zodebala/iStock via Getty Images

Newegg Commerce Inc (NASDAQ:NEGG) is a leading online retailer and marketplace platform for tech products. While capturing record growth during the pandemic, the stock has embodied the market selloff this year on the wrong side of the bust in several high-level themes. NEGG as a 2021 SPAC merger IPO is down by a catastrophic 90% from its high, pressured by everything from the chips shortage, weakness in PC sales, the slowdown in gaming, and even lower demand by remote workers returning to the office. The result has been disappointing sales, with a widening loss in recent quarters.

We last covered NEGG one year ago with an article that frankly aged poorly given the performance, even as the initial bullish call captured some early upside. Our update today recaps recent developments, noting that the long-term outlook remains positive despite the near-term industry headwinds.

Shares are likely to remain volatile, but NEGG is well-positioned to rebound in a scenario where macro conditions improve going forward. A strong balance sheet and metrics suggesting trends remain above pre-pandemic levels keep the stock interesting.

Why Did NEGG Crash?

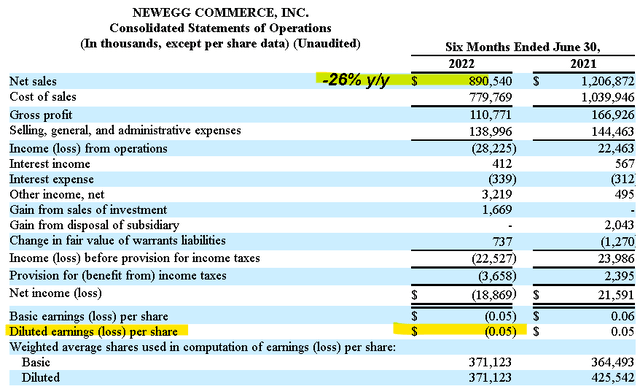

The company last reported its first half 2022 financials on August 30th. While Newegg Commerce has its operating headquarters in California, the company is technically incorporated in the British Virgin Islands as a foreign stock. Year-to-date sales of $890.5 million are down 26% year-over-year.

The gross margin of 12.4% is also down from 13.8% last year. Even with a -4% decline in SG&A as part of an effort to control expenses, a -$28.2 million loss from operations reversed a profit of $22.5 million in the period last year. Similarly, an EPS loss of -$0.05 compared to positive earnings of $0.05 per share in the first half of 2021.

source: company IR

Management notes that changes in consumer spending amid high inflation and macroeconomic conditions have been the main challenge. A large part of the business is in PC components and systems, particularly with high-performance parts like CPUs and GPUs required for gaming and media creation. Naturally, potential buyers getting squeezed by high prices in consumer staples, housing, and transportation translate into lower demand for electronics overall.

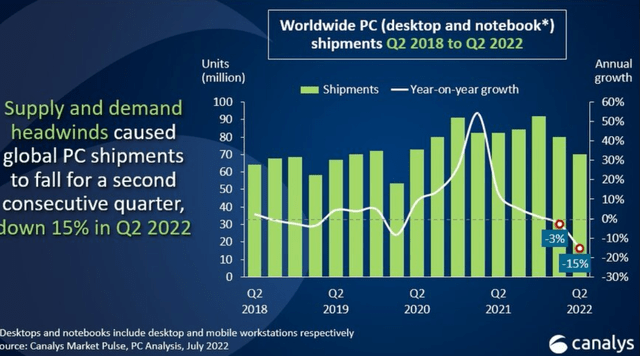

source: company IR

The data shows worldwide PC shipments fell by -15% in Q2 with forecasts for tepid annual growth through at least 2026. In this case, Newegg has seen not only lower volumes but also pricing pressures in key items based on a glut of inventory from vendors. With video cards, for example, there is even a connection with the crash in cryptocurrencies flooding the market with used GPUs.

source: Canalys

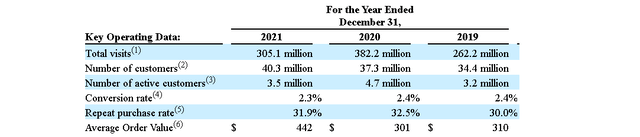

For Newegg, the company’s growth momentum peaked back in the first half of 2020 during the early stages of the pandemic when buyers were stuck at home either gaming or building a home office. From 4.7 million active customers in 2020, that level pulled back to 3.5 million in 2021 along with an approximate 20% drop in total site visits.

source: company IR

While these metrics have not been updated for 2022, the latest financial trends indicate the weakness has persisted this year. Nevertheless, it’s encouraging to see some trends still above 2019 pre-pandemic benchmarks. Q2 sales at $455 million were up 3% compared to the $431 million in Q2 2019.

The number of repeat purchases from apparently loyal customers remains elevated while the average order value has also climbed on a three-year staked basis. Engagement initiatives among organic social media exposure and a high net promoter score, as a measure of customer satisfaction, have also been positive.

In terms of guidance, management is targeting Q3 net sales between $359 and $383 million which, at the midpoint, represents a -33% decline from the period last year. The focus is on improving efficiency and driving profitability with a Q3 adjusted EBITDA target approaching breakeven between -$1.7 million to a positive $0.1 million.

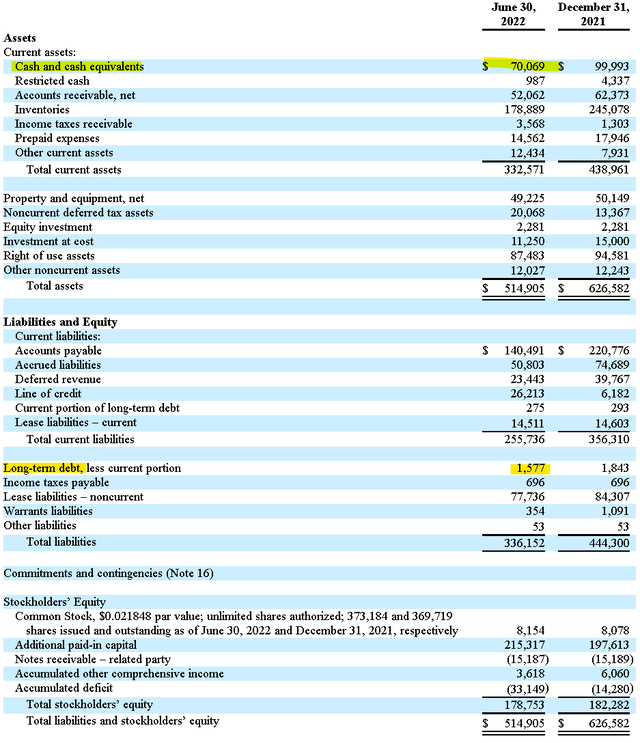

Newegg’s balance sheet ended the quarter with $70.1 million in cash against less than $2 million in long-term financial debt. The understanding here is that even as conditions are expected to stay difficult through the end of the year with negative cash flows, the company’s liquidity is stable for the foreseeable future.

source: company IR

What’s Next For NEGG?

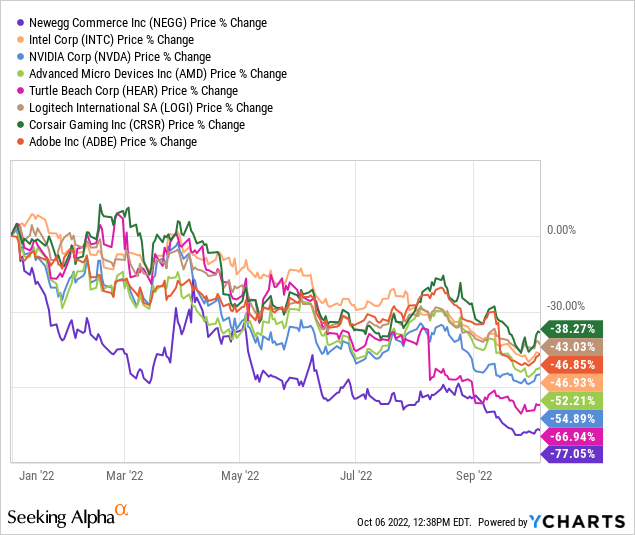

The top-line weakness and impact on earnings explain much of the stock price selloff this year with shares of NEGG down 77% year to date. Conditions for IT products have simply evolved much weaker than imagined this time last year. On this point, it’s important to recognize that Newegg is not alone in getting hit by the macro and industry headwinds.

Everyone from large-cap chips leaders like Intel Corp (INTC), NVIDIA Corp (NVDA), and Advanced Micro Devices (AMD), along with specialty PC accessory makers like Logitech International SA (LOGI) and Turtle Beach Corp (HEAR) have all been crushed with a deep selloff in there stock prices. Newegg is a major distributor, and in some cases, the largest single direct customer to some of these companies against operating conditions beyond its control.

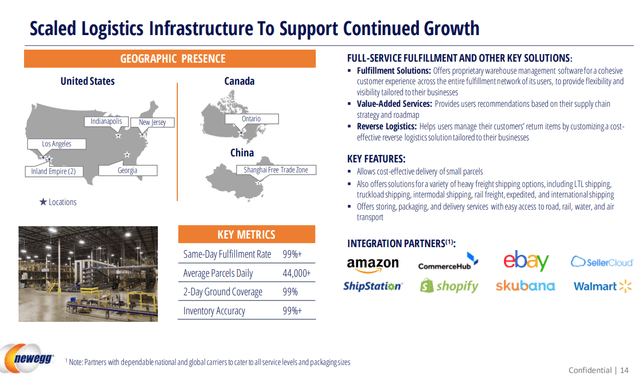

There is a case to be made that as supply chain disruptions ease into 2023, margins have room to rebound supporting a return to profitability. The company benefits from its deep industry relationships, a built-out logistics infrastructure, and brand recognition. The attraction here is the potential that NEGG outperforms to the upside just as fast as it lagged lower. Longer-term, growth opportunities include an expansion of its business-to-business platform and entry into new product categories.

source: company IR

As it relates to valuation, there’s not much to go by considering the negative current income. Considering 2021 adjusted EBITDA of $51 million last year, the company’s current enterprise value of approximately $860 million implies an EV to adjusted EBITDA level of 17x. The question becomes, how long will it take for Newegg to reclaim that profitability level, if ever? Still, any company that is generating more than $1.5 billion in annual sales with effectively zero debt has intrinsic value.

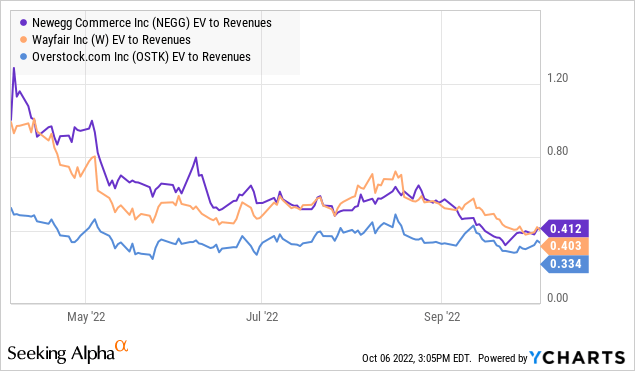

Among specialty e-commerce players, the comparables we’re looking at are Wayfair Inc (W) and Overstock.com (OSTK) which operate on the side of home furnishings. Curiously, all three stocks trade at a similar EV-to-sales multiple of around 0.4x. We make the argument that NEGG deserves a premium to these names given its tech exposure with stronger long-term growth opportunities.

NEGG Stock Price Forecast

With shares of NEGG in an apparent freefall, any bullish case from here will need the macro picture to cooperate. From the U.S., we want to see a combination of inflation trending lower, with a resilient labor market and solid retail spending indicators brushing aside fears of a deepening recession. The possibility of interest rates at least stabilizing or pulling lower would help to support stronger consumer sentiment and an uptick in the tech products market on the demand side.

To the downside, further deterioration in economic conditions defined by a sharply higher unemployment rate and even weaker PC sales trends would open the door for NEGG to take a leg lower. Cash flows and the gross margin are key monitoring points over the next few quarters.

Ultimately, the setup here is that it’s too late to sell while a long position is still highly speculative. We see room for shares to rally higher and even the potential for the stock price to return to levels from August above $4.00 would offer more than 100% upside. By this measure, the stock looks interesting on a reward-to-risk basis under the assumption that the selloff has already priced in the new operating reality and some of the worst-case scenarios.

Seeking Alpha

Be the first to comment