shapecharge/iStock via Getty Images

The price action in the CEF market this year was a stark change from the previous 18 months. In fact, all the key supports of the market such as low leverage costs, tight credit spreads, tight CEF discounts, rising equity prices, and low long-term yields reversed and went from tailwinds to strong headwinds in the first three months of the year.

The key risk for investors is that we see more of the same, leading to further weakness in the market. In this article, we screen for funds that have remained relatively resilient so far this year and that also offer attractive yields and trade at discounts.

And although the same pace of rising interest rates is not our base case scenario, a partial allocation to this group of funds can make a lot of sense in the context of a diversified portfolio.

A Look At Resilient Funds

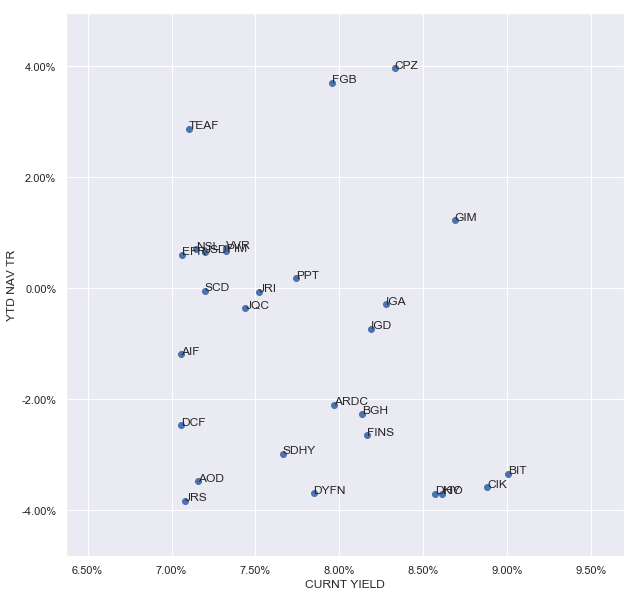

In this section we carry out a CEF screen across three dimensions:

- Year-to-date total NAV return above -4%

- Current Yield above 7%

- Discount < 0 (i.e. those funds trading at a discount)

To keep the chart readable we exclude funds with total returns above 4% (which are mostly MLPs) as well as those with yields above 10% (which are mostly unearned anyway).

The scatter plot below shows funds that pass this screen with the year-to-date total NAV return on the y-axis and the current yield on the x-axis.

Systematic Income CEF Tool

What are the takeaways of this screen?

First, there are few long-duration funds. This makes a lot of sense given the sharp move higher in Treasury yields. Higher-quality long-duration funds such as Municipal or Investment Grade corporate bond sectors also tend to boast relatively low current yields so they would be excluded for that reason as well.

Second, there are quite a few floating-rate funds which makes a lot of sense as these funds feature a relatively low duration.

Third, there are a few sector equity funds such as Utilities which tend to be more defensive during risk-off periods. It should be said, however, that the net investment income of equity funds tends to be in the low single digits despite their high current yields.

Fourth, there are also plain idiosyncratic funds. These include funds like BRW which is SPAC-heavy, the Templeton funds TEI and GIM which are FX-oriented, FGB – a BDC CEF, RSF – a BDC bond and small business loan focused fund, IHIT – one of the few CMBS funds and others. This highlights that it can make sense to have allocations to relatively niche sectors of the CF market for the purpose of diversification.

Where We See Value

Among the funds that pass the screen we would highlight the following that look attractive to us. Most of these funds are either loan funds or are short-duration funds.

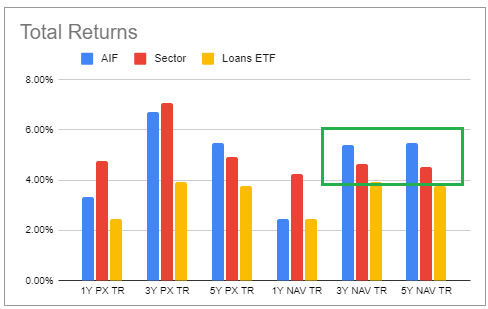

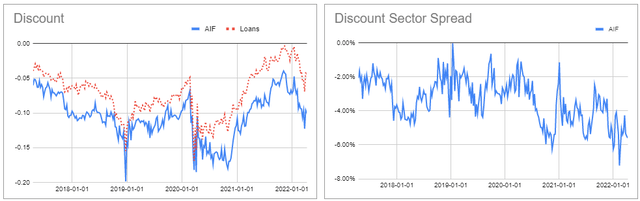

The Apollo Tactical Income Fund, Inc. (AIF) trades at a 10% discount and a 7.06% current yield. The fund has allocations primarily to loans as well as a smaller allocation to high-yield corporate bonds and CLO debt securities. It is one of the best performers in the loan sector over the last 3-5 years in total NAV terms.

Systematic Income CEF Tool

AIF continues to trade cheaper to the sector discount – with a discount that is close to 6% wider of the sector average.

The Ares Dynamic Credit Allocation Fund (ARDC) is trading at a 8% discount and a 8% current yield. We discussed the fund in a recent article so we won’t fully rehash the story here.

The Barings Global Short Duration High Yield Fund (BGH) is primarily a high-yield corporate bond fund with a tilt to energy and mining issuers. It is trading at a 9.4% discount and a 8.1% current yield. The fund has put up historic total NAV returns in line with the longer-duration high-yield corporate bond sector. It features distribution coverage well north of 100%.

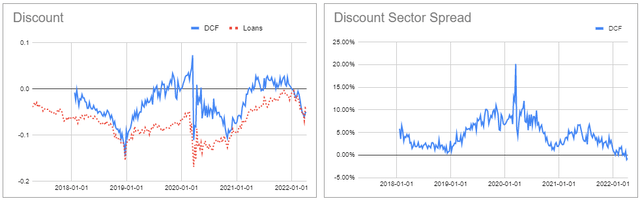

The Dreyfus Alcentra Global Credit Income 2024 Target Term Fund, Inc. (DCF) allocates to loans and CLO debt securities. It is trading at a 5.1% discount and a 7.06% current yield. The fund has outperformed the loan sector by 1.3% per annum over the last 3 years. It also features a termination date in 2024 – an attractive margin of safety with potential upside of 5% discount compression over two and a half years in case of termination, and little downside if it turns into a perpetual fund (without giving shareholders an exit at the NAV), as it’s already trading at a discount wider of the sector average. We reduced the fund’s allocation in our High Income Portfolio when its discount moved out into premium territory, however, it now looks attractive again.

Other funds with “honorable mentions” are

- Invesco Senior Income Trust (VVR) – a loan fund , trading at a 7.2% discount (2.8% wider of the sector average) and a 7.32% current yield (0.4% higher than the sector average) with above-sector historic total NAV returns. Last distribution coverage was 83% however this will rise towards 100% over the coming months as Libor moves further up.

- Western Asset Diversified Income Fund (WDI) barely didn’t make it into the screen with a -4.04% total NAV year-to-date return. It is a multi-sector credit fund with a modest duration of 3. It trades at a 10.7% discount and a current yield of 8.5%.

- Invesco High Income 2024 Target Term Fund (IHTA) allocates to CMBS, some of them floating-rate, and also hedges its duration exposure with an interest rate swap. The fund has an expected termination date in 2024 which provides a potential 5% upside in discount compression. It has a 5.5% current yield.

Takeaway

Taking a look at historic performance is a great way for investors to gain an intuition about how funds have performed in practice in different market regimes, offering a kind of “proof-in-the-pudding” analysis.

And while investors should be careful that, to paraphrase, market history rarely repeats itself, it often rhymes. Inflation has remained high and persistent, while the Fed has turned increasingly hawkish. This, plus the fact that the Fed will likely be embarking on balance sheet reduction this year, creates a real risk that interest rates will keep moving higher.

And although it’s not our base case for rates to keep moving higher at the same pace, we don’t have a crystal ball. In our view, it makes sense to have allocations in the portfolio that can perform across a wide range of market outcomes. For this reason, it makes sense to have some allocation to funds that have proven relatively resilient to the market environment of 2022.

Be the first to comment