Oselote

Last week I wrote about the Sprott Physical Gold Trust (PHYS) and said investors should “back up the truck.” The thesis largely centered on the rather large discount to net asset value coupled with the premium that comes with buying physical Gold from a bullion dealer. The combination of those two facts puts PHYS in the very advantageous position of being an inexpensive physical bullion play. While PHYS is my largest single investment in my entire portfolio, the second largest is in the Sprott Physical Silver Trust (NYSEARCA:PSLV) shares. If you have two trucks, you should consider backing up the other one for this silver play.

Discounts, Premiums, and Pound Pricing

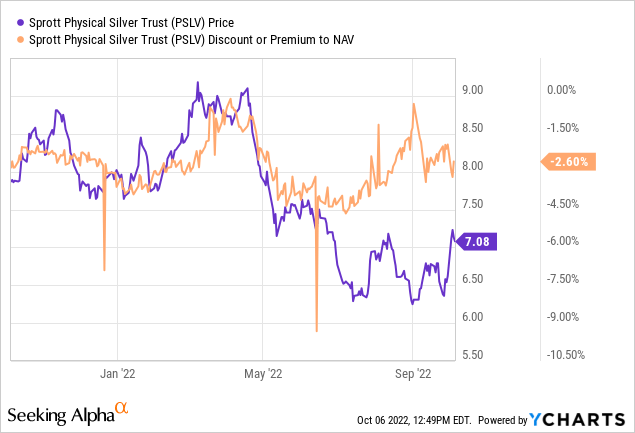

Much of the same thinking from my PHYS article last week applies to PSLV as well. The PSLV shares trade at a large discount to the value of the underlying assets.

While not at the NAV discount lows that have been seen in the last 12 months, PSLV still trades at a 2.6% discount at current prices. This is while the premiums for coins and bullion on the same websites that I highlighted last week are significantly larger than the premiums for Gold. This is how the premiums shake out at a $1,721 Gold ask and a $20.75 Silver ask:

| Dealer | 1 oz Gold Eagle | Premium | 1 oz Silver Eagle | Premium |

|---|---|---|---|---|

| SD Bullion | $1,912.00 | 11.10% | $38.75 | 86.75% |

| JD Bullion | $1,914.00 | 11.21% | $38.49 | 85.49% |

| APMEX | $1,918.00 | 11.45% | $38.83 | 87.13% |

| Average | 11.25% | Average | 86.46% | |

| Dealer | 1 oz Gold Bar | Premium | 1 oz Silver Bar | Premium |

| SD Bullion | $1,800.00 | 4.59% | $27.25 | 31.33% |

| JD Bullion | $1,811.00 | 5.23% | $29.70 | 43.13% |

| APMEX | $1,816.00 | 5.52% | $28.15 | 35.66% |

| Average | 5.11% | Average | 36.71% |

Source: company websites as of 2p 10/6/22

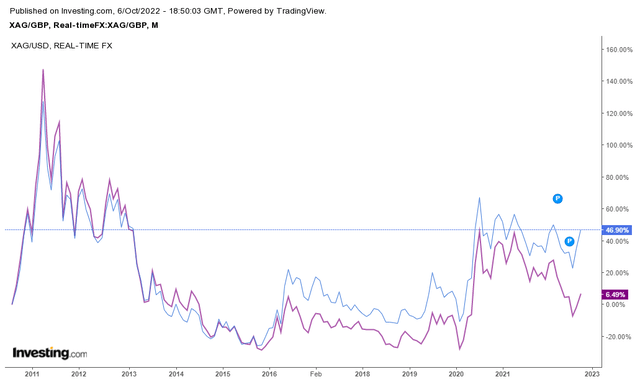

The point is, if you agree with the general thesis behind my PHYS article last week then PSLV is an even better buy because the spread between buying physical Silver and PSLV is enormous. There’s also the difference when pricing the asset in foreign currencies:

Silver in dollars and pounds (Investing.com)

Just like we’re seeing Gold stay relatively near its COVID highs when priced in British pounds, the same is true for Silver. If/when the Fed pivots, Silver in dollars will have a lot of catching up to do.

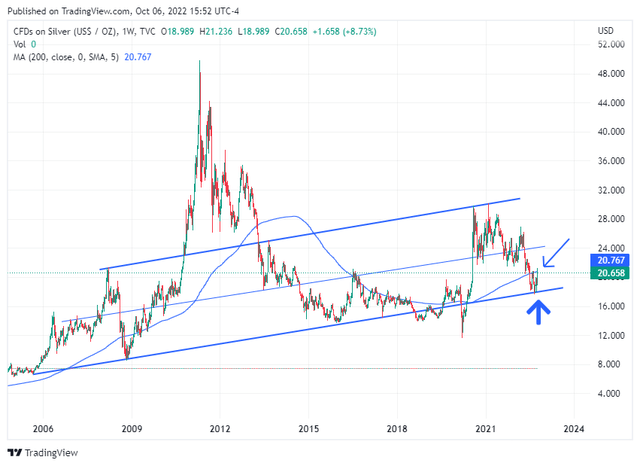

Technical Setup in Silver

Looking at Silver on a weekly chart we can see a large channel that has been generally respected by the metal for the last 15 years or so. The exceptions were the COVID crash to the downside and the quantitative easing following the great financial crisis to the upside. Not only has Silver held the low end of that range over the last several weeks (thick blue arrow), but it’s now challenging the 200-week moving average of $20.67 as well (thin blue arrow).

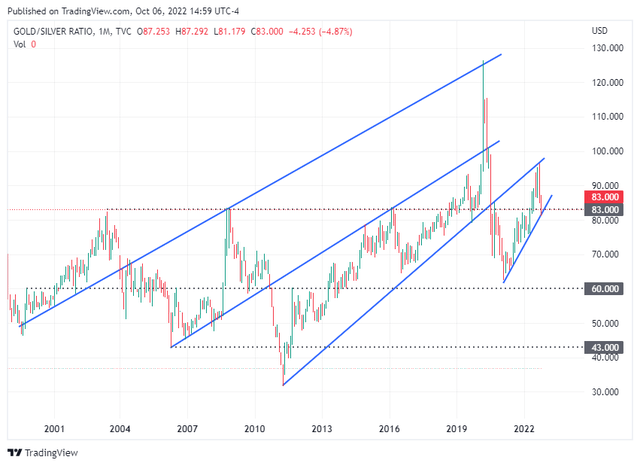

If Silver breaks that moving average on a weekly close, I think it’s going to move up fairly quickly – as it did following the COVID crash. Another way to look at Silver in the context of its potential performance vs Gold is through the Gold/Silver ratio. Personally, I don’t like to look at this metric as a primary motivator for going long Silver, but I do see some really interesting levels on this chart, especially considering some of the trading ranges that seem to be breaking down:

Gold/Silver Ratio (GoldPrice.org)

First, when this number is going up, it means Silver is underperforming Gold. Over the last few years, when these vertical channels break down, they do so sharply – that means Silver is outperforming Gold when the ratio is plummeting. The ratio appears to be at a serious inflection point right now.

I see yet another vertical channel threatening breakdown at 83. We could see a swift move down to 60 in the ratio if this breakdown does indeed happen. Even if Gold stays at $1,720 (which I highly doubt), a Gold/Silver ratio of 60 implies a $28 silver price. At a 2% discount to NAV, PSLV shares would trade at about $10. This implies nearly a 30% rise in the PSLV shares at current pricing. All it takes is the right catalyst to trigger this move.

Political Pressure on The Fed is Starting

While many believe the Federal Reserve will continue raising rates and the balance sheet roll off, we’re already starting to see political pressure on the Fed from global institutions to slow down hikes. Earlier this week the United Nations called on global central banks to halt interest rate hikes and warned continued hiking would risk harming developing nations:

In its annual report on the global economic outlook, the United Nations Conference on Trade and Development said the Fed risks causing significant harm to developing countries if it persists with rapid rate rises.

This is a sentiment that seems to be shared by the IMF as managing director Kristalina Georgieva reportedly acknowledged the Fed’s policy has an impact elsewhere in the world:

Georgieva called on the Fed to be extremely prudent in its policies and be mindful of the spillover impact on the rest of the world

Taken together, we have concerns brewing from the global establishment. If Credit Suisse is any indication, we can already see potential problems starting to pop up with banking institutions that have systemic importance. And this doesn’t even take into consideration the physical supply crunch that is happening in the metal. I could detail that as well in this article but I don’t think I can do a better job than GoldStreetBets Research did last month.

Summary

There are too many factors aligning at the same time for me to believe Gold and Silver have anywhere to go but up. We have global economic uncertainty that creates a fundamental setup for metal. If the central banks can’t beat inflation without collapsing the entire global economy, then I have serious doubts the hikes will continue. And if the hikes can’t continue while inflation remains elevated, Gold and Silver should do what they’ve generally done throughout history; protect savers from currency debasement.

The fundamental story is there. When you factor in the technical setup as well, Silver seems primed for a big move up. And if that happens, PSLV is going to move right with it because it becomes too attractive not to buy the shares at a discount when buying physical bullion from a dealer carries such a high premium.

And as commenters in my PHYS article accurately pointed out, these Sprott funds have a redemption mechanism that can’t be ignored. While the minimum threshold is higher than most investors will be able to tolerate, if the right people get worried enough, the NAV discounts in these funds could theoretically turn to premiums should the metal supply from other sources continue to dwindle.

Be the first to comment