deeltijdgod/iStock via Getty Images

Hess Corporation (NYSE:HES) is a rapidly growing oil company with a market capitalization of $35 billion. With the 4th phase of Guyana sanctioned, and the company’s overall production growth, as we will see throughout this article, the company has the ability to generate substantial shareholder rewards. This helps to highlight the company as a valuable investment.

Hess Corporation Unique Positioning

Hess Corporation has a unique portfolio of assets that will enable continued shareholder rewards.

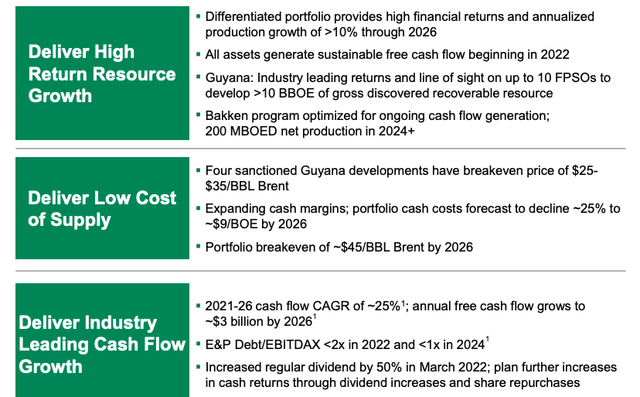

Hess Corporation expects to see double-digit production growth through 2026 with all assets generating sustainable FCF starting this year. The company already has >10 billion barrels of resources in Guyana, and as we’ll see throughout this article, the company has a line of sight on millions of barrels / day worth of production.

The company is focused on lowering breakeven prices and portfolio cash costs. The company’s breakeven by 2026 is $45 / barrel, and with Brent at more than $100 / barrel, the company’s cash flow will be able to be immense. The company’s 2026 FCF forecast is $3 billion at $65 Brent, $62 WTI, which’ll be able to grow.

The company has already announced a 50% dividend increase, although its overall yield is low, and we expect continued growth here.

Hess Corporation Financial Strength

Hess Corporation has strong financials, which’ll combine with the company’s assets for substantial shareholder rewards.

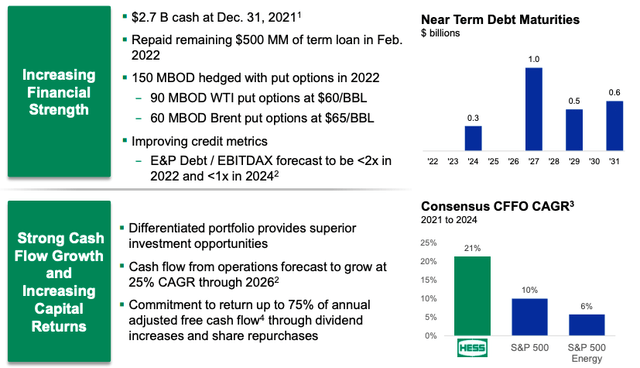

Hess Corporation has $2.7 billion in cash, enough to cover all of the company’s debt due to the 2030s. The company has 150 thousand barrels / day in hedged production, which it’ll likely not need throughout 2022, and incredibly strong credit metrics. The company expects 25% annualized cash flow growth from operations and is committed to returning additional cash flow.

The company has two important financial attributes worth paying close attention to.

(1) The company has finished a capitally heavy growth phase without being in a tough financial position. That’s rare, especially in a capital-intensive industry such as crude oil. The company can go into its cash flow generation phase without substantial debt to payback.

(2) The company’s rapid cash flow growth phase means through the end the end of the decade the company’s FCF should increase significantly. That’ll enable substantial and growing shareholder rewards.

Hess Corporation Guyana

Hess Corporation’s crown jewel asset is its 30% stake in Guyana.

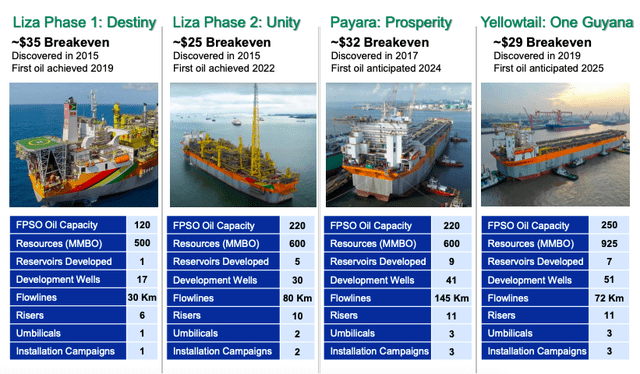

The Yellowtail Guyana discovery from 2019 was recently sanctioned at a $29 breakeven. It’s been decided to move forward with first oil anticipated in 2025. The massive development will chase 925 million barrels of resources with a development cost of roughly $10 billion ($11 / barrel). From this the company will be able to produce 250 thousand barrels / day.

The company’s line of sight on 10 FPSOs with 1 FPSO / year implies 2025 production of 810 thousand barrels / day (250k barrels / day for Hess) growing to 2+ million barrels / day (600k barrels / day for Hess) going into 2031. These assets and their combined breakeven of roughly $29 / barrel weighted means massive cash flow.

For Hess Corporation alone, at $100 Brent, the company’s 2031 profits will be >$15 billion showing the asset’s strength.

Hess Corporation Shareholder Returns

Hess Corporation has the ability to generate massive shareholder returns.

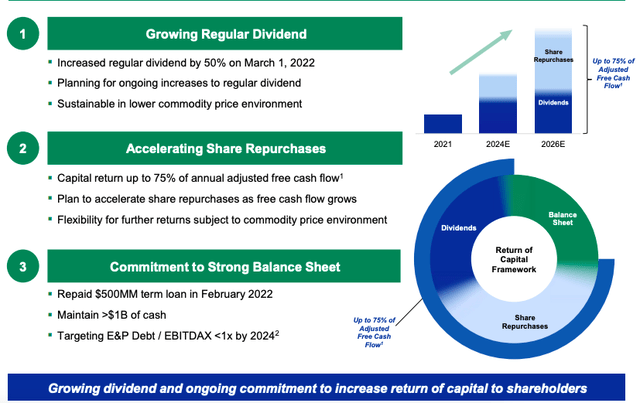

The company expects to generate $3 billion in 2026 FCF at $65 Brent. The company is committed to spending 75% on shareholder returns, although the rest won’t disappear, it’ll go to its balance sheet. The company’s 2026 FCF yield is 9% implying roughly 7% in shareholder returns annualized just 4 years down the road.

However, there’s again 2 important aspects worth keeping track here.

(1) Growth doesn’t end in 2026. The company’s attributable production from Guyana alone is expected to increase by 150% from 2026 to 2031.

(2) The FCF above is at $65 / barrel versus the company’s $46 / barrel breakeven for the portfolio. At current Brent prices that can be expected to grow towards a 20+% FCF yield (15% shareholder returns).

Putting this together, we expect the company to continue generating substantial shareholder rewards going forward.

Thesis Risk

The largest risk to our thesis is crude oil prices. Hess Corporation, by entering its growth phase is more reliant on oil prices to generate continued shareholder rewards. The company’s breakeven is $46 / barrel which is still higher than some producers, and the company to date hasn’t had substantial shareholder rewards.

Conclusion

Hess Corporation has a unique portfolio of assets. The company is one of the best producers to generate substantial shareholder rewards at more than $100 / barrel Brent. The company has recently announced the 4th Guyana development taking total production to more than 800 thousand barrels / day and the company has numerous other exciting developments.

Putting this together we recommend investing in Hess Corporation. The company at $65 Brent can generate almost double-digit shareholder rewards in 2026. The company’s Bakken and other assets will continue to support growth and generate additional FCF, and we expect the company to reward shareholders well going forward.

Be the first to comment