S_Bachstroem

Article Thesis

The Canadian central bank, the BOC, has recently increased its hawkishness when it comes to its goal of clamping down on inflation. That has increased worries about downward pressure in Canada’s housing market, which has, in turn, led to share price declines in the stocks of Canadian banks, such as Toronto-Dominion (NYSE:TD), Royal Bank of Canada (NYSE:RY), and the Bank of Montreal (BMO). I do believe that this share price decline could be overblown and that these bank stocks are attractively priced at current levels, as their exposure to the housing market is not as dangerous as some believe. On top of that, their valuations are low and rising interest rates could expand their net interest margins, which would be beneficial for their profitability.

The BOC Is Getting More Hawkish

Bank of Canada Governor Tiff Macklem has recently increased his hawkish tone when it comes to clamping down on inflation. His most recent speech is available here. The Governor and other Canadian central bankers have, like in the US, been hawkish in order to bring down decades-high inflation levels. Unlike in the Eurozone, where inflation is high as well but where the ECB has not increased rates much, the BOC has been hiking rates aggressively, like the Fed. The current BOC rate is 3.5% for the bank rate, and 3.25% for overnight deposits. But that has not been sufficient to bring down inflation to the target range of around 2% yet, as the most recent CPI reading in August stood at 7.0%.

Is There A Housing Bubble?

With the BOC making it clear that that’s not good enough and that further rate hikes will be necessary in order to squash inflation, the market is now increasingly worrying about what that might do to the Canadian housing market.

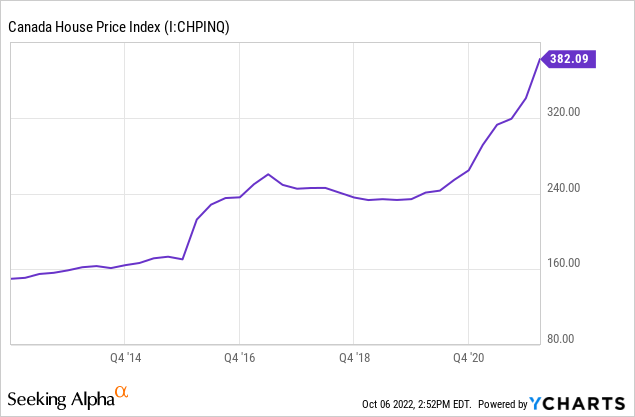

In the above chart, we see the Canadian House Price Index over the last decade. Clearly, prices went parabolic over the last two years, rising by more than 50% in that time frame. Over the last decade, prices rose by 155% — that pencils out to a 9.8% annual increase. That’s above the norm, but not necessarily outrageous — in many other markets around the world, housing prices rose at a high-single-digit pace over the last decade as well. Still, the very pronounced increase in house prices over the last two years, or during the pandemic, seems unsustainable. I believe it is essentially guaranteed that prices will not continue to rise at that rate. But that does not necessarily mean that they will come crashing down.

After all, costs for newly built homes will remain high due to the cost increases for all kinds of building material we have seen in the recent past. On top of that, homeowners that have locked in low mortgage rates over the last couple of years will not be inclined to sell their homes, as having a low-cost mortgage is quite an advantage in a high-inflation environment. On the other hand, demand for homes will be lower as well, as the increase in interest rates over the last couple of quarters has made mortgages more costly.

All in all, this could translate into an environment where both supply and demand are declining. That means that there will be less activity on the housing market, and the pace of new homes being built could decline as well. But prices will not necessarily decline much in this scenario, especially as long as employment remains strong. In a way, the Canadian housing market is thus comparable to the US — a slowdown is pretty likely, but lowish supply could prevent home prices from declining much.

The current situation is thus not comparable to the housing bubble in the US, Spain, etc. in the late 2000s. There’s no large sub-prime market, and lending standards were reasonable in recent years. Those that have bought homes in Canada in recent years generally have considerable equity in these homes due to the recent price increases, thus even if home prices were to pull back somewhat — e.g. 10% or 20% over the next couple of years, banks wouldn’t be widely exposed.

Bank Stocks Drop, But Is That Justified?

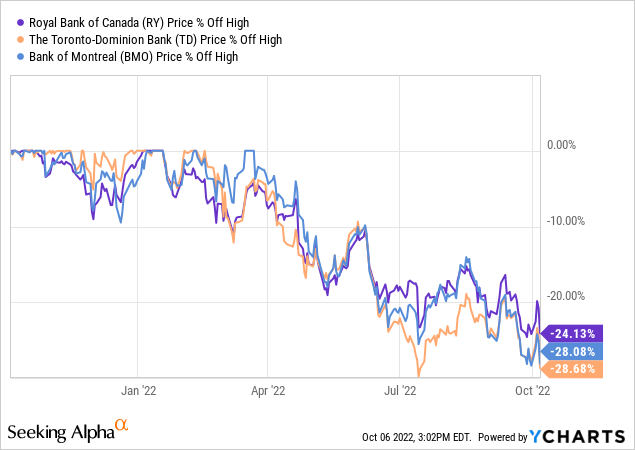

Royal Bank of Canada, Toronto-Dominion, and Bank of Montreal have all dropped considerably from recent highs:

They dropped 24% to 29% from their respective 52-week highs, generally moving relatively in line with each other.

This is partially attributable to the broad equity market decline, while bank-specific fears play a role as well. Among some investors, there’s fear that these banks will suffer when/if house prices decline in Canada — they fear that the bubble burst will hurt banks tremendously, similar to what happened in the US around 15 years ago. But I believe that the situation is not really comparable. Not only is there no large sub-prime market and massive speculation like what we saw in the US during the housing bubble, but there are also some other important differences. The US has non-recourse mortgages, meaning that borrowers can just mail back the keys to the home they bought if they are underwater and it’s the bank’s problem. In Canada (and many other markets), there are recourse mortgages — the debt follows you, no matter what happens with the house. That reduces both speculation and the risk of defaults, as borrowers will have to access/sell other assets to generate cash in case they can’t or don’t want to pay their mortgages. That’s why default rates in Canada were way lower than in the US in the past.

Mortgage delinquency rates in Canada are also ultra-low, at just 0.16% in the most recent quarter. Over the last decade, delinquency rates never breached 0.4%. Even among the 0.16% of mortgages that are delinquent, it’s not like all of those will not get paid. Some payments will be made at a later point in time, for example. Even a massive 10x increase in delinquency rates would leave the Canadian mortgage delinquency rate below the current delinquency rate in the US, which stands at 1.96%.

Banks are also protected by their well-above-average equity positions. Toronto-Dominion has a CET1 ratio of 14.9% as of the end of the most recent quarter, while the CET1 ratios of Royal Bank of Canada and Bank of Montreal stood at 13.1% and 15.8%, respectively. That’s way above comparable levels for major US banks, and also well above the levels demanded by regulators. Canadian banks are very well-capitalized, one could even argue that they are overcapitalized and holding on to too much capital instead of returning it to their owners. No matter what, the strong capitalization that is way higher than in many other countries, on average, reduces risks further when it comes to potential headwinds from a (potentially) declining housing market.

I do believe that the selloff in the stocks of these banks also does not account for the fact that rising interest rates generally lead to expanding net interest margins. Even if credit losses increase, that could be more than offset by growing net interest income.

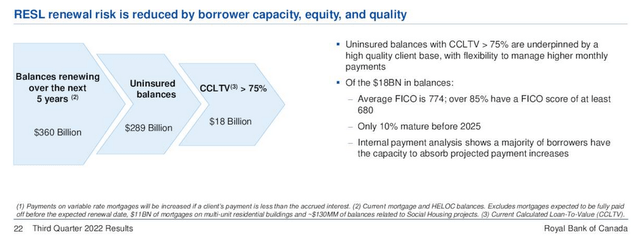

The following slide from Royal Bank of Canada’s most recent earnings presentation shows that at-risk mortgages are pretty small:

RY presentation

Just $18 billion of the bank’s mortgage portfolio has a loan-to-value of more than 75%. Thus even if house prices dropped by 25%, which would be a hefty bear market, 95% of RY’s overall mortgages would not be impacted at all, as the loan-to-value is low enough for the equity in these houses taking the entire hit. And even if house prices dropped this much and $18 billion would be at risk, it’s extremely unlikely that they would all default. Many of those homeowners would most likely continue to make mortgage payments, even if underwater — these aren’t non-recourse mortgages, after all. FICO scores are pretty high in the high 700s on average, meaning that these are generally high-quality borrowers with secure and reliable income and a history of paying their loans.

And yet, the shares of BMO, RY, and TD have dropped considerably. I do believe that there is a fear-driven disconnect between perceived risks and actual risks, likely driven to a large degree by knowledge about what happened to US banks 15 years ago. The situation is not comparable, however, due to differences when it comes to capitalization, recourse/non-recourse mortgages, sub-prime exposure, and so on.

I do believe that the major Canadian banks are attractive at current valuations. Let’s take a deeper look:

Royal Bank of Canada

Royal Bank of Canada is the largest Canadian bank by market capitalization. It was not able to grow its profit during the most recent quarter, due to weaker profit generation in its Capital Markets segment. That’s not surprising, as major US banks experienced the same — fewer IPOs and takeovers resulted in lower fee income in that segment. Apart from that, results were strong, however. Net income totaled $3.6 billion still, and a 7 basis point net interest margin increase during the quarter alone bodes well for future revenue growth via net interest income expansion.

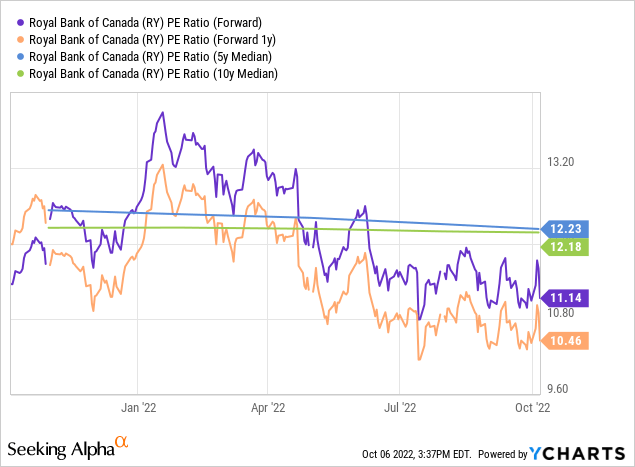

RY is trading at just 11x this year’s expected net profit today, while the 2023 earnings multiple is even lower, at 10.5. That’s 15%-20% below the long-term average, meaning that Royal Bank of Canada trades at an attractive valuation today. Its dividend yield is high as well, at 4.2%, meaning that RY is also a compelling income stock at current levels. Due to a payout ratio in the 40s, even a major profit decline (that is not expected) could easily be stomached without a dividend cut.

Toronto-Dominion

Toronto-Dominion is the second-largest bank in Canada by market capitalization, being valued at around $110 billion today. During the most recent quarter, the bank performed pretty well. Earnings per share beat estimates and grew both on a quarter-to-quarter basis as well as on a year-over-year basis. An expanding net interest margin (see the aforementioned connection to rising interest rates) allowed the bank to grow its net interest income by an attractive 10% year over year, which was more than enough to offset profit headwinds from higher provisioning for credit losses. With a return on equity of 16%, TD is one of the most profitable and high-quality banks in the world — many of its US peers would envy it for this return on capital.

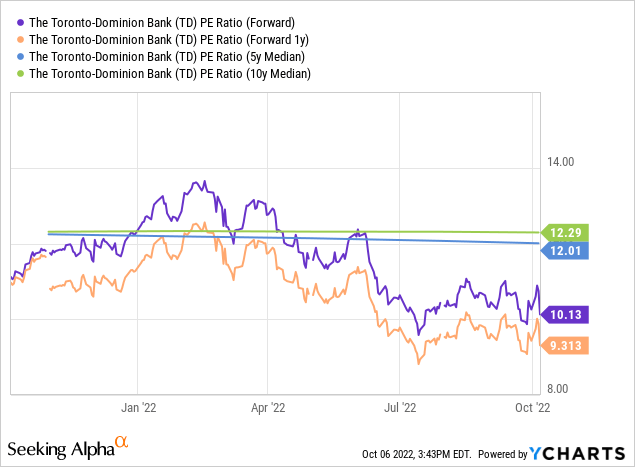

Like RY, TD is cheap — it’s valued at just 10x this year’s profits and at 9x next year’s profits. That represents a 20%-30% discount versus the longer-term average, meaning TD is even more undervalued versus the historically normal level relative to RY.

Toronto-Dominion also offers a sizeable dividend yield of 4.3%, creating a compelling income stream. With a dividend payout ratio in the mid-40s, there is very little risk of a dividend cut.

Takeaway

Canadian central bankers are cracking down on inflation — as they should. This will likely dampen the Canadian housing market to some degree, but that does not mean that prices will fall a lot. After all, demand keeps growing, among other factors due to positive net migration into Canada.

If the housing market consolidates at current levels, that would not impact Canadian banks meaningfully. In fact, I believe even a pullback in housing prices could be easily stomached as Canadian banks are well-capitalized while loan-to-value ratios are not elevated. Country-specific factors, such as there being no non-recourse mortgages unlike the US, reduce risks further.

TD and RY are priced for disaster and offer attractive income yields today. These banks have performed very well in the long run and are managed excellently. I do believe that the current sell-off provides nice entry points.

Be the first to comment