Kira-Yan

Overview

I recently wrote an article equating the stock of exceptional companies to a 4-legged stool. One of the 4 legs poses the question, “Does the company provide a product or service that benefits society?”. With Mark Zuckerberg’s drastic pivot to the Metaverse, I find myself wondering if Meta Platforms Inc. (NASDAQ:META), formerly Facebook, still answers “yes” to this question.

Is a virtual world, where you can live an alternate life, buy property, clothes, get a job, etc… going to have a positive impact on society? Is being detached from reality while your real life passes you by an attractive proposition? Maybe I’m old school, but I struggle to comprehend how this is a net positive.

I’ll try to leave most of my personal views out of it; however, I do have concerns with how Meta plans to monetize the Metaverse once/if it becomes mainstream. Does Meta plan to market and sell property, goods, and services in a virtual world? Is enticing users to spend time and money in the Metaverse a reputable mission? I’m not sure. Thus, in lies my dilemma.

How many of us have been sucked into hours of mindless scrolling on Facebook, Twitter (TWTR), TikTok, Snapchat (SNAP), or other similar platform while a 70F cloudless, blue sky day passed us by? I’m certainly guilty.

As a shareholder, do I stick around in hopes Meta pivots back to its core business? Or do I jump ship now given uncertainties surrounding the Metaverse and its future impact, if any, on the world?

The Name Change

Recently, a number of Seeking Alpha authors have lamented that they’d like to see Meta focus on their core business, which is operating a top tier social media platform to drive user engagement and, ultimately, generate more ad revenue. I too share this sentiment. Not that Meta shouldn’t innovate, but I question the “all-in” bet Zuckerberg put on the Metaverse.

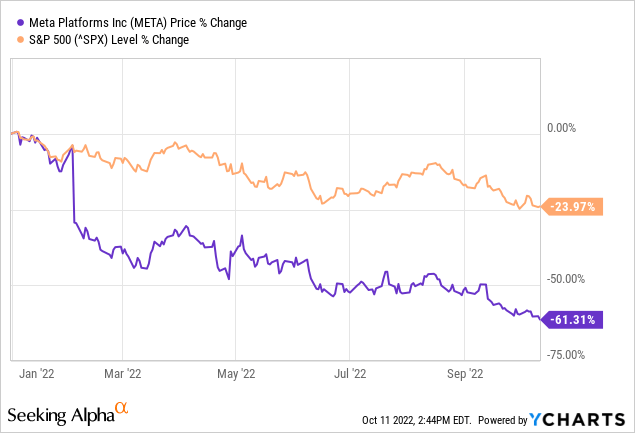

In my opinion, the Metaverse has been nothing but a major distraction, and likely one of the factors contributing to Meta’s dismal stock performance in 2022. Shares are down 61% compared to the S&P 500’s slide of 24%.

After all, a name change is symbolic for commitment. Take marriage, for example. A new bride often takes the last name of the husband in a symbolic demonstration of commitment. In 2021, Zuckerberg married the Metaverse and I’m not convinced that’s in the best interest of shareholders. I would’ve much preferred Meta keep the Facebook name and report their efforts in the Metaverse in an “Other Bets” or similar category, like Google (GOOGL)(GOOG) does for its various initiatives.

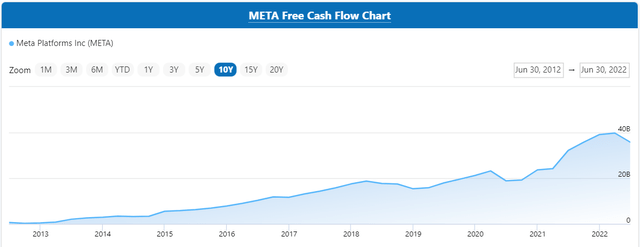

Seduced By The Cash Flow

I’m currently a Meta shareholder, having picked up shares back in February when the stock plunged after reporting earnings and growth that failed to impress wall street. Admittedly, I was seduced by the cash flow. Meta pulls in billions of advertising dollars and produces billions in free cash flow (“FCF”) each year. After a swift drop in share price, shares looked like a bargain.

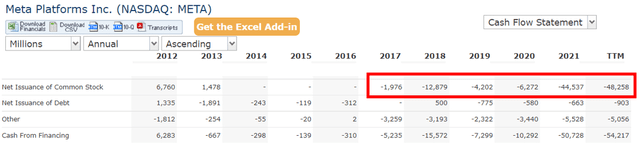

Additionally, Meta has spent billions in recent years repurchasing shares of its own stock and reducing total number of shares outstanding, albeit at a snail’s pace. Since 2017, Meta has spent nearly $70 billion repurchasing its own stock (based on net issuance of common) which demonstrates their ability to generate cash and willingness to allocate it to shareholders. Friendliness toward shareholders is leg number 3 of the 4-legged stool test. As such, Meta receives a passing grade.

META Share Repurchases (Quickfs.net)

Valuation

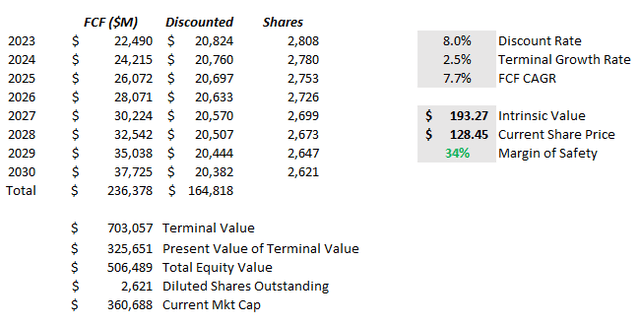

I performed a DCF analysis as well as a market multiple valuation for Meta. At $128, the stock looks cheap no matter how I slice it.

Using the DCF, I arrive at an intrinsic value of $193. I used an 8% discount rate, 2.5% terminal growth rate, 7.7% FCF CAGR, and a -1% annual reduction in shares outstanding.

META DCF Valuation (Author’s personal data)

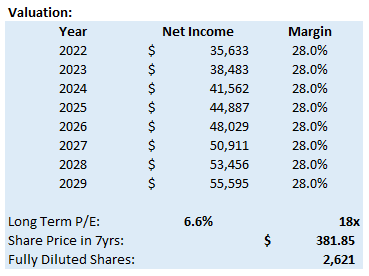

Using the market multiple approach (P/E), I arrive at a 2029 price target of $382, which equates to a near 17% share CAGR from today’s price of $128. I assumed a long-term P/E of 18, a 6.6% revenue and net income CAGR, and a -1% annual reduction in shares outstanding.

META P/E Valuation (Author’s personal data)

Stuck In A Value Trap?

The fundamentals and cash flow lured me in, but the pivot in priorities coupled with what appears to be a major share discount, has me wondering if I’m in a value trap. I realize the market is selling off due to macroeconomic issues and we’re arguably in a recession, but if it’s not a value trap, why is Meta so cheap?

The market is a smart beast and tends to get it right most of the time, and I think it may be trying to tell us something about Meta. Are investors so concerned about Meta’s slowing user engagement and below average revenue guidance to discount shares by some 40%, or is the Metaverse weighing on sentiment? I tend to think it’s the latter.

Conclusion

I like the business fundamentals of Meta. It’s what led to me becoming a shareholder in the first place. Meta is one of a few iconic companies of a generation. However, I’m inclined to believe the company’s pivot away from its core business toward the Metaverse is having more of a far-reaching impact than meets the surface. Perhaps there are a lot of investors out there like me who are questioning (1) if Zuckerberg can pull off the Metaverse in the first place and (2) if doing so is a net benefit to the world.

Until these questions are answered, shareholders have a decision to make. I’ll rate Meta as a Hold as I work through my next steps as an investor.

Be the first to comment