USD/JPY ANALYSIS

JAPANESE YEN FUNDAMENTAL BACKDROP

2022 has been relatively strong for the Japanese Yen against an overextended U.S. dollar. The Yen’s safe-haven appeal has also come into play with tensions surrounding Russia and Ukraine. U.S. 10-year Treasury yields popped to yearly highs on Friday supportive of USD strength (USD/JPY is the highest positively correlated G10 pair to 10-year U.S. Treasury yields), and continues this week despite U.S. bond markets being closed. Tomorrows open should bring in more liquidity and volume to what is likely to be a thin trading day. However, volatility may be apparent via the significant option expirations today (see strikes below). In many cases, market participants tend to move prices closer to the respective strike values as expiration looms which could point to maintained upside as the large 115.00-10 expiry materializes.

USD/JPY OPTION EXPIRIES TODAY:

114.05-10 (520M), 114.20 (1.0BLN), 115.00-10 (1.577BLN)

JPY ECONOMIC CALENDAR

Source: DailyFX economic calendar

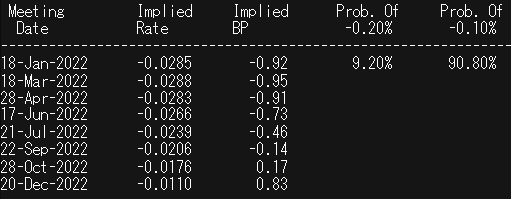

Tomorrow’s Bank of Japan (BOJ’s) interest rate decision is expected to be anticlimactic with no policy changes expected. Growth forecasts are likely to be reviewed lower with inflation on the up. We can see markets pricing in no change to the current rate in the table below with roughly 90% conviction.

Source: Refinitiv

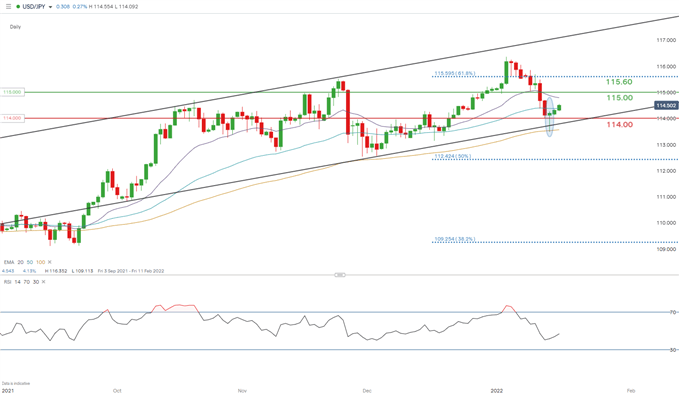

USD/JPY TECHNICAL ANALYSIS

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

Friday saw channel support (black) tested for the third time since October 2021 with the trendline holding once more. The daily candle print represents a long lower wick (blue) thus signaling this weeks positive open for USD/JPY bulls, coinciding with a failure to close below the 114.00 psychological handle.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT BEARISH

IGCS shows retail traders are currently net short on USD/JPY, with 57% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment which suggests further upside on the pair however, the net change (daily) in long positions outweigh shorts which points to a short-term downside bias.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment