Natt Boonyatecha/iStock via Getty Images

Introduction

After seeing the share price of Methanex (NASDAQ:MEOH) suffer a sell-off earlier during 2022, my previous article highlighted how investors could grab a long-term bargain, although they would have to ignore the short-term noise of a volatile and uncertain market. Now that 2022 is drawing to a close, it feels timely to consider the year ahead that in my eyes, sees an interesting outlook for 2023 with a battle between weaker economic conditions and the global energy shortage.

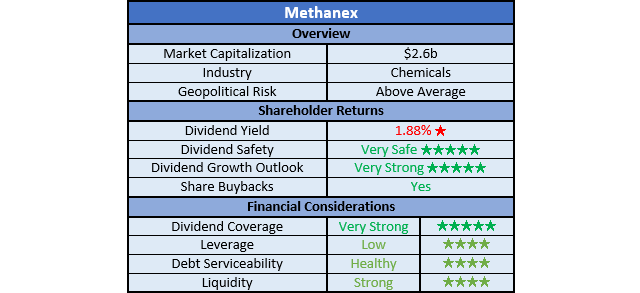

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

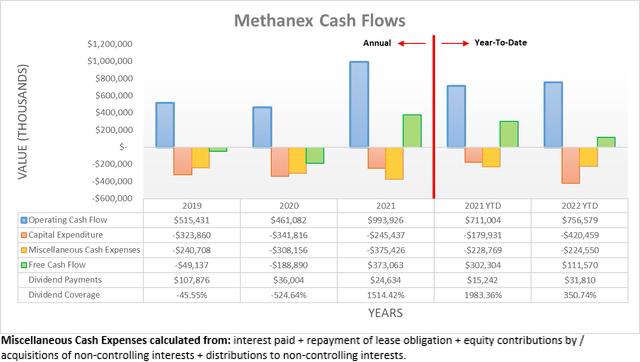

They enjoyed strong cash flow performance during the first half of 2022 and thankfully, this continued into the third quarter. As a result, their operating cash flow climbed to $756.6m and thus modestly above their previous result of $711m during the first nine months of 2021. Due to construction restarting on their flagship Geismar 3 project, unsurprisingly, their capital expenditure powering ahead during 2022 to $420.5m across the first nine months, thereby more than doubling its previous level of $179.9m during the first nine months of 2021. After accounting for their accompanying miscellaneous cash expenses as listed beneath the above graph are also considered, their free cash flow lands at $111.6m and $302.3m across these same two periods of time. Even though lower free cash flow is not necessarily positive, it solely stems from higher capital expenditure for their Geismar 3 project that as subsequently discussed, should be completed during 2023 and thus see them enter 2024 with never-before-seen cash-generating potential as they enjoy both higher methanol production and dramatically lower capital expenditure.

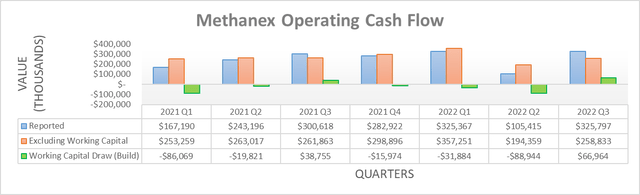

Quite unsurprisingly, zooming into their quarterly operating cash flow continues to show strong results, albeit with the usual volatility expected for a commodity-producing company. The third quarter of 2022 was actually the single highest cash-generating quarter since at least the beginning of 2021 with a reported result of $325.8m. Admittedly, this was aided by a working capital draw of $67m but even excluding this benefit, their underlying result of $258.8m was still a strong result that provides ample cash to fund capital expenditure and shareholder returns.

Whilst interesting, their outlook for 2023 is far more important as 2022 draws to a close than their historical financial performance. On this front, the prospects of a recession make for weaker economic conditions on the horizon and unsurprisingly, they expect this will pose a headwind. If interested in reading their exact response, it can be found quickly by searching their third quarter of 2022 conference call transcript for the words “recession scenario”. Such an outlook was not surprising given the wide-ranging industrial uses for methanol but interestingly, they also expect some, possibly all of this weakness could be offset via benefits from the higher energy price environment, as per the commentary from management included below.

“I think the other thing that we’re seeing though, is we’re seeing potential recessionary impacts in a high energy price environment and that tends to be a driver for demand growth for methanol. So how those two things interplay will ultimately determine demand. So we think that the higher energy price environment certainly is a positive for supporting demand growth.”

-Methanex Q3 2022 Conference Call (previously linked).

When thinking about the global energy shortage, seldom is methanol included in the discussion nor likely even passes the mind of most investors, although in reality, it sees a range of uses as a fuel that is also clean from an environmental perspective. In my eyes, this creates an interesting outlook for 2023 with a battle between weaker economic conditions and the global energy shortage. Whilst it remains impossible to know exactly how the wide array of moving parts within the rapidly changing and geopolitical-driven energy sector will intersect in the years ahead, this nevertheless stands to help limit the downside risk of weaker economic conditions in the short-term, whilst also enhancing its solid medium to long-term outlook, as discussed within my previous analysis.

Notwithstanding this outlook, it is still important to remember that methanol is ultimately a commodity and whilst management can do its best to assess its outlook, realistically, its price will fluctuate and is unavoidably open to volatility. To this point, only time will tell where their operating cash flow lands but thankfully, there is far greater certainty surrounding their capital expenditure during 2023, as per the commentary from management included below.

“Construction of our Advantage G3 project is progressing safely and is scheduled to be completed in the fourth quarter next year. We have spent approximately $810 million before capitalized interest to the end of the third quarter and expect approximately $450 million to $500 million remaining capital cost before capitalized interest, which is fully funded with cash on hand.”

-Methanex Q3 2022 Conference Call (previously linked).

When it comes to capital expenditure, their biggest item relates to their Geismar 3 project that still had another $475m at the midpoint of remaining costs following the third quarter of 2022. If looking into the parts of their capital expenditure during the first nine months, there was $318.1m attributable to this project, thereby seeing a quarterly rate of circa $106m. In theory, the upcoming fourth quarter should see a similar amount, thereby reducing the circa $475m of remaining costs down to circa $375m by the start of 2023 to be funded throughout the year as they complete the project.

Concurrently, they also incurred $102.4m for all other capital expenditure during the first nine months of 2022, which annualizes to circa $140m and is not abnormally different than during prior years and thus in theory, should broadly continue at this rate throughout 2023. If aggregated, this leaves their estimated capital expenditure at circa $515m for 2023, which if it comes to pass, would represent a modest decrease versus the $560m annualized rate during the first nine months of 2022. Even though on the cash inflow side of the equation, their operating cash flow is impossible to predict with both accuracy and certainty, at least on this cash outflow side, their modestly lower capital expenditure will help provide a cushion to their free cash flow in the event that weaker economic conditions prevail over the global energy shortage.

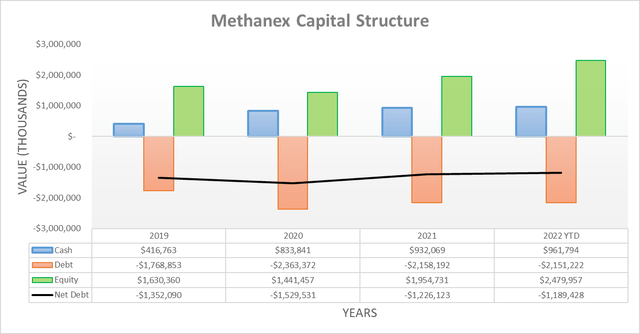

Thanks to their continued strong cash generation, their net debt once again decreased during the third quarter of 2022, despite a further $31.8m of share buybacks running in tandem. As a result, their net debt is now $1.189b and thus down modestly versus its previous level of $1.276b following the second quarter. When looking ahead into 2023, the direction their net debt takes is going to heavily depend upon the battle between weaker economic conditions and the global energy shortage but if nothing else, at least the prospects for modestly lower capital expenditure will limit the damage if the former wins over the latter.

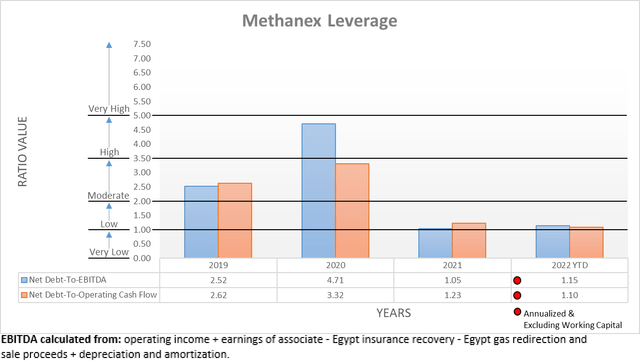

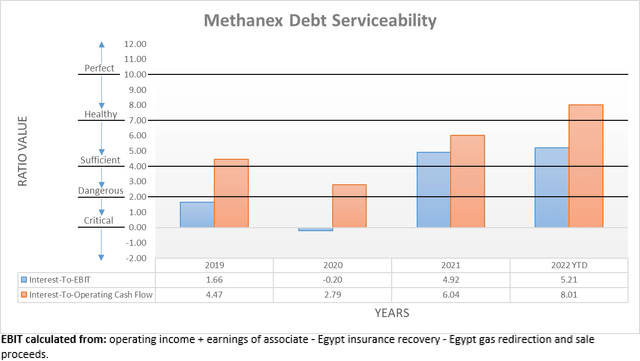

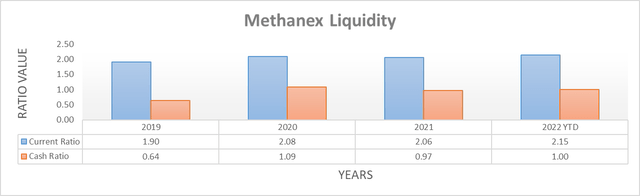

To circle back to their net debt, as it stayed fairly close to where it was when conducting the previous analysis, it would be redundant to reassess their leverage or debt serviceability in detail this time around, especially as their outlook for 2023 was the primary focus of this analysis. Furthermore, as their cash balance also grew modestly larger during the third quarter of 2022, the same also applies to their liquidity.

The three relevant graphs are still included below to provide context for any new readers, which once again show their leverage is still low, as primarily evidenced by their net debt-to-EBITDA of 1.15 and net debt-to-operating cash flow of 1.10 both sitting within the applicable range of between 1.01 and 2.00. Unsurprisingly, this is accompanied by healthy debt serviceability given their interest coverage of 5.21 when compared against their EBIT and whilst a higher result of 8.01 was seen when compared against their operating cash flow, I prefer to judge on the worse side. It was also not a surprise to see their strong liquidity persisting on the back of the higher cash balance, which now sees their current ratio at 2.15 and cash ratio at 1.00. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

After a strong performance during 2022, it appears 2023 will be a transitionary year as they complete their Geismar 3 project before subsequently entering 2024 with never-before-seen cash-generating potential, thanks to both higher production and dramatically lower capital expenditure. In the meantime, it will be interesting to see how the battle between weaker economic conditions and the global energy shortage plays out during 2023. Even if this fails to be profitable in the short-term, their prospects for modestly lower capital expenditure will help cushion the impact. More importantly, in the medium to long-term they still see a solid outlook and thus, I believe that maintaining my strong buy rating is appropriate with their share price only being around 10% higher since my previous article.

Notes: Unless specified otherwise, all figures in this article were taken from Methanex’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment