MF3d/E+ via Getty Images

Investment thesis:

Cybersecurity continues to be one of the most dangerous threats of our time. Our critical infrastructure, financial sector, cloud services, and others are constantly under threat of malware, ransomware, breaches, and other threats from bad actors. In many cases, those bad actors are supported, directly or indirectly, by nations.

According to one source, cybercrime will cost global economies $6 trillion in 2021. Businesses must also adapt to the endpoint protection requirements of remote workers and the migration to the cloud. According to a Gartner survey, cybersecurity was the top priority for new spending among 2,000 chief information officers.

All of this adds up to a fertile sector that is poised to grow.

The Threat

I think it’s more than likely we’re going to end up, if we end up in a war – a real shooting war with a major power – it’s going to be as a consequence of a cyber breach of great consequence and it’s (the threat) increasing exponentially…

The Russian attacks on Ukraine included a coordinated cyberattack on Ukrainian interests. These included banks and government websites. These assaults are likely a blueprint for future conflict. These attacks are reported to include distributed denial-of-service (DDoS) and malware. DDoS is an attempt to overload a server by sending a massive flood of traffic to it. Cloudflare (NET) provides a more detailed explanation here. Cloudflare lays claim to stopping one of the most significant such attacks ever recorded with its software.

There’s serious concern that attacks in Ukraine could spill over into NATO member nations. After all, Ukraine is connected digitally to others, and officials are concerned about “spillover.” Banks and utilities in Europe and the U.S. have also been advised to be prepared for potential cyberattacks, possibly as retaliation for sanctions against Russian financial institutions.

The Solar Winds hack may be the most famous hack perpetrated on U.S. government agencies, and many believe the hackers had links to Russia. In this case, the hackers infiltrated and spied on departments, including the Department of Homeland Security and the Treasury, for months before being noticed.

Next came the Colonial Pipeline ransomware hack, which caused the pipeline to shut down for several days completely. This led to a shortage of gasoline in some areas of the U.S. These are just two examples out of many.

The White House convened a cybersecurity summit in the Summer of 2021 where private and public sector leaders met to discuss mitigation efforts. The result was an executive order that made clear that cybersecurity was an urgent priority and that it could only be accomplished with a public-private partnership.

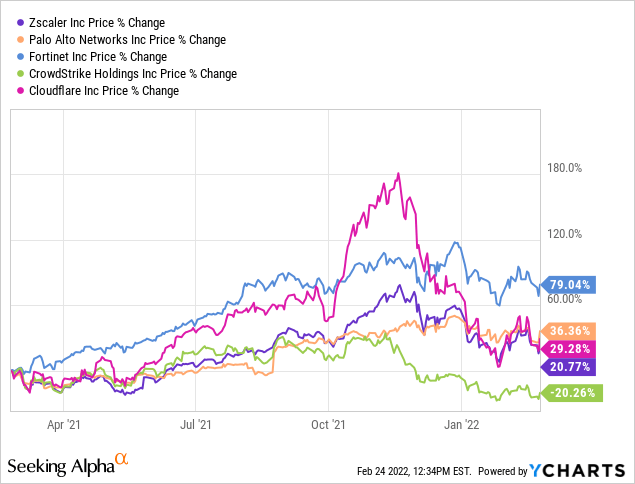

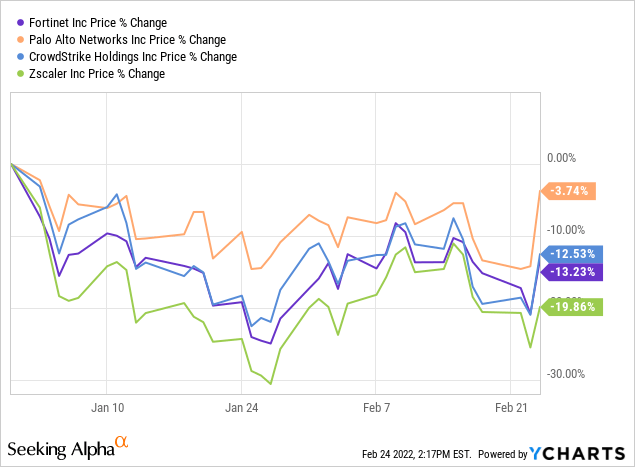

Cybersecurity companies have had a rough few months in the market. This is partly due to inflation concerns and the feeling that many valuations had become quite stretched during the market highs in 2021. However, I still believe in and invest in the cybersecurity sector for the long term. With this in mind, let’s take a look at some of the names that could benefit from secular tailwinds.

Zscaler

Zscaler (ZS) provides cloud-based solutions to mitigate threats to companies. Its software takes the place of expensive and clunky hardware. The company offers a Secure Web Gateway that protects users from web threats and enforces corporate policies, among other functions. Zscaler was the only leader in Gartner’s 2020 Magic Quadrant for Secure Web Gateways. The cloud-based infrastructure is critical as companies embrace employees connecting from outside the office.

Zscaler estimates a $72 billion addressable market, and the company is global. The company has 150 data centers worldwide and receives nearly half of its revenue from outside of the U.S.

On the financial side, Zscaler has some impressive metrics. It reports a non-GAAP gross margin that exceeded 80% in fiscal 2021. Its sales grew 62% in Q1 fiscal 2022 over the same period in 2021 to $231 million. For full fiscal year 2021, revenue reached $673 million for a 56% year-over-year (YOY) growth rate. The acceleration of revenue growth in Q1 fiscal 2022 is encouraging.

Billings in Q1 fiscal 2022 grew even faster than revenue, at 71% YOY, which bodes well for future sales growth. For the full fiscal 2022 year, Zscaler is forecasting $1 billion in revenue and billings over $1.3 billion.

Zscaler is not GAAP profitable and will likely not be for several years. It spends much of its revenue on sales and marketing during this period of rapid growth. This is a risk for stockholders, especially in the current market. Inflation and interest rate hikes could hurt the stock price.

CrowdStrike

CrowdStrike (CRWD) also uses a cloud-based platform to protect organizations against cyber threats. The company’s Falcon Platform provides endpoint security, cloud security, threat intelligence, and many other functions. CrowdStike also utilizes artificial intelligence (AI) to provide increasing levels of intelligence.

CrowdStrike stock has taken a significant hit in recent months and is down over 20% YTD and over 41% off its 52-week highs.

Like Zscaler, CrowdStrike is not GAAP profitable and focuses on S&M to gain customers and grow.

As of Q3 of the fiscal year 2022, CrowdStrike has grown to 14,687 customers, a 75% increase over the prior year. This includes 63 of the Fortune 100, 234 of the Fortune 500, and 14 of the top 20 banks. Due to new product offerings, the company’s TAM is expected to reach $67 billion by 2024 and $116 billion in 2025. The Cybersecurity and Infrastructure Security Agency (CISA) has also partnered with CrowdStrike to provide endpoint and workload protection.

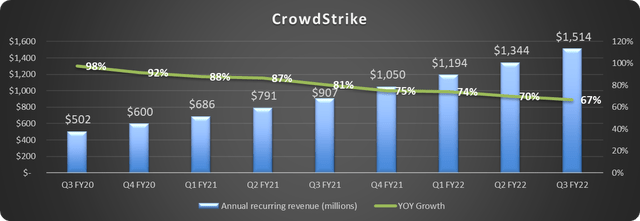

CrowdStrike exceeded $1.5 billion in annual recurring revenue in Q3 fiscal 2022 on 67% YOY growth, as shown below.

Data Source: CrowdStrike. Chart by author

Fortinet

Fortinet (FTNT) provides security solutions for networks to protect users and data from the evolving threats faced each day. Fortinet delivers hardware and software solutions, including next-gen firewalls, SD-WAN, VPNs, and many others, through its FortiGate, FortiGuard, and FortiCare lines. According to the company, Fortinet accounts for over one-third of all firewall shipments. Gartner recognizes Fortinet as a leader in the network firewall category.

A big attraction to Fortinet is its profitability. Unlike some of the growth names, Fortinet is GAAP profitable. In fact, Fortinet reports that it has been free cash flow positive annually since 2009. For fiscal 2021, $1.2 billion in free cash flow was produced.

Sales for 2021 came in at $3.34 billion. This is a 29% increase over 2020. The company also reported a GAAP operating margin of 19% and a non-GAAP margin of 26%.

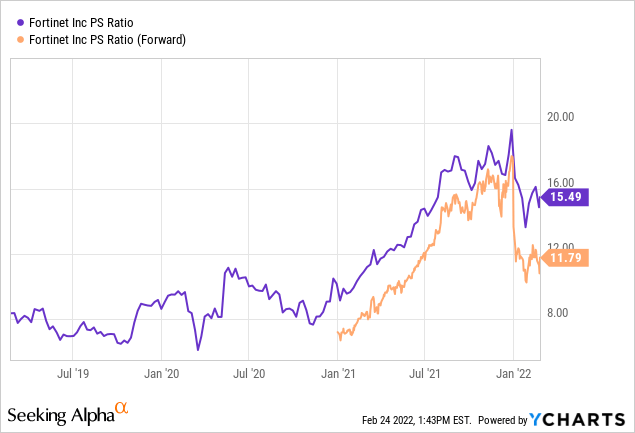

Fortinet is currently trading down from its peak price-to-sales ratio, but still higher than it has traded historically, which could concern investors.

Palo Alto

Another leader in network security and cloud security is Palo Alto Networks (PANW). Palo Alto is a leader in several Gartner and Forrester categories, including Zero Trust. Palo Alto notes that the pandemic has accelerated trends to hybrid work environments, the cloud shift, and the integration of big data analytics. Because of this, attacks have increased, and customers need to spend to defend their infrastructure. This increases the company’s TAM, which is now expected to reach $110 billion by 2024.

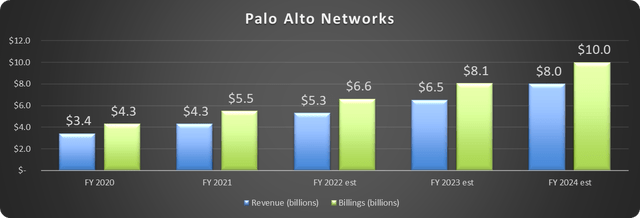

Palo Alto is forecasting a compound annual growth rate in revenue of 23% from fiscal 2021 to fiscal 2024. This would put revenue for fiscal 2024 at $8 billion, as shown below. The company also expects billings to reach $10 billion by 2024 on a CAGR of 22% from 2021.

Data Source: Palo Alto. Chart by author

To accomplish this, Palo Alto has invested heavily in its sales staff. The core sales team now stands at more than 3,000 representatives.

In Q2 fiscal 2022 earnings just released, Palo Alto posted $1.3 billion in sales and $1.6 billion in billings for a 30% and 32% increase, respectively. Palo Alto posted a GAAP net loss of $93.5 million, narrower than the $142.3 million net loss for the same period one year ago. On a non-GAAP basis, the company reported $185 million in net income vs. $154 million in the prior year. The company also raised guidance for the full fiscal 2022 year.

The takeaway

Cybersecurity remains one of the most dangerous threats facing enterprises today. The industry landscape is varied, with many companies scrambling for a piece of this lucrative market. There are growth stocks with terrific potential, like Zscaler and CrowdStrike, and more mature corporations like Palo Alto and Fortinet from which investors may choose.

2022 has not been kind to the sector overall, as shown above. However, the long-term secular trend is one of growth. The crisis overseas has brought this clearly back into focus.

Be the first to comment