PytyCzech

Back in June 2021, I wrote a longform piece on the energy sector called, “The Case for a Longer-term Oil and Gas Bull Market“.

I followed this up with a shorter piece in July 2022 called “Energy: The Area Under the Curve“, which emphasized that it was the integral of energy prices (i.e. the time spent elevated) that is damaging to an economy, not just the high water mark that energy prices will reach in any given short timeframe.

My overall view continues to be that the world is currently energy-constrained, mainly due to several years of low capital expenditure and improper energy planning, but then also exacerbated by war-related disruptions.

By limiting nuclear power and hydrocarbon development for various reasons, due to other technologies not being able to replace them at the current time, due to the historical boom/bust capex cycle that the energy sector inevitably goes through, and due to Russia’s war, we’re set up for quite a turbulent decade in terms of accessing abundant and affordable energy.

To the extent that this continues to be true, it has implications for inflation, asset allocation, and geopolitics. This article continues the research theme by exploring the potential future directions of global energy supply. It starts with a foundational overview to get on the same page about what specifically we’re optimizing for here (since this is inherently a controversial topic) and then builds into more investment implications by the end.

Energy Usage and Human Life

A large portion of economic growth is about the ability to harness more energy to shape the world around us to a greater and greater extent.

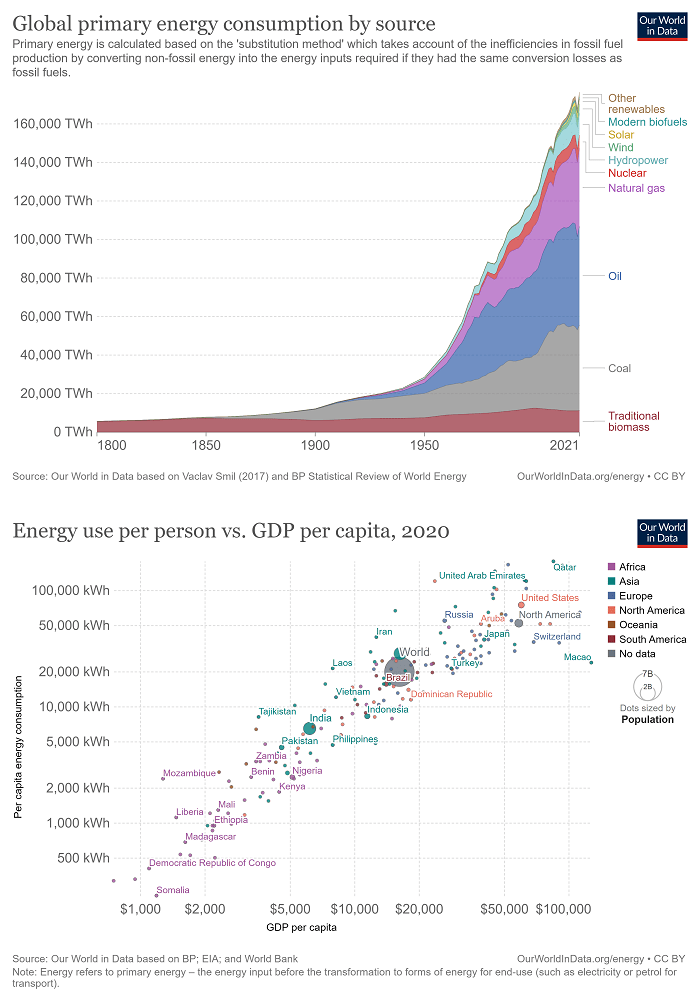

The huge uptick in energy usage is what has allowed humanity to maintain such massive carrying capacity on our planet.

In order to live safely and abundantly in a dangerous world, we rely on electricity, cooling, heating, pumping water, cleaning water, mining minerals, building durable structures, growing food in a mechanized way, and transporting ourselves and our things.

We make uninhabitable environments or barely-environments into comfortably-habitable environments, that are safe and filled with the richness of communication and media.

Our World in Data

There is a strong relationship between a country’s GDP per capita and its energy usage per capita, albeit with some extremes. Among middle and high-income countries, the ones with more urban environments, which naturally comes with apartment living and less car usage, will generally have less energy consumption than less densely populated suburban driving-oriented countries with single-family homes.

The other side of the story is technological productivity. The better our technology, the further we can make each unit of energy go.

For example, the invention of better silicon chips and better internet bandwidth gave rise to the smart phone. The smart phone allowed us to dematerialize all sorts of devices, ranging from desktop computers to scanners to cameras to watches to radios to landline phones to alarm clocks to mp3 players and to all sorts of physical books and magazines and calendars and paper, into one small application-dense device.

Of course, the smartphone didn’t completely replace all of those things, but it replaced a significant percentage of them in many contexts, and thus reduced overall demand for them. The billions of smartphones in the world have a significant environmental and financial cost, but they replace countless devices that collectively have a larger environmental and financial cost, and in a way that is usually more convenient too.

Nobody had to be convinced to switch to smart phones for environmental reasons; the technology made it obvious to do so. It’s a win/win.

Similarly, better materials and improved engineering designs can allow us to retain heat or cold better, which makes more economic usage out of each unit of energy that we use for heating or cooling. It takes a lot less effort to keep a sealed bucket full of water than it does to keep a leaky bucket full of water, in other words.

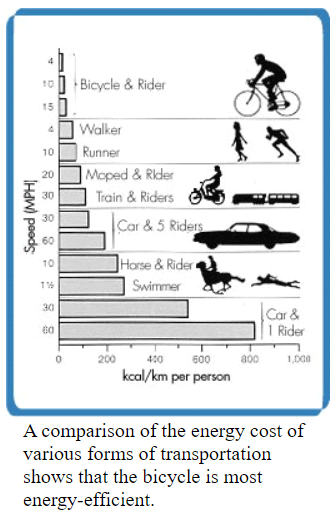

This division of “more energy” or “more efficient usage of energy” matters for transportation as well. Usually, in order to move faster we have to expend more energy per kilometer, which means we sacrifice efficiency for higher speed. We’re usually willing to make that sacrifice because that time can be spent doing other important things.

The bicycle is an exception where we get to have our cake and eat it too, where we get to go faster than walking *and* for less energy per kilometer. After an upfront manufacturing cost, a well-maintained bicycle over decades is an example of saving energy and adding speed and convenience at the same time, at least within a certain transportation range.

Exploratorium

When it comes to faster mechanized movement (motorcycles, cars, buses, trains, and planes), efficiency comes from using less material per person. In other words, a train filled with people is more energy efficient than the same number of people traveling in their own individual cars because there is a lot less material per person that needs to be moved. And then of course there are different optimizations you can do with friction on tracks vs on roads.

Usually the more flexible a transportation system is, the less energy efficient it is. That flexibility comes at a cost. Planes and cars have a lot more flexibility with where they can go than trains which are limited to tracks, for example, but the trade-off is less energy efficiency per person per kilometer.

Therefore, when a trip between two points is extremely well-traveled, putting a train there usually makes productive sense. Not building it, and thus leaving people to use more flexible and less economical transportation to cover a distance regularly that could be done with a train, is leaving some energy efficiency and financial savings on the table, untapped.

Urban planners can incorporate all of these details when designing a city, and connections between cities, to maximize energy efficiency and convenience, but often due to the path-dependence of how cities developed, that’s not always possible. It’s harder to optimize a city or region gradually than it is to do it if engineers get to start fresh with a clean blueprint.

The same can be said for shutting things off. Leaving devices on when we don’t need them expends considerable amounts of collective energy. Sensors and automation can reduce this unnecessary usage, by tailoring lights, temperature, and devices around the locations of people, but that level of optimization opens up privacy and surveillance concerns.

The summary and point of this section is that whenever you think about the concept of economic growth, you can divide it into two parts: more total energy usage, or more efficient usage of energy to do roughly the same thing.

Energy Optimizations

When it comes to any specific energy type, there are several variables that can be optimized or emphasized relative to others, which is often why there is no one-size-fits-all best type of energy.

In a detailed section of one of my prior energy articles, I went into the shortcomings of each major energy source, including hydrocarbons and non-hydrocarbons.

This article examines the issue from another angle – which are the specific variables that an energy source can be optimal for, which allows people to “score” an energy source along these variables for its suitability in a given application.

Energy Return on Investment (EROI)

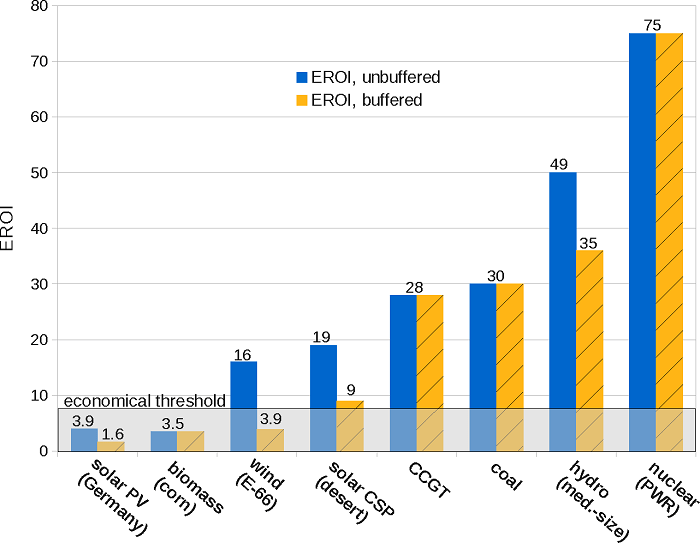

The “energy return on investment” or “EROI” of an energy type is an approximate measure of how much energy has to be expended in order to get it.

For example, it takes a certain amount of energy to dig an oil well, extract the oil, transport it, and refine it. But each barrel of oil recovered this way gives a much larger amount of energy back than what was required to get it. The return on energy invested is quite high, especially for conventional “easy to get to” oil.

For an apples-to-apples comparison, if a given power source is going to be a large portion of our total electrical usage, we have to assume storage for it if it is variable/inconsistent. In other words, we can’t just consider solar panels; we have to consider solar panels and battery storage together, since that is what it takes to replace the reliability of base load power.

EROI is pretty hard to measure because it changes over time, each energy subtype is unique, and a detailed analysis requires going back extremely far in the supply chain. I wish there were more numerous estimates out there for various sources, and with more frequent updates.

Weissbach et all, 2013 EROI Study

Energy types with high EROI let nature do most of the concentration for us:

- Uranium was forged in the heart of stars. That’s near the high end of what nature has given us in terms of energy density, based on our current level of technology.

- Hydroelectric dams use the natural features of geography and gravity over vast distances where the movement of water (thanks to the sun’s power, through evaporation) concentrates from rain into tributaries and then into mighty rivers. The energy is then captured at that concentrated point. We can think of hydroelectric power as highly-concentrated solar power, making use of Earth’s features.

- Geothermal facilities use naturally-occurring places where the Earth’s heat is close to the surface, and make use of that to generate usable power. There’s basically a mini-sun miles beneath our feet, and in some parts of the world it’s close enough to tap into.

- Most hydrocarbon (coal, oil, and gas) deposits on Earth are liquid chemical batteries from lifeforms (ancient forests and seas) that collected solar energy over millions of years and concentrated it with pressure and heat for us.

Energy types with low EROI lack natural concentration and storage, and so we have to concentrate and store it ourselves:

- Solar panels capture solar energy as it comes in, without it being concentrated by nature. We have to use a lot of silicon, glass, and various metals to capture and concentrate it.

- Wind turbines capture wind energy (which is a derivative of solar energy) as it flows around, without it being concentrated by nature. Again, it falls entirely on our engineered machines to collect it into concentrated power.

- Biomass fuels allow solar energy to be collected from nature over months, years, or decades, and then harvested. However, biomass is much less concentrated than hydrocarbons which are the multi-million year densely concentrated versions of biomass. With biomass, we’re collecting and releasing carbon at the same rate, rather than tapping into millions of years of stored-up carbon.

EROI is very important, one of the foundational variables, because getting out as much energy possible relative to what is put in, is a key limiter to the speed of economic growth in the physical realm, which includes health and safety.

Energy Speed and Payback Period

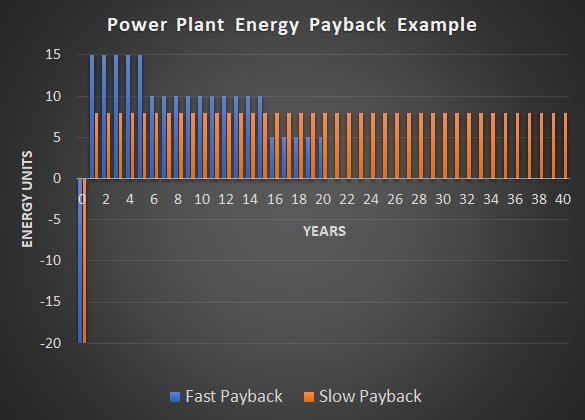

Even a high-EROI energy source can be slow to pay for itself in some cases.

For example, nuclear plants generally have higher EROI than coal power plants, although both are quite high. The reason that coal plants are very popular around the world is twofold; one is that they are easier to build, and two is that they have rapid payback periods.

A nuclear power plant can last for 50-100 years and provide an immense amount of energy, but is more expensive and time-consuming to build and thus takes more years to recoup its initial energy and financial costs. A coal plant pays back its energy usage and its financial investment quite quickly in comparison. A fast-growing energy-starved country needs energy now, and thus tends to resort to coal.

Here are two hypothetical power plants, just for simple visualization. The first is medium-EROI and faster-payback, where 20 units of energy are required to build it, and then it gives 200 units of energy back within a 20-year period, and it’s front-loaded. The second is a higher-EROI and slow-payback, where 20 units of energy are required to build it, and then it gives 320 units of energy back within a 40-year period.

Lyn Alden

Which one is better? If you already have abundant energy and want to maintain it, then building the second one is probably a better idea. If you’re energy starved and need energy faster, then building the first one is probably necessary.

Over time, these dynamics can change. For example, small modular nuclear reactors and a better regulatory environment could substantially improve the payback period of nuclear power by reducing the on-site construction time considerably.

Solar’s longer payback period is more fundamental. Although it is shortening over time thanks to more efficient panels, because solar power uses non-concentrated energy, it inherently takes a while to pay for itself.

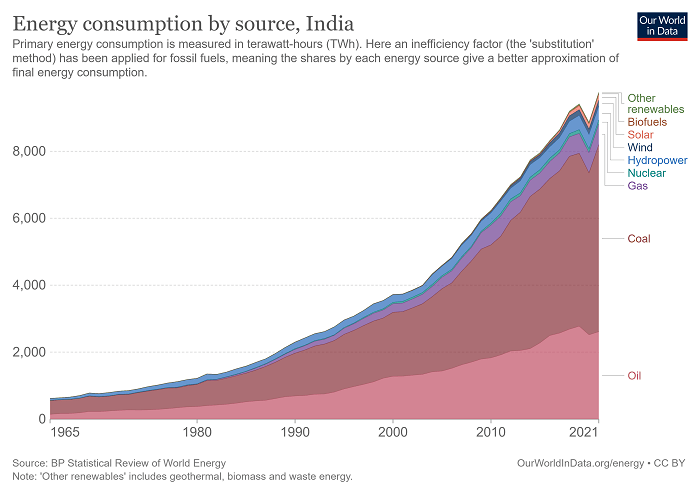

This is why even though India’s installed solar capacity is growing quickly in percentage terms from a small base (they’ve increased their installed solar capacity by 10x over the past decade), they installed way more absolute coal generation over that period and have not been reducing their hydrocarbon share of the energy mix:

Our World in Data

Energy Transportability

Some energy is more transportable than others, giving it the ability to serve different applications.

Nuclear reactors, for example, are quite big, and so they are limited to powering electrical grids and large ships. You can’t power your car or motorcycle with nuclear energy, other than indirectly through the electrical grid.

The same thing is true for solar panels; due to the low energy density, it’s impossible to propel a high-powered vehicle mounted with solar panels in real time; it needs to collect into a stored-up battery to do that job and even then, it has a worse energy-to-weight ratio than hydrocarbons.

Hydrocarbons are rather flexible on this metric. They can be used for stationary grid power, large vehicle power, or small vehicle power, with different derivatives of hydrocarbons being more optimal for different purposes. They can also be used for flexible electrical generator locations, as backup power.

Hydrogen is not itself an energy source, but creating it is a way to turn excess electricity into a more transportable fuel. However, it’s harder to store and transport than hydrocarbons.

Energy Decentralization

Some energy sources need to be centralized by their nature, while others can be more distributed, in the hands of the consumer.

For example, putting solar panels on your roof along with a battery pack makes you more “energy sovereign”. If the grid goes out, you can still get some limited power without the need for refueling (other than some sunshine, including partially cloudy sunshine). It might not be the most efficient power, but that self-ownership and decentralization comes with some benefits.

Similarly, natural gas distribution requires a lot of infrastructure, and is often lacking in developing countries and/or in rural areas. Propane is a more portable alternative that can be stored in significant amounts by the end-user, giving them a higher degree of energy sovereignty than they get with natural gas.

Large centralized power generation tends to be more efficient, while the more decentralized sources are more resilient to disruption at scale.

Baseload or Variable Power

Some types of electrical power sources are always on. For example, a nuclear power plant’s cost is almost entirely the infrastructure, with the uranium fuel being a very small percentage of the cost. They are usually kept running 24/7, month after month, except for rare maintenance periods.

Other types of electrical power sources can be finely controlled by the operator, such as natural gas peaking plants. The operator can rapidly turn them on or off at will to match demand as needed, and the biggest input cost over the lifetime of the project is the fuel itself.

Still other types of electrical power sources are in nature’s hands. Solar panels only produce power during daytime hours, and clouds will impact their overall generation. Wind turbines produce power during windy periods, day or night, but unpredictable periods of low wind will sharply reduce or eliminate their ability to generate power.

Storing energy for a long period of time, and being able to release it in bursts for high levels of power, has historically been very challenging. Workable batteries existed as far back as the 1800s, including for electric vehicles, and it has been a long engineering grind to make them better over the decades. Storing a lot of energy in a small space and weight, and having that energy not dissipate quickly, is hard. As of this writing, batteries store considerably less energy per unit of weight or volume than hydrocarbons, have rather short operating lifespans, and require a lot of somewhat-scarce metals.

It’s one thing to build battery storage systems so that a power company can keep the grid working for a brief period of time as it switches between other power sources. It’s a much different thing to build a battery that can store excess utility power generation from variable power sources for long periods of time, and then tap into it during multiple days or weeks where that power is unavailable.

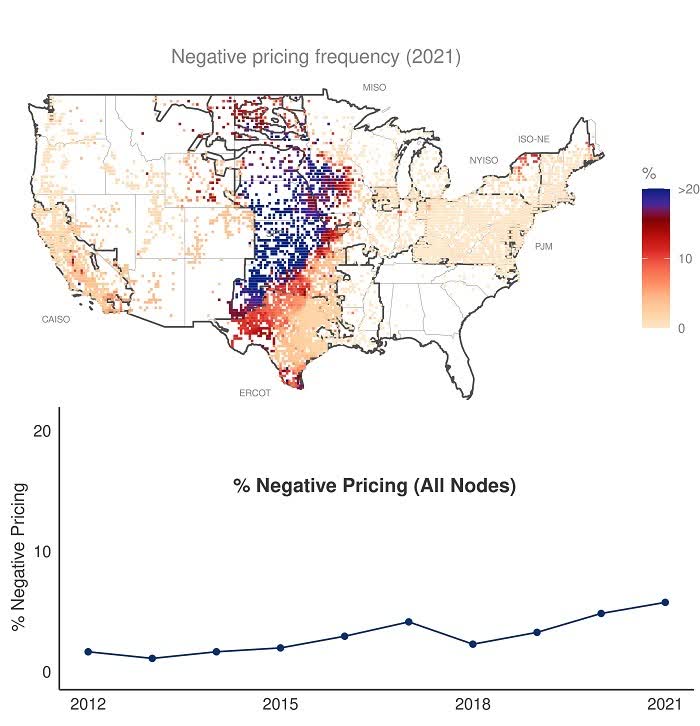

The southern middle of the US has a lot of sun and wind generation potential, and thus a higher portion of the electrical power is generated from those sources. That’s also where the negative electricity pricing tends to happen:

Berkeley Lab

A decade ago, 1-2% of nationwide electricity was negatively priced, now it’s 5-6%. And it’s mainly in areas with a lot of wind and solar capacity, where the occurrence of negative pricing reaches over 20%.

That sounds good at first. Solar and wind power are so cheap that the price is negative! The problem is that negative pricing is indicative of a mismatch of supply and demand- too much power is being generated precisely when and where people don’t want it, and often not enough power is being generated when and where they do want it, with limited ability to take that surplus power, save it up, and release it during those deficit periods. A lot of it is therefore wasted.

This is also why bitcoin miners tend to go to this region of the country; they want the cheap, stranded power that nobody else wants, and they improve the economics of variable power sources by giving them a guaranteed buyer at a low but nonzero and non-negative price. At the same time, since bitcoin miners are more flexible than most sources of electrical demand, bitcoin miners can sign contracts to be the first to shut off during periods of electrical deficit (such as for example on the hottest days of the year where everyone has their air conditioning on full blast). So, they can consume power, financially incentivize more build-out of power generation, and then shut off faster than any other consumer of electricity whenever there is a shortage.

Material science breakthroughs can change what is or is not economically viable for this category, but there are physical constraints and long lead times between creation and implementation. Batteries don’t improve at the pace of Moore’s law, and there have been tight physical limits on what engineers can do with them.

Energy Cleanliness

Every energy source affects the environment in some way.

Burning natural gas puts carbon dioxide into the atmosphere (which has a global impact but less-so an immediate local impact). The burning of coal and oil-based fuels also adds a mercury and/or particulates into the environment (which has both a local and global impact).

Solar panels and batteries require considerable amounts of mining for various metals, which has a significant environmental impact. The panels and batteries take energy to be made, and then after their lifetime, they represent e-waste that often gets discarded. Although solar energy is renewable, the devices we use to capture solar energy are much less-so.

Solar panel recycling (or lack thereof) continues to be a major issue. And if it’s not solved at a faster pace than solar panel capacity ramps up, then the problem could increase multiple times over in the coming decades.

More than 90% of photovoltaic (PV) panels rely on crystalline silicon and have a life span of about 30 years. Forecasts suggest that 8 million metric tons (T) of these panels will have reached the end of their working lives by 2030, a tally that is projected to reach 80 million t by 2050 (Nat. Energy 2020, DOI: 10.1038/s41560-020-0645-2). But today’s technologies for recycling these units are inefficient and rarely deployed.

That is an enormous problem. PV panels contain toxic materials, like lead, that can cause environmental pollution, yet many are dumped in landfills when they die. They also contain valuable materials that could be reused to make new solar cells, but today these resources are mostly wasted.

In the US, there are no federal regulations to mandate PV recycling, and according to the US National Renewable Energy Laboratory, less than 10% of the country’s decommissioned panels are recycled. Even in the European Union, where legislation requires PV recycling, many waste facilities merely harvest bulk materials like aluminum frames and glass covers, which make up over 80% of a silicon panel’s mass. The remaining mass is often incinerated, even though it contains elements like silver, copper, and silicon, which together account for two-thirds of the monetary value of a silicon panel’s materials.

This same recycling problem exists for wind turbine blades and many types of batteries. They could be designed to be more recyclable, but that would likely come at the cost of lower efficiency, since that is a new constraint that engineers would be optimizing for in addition to their other constraints.

Nuclear power has historically been one of the safest and cleanest energy sources. Adding up the Three Mile Island, Chernobyl, and Fukushima incidents together results in a much smaller number of human deaths and environmental damage than coal power does each year, and all of those were built with 1960s/1970s technology. Chernobyl was particularly bad because it didn’t have a concrete shield around it during operation, which is meant to block radiation and is now standard practice for every working reactor. Plus, contrary to public thought, storing nuclear waste requires a small geographical footprint and is safer than the overall damage caused by many other energy sources.

Some energy sources are easier when it comes to outsourcing the environmental impacts. Coal is not an example of this; wherever it is burned, it affects the air quality in that area, although there are ways to mitigate it to varying degrees. The same is true for the exhaust that comes out of hydrocarbon-powered cars.

Solar panels and batteries are examples of where most of the environmental impact is from the mining and construction of the devices, and thus a country can outsource this pollution to others that are willing to do it, either because they have the natural resources or because they have the industrial capacity.

I’m an environmentalist in the sense that I want cleaner water, cleaner air, preservation of old-growth forests where possible (try not to destroy what you can never re-create), more focus on building soil, sustainable fishing practices, and much less spread of environmental chemicals in general. But I tend not to be readily onboard with the bureaucratic-checkmark and corporate-sanitized ESG frameworks, because they usually obfuscate trade-offs and often aren’t optimizing things properly in my view.

Energy Across Borders

East and southeast Asia in general have quite a lot of coal, but not a lot of oil and gas. This includes highly-populated countries like China, India and Indonesia that make up a considerable percentage of the world population and energy usage.

If India were to entirely switch out of coal and burn entirely natural gas for its electricity grid instead, that means leaving the coal in the ground (their natural resource) and pay to import that gas from a foreign source, which is bad for the country’s trade deficit. It makes the country more externally reliant on global energy markets and would be bad for the currency.

Similarly, China produces over 80% of the world’s solar panels. They have a tighter lock on the solar market than OPEC has on the oil market. This could be fixed over time, but basically, countries that are better at manufacturing things cheaply and efficiently have an advantage when it comes to producing solar panels.

Nuclear reactors are even more specialized; only a handful of countries have the teams required to build nuclear plants. Many countries hire Russian teams, for example, to come in and build their nuclear plant for them. This could change over time as the know-how becomes more globally distributed.

Talking about energy transitions must include an analysis of what a country can produce and what a given change would do to its trade deficit.

Building Energy Infrastructure Stock

Humanity has never transitioned from a higher EROI energy source to a lower EROI source for most of its energy usage before.

In terms of thermal energy, humanity went from biomass to coal to oil to gas to nuclear, which was a steady climb up the EROI list. Several countries eventually shied away from nuclear but are starting to run into frictions with that decision.

Meanwhile, high-EROI hydroelectric power has been around for a long time and continues to be a highly relevant part of the mix, and is dominant in certain countries that have the geography for it. The same is true for geothermal energy. These are good sources of power but are limited by geography.

While the total amount of solar energy reaching the Earth’s surface is immense, the amount of solar energy hitting any given square meter is low, and highly variable. That’s why solar panels are a low-density power source, and a low-EROI power source. That’s why solar power requires quite a bit of (currently mostly unrecyclable) material for us to capture it, and then just as importantly to store it.

To bring back a prior example, hydroelectricity works well as a high-EROI energy source because rather than trying to collect individual rain drops for power, we let Earth’s gravity concentrate those raindrops over hundreds of square miles, collect into tributaries, collect into a big river, and then build infrastructure to capture it right there, where it is naturally concentrated and almost always flowing. The usage of solar panels is similar to trying to capture the individual rain drops for energy.

Does that mean it’s impossible to switch to a lower-EROI energy source on any sort of cost-effective basis while still maximizing human flourishing? Kind of yes, but with one important caveat. Population tends to slow down as a society becomes richer and urbanized, and humans are projected to eventually reach a peak population level before flattening and rolling over. Some of this is locked in already, whereas some of this can change depending on what happens in the future.

In addition, there may be an upper ceiling on how high the average energy usage gets in a society. Once you have a nice home, cost-effective transportation, most of the material comforts you want, electricity, internet bandwidth, robust food and water systems, then all of your material natural instincts are rather satisfied. Of course, it’s always nice to push it further with things like private jets if you’re wealthy enough, but subject to economical limits, there is a point where enough becomes enough for most people, and where additional per-capita energy usage provides sharply diminishing incremental improvements in quality of life.

A country that has growing population and/or that is developing from a low energy per capita state, needs to focus on high-EROI and fast-payback projects at all costs.

A country that reaches a high level of wealth and a rather flat population has more ability to make long-term optimization choices regarding its energy systems. As existing energy systems age, they can be replaced over time by energy systems that come at a longer payback period, in exchange for what sources they view as being more clean, or what sources are less reliant on foreign sources. For example, modern nuclear facilities are cleaner and longer-lasting than coal facilities.

As we look out over the long arc of time, it’s possible to envision a nuclear renaissance due to changing perceptions and regulations, as well as improvements in small modular reactors, and then a mix of other capital-intensive long-lifecycle projects as well, including various energy designs that remain mostly on the horizon at scale. For example, I’ve been intrigued lately by ocean thermal energy conversion “OTEC” for providing baseload power in equatorial coastal regions of the world. OTEC lets the ocean do a decent amount of solar-powered concentration and storage, and taps into that temperature differential between surface and deep water to generate power.

A developed country can build a higher “stock” of energy infrastructure, with big upfront costs for systems that are optimized over a multi-decade or century lifecycle to provide clean and abundant energy, since they don’t have the constraints of a developing country that needs to optimize for fast-payback periods.

However, that doesn’t mean a society should get ahead of itself, where policies and desires front-run what is technologically and economically feasible. Any society that mismanages its energy policy and gets persistent problems with energy security or affordability, basically degrades into a developing country. It gets de-industrialized, far less efficient, and is likely to run into political reversals as the situation grinds on. Luxury beliefs vanish when people can’t keep the lights on and the home warm.

The key, and this should be intuitive but is usually not, is that any good engineering solution regarding power lets nature do as much of the concentration and storage as possible. The more of the concentration and storage that humans have to do with artificially-constructed metallic machines with finite lifespans, the less efficient and feasible that energy source will usually be at providing foundational energy to society.

Projections for This Decade

There isn’t a central world government to reduce or control everyone’s energy and/or hydrocarbon usage. Some countries can deploy techniques to try to manage energy consumption among the population (with the elites being excluded, of course), but that’s a rather unsustainable and dystopian situation over the long run.

Countries that push their energy policies ahead of what is technically feasible, especially on the supply side with bans or restrictions, will generally diminish economically, or have sociopolitical pushback and then go in another direction. Policies such as windfall taxes on energy corporations basically tells these companies, “your upside risks being capped in a bull market, but you still have all of the downside risk in a bear market,” and this is not exactly a strong incentive for them to deploy capital on new hydrocarbon exploration and production. Bans on production and bans on pipelines limit the supply as well, without addressing demand, contributing to risk of recurring energy crises.

Suppressing demand through tight monetary policy can work for periods of time, but is like holding a beachball underwater. As long as the supply limitations remain, the upward pressure is still there, ready to pop back up as soon as they stop pushing down. The Federal Reserve has had a lot of power in this; in addition to tightening US demand, their strong dollar policy also hurts multiple frontier markets and slows their energy consumption out of necessity.

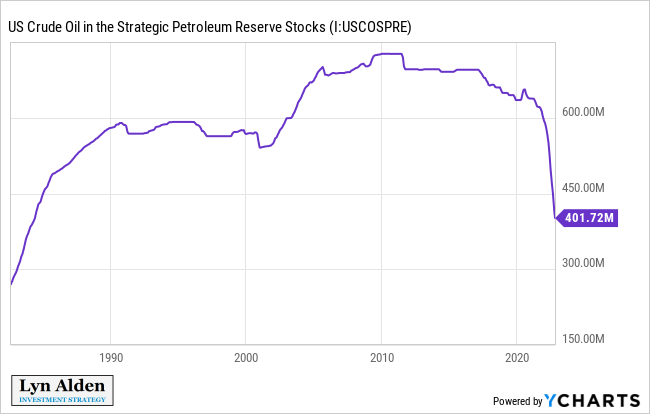

At the current time, the US Strategic Petroleum Reserve is rapidly being drawn down, providing temporary excess supply to the market. But there’s a limit to how much they can draw down:

YCharts

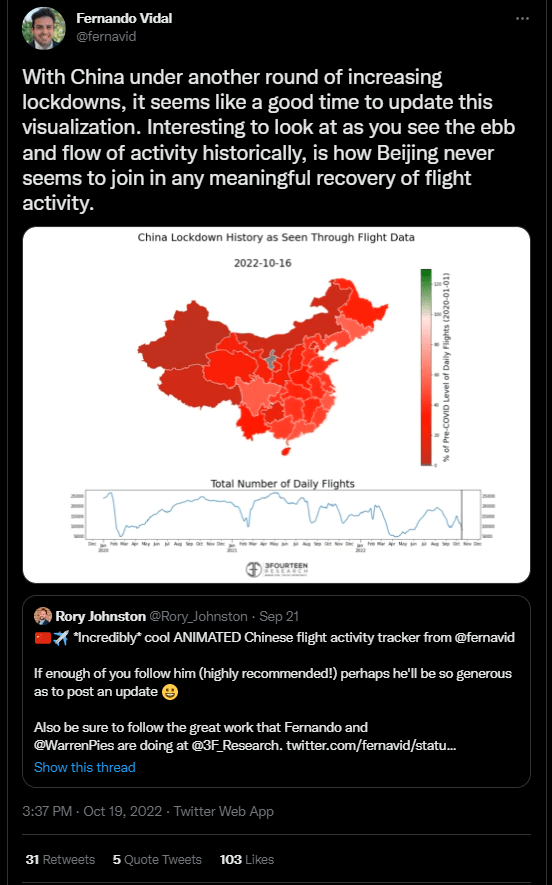

Meanwhile, China has been in a rolling set of lockdowns for almost three years now, which limits jet fuel and other energy sources (demand destruction). With their equities crashing, their currency weakening, and their real estate slumping, it’s only possible to push these policies for so long before public sentiment shifts.

Fernando Vidal

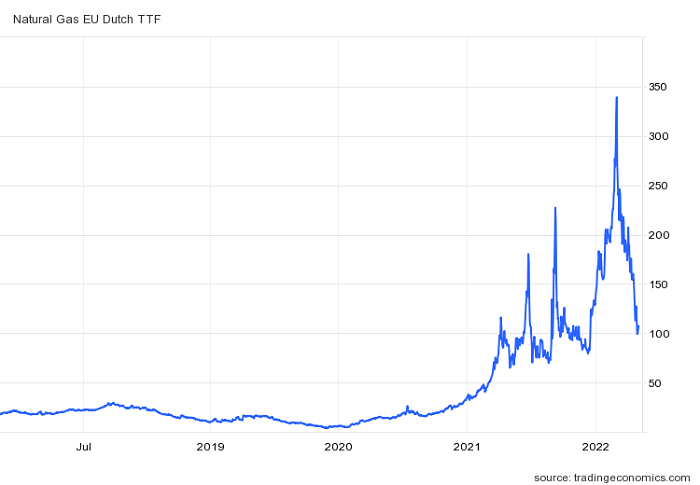

Europe has temporarily gotten natural gas prices under control, and with good storage conditions, but it did so with unseasonably warm weather and various facility closures (demand destruction). A large percentage of fertilizer production, steel mills, and aluminum smelters have gone offline in Europe because they were unprofitable with those extraordinarily high input costs, and now Europe has to import more of those things from the rest of the world’s capacity to produce them.

Trading Economics

Europe is also putting a lot of pressure on poorer nations due to consuming a larger share of the global LNG market to replace their Russian gas, so to some extent fixing things in Europe means hurting things elsewhere until a lot more LNG capacity can come online.

Pakistan’s acute energy shortage is at risk of lasting years after the government was unable to secure a long-term supply of liquefied natural gas.

Not one supplier responded to Pakistan LNG Ltd.’s tender to buy the power-plant fuel for between four to six years starting January, said traders with knowledge of the matter. The tender, which closed Monday, was seeking to procure one cargo of LNG each month.

The cash-strapped nation has been hit with widespread blackouts this year after several failed attempts to buy gas from the expensive spot market. It tried to get a long-term deal looking for more reasonable prices, but that hasn’t materialized.

There’s little LNG supply available until 2026 when massive new export projects start up, according to traders. Many spot cargoes are currently going to Europe, where buyers are willing to pay high prices in the rush to secure gas to replace dwindling Russian pipeline flows. That’s leaving developing nations facing energy shortages and economic uncertainty for years.

In addition to squeezing poorer nations out of the LNG market, other options for Europe include burning more coal and burning more oil for electricity. Neither of those are optimal, but that’s where the continent finds itself. They have also been burning wood pellets, harvested from old-growth forests both in Europe and elsewhere, which is classified as a renewable energy source but is clearly not, or at least not in the way people think it is.

When investing in the energy sector, I continue to be bullish on hydrocarbons and their producers for years into the foreseeable future. The industry continues to be under-invested in. I do expect it to be a bumpy ride, however.

Whenever there is a severe mismatch between different ignitable energy sources in terms of how much energy you can get per dollar of that resource, then that gap becomes ripe for arbitrage. Therefore, a European natural gas shortage also puts upward pressure on European oil and coal and wood pellet demand, which has global price implications.

I’m also bullish on uranium, partially due to the structural consumption-production deficit that exists there, but also because I think humanity will need to turn to more nuclear in the years ahead, by way of reversing facility closures and investing in future facilities.

Lastly, I’m bullish on selective long-term opportunities, such as the concept of ocean thermal energy or others, that emphasize letting nature do as much of the concentration and storage as possible.

Capital Expenditures

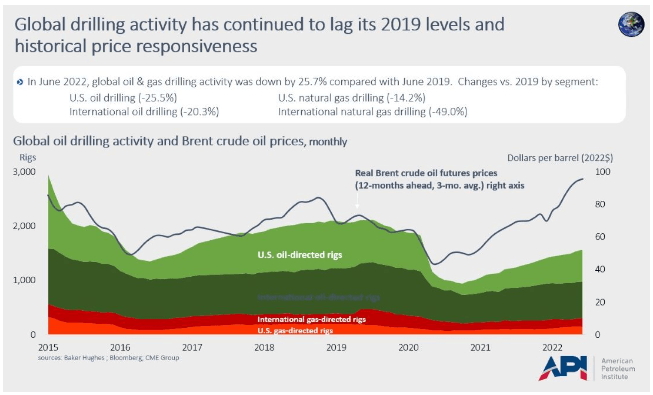

Shale oil and gas capital expenditures have been heating up, but remain below 2018 levels.

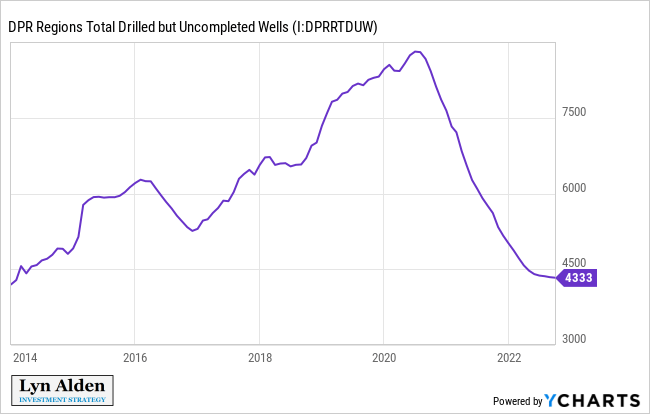

During the past two and a half years, shale oil companies could tap into their big stockpile of drilled-but-uncompleted wells, meaning they could complete these assets and get more oil flowing pretty cheaply.

YCharts

Now this excess surplus of drilled-but-uncompleted wells has been used up (completed), and shale oil growth production is slowing. Considering that shale well output rapidly declines after it opens, it will take more aggressive drilling going forward to keep growing the possible output. There were over 250+ oil and gas producer bankruptcies between 2015 and 2020 in that low-price environment, and therefore many of them are cautious about investing too heavily going forward.

Meanwhile, OPEC+ is likely near the top end of its current capacity limits, and has shown little willingness to reduce prices. They’ve been cutting their output quotas, rather than increasing them.

The number of rigs isn’t a perfect indicator, but overall, there’s just not a very aggressive push globally for more hydrocarbon supply.

American Petroleum Institute

Inflation, and Summary Thoughts

The 2020 pandemic lockdowns rapidly shifted consumer demand from services to goods, which, along with frictions on working efficiently, put a lot of pressure on supply chains. As much of the world opened back up, consumption patterns have drifted back towards normal. This eased some of the most extreme bottlenecks.

However, a low capex cycle from 2015 to the present, exacerbated by dislocations that have arisen from Russia’s war, have resulted in hydrocarbon scarcity and price pressure. And, that hydrocarbon scarcity is impacting fertilizer and industrial metal production in Europe.

With the Federal Reserve tightening monetary policy, the dollar index roaring higher lately, and with various temporary supply releases or demand suppression strategies, oil prices have been rangebound. However, investors must ask, “what’s next?” A lot of investors seem to assume that if the Fed gets inflation under control, then they can just release the pressure and inflation will stay low.

But if significant new energy supply doesn’t come online, then the reality is that energy price inflation and to some degree broad inflation would be ready to come back whenever policymakers try to let their economies grow again. Victories on the energy price front will be cheered, but likely short-lived and with the cost of less economic growth.

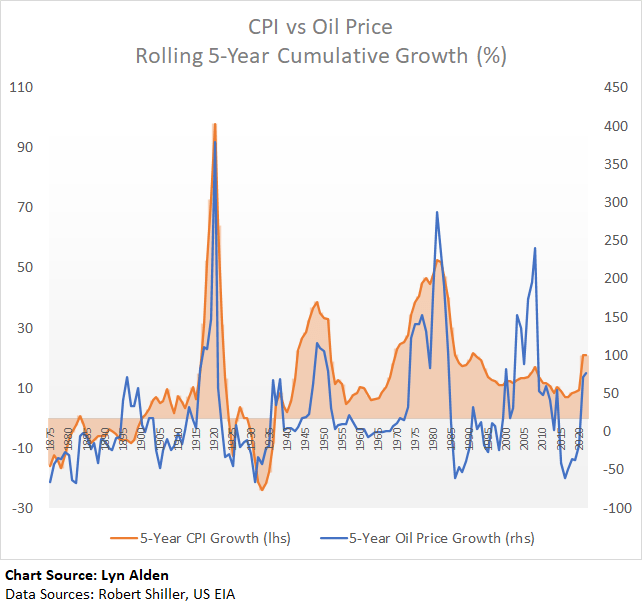

This chart shows rolling 5-year periods of cumulative CPI changes and oil price changes for the United States:

Lyn Alden, w/ data from Robert Shiller and US EIA

Oil has historically been one of the most inflationary variables to consider. The 2000s decade managed to avoid most of its wrath due to aggressive offshoring (a strongly disinflationary variable that countered the rise in oil prices), but so far, they haven’t been able to repeat that trick in the 2020s.

In the years ahead, I expect higher oil prices, and persistent background inflationary pressures, even though there will naturally be disinflationary periods within that inflationary trend. Until there is a more robust capex cycle in the energy sector, those disinflationary periods will unfortunately be mostly about the deceleration or cessation of economic growth, rather than the good type of disinflationary growth that people want.

Be the first to comment