Justin Sullivan

Micron Technology (NASDAQ:MU) and NVIDIA (NASDAQ:NVDA) are two heavyweights in the semiconductor space. The former is a memory and storage maker that sells to Apple (AAPL) and others, the latter is a gaming chip maker that also has various cloud and enterprise offerings.

Both Micron and NVIDIA shares are down this year. Micron’s revenue fell 19% last quarter, NVIDIA’s fell 17%. Both companies are being impacted by the decline in demand for chips, but the impact on Micron has been greater so far.

That doesn’t mean that NVIDIA is a better buy, though. Due to its sky-high valuation, NVIDIA has quite a ways to fall if it can’t return to positive growth soon. Micron has the benefit of a price that’s not too far ahead of book value, which gives it a margin of safety. For this reason, Micron is looking like a safer bet than Nvidia at today’s prices.

Competitive Position

The first area where we can compare Micron and NVIDIA is in their competitive positions. This is actually a very interesting comparison because both companies have competitive advantages, but very different ones.

Micron’s big advantage is how few competitors it has in DRAM. RAM is basically an oligopoly between Micron, Samsung (OTCPK:SSNLF) and SK Hynix, so margins in the space tend to be pretty high. However, RAM is a commodity, so the companies selling it do face declining prices sometimes (for example, this year).

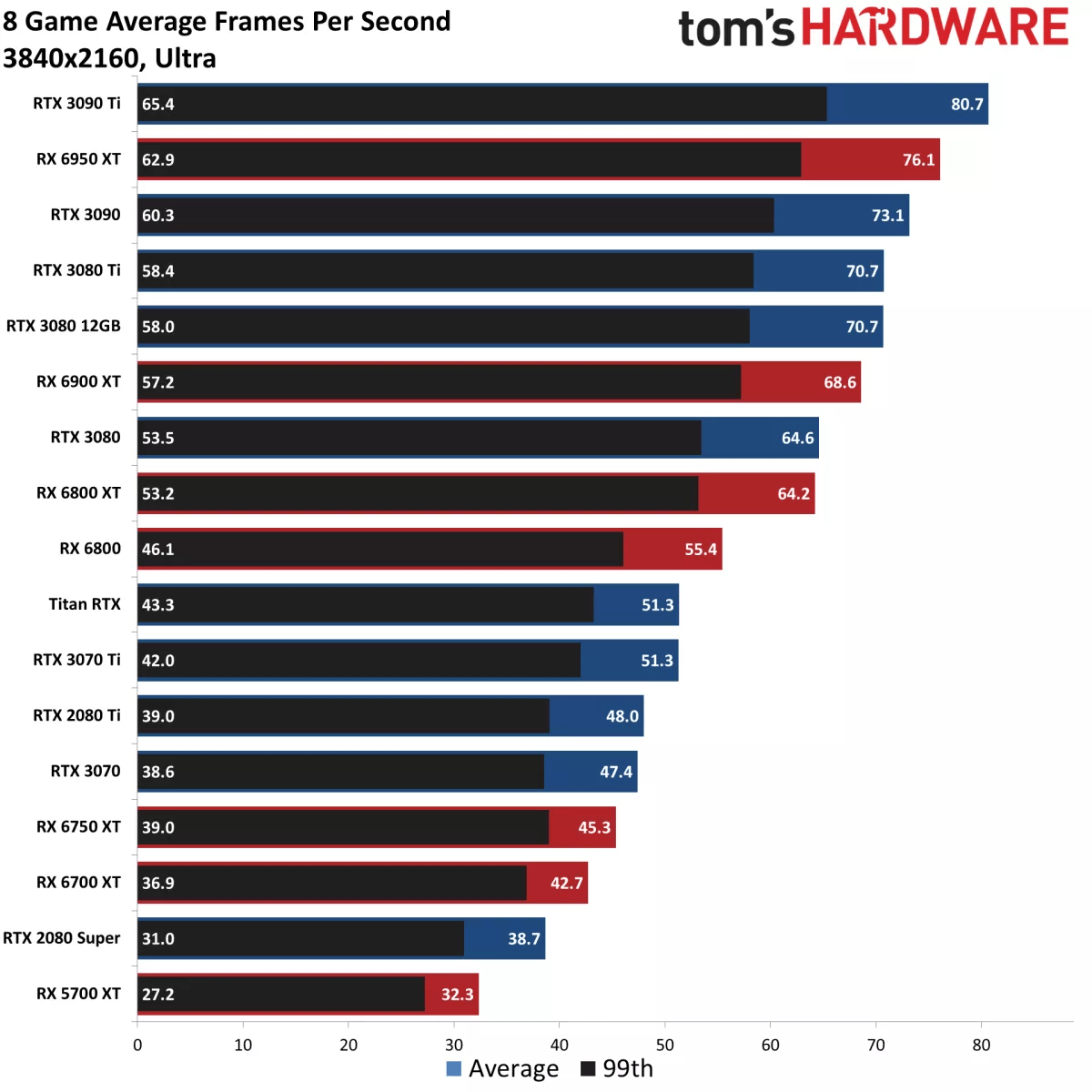

NVIDIA’s edge is differentiated products. For years, it was pretty much the only company selling advanced dedicated GPUs. These days, it faces competition from AMD (AMD), but the competitive field is still pretty limited. NVIDIA still has a solid position in the high end of the market. As the chart below shows, NVIDIA’s cards dominate the gaming chip rankings, with four out of the five fastest cards (as measured by frames per second) being NVDA offerings.

Tom’s hardware (NVIDIA vs AMD)

Micron doesn’t have as much technical differentiation as NVIDIA does. It has claimed that it is making its products more differentiated, but its revenue nevertheless declined when DRAM prices went down. This suggests that buyers still view Micron RAM as comparable to that of the competition. Micron was the first company to develop 232-layer NAND, which it announced in July of this year. Being first to such a milestone provides advantages in selling to high end buyers but NAND is the less profitable part of Micron’s business, subject to more competition than the lucrative DRAM market.

On the whole, I’d give NVIDIA a slight edge over Micron in competitive position. Micron is really counting on Chinese competitors not emerging, if China succeeds in making that happen then Micron’s margins will shrink. NVIDIA’s moat has more to do with product differentiation and therefore is harder to penetrate.

Foreign Presence

Another area where we can compare Micron and NVDIA is their foreign presence. Semiconductor companies usually have business in multiple countries, the wider their reach the greater their sales. However, sales to Chinese companies are vulnerable at the moment, because the U.S. is banning chip exports to that country. So, we’d like to see MU and NVIDIA doing a lot of foreign sales, ideally to U.S.-aligned countries, because any sales to Chinese customers could be shut down by the government.

Micron Technology lists a number of foreign subsidiaries in its SEC filings. A few notable ones include:

-

Micron Technology Xi’an.

-

Micron Technology Taiwan.

-

Micron Technology BV (in the Netherlands).

According to Bloomberg, Micron Technology Xi’an not only produces chips in China, but sells them there as well. This subsidiary looks like it could be at risk if the chip war ramps up. Apart from that, Micron’s geographic diversification is a positive.

It’s a similar story with NVIDIA. According to its SEC filings, NVIDIA has these foreign subsidiaries:

-

NVIDIA Hong Kong.

-

NVIDIA Shenzen.

-

PhysX Beijing.

The above are all Chinese NVIDIA subsidiaries. Micron has only one Chinese subsidiary. It appears that NVIDIA has more investments in China than Micron does, which exposes it to more political risk. On the other hand, China is a massive market with a lot of tech companies. Having a presence there is a positive, assuming that the U.S. government doesn’t abruptly ban you from selling to the Chinese. Still, NVIDIA’s international operations are more at risk of bans than Micron’s are.

There are various other aspects of NVIDIA and Micron’s foreign presences that are worth talking about. The first is the impact of the U.S. dollar rising. The dollar is gaining on most foreign currencies this year, which makes U.S. dollar income more valuable and foreign income less valuable. It’s possible to go pretty deep on this topic in itself. You can get into topics like current rate translation (where you convert income statement items at the average rate and balance sheet items at the current rate), temporal translation (where money balances are translated at the current rate and non-monetary assets at a historical rate), and more. These ‘translations’ are needed to figure out how much Micron and NVIDIA lose selling to foreign markets, but unfortunately such disclosures aren’t available.

What we do know is that foreign currency income is declining against the dollar this year. So, foreign income takes a hit when translated to U.S. financial statements. Let’s say RMB/USD is 7.1, and declines to 6.5 in the span of a year. What happens here is that ¥100 that would have turned into $710 last year, turns into $650 this year. If sales volume doesn’t increase, then earnings from China decline.

Who, between the two companies we’re looking at, is taking a bigger hit from currency weakness this year?

In its most recent fiscal year, Micron reported a $-106 million currency impact, 0.34% of revenue. NVIDIA reported a 4% gap between reported and constant currency revenue in fiscal 2023. So, the currency impact on NVIDIA was larger, making this a favorable comparison for Micron.

Valuation

Armed with “big picture” info on Micron and NVIDIA, we can proceed to a valuation. It’s here that Micron really jumps into the lead. While both MU and NVDA are likely to report large declines in earnings next quarter, Micron isn’t much more expensive than its assets, net of debt. So, there is a limit to how far MU should theoretically decline.

At today’s prices, Micron trades at 1.28 times book value. The same multiple for NVIDIA is a truly awe-inspiring 17.8! Were Micron and NVIDIA to stop earning money and go out of business, MU’s holders could recover 78% of their investment, NVIDIA holders a mere 5.6%. Micron would be trading at book value if it fell just 22%, suggesting limited downside. There is really no limit to how low NVDA can go.

Next we can get into discounted cash flows. This is complicated for companies like Micron and NVIDIA, whose cash flows are declining, but it’s an exercise worth doing.

‘Free cash flow’ is net income, plus non-cash charges, plus interest adjusted for taxes, minus fixed and working capital investment. ‘Free cash flow to equity,’ or ‘levered free cash flow,’ is FCFF minus the interest income (shareholders don’t collect it) plus net borrowing. Since I’m writing for an audience of stock investors, I’ll go with FCFE here.

In the last 12 months, Micron had $2.80 in FCF per share. NVIDIA had $1.93. Normally, when you do a DCF model, you assume some period of fast growth followed by a period of slower growth. Both MU and NVDA’s revenues are declining, so I’m not going to assume positive growth in cash flows in the foreseeable future. However, we know that the chip industry is cyclical, so these companies will probably recover to their current FCF levels after next year’s projected recession ends. So, we can take each company’s current FCF as the long-term average and calculate terminal value.

If we discount MU’s $2.80 in FCF per share at the 10-year treasury yield, we get $77.7 in terminal value. That suggests upside. If we do the same exercise on NVIDIA, we get $50 in terminal value. That suggests downside. There really is no contest here: Micron is cheaper than NVIDIA in terms of terminal value.

Additionally, Micron arguably retains upside even after you bake some risk into the assumptions. If you up the discount rate to 8%, the terminal value estimate shrinks to $35, but remember that Micron is not much more expensive than its book value. Add the $44 in tangible book value per share to the $35 in discounted cash flows, and suddenly Micron is worth $79 even with the higher discount rate! The same exercise doesn’t help NVIDIA, it only has $6.93 in book value per share, and the 8% discount rate causes the value of its cash flows to plummet to $24. We’re looking at about 80% downside here if NVDA doesn’t get its growth back.

The Bottom Line

The bottom line in the comparison between Micron and NVIDIA is that the former is simply a better value than the later. NVIDIA really needs a lot of growth to justify its current stock price, Micron doesn’t need it. Both companies’ earnings are declining, but Micron’s earnings decline is priced in, NVDA’s isn’t.

NVIDIA certainly has some advantages as a business. Its products are much more differentiated than Micron’s are, and it has a great brand that’s very respected by gamers. Unfortunately, its stock price is unreasonably high. I’m much more comfortable holding Micron than NVIDIA going forward.

Be the first to comment