Edwin Tan

The current Lions Gate Entertainment Corp. (NYSE:LGF.A, NYSE:LGF.B) long-delayed transaction story needs a script doctor ASAP. Since its sound decision to unlock shareholder value by possibly separating its studio business from its streaming efforts, there has been delay after delay as postponed deadlines for deals came and went. The problem is not the intent. As a relatively small, but content-rich, player in the huge movie and streaming space, the decision to hang up the for sale sign was a good one.

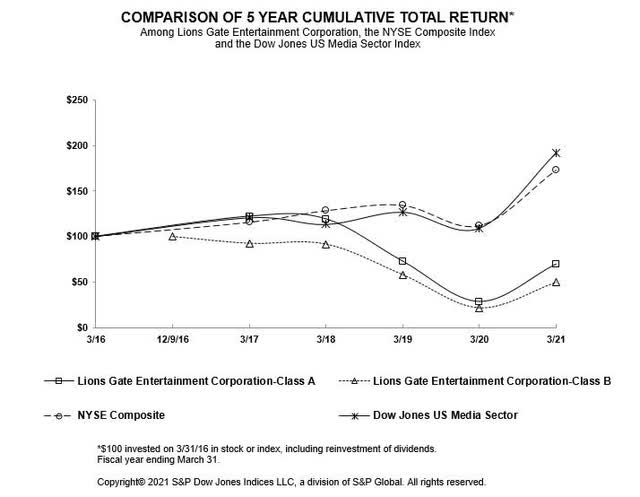

LGF.A is a classic example of a company with a supreme irony built into its core: it’s too big to be marginal and too small to be dominant. Management has recognized this. A deal to spin off either the STARZ streaming business or the studio makes sense on many levels. The problem is valuing entertainment assets in a marketplace now where excessive product and delivery systems in streaming devalue content and, at the same time, the classic structure of movie business economics is undergoing creative destruction.

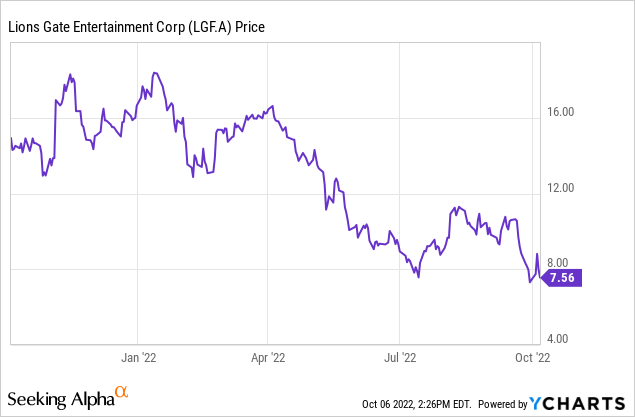

Above: The natives are getting restless as the hunger games go on.

Between inflation battering production costs, and the pandemic-charged decline of live attendance which may never return, movie studio values now are not what they may have been when, in 2016, Amazon overpaid for MGM at$8.4b.

LGF.A is using that deal as a kind of yardstick to measure just how valuable their content could be. But that doesn’t take into account the fact that Amazon.com, Inc. (AMZN) was a unique, one-only buyer with a wallet so fat with cash that price virtually meant nothing. It was a strategic move linked to prime usage. There are no AMZNs out there playing the hunger game that would value LGF.A assets against a money-no-object buyer. This is not in any way to discount the real value of many of the company’s ongoing businesses. Their 17,000 title library’s value does indeed contain a few gems, like The Hunger Games and John Wick among several others.

A bit of history for context is in order: Mr. Ted Turner’s “folly”

In 1985, I was a c-suite executive at Caesars Entertainment, Inc. (CZR). Our PR firm also represented MGM Entertainment, the venerable tiffany movie studio storied in the business over 60 years at the time.

Out of nowhere, Mr. Ted Turner, now 83, the eccentric creator of the then eponymous cable empire, bought MGM for $1.5b. (The equivalent in today’s dollars of perhaps $4.5b.)

The deal triggered tons of laughs for many Wall Street wise-guys who barbecued Turner for what they saw as wildly overpaying for the studio and its 2,200-movie library. I had a front row seat to the doings courtesy of my PR guy, who after the deal was public told me, “These idiots don’t realize that Ted may be eccentric. But what they don’t understand is that his oddness disguises a genius vision. Just watch.”

One prominent critic cited the value of MGM as, “Big deal, you show Gone With The Wind once a year and The Wizard of Oz, and the rest? Andy Hardy comedies from the 1930s? For today’s audiences? Ted was taken.”

Lo and behold, what eventually emerged was Turner Classic Movies, one of the gems then of the cable channels, and today, a sparkling but updated diamond of Warner Bros. Discovery, Inc. (WBD). It remains commercial-free. It has shuffled its host contingent to become more relative to the times. It has reached out to younger demos by grouping genres under sub-programming like Film Noir. It remains an oasis of ad-free streaming (at least until now), and the ultimate go-to click for millions of viewers who these days complain, “Thousands of shows and nothing to watch,” according to several colleagues in the business who hear their email moaning day and night.

What few critics recognized at the time was that Turner’s eagle eye was on the MGM library from the get-go. The studio was an afterthought. The lesson here we believe: of all its assets, the 17,000 title LGF.A library is really the shining star. And that is where the real value should command a premium. That is not only because of the handful of blockbusters already on the shelves ready for dust-off and sequels, but for the biggies that may come from a studio with a proven ability to produce winners and not entirely break the bank.

The entertainment weather report: Headwinds persist

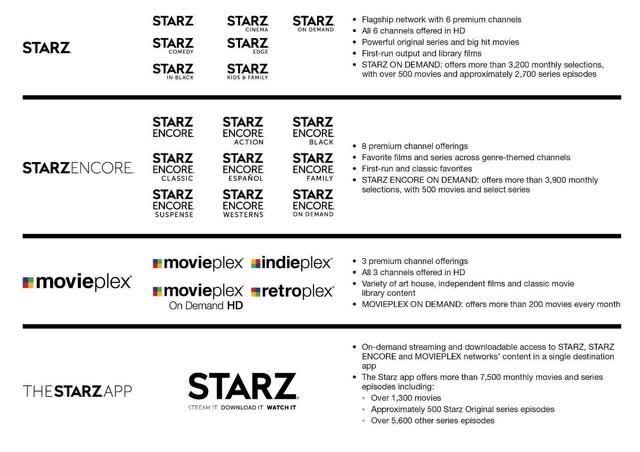

The macro environment across the entire entertainment spectrum is particularly challenging for the streaming segment. It is in this area where LGF.A management apparently is pointing with pride. And where it believes that any deal it does do will produce the fattest premium for them as sellers going forward.

Not so fast. For some of our industry colleagues, it is the studio, not Starz, rebranded now to Lionsgate+, that presents the most tempting morsel for a buyer. And part of that is, of course, the library.

Against a March 30 th fiscal, the company reported Q1 2023 results this past August

To be brief, between all the “we’re excited” rhetoric we hear from them and, frankly, most operators in the field, it was not much to cheer about. Revenue came in at $893.9m against an operating loss of $68.2m. Net loss to shareholders was $119m, or $0.53 diluted per share. OIBDA was $5.0m.

The good news: Global streaming subscribers grew 57% y/y to 26.3m. Overall global subs grew to 37.3m, including STARZPLAY Arabia.

But film and TV library revenue was $749m for the trailing 12 months, which we cite as two cheers for the company.

Media networks segment produced $381.2m vs. $382.3m YOY. Management said the flat results were due to lower domestic linear revenue, offset by growth in streaming revenue and STARPLAY international revenue throwing a loss of $370m vs. a profit of $88.2m YOY 2022. This loss had to do with programming amortization and marketing costs, endemic to the industry. The time lag between production costs incurred in new content, break-even, and ultimately a profit is a long trek, never a happy calculus for the industry. But given its scale compared to giant competitors, it imposes real burdens on earnings.

The Studio, movie and TV production increased revenue by 5% to $711m vs $677m YOY. Segment profit was up a nice 48% to $70.lm vs $47.3m in the prior-year quarter. TV production was the catalyst for the gain.

Movie revenue was down 4% to $278.8m vs $291.2m YOY. Profit was up 14% to $50.5m from $44.3m the previous year. Direct-to-streaming licensing grew, but wide-release theatrical movies and marketing costs bruised profits.

Television production revenues were up to $432.2m vs $386.1m YOY. Profit was up to $19.6m vs $3m YOY.

So what we have here in a capsule glimpse is a realistic reflection of the state of play in today’s turbulent entertainment sector. On an annual basis, the capsule numbers aren’t very pretty:

TTM

Revenue: $3.78b

Operating cash flow: –(312.4m)

Analysts looking for –($0.34) in 2023 and $0.11 in 2024

Debt: (mrq) $3.46b

Cash on hand (mrq): $378m

Current ratio: 0.44. This is a bit ugly.

In its earnings call, management made a few salient points, citing hot sequels of proven blockbusters in the can and ready to be unleashed on audiences in the coming quarters.

But far more salient to investors is management’s commitment to move ahead with slates of low-risk films, go-direct-to-challenger streamers, and independents. This is the good news.

The bad news is that betting too much on challenger streamer business may have some dead-end street aspects to such a marketing focus. If giants like Disney (DIS) and WBD are wrestling with out-of-control costs, declining rates of new subscribers, and mushrooming competition from new challengers in streaming, how is a smaller scale content/streaming operation to compete? The mantra we hear is the same from all operators in the sector paraphrased by your author: “We’re gonna kill the market with spectacular new content. That’s our skill set. We’re savvy storytellers.”

We like the studio’s decision to reduce its production of theatrical films from 14 per year to a range of 10 to 12, with production cost discipline and realistic estimates of profitable but not necessarily blockbuster grosses. This makes sense.

Given the trading range of the stock over the past year, apparently Mr. Market is not yet buying this scenario. They’ve simply heard it too many times.

And there is always that pesky issue of wokeness that has become sort of a growling little dog gnawing at the industry’s pants leg. LGF.A apparently joined the ranks of true believers. On their “About us” tab on the corporate site, they proclaim a commandment on content aimed at “women and underrepresented groups.”

When you look at the streaming programming across the board industry-wide today, does anyone, including your neighborhood stray dog, lack for “representation” now? Does that have anything to do with persistent red ink in streaming? Perhaps so, perhaps not. But, message to LGF.A PR people: hit the delete button on that promise. We cite it only to put in context what some may see as a clueless, industry-wide obliviousness to the hard-edged realities of the business today. You want to invite the entire world to your content party—and leave the culture clashes to the non-profit and political hustlers all over the spectrum.

With such a complexity of headwinds facing the industry today, one can only conclude that Lions Gate is at least holding its own. Its effort to impose cost discipline and adhere to a very sensible policy of producing cost-efficient content will keep it as a viable player in the space.

But on the shares, Mr. Market has spoken. It understands that Lions Gate will continue to be a player — they have demonstrated skill sets in content and deal making for steaming bundle representation. What this stock is all about now is: Deal or no Deal. Period.

“It’s complicated, we’re working on it” says management

The seeming endless delays in winding up presumed ongoing negotiations between FGF.A and a currently unnamed buyer have been attributed to “complications.” We surely concur that a deal in the swirl of present turbulence in the economy in general and the not-so-quiet revolution in content production and steaming presents no quick slam-dunks for negotiators.

Questions arise: Should a deal merely split the studio from the streaming business? Should they sell the studio and keep the steaming business, or just the reverse? How can you value the assets in this kind of market? Answer, it really is tough. We have seen estimates with STARZ alone at 15 to 17X EBITDA with the AMZN MGM deal cited as a standard.

That would value it around $2b. But it’s not a very good look for management in consideration that they paid $4.4b in 2016. In fairness, understand that although it is only 6 years ago, it was a different world in streaming. It was an Oklahoma land-rush mentality afoot we see as the same thundering dash to sports betting stocks after the 2018 Supreme Court decision threw open the legal doors.

The steaming sector is already overcrowded, content costs are through the roof and getting worse, the subscription growth rate for all players, the biggies as well as the challengers, is declining. The international market can grow, but it is choppy and marketing costs are soaring. At the same time, holding existing subscriber rolls to sensible lifetime value estimates as a path to value discovery presents yet another challenge to the LGF.A negotiators. Despite this understandable wading through of so much conjecture to arrive at a fair valuation for buyer and seller, it would seem that a fundamental truth has been lost: if any configuration of the present company was that good, why haven’t possible buyers seen it by now?

So much that is positive about the company should have long been self-evident. And at the same time, much remains fuzzy due to the bloated content environment. The CEOs of almost every streamer on the plant are singing from the same songbook: We’re blowing a wad on spectacular new content that will dazzle the world.

Surely there will indeed be new entries that audiences will love, some of them becoming very sticky indeed. Most recently, the very non-woke series Yellowstone, debuted is season five trailer. We are told over 14m pairs of eyeballs have already clicked on the trailer — evidence of a mammoth audience to come. And we do believe that LGE.A’s track record in generating sticky content puts them in contention with their much bigger and richer competitors over time. But to what extent that translates into a sound valuation that closes a good deal for the company and its stockholders is another case.

Price at writing: $7.69

Discounted cash flow value (GuruFocus): –$14.48

Terminal value: —$5.42

52 week range: $18.84 -$6.90

Conclusion

This is a conundrum stock. On one hand, there is much to like about the company. As noted, we think the lifetime value of its library is much better than one based on much older content. We think their streaming business puts them in a bind more than promises to become a high-percentage EBITDA accretion producer. Yet, we do see value for selling it outright to a bigger competitor who can better amortize marketing and development costs over time. The gestation period between producing a show, licensing it, its run to break even, and ultimately through renewals to profit is simply too long for a company that will be pressed by an unfavorable current ratio for the foreseeable future. Yet there is good content in STARZ that could add to a large-scale competitors’ offerings and make it worth something close to the 15X to 17X EBITDA formula. So that would be a sale.

The movie studio has produced some good films. It has proven in an ever-hungry market for good movies made at sensible cost that controllable marketing spend can make money. If theatrical release revenue continues to shrink, its studio product will find buyers among challenger and possibly larger-scale streamers. So that might be a keeper.

Based on both what is seen and may be unseen, we think that hopes for a blow-away premium on a deal for the entire company or one of its parts will not work. But one which sells off the STARZ unit alone at something around a 10X to 12X EBITDA number makes great sense all around.

We like the library a lot and believe it shouldn’t be this difficult to value after this long siege of talks.

If a deal continues to loom in the what-if shadows much longer, clearly the stock will wallow under $10. But with enough assets to believe a nice deal can be struck, we see a price target of ~$22.50 in the aftermath of a deal announcement. That is a realistic premium for shareholder. And for those with the risk tolerance to dive into it in the current whirlpool eddies of the market, we’d call it a buy. For everyone else, there is no huge loss keeping money on the sidelines a bit longer and jumping it on the first news of a done deal.

Be the first to comment