Lukas Schulze

Investment Thesis

Nintendo has a number of competitive advantages: loyal and talented management and employees, the financial scale to invest liberally in each one of its entertainment products, and a long-standing dedication to research and development being just a few examples. Nintendo’s most important advantage, however, has always been their extremely valuable intellectual property portfolio, which they have been able to recycle across their products over the decades. The market seems to underestimate the company’s ability to repeat this winning formula in future, offering a company with a wide moat and wealth compounding potential at a surprisingly low valuation relative to the wider market.

Franchise Wealth

Nintendo has to be one of my favourite companies, and that’s not just because of the quality of their products, but also, from my perspective as a long-term investor. I am such a fan of the company, in fact, that from a long-term investment perspective, I’d probably like to buy and hold the company’s stock until I’m as old as Mr. Buffett or Mr. Munger. I guess we’ll see how that goes!

But why, as an investor, do I like Nintendo so much?

Perhaps most importantly, it’s because of the company’s wealth in intellectual property, represented by original franchises which they are able to deploy over and over again in their entertainment products.

Some of Nintendo’s most popular franchises include: Mario Kart, Super Mario Brothers, Pokemon and the Legend of Zelda. And the sales figures for games sold under these franchises are quite extraordinary, as you can see from the sales data for Nintendo’s latest console, the Switch.

As an example, Mario Kart 8 deluxe has sold almost 50 million units globally over the lifetime of the Switch so far, with other titles achieving similarly impressive results.

If you look back to the sales figures for the legendary Wii console, which was released almost 16 years ago, you can see that curiously similar-sounding titles to the ones available on the Switch today sold equally successfully back then. And I’ve no reason to doubt that in another 16 years’ time, Nintendo will be continuing with this winning recipe of combining new technology with classic franchises as they release new consoles.

To borrow a phrase from Mark Twain:

History doesn’t repeat itself, but it often rhymes.

This is the phrase which comes immediately to my mind when I see 37 million in sales on the Wii for Mario Kart Wii, and then almost 47 million sales on the Switch for Mario Kart 8 Deluxe, or approximately 83 million sales for Wii Sports, and 4.84 million sales for the new Nintendo Switch Sports game released during the 1st quarter of the current financial year (the latest we have data on). New Super Mario Bros Wii sold 30 million units, while so far Super Mario Odyssey is at almost 24 million. Hopefully, you can now more clearly see what I mean when I refer to the “recycling” of franchises.

Further Competitive Advantages

At this point, it should perhaps be emphasized that Nintendo really do make some of the best quality games from the perspectives of game critics and players. The Legend of Zelda: Ocarina of Time (1998) is now widely agreed to be the best video games ever developed (see Metacritic) and other titles such as Breath of the Wild (2017) and Super Mario Galaxy (2007) have also been described in similar terms. Employees (like fans) of the company have an almost religious devotion to creating high-quality software, which some might argue is reflected in the 14.2 year average length of service for the average Nintendo employee.

And I haven’t yet highlighted one of Nintendo’s other great competitive advantages: video game development is an area with extremely high technical barriers to entry, especially at the elite level Nintendo is playing at; and the company has an extremely wide moat in its unique niche within the gaming market, perhaps because it spends so much on research and development.

In the 2022 Fiscal Year, the company spent $843 million on research and development in areas including but not limited to “virtual reality (VR), augmented reality (AR) and mixed reality (MR), deep learning and big data analysis”. Given the scale of investment in R&D by the company, I’m inclined to believe their claim that this will allow them to “put smiles on the faces of everyone Nintendo touches around the world by offering new and compelling products that anyone can enjoy” in future.

I’ve made a big point of Nintendo’s wealth in intellectual property so far. But the fact of the matter and core point of this article is that Nintendo’s historical and ongoing business model of creating and then recycling these different gaming franchises has proven to be very lucrative, and there’s no reason to think this pattern won’t continue over the coming decades. The argument is only more convincing when one considers that a generation of children who played the highly successful Wii and DS consoles are now adults, and their emotional investment in Nintendo and its franchises will likely motivate them to want to buy Nintendo games for their children in the coming decades.

And perhaps the most important thing to keep in mind is that since the potential future value of this intangible intellectual property can’t be evaluated by an accountant, it’s not on the company’s balance sheet, even though it’s probably their biggest asset.

Financial Considerations

For a more concrete evaluation of the company, we also need to look at some numbers which will illustrate its current financial position.

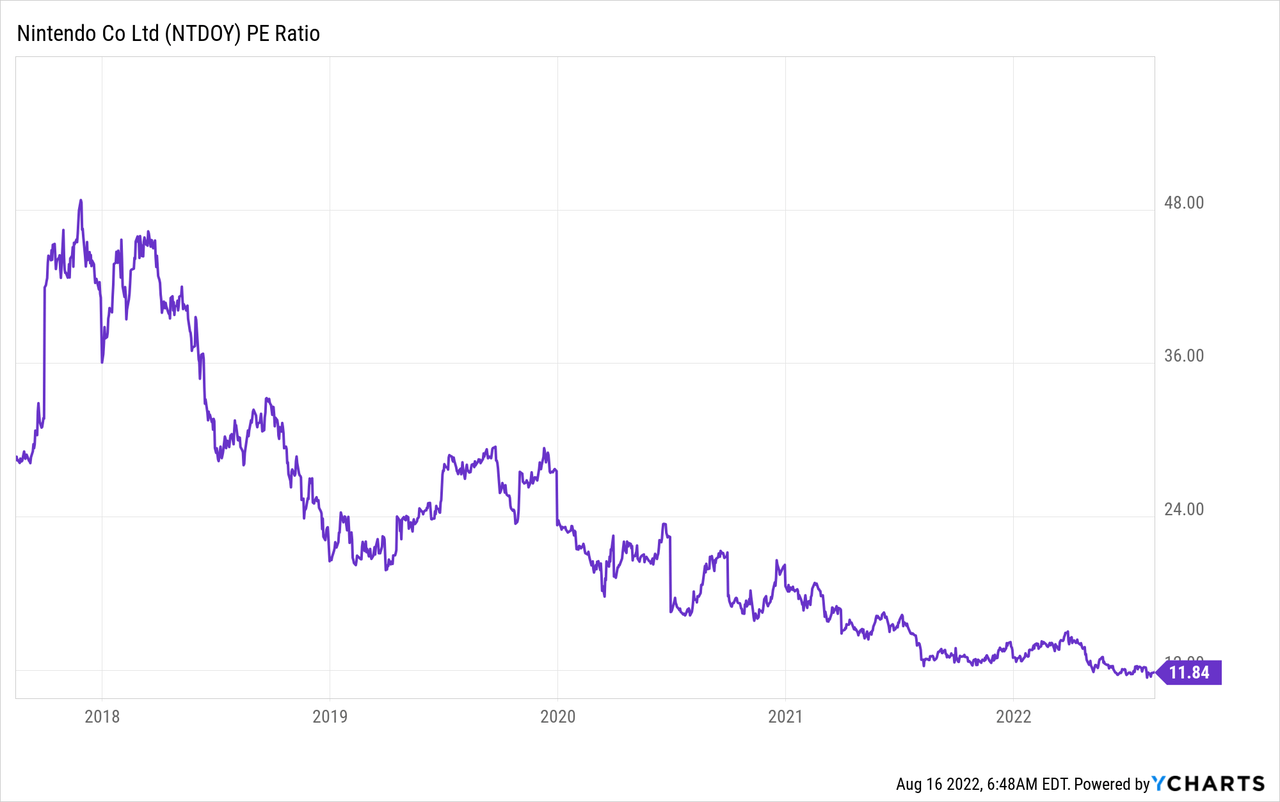

In the 2022 fiscal year, business activities generated approximately $14 billion USD in sales and ultimately $3.95 billion USD in net profit attributable to owners of Nintendo stock, giving a shockingly low P/E relative to its peers of 12.3x. For context, game developers like Activision Blizzard, Take Two Interactive and Electronic Arts are currently have P/E ratios of 33.6x, 81x and 41.6x respectively.

78.8% of Nintendo’s sales over the past financial year came from outside of Japan, with the Americas representing 43.5%, Europe 25% and everywhere else representing just over 10%. From my point of view, this US dominance in the company’s customer base is very positive for US investors, as they probably needn’t be too concerned with what is going on in Japan’s economy or currency. If customers purchases are largely taking place in dollars, then, to a greater or lesser degree, this will follow through into profits too.

A glance at the balance sheet reveals a company in very good shape to be able to handle the uncertain whims of the gaming market, with minimal debt and plenty of cash (approximately $12 billion compared with a $50 billion market cap). Not every Nintendo product is a success (the Wii U was an infamous flop) and the company’s conservative financial approach was in my view critical to their turnaround with the launch of the Switch after that relative failure.

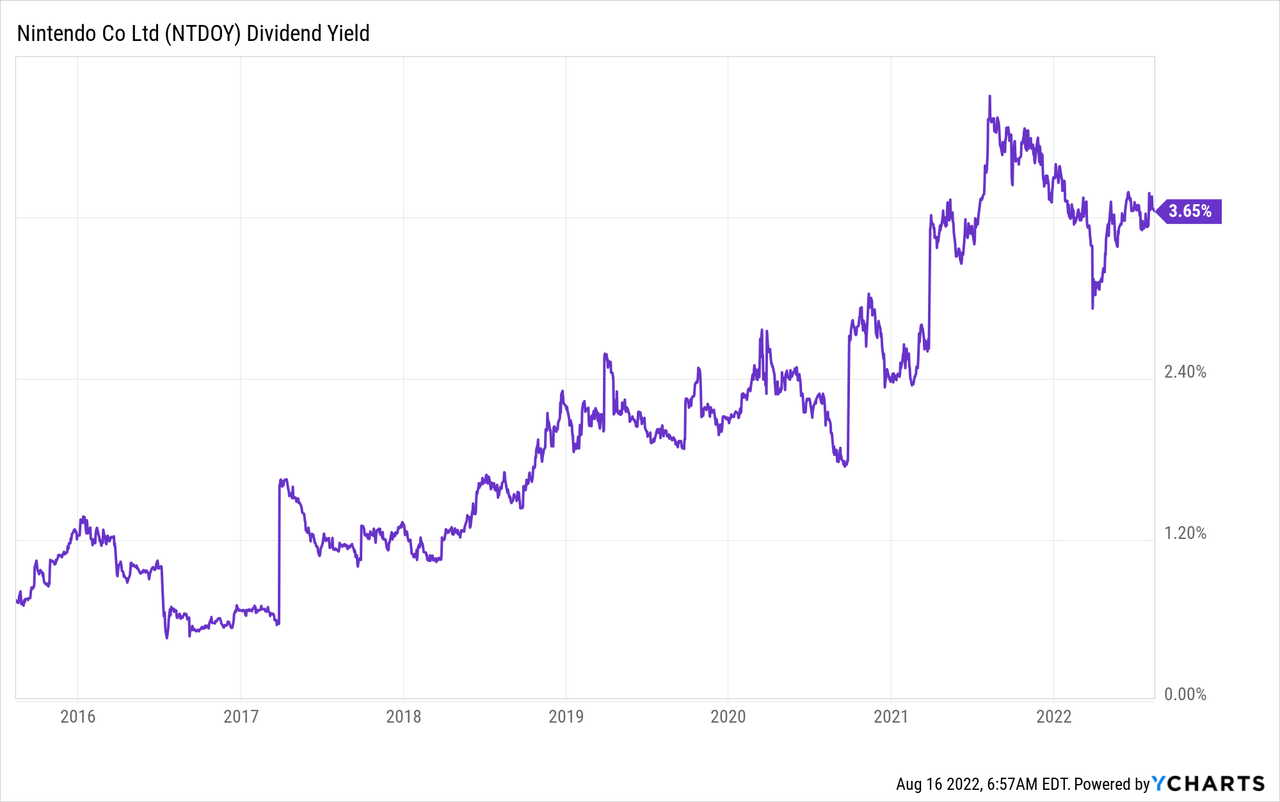

As a final point, income focused investors will also be very pleased to hear that the company pays a healthy dividend, and the yield here has increased nicely over the past few years, as you can see in the graph below.

Management

Another critical aspect of the company which must obviously be considered when making an investment decision is the quality of the management team. In Nintendo’s case I have a lot of confidence in the President and CEO, Shuntaro Furukawa, who joined the company in 1994 aged 22 and has therefore developed a long-term sense for what works and doesn’t for the company. The fact that he was Director of the Global Marketing Department before becoming CEO is also reassuring – it shows that the company is aware it needs directors very familiar with the international side of the business given that such a large proportion of its sales are outside of Japan.

Encouragingly, the more creative figures in the company also have a voice, with Shigeru Miyamoto, the original creator of the Mario and the Legend of Zelda franchises, who joined the company back in 1977, also a Representative Director and Fellow of the Board. That such voices are present at the highest level is essential for the company to continue exploiting its winning recipe of recycling classic IP into new formats.

Future Considerations And Risks

An important consideration to keep in mind is that the wildly successful Nintendo Switch (111 million hardware sales at time of writing) is currently reaching the end of its lifetime, having been released in March 2017, and there’s undoubtedly a lot of uncertainty about what we might see from the next console. The Switch has been extraordinarily successful, but there’s no guarantee the next console will perform similarly, and the company has had flops in the past (the Wii U probably the biggest in recent memory). While I think a similar situation for the Switch 2 is highly unlikely given the degree of experience of the management team, it’s reassuring that the company has a lot of cash on the balance sheet to recover from a misstep with their next console, however unlikely that may be.

Most of the other potential threats to the company’s business performance seem to me to be short-term and not too serious, the main ones worth mentioning are related to the supply chain: dependence on outside companies to produce key components and assemble finished products and also rising shipping costs. I am confident these are not issues which long-term investors need to be concerned about, especially with the company’s president reassuring that the company is on track to improve its chips procurement in the second half of the summer.

Conclusion

Nintendo’s intellectual property is its biggest asset, yet you won’t see it on the company’s balance sheet. Perhaps this is why the market is offering us shares in this company at what seems to be a significant departure from fair value. The company’s other competitive strengths seem to further solidify the case that Nintendo is currently cheaper than it should be – in my view offering an attractive potential long-term investment with a great risk-reward profile.

Note: Nintendo trades on the Japanese stock market as well as as an ADR (OTCPK:NTDOY) in the US. At the time of writing, the price of the ADR is around $54. The ADR represents one eighth of the stock trading on the Japanese market (7974:JP).

If you liked this article, please scroll up and click “Follow” next to my name to not miss future investment opportunities.

Be the first to comment