Eoneren/E+ via Getty Images

Axsome

Price is what you pay, value is what you get. – Warren Buffett.

As a biotech investor, you can relate to the high volatility of your stocks. One of the events that cause volatility is when there’s an uncertainty relating to an FDA filing. A notable example is a filing delay due to the deficiencies in Chemistry, Manufacturing, and Control. In that situation, you can expect your stock to tumble by roughly 40%. Now, if the company can resolve the situation, your shares usually ride to a new high in the ensuing quarters.

As you know, there was a delay in Axsome Therapeutics‘ (NASDAQ:AXSM) filing for AXS05 for major depressive disorder. The company indicated in the latest filing that it is now resolved. Moreover, Axsome recently acquired another molecule, Sunosi, to deepen its pipeline. In light of such robust fundamental developments, the shares rallied more than 27% in the past month as of this writing. Better yet, I believe there’s much more to come. In this research, I’ll feature a fundamental analysis of Axsome and provide my expectations of this stellar growth equity.

StockCharts

Figure 1: Axsome chart (Source: StockCharts)

About The company

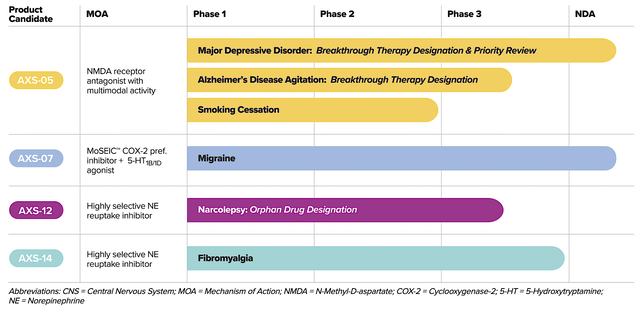

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. Operating out of New York, Axsome dedicates its efforts to the innovation and commercialization of novel medicines to fulfill the unmet needs in psychiatry. Powering the pipeline are four promising molecules in development, including AXS05, AXS07, AXS12, and AXS14. As you know, there’s another new and commercialized drug (i.e., the Sunosi acquisition).

As the crown jewel of this pipeline, AXS05 is being assessed for various disorders such as major depressive disorder (“MDD”), agitation associated with Alzheimer’s disease (“AD”), and smoking cessation. By experimenting with multiple uses for a single drug, Axsome can maximize the value of its innovation. That is to say, it increases the chances at least one indication would become a bonanza.

Axsome

Figure 2: Therapeutic pipeline (Source: Axsome)

Sunosi Acquisition

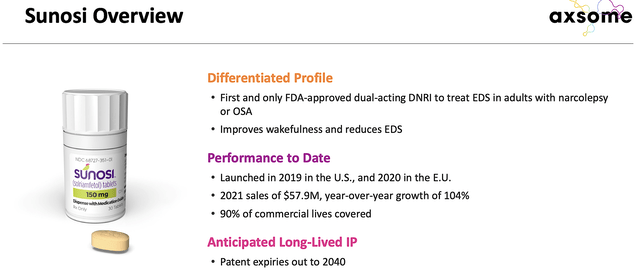

As you can see, growing by acquisition is a prudent and sophisticated approach. On March 28, Axsome announced that the company acquired solriamfetol (Sunosi) from Jazz Pharmaceuticals (JAZZ). As a dual-acting dopamine and norepinephrine reuptake inhibitor (DNRI), Sunosi is approved in 2019 for excessive daytime sleepiness (i.e., EDS) associated with obstructive sleep apnea (OSA).

From the figure below, you can see that Sunosi is the first and only DNRI approved for the aforesaid condition. In boosting dopamine and norepinephrine, Sunosi improves wakefulness for patients. Already approved in both the US and EU, Sunosi procured at $57.9M in net sales with a 104% year-over-year (YOY) growth rate. With the patent coverage into 2040, you can expect very strong intellectual property protection for the continuity of revenues. Commenting on the recent acquisition, the CEO (Dr. Herriot Tabuteau) enthused,

This acquisition immediately transforms Axsome into a global commercial entity, upon closing, and accelerates our growth as a premier biopharmaceutical company focused on delivering potentially life-changing medicines to people living with serious CNS conditions. Sunosi has demonstrated clinically meaningful efficacy, possesses a unique mechanism of action, and has generated positive patient and physician feedback. We are excited by its significant growth potential and excellent strategic fit with the Axsome portfolio. Furthermore, the addition of Sunosi augments and accelerates our commercial preparedness ahead of the potential near-term launches of our two existing lead assets, AXS-05 and AXS-07, and allows us to fully leverage our first-in-class Digital Centric Commercialization platform with three complementary assets. We are committed to ensuring uninterrupted patient access to Sunosi during the transition period and look forward to building on the strong foundation for Sunosi laid by Jazz.

Axsome

Figure 3: Sunosi differentiated profile (Source: Axsome)

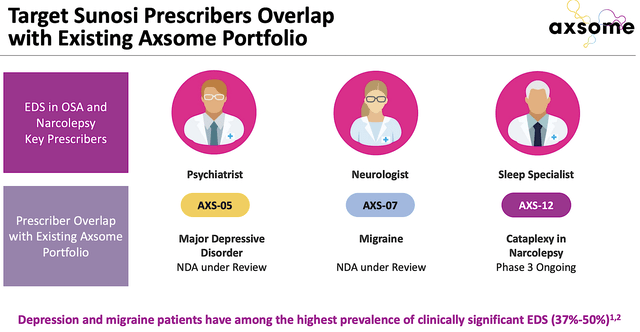

Now just gobbling up a bunch of unrelated businesses won’t do much to boost growth. The key is that there has to be “pipeline synergy” for the company to leverage what it’s already built. As you know, Sunosi is special because it’s already revenue-generating. As such, there’s an established network of physicians who are prescribing and enjoying the robust clinical benefits Sunosi provides for patients. As Axsome is poised to gain approval for its big three medicines (i.e., AXS05, AXS07, and AXS12), the company can leverage those same physicians to improve the launch success. A little effort come a long way here.

Axsome

Figure 4: Overlapping of prescribers (Source: Axsome)

As you can appreciate, acquisition is an excellent and risk-deleverage approach. It fits within the paradigm of Phillip Fischer (who is one of Warren Buffett’s two mentors). Growing by this synergistic strategy is like a tree forming additional branches (i.e, related businesses). By sharing the same trunk (expertise and resources gained), there are much less risks than doing something completely new.

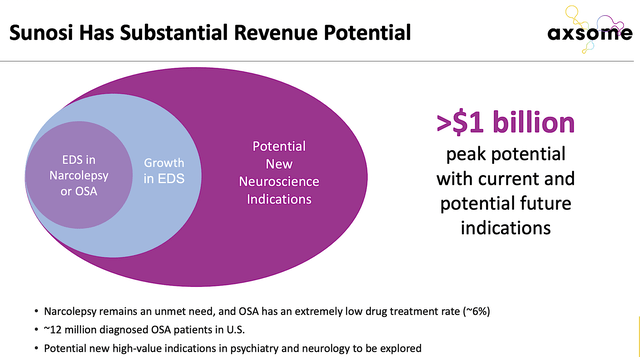

Notably, Sunosi has over a billion dollars in revenue potential. That’s to say, OSA has a very high prevalence because it’s associated with obesity. You don’t need much research to back up that claim. Just look around and you’d see how many people are suffering from being overweight and obesity. When you develop a new drug, you want to make sure the condition either has a vast market or an extremely small market.

Axsome

Figure 5: Huge Sunosi revenue potential (Source: Axsome)

For a large market, you can offer the drugs to many patients to boost revenues. For an extremely small market, you’d then enjoy the orphan (i.e., rare disease) status to warrant a premium (on average of $150K in annual sales). The premium is to ensure that there’s innovation in this space to offset the nearly $1B (it takes to bring a drug from bench research to commercialization).

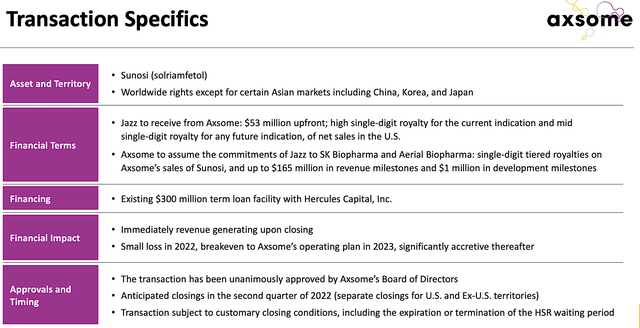

If you’re into the deal terms, you should take a look at the figure below. Accordingly, Axsome paid Jazz $53M in upfront payment with the corresponding high single-digit and mid-single-digit for sales in the U.S. for the currently approved indication and future expansions. Additionally, Axsome will assume responsibilities that Jazz made with the originator of Sunosi (i.e., SK Biopharmaceuticals) and Aerial Biopharma. To finance the deal, Axsome will tap into the $300M term loan facility it has with Hercules Capital.

Axsome

Figure 6: Sunosi transaction terms (Source: Axsome)

A Flurry of Other Catalysts.

Asides from the Sunosi buyout, Axsome has a flurry of catalysts to galvanize the shares for a big comeback. The first one is the upcoming Prescription Drug User Fee Act (i.e., PDUFA) of AXS07 for migraines headache that’s set for April 30. Leveraging my Integrated Forecasting system, I ascribed the 65% (i.e., more than favorable) chances of approval. My rationale rests upon the robust data, my experience over the decades, and my intuition. Simply put, you can expect a high likelihood of approval.

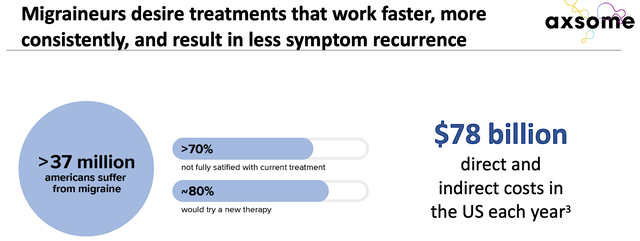

About market size, you can see from the figure below that migraines represents a staggering $78B in spending. By cutting into, says 1% of the total addressable market, you’re looking at $780M. Here, having a large market for your drug is crucial to ensure launch success.

Axsome

Figure 7: Migraines estimated market (Source: Axsome)

Now, the biggest upcoming catalyst for Axsome is the PDUFA date of AXS05 for MDD. As you can see, the most devastating hit to Axsome is the “uncertainty” relating to Chemistry, Manufacturing, and Control (i.e., CMC) for AXS05 regarding MDD. In my opinion, that’s what caused the delay of several months for its approval. Of note, this issue is now resolved, and you can expect an approval sometime in either Q3 or Q4 this year. Pertaining to Axsome,

NDA for AXS-05 for the treatment of MDD was granted Priority Review and is currently under review by the FDA. The Company has provided a response to the FDA addressing the two, previously disclosed, deficiencies related to analytical methods in the CMC section of the NDA. The FDA has acknowledged receipt of the Company’s response. At this time, Axsome has not been made aware of any other deficiencies related to the NDA by the FDA.

Beyond AXS05 for MDD, AXS07 for migraines, and Sunosi for EDS, Axsome still gives you a flurry of catalysts. In other words, you have AXS12 and AXS14 baking in the oven. Then, there’s the potential label expansion for AXS05 in Alzheimer’s. Excited with a deck full of catalysts, Dr. Tabuteau remarked,

2021 was a year of continued progress which has put us in a position to potentially launch two new investigational medicines for patients living with depression and migraine. Specifically, FDA review of our NDA for AXS05 in depression is progressing, and the April 30 PDUFA date for our NDA for AXS07 in the acute treatment of migraine is approaching. In addition, we continue to advance the rest of our industry-leading late-stage CNS pipeline, with an NDA for AXS14 in fibromyalgia, and top-line results from our Phase 3 trials of AXS12 in narcolepsy and AXS05 in Alzheimer’s disease agitation, all anticipated in 2023.

Financial Assessment

Just as you would get an annual physical for your well being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that ended on Dec. 31.

Like other developmental-stage companies, Axsome has yet to generate revenue. Nevertheless, you can expect the company to enjoy robust revenue in the upcoming quarters due to the Sunosi acquisition. By 2023, you can bet that Axsome will break even in its cash flow.

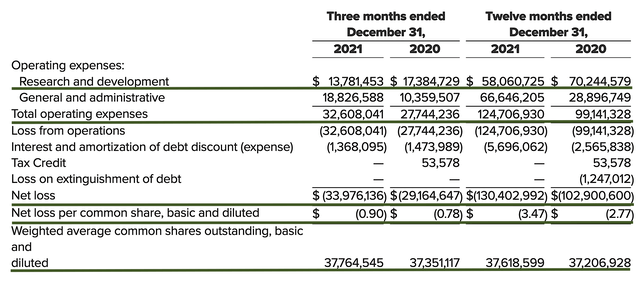

That side, the research and development (R&D) registered at $13.7M compared to $17.3M for the same period a year prior. As you know, I prefer to see increasing R&D. In this situation, Axsome’s medicines already completed their key trials and thereby translated into a lower R&D spending.

Additionally, there were $33.9M ($0.90 per share) net loss compared to $29.1M ($0.78 per share decline) for the same comparison. On a YOY basis, the bottom-line depreciated by 15.3%. As you know, Axsome is expanding rapidly and it makes sense for the company to spend more cash to fund its acquisition and other activities conducive to growth.

Axsome

Figure 8: Key financial metrics (Source: Axsome)

About the balance sheet, there were $105.9M in cash, which accounted for the $20M ATM that the company accessed in February. Against the $32.6M quarterly OpEx, there should be adequate capital to fund operations into nearly year-end 2022. While on the balance sheet you should check to see if Axsome is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 37.3M to 37.7M, Axsome easily cleared my 30% annual dilution cut-off for a prudent investment.

Valuation Analysis

It’s important that you appraise Avalon to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there’s no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it’s most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That’s to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 37.7M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

AXS05 for MDD |

$1B (estimated based on the $16B global depression market and $7.9B MDD market) | $250M | $66.31 | $53.04 (20% discount because you’re waiting for approval soon) |

| AXS05 for Alzheimer’s agitation | $2B (estimated based on the $25B global Alzheimer’s market) | $500M | $132.62 | $66.31 (50% discount because the drug is still in Phase 3 trial) |

| AXS05 for smoking cessation | Waiting for it to advance before valuing | N/A | N/A | N/A |

| AXS07 for migraines | $1B (estimated based on the $78B US migraines market) | $250M | $66.31 | $53.04 (20% discount because you’re waiting for approval soon) |

| Sunosi for EDS | $250M (Estimated 25% actualization of the $1B peak sales) | $62.5M | $16.57 | $14.08 (15% discount) |

| AXS12, AXS14, etc | Will wait for more development | N/A | N/A | N/A |

|

The Sum of The Parts |

$186.47 |

Figure 9: Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Axsome is whether the CMC issues are now far gone. There’s also a concern if AXS05 would gain FDA approval for MDD toward yearend. The other risk is if the company can successfully integrate Sunosi into its overall sales/marketing campaign.

Moreover, there’s a small risk that AXS07 would not gain approval for migraines. Furthermore, AXS05 and AXS12 might not deliver positive data in 2023. Overall, I ascribed the 35% risk of non-positive data as well as a 30% chance of having a CRL. If negative, you can expect a 50% haircut in any of the aforesaid events. As an aggressive growth company, Axsome might grow too rapidly and thereby encounter a potential cash flow constraint.

Concluding Remarks

In all, I maintain my buy recommendation on Axsome with a 4.8 out of five stars rating. Despite the biotech bear market of 2021/2022, Axsome is poised to make a big comeback. With a flurry of catalysts for this year and beyond, the company is exhibiting increasing signs of bear deterrence. As an investor, you should keep tabs of the first key event, i.e., the upcoming approval of AXS07 for migraines later this month. Later in the year, you can expect approval of the crown jewel (AXS05) for MDD. The issue of CMC is now seemingly resolved.

In the coming quarters, you can expect to see increased revenues from the Sunosi acquisition. In 1H2023, you should also check on AXS05’s Phase 3 ACCORD trial that assesses AD agitation. The data would also be reported for AXS12 for narcolepsy in that same time frame. And Axsome is projected to submit an NDA for AXS14 for fibromyalgia in 2023. If you’re patient, you are most likely to bank profit on Axsome. I believe that the best is yet to come for this stock.

Be the first to comment