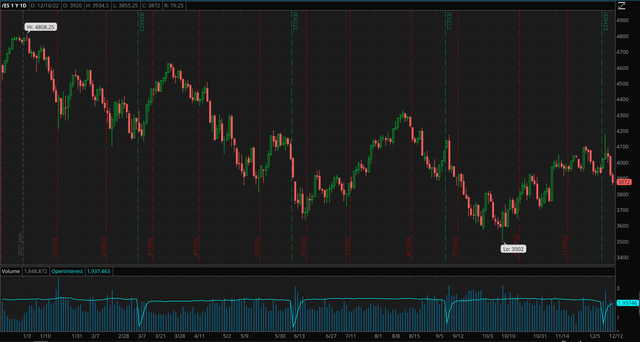

Let’s face it! We’re in a bear market until proven otherwise, and I still need convincing evidence that this downturn is over. We see the price action we expect during a bear market (powerful countertrend rallies followed by lower lows). My recent “Near-term Top is Here” article discussed why the S&P 500’s (SP500) 4,100 level likely marked the top in the recent countertrend run-up. We’re at another inflection point, and the market could move substantially lower.

SPX Chart: 1-Year

We’ve seen several similar rallies over the last year, and this one was very comparable to the prior’s. SPX skyrocketed by approximately 19% from the 3,500 recent low. Since then, we saw a double top followed by a bearish reversal. The technical image implies that we may get an end-of-the-year drop instead of a Santa Clause rally. Furthermore, fundamental factors have aligned and support the deteriorating technical image.

The Fed Chair had the opportunity to give stocks and other risk assets the green light but didn’t. Instead, the bearish rhetoric implies the Fed is prepared to put the economy through a deeper recession to bring inflation back down to around 2%. Therefore, there will likely be more near-term pain for the S&P 500 and stocks in general. I’m staying hedged and limiting my risk exposure while raising cash to enter the market at lower levels. My SPX bottom buy-in range remains 3,200 – 2,800.

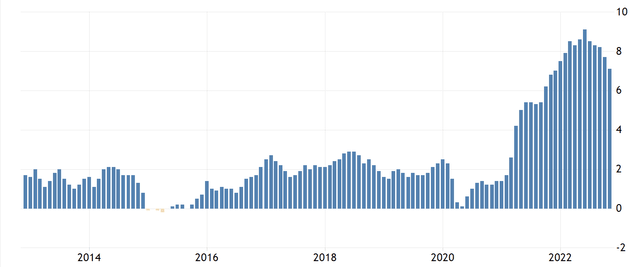

Why The Stock Market Will Likely Go Lower

Despite the recent progress on inflation and the 50 Bps rate increase, the Fed remains hawkish. Jerome Powell did not deliver a dovish speech at the FOMC’s recent press conference. The Fed Chair said it’s good to see progress, but we still have a long way to get back to price stability. Price stability means having inflation run down at about 2%. The Fed had inflation down at around 2% for much of the last decade. However, the recent rise has been different, and despite some progress, inflation is still very high at 7.1%.

CPI Inflation: 10-Years

It’s not going to be a smooth ride from here, and I think The Fed Chair realizes this. If the Fed takes its foot off the gas too quickly, inflation could spike back up, which is the last thing the agency wants to see. The Fed would instead put the economy and the market through a difficult period to get inflation back down to a reasonable target rate. We often hear Chair Powell speaking about the economy needing to endure more pain before the objectives on inflation are achieved. Therefore, the Fed will continue raising rates soon, which should continue negatively impacting the economy.

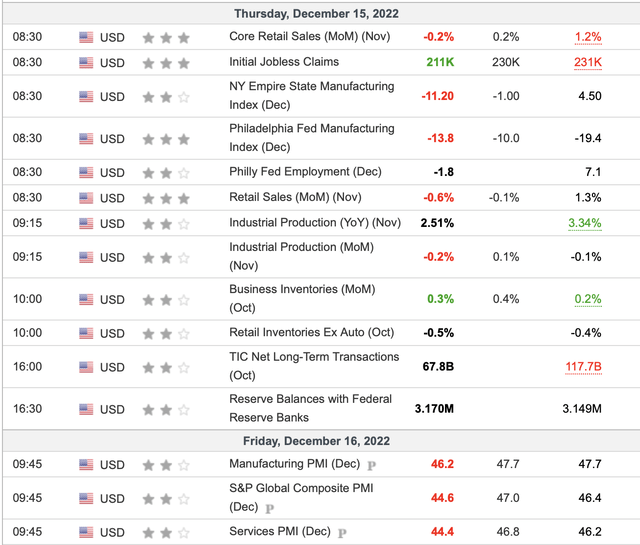

Cracks in the Data

Recent retail sales, manufacturing, and other data have been disappointing, even with the lowered estimates. We see many numbers turn negatively, and PMIs below 50 signal contraction. Therefore, we’re likely in the initial stage of this dynamic, where the data worsens, signaling a deepening economic recession. Jobs reports have held up very well, but that may be the next domino to fall.

Many major corporations are initiating mass layoffs. Through mid-November, 73,000 employees were laid off in the U.S. tech sector alone. Of course, technology is not the only sector conducting layoffs, as many companies attempt to optimize costs in this challenging macroeconomic environment. The problem is that mass layoffs are just starting and likely will continue for some time.

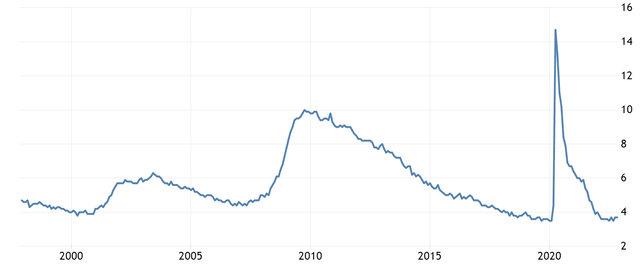

The Unemployment Rate

Unemployment rate (tradingeconomics.com)

The unemployment rate is around a rock bottom at 3.7% now. However, the unemployment rate increased from 3.5% in the prior month and came in above the 3.6% projected estimates. Therefore, we’re already beginning to see a tick-up in unemployment, despite the participation being relatively low. Continuing layoffs should bring future job estimates into question, as the economy may lose more jobs than it adds. In this scenario, the economic outlook could weaken, leading to more selling in the SPX. Nevertheless, the Fed Chair seems intent on keeping monetary conditions very tight, which could exacerbate the situation leading to lower lows in the S&P 500.

Here’s What I’m Doing to Stay Ahead

Getting hedged is crucial in this environment. Therefore, I initiated several hedges on some riskier tech holdings on December 6th. More specifically, I implemented collars on Lucid (LCID), Zoom (ZM), AMD (AMD), NVIDIA (NVDA), and (SQ). Moreover, as SPX support broke down around 3,900, I opened additional collar hedges on several other companies in The AWP to profit from the potential downside in the equity markets.

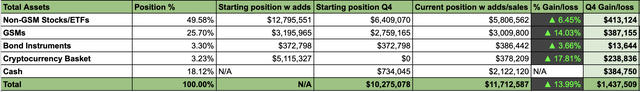

The All-Weather Portfolio

The AWP (The Financial Prophet)

Note: Portfolio results don’t include recent collar hedging premiums, as the options positions remain in play.

I made several other adjustments in addition to recent hedging. After some moderate short-term gains, I dropped the cryptocurrency basket to just 3%. There is too much risk in crypto now, and we should see better buying opportunities at lower levels. Gold remains the ideal inflation hedge. Therefore, gold and silver should continue doing well as inflation remains well above the Fed’s 2% target rate. The dry powder position has increased to 18%. I will expand hedges and decrease risk exposure if the price action or the fundamental image continues deteriorating.

The Bottom Line: More Pain Ahead for Stocks

Technical and fundamental factors remain aligned against the stock market for now. Inflation is much higher than the Fed’s target rate, and the Fed could keep rates higher for longer now. Moreover, higher rates will continue impacting borrowing costs, worsening consumer sentiment and spending. Manufacturing and services are in contraction that’s likely to worsen. Furthermore, the unemployment dynamic could deteriorate significantly, leading to a substantially higher unemployment rate and various negative unintended consequences. Therefore, the S&P 500 will probably bottom at a lower level. I’ve discussed the 2,800 – 3,200 range as a potential low in this bear market, and I stand by my call. So, stay hedged, and stay safe! All my best, and thanks to everyone for reading my article.

Be the first to comment