tdub303

Investment Thesis: I take a bullish view on Euronet Worldwide (NASDAQ:EEFT) due to strong performance across the EFT Processing segment as well as an attractive valuation from an earnings standpoint.

In a previous article back in November, I made the argument that while Euronet Worldwide has seen significant earnings growth – strong dependence on the EFT Processing segment as well as a potential upcoming recession reducing the demand for electronic transactions could mean that investors could choose to look for evidence of sustained earnings growth before seeing further upside.

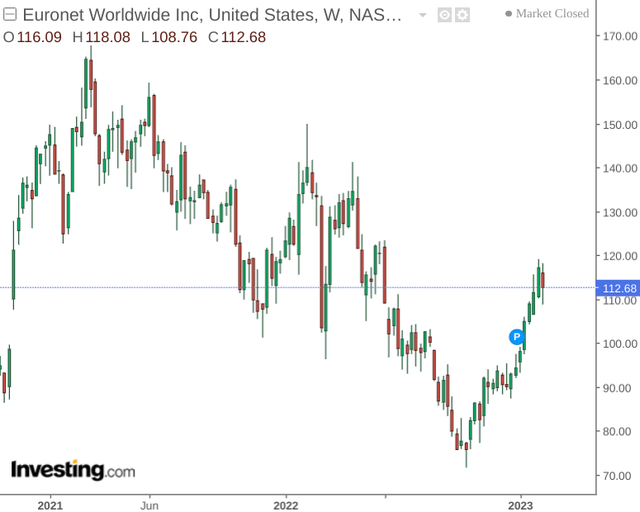

Since my last article, EEFT stock is up by nearly 25% – albeit still below the highs that we saw for Euronet Worldwide at the beginning of 2021:

The purpose of this article is to assess whether Euronet Worldwide could see a rebound to such prior highs taking recent performance into consideration.

Performance

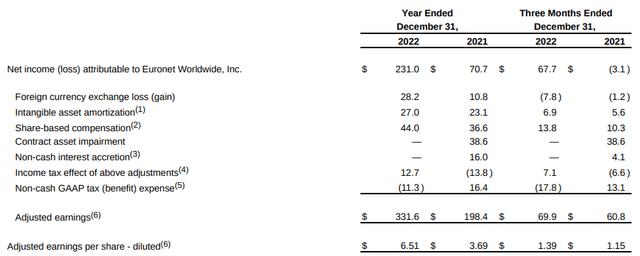

When looking at Q4 and full year 2022 earnings results, we can see that adjusted diluted earnings per share was up strongly on a yearly basis:

Euronet Worldwide: Fourth Quarter and Full Year Financial Results

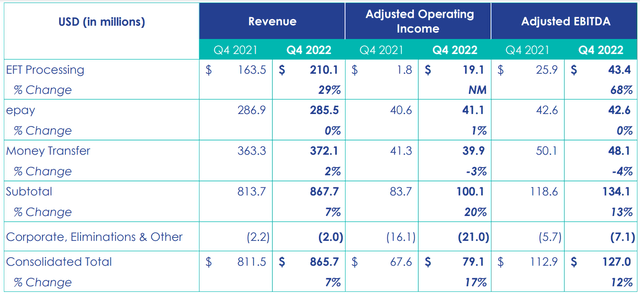

Moreover, we can also see that the EFT Processing segment has led growth in both revenue and adjusted EBITDA on a percentage basis – up by 29% and 68% on last year respectively.

Euronet Worldwide: Fourth Quarter and Full Year 2022 Financial Results

Additionally, we can see that while the epay and Money Transfer segments are larger on a revenue basis but growth has been more modest across these segments – the fact that EFT Processing has continued to see strong growth is encouraging, as higher growth in this segment helps to compensate for the low level of growth across the former two segments.

From a balance sheet standpoint, we can see that both the quick ratio and long-term debt to total assets have remained at or near previous levels:

Quick ratio

| Dec 2021 | Sep 2022 | Dec 2022 | |

| Cash and cash equivalents | 1260.5 | 967.1 | 1131.2 |

| Trade accounts receivable, net | 203 | 225.2 | 270.8 |

| Total current liabilities | 1852.6 | 2170.4 | 2354.1 |

| Quick ratio | 0.79 | 0.55 | 0.60 |

Source: Figures sourced from Euronet Worldwide Third and Fourth Quarter 2022 financial results. Figures provided in millions USD, except the quick ratio. Quick ratio calculated by author as cash and cash equivalents plus trade accounts receivable all over total current liabilities.

Long-term debt to total assets ratio

| Dec 2021 | Sep 2022 | Dec 2022 | |

| Debt obligations, net of current portion | 1420.1 | 1428.5 | 1609.1 |

| Total assets | 4744.3 | 4827.8 | 5403.6 |

| Long-term debt to total assets ratio | 0.3 | 0.3 | 0.3 |

Source: Figures sourced from Euronet Worldwide Third and Fourth Quarter 2022 financial results. Figures provided in millions USD, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

The fact that Euronet’s long-term debt relative to total assets has not increased is encouraging, as is the fact that the company’s short-term financial position has also slightly improved. Moreover, the strong growth that we have seen across EFT Processing indicates that demand for digital payments remains strong and fears of a reduction in demand due to a potential recession has not materialised.

Looking Forward

While I was previously apprehensive on growth prospects for Euronet Worldwide, I take the view that the stock could have significant upside going forward.

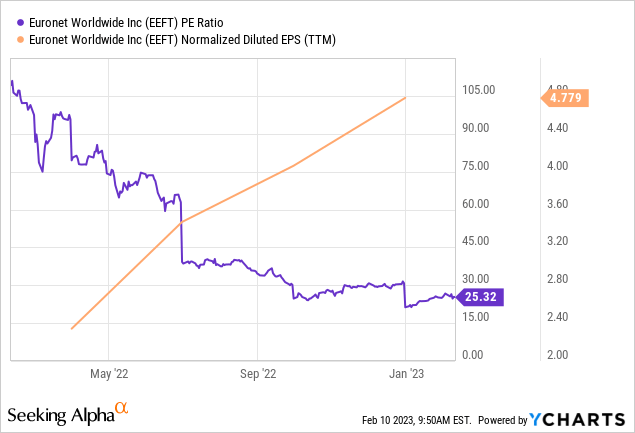

When looking at Euronet’s P/E ratio over the past year – we can see that the ratio has continued to decrease while earnings per share (on a normalized diluted basis) has continued to increase.

ycharts.com

From this perspective, the stock appears to be more attractively valued than previously, even when taking the recent appreciation in the stock price into consideration.

Demand for EFT Processing services has continued to see growth in spite of fears over a potential recession – and I see no evidence to suggest that this will cease going forward.

Additionally, while I had pointed out that signs of a global decline in demand for ATM services could be a risk to growth across this segment – the company’s expansion of its ATM network into Southeast Asia is set to help the company diversify from the European market which could lead to a rebound in growth.

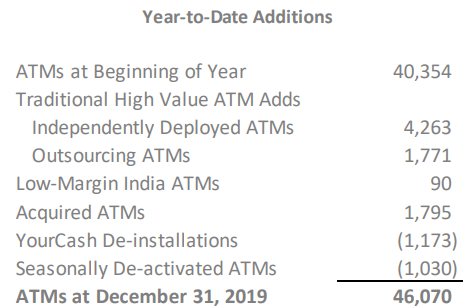

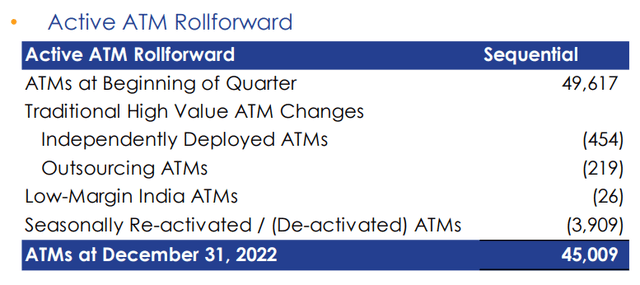

Moreover, when comparing the size of the company’s ATM network to that of the same quarter in 2019 – the number of ATMs has not decreased by a significant amount – indicating that demand still remains vibrant.

Fourth Quarter 2019 Financial Results

Euronet Worldwide: Fourth Quarter 2019 Financial Results Presentation

Additionally, we can see that there were more ATMs in circulation at the beginning of the quarter for 2022 as compared to 2019.

Fourth Quarter 2022 Financial Results

Euronet Worldwide: Fourth Quarter 2022 Financial Results Presentation

This indicates that the overall decrease was due to a higher number of ATMs being deactivated.

Conclusion

To conclude, Euronet Worldwide has seen a strong rebound in price growth and performance across the EFT Processing segment continues to remain strong. In light of recent performance, I take a bullish view on Euronet Worldwide.

Be the first to comment