5./15 WEST/iStock Unreleased via Getty Images

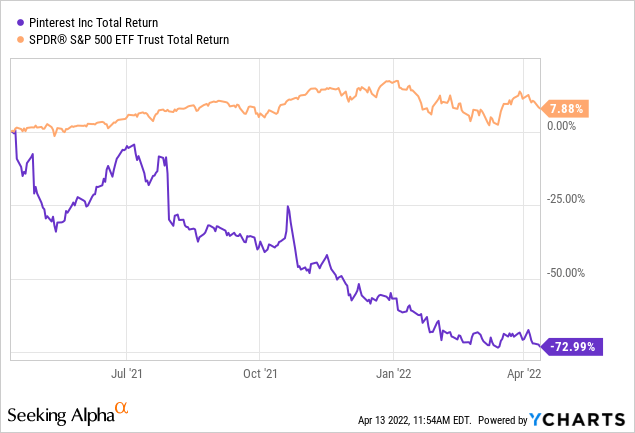

Pinterest, Inc. (NYSE:PINS) offers a platform with 400M+ people around the world to get inspiration for things like cooking, clothing, housing, fitness, gardening, traveling, events, etc. Last year, the stock suffered a lot of volatility by multiple seasonal headwinds. However, I think the negative sentiments are already represented in the stock price and the business is getting stronger since the pandemic. I will share some of my thoughts here.

PINS has a unique value proposition

Pinterest is both a tool and a social media platform. Pinners create Pins by saving and organizing web content to the Pinterest platform through convenient tools such as boards and sections. They could also communicate with each other by following, commenting, and saving Pins.

On Pinterest, inspiration is the key driver of usage. For example, you start with a desire to know what your living room looks like. But people often have no idea what exactly they want until they see it. Pinterest can connect you to pins that help refine your choices through the images and videos and act as a true catalyst for your final purchasing decision such as a new sofa or curtains.

Pinterest is not an entertainment platform for making funny photos/videos (Tiktok, Instagram), talking to friends (WhatsApp), or reading news (Twitter). Instead of killing time, it saves your time when you do research for your project ideas. In this sense, Pinterest is differentiating it from other notorious social media platforms. It’s actually creating value for users.

PINS is a taste driven AI machine

As the CEO has stated, machine learning and computer vision are core competencies for the company. Users are constantly telling Pinterest what they like through Pins. Boards and sections require users to classify visual content into different groups which provides free classification data to train its AI models. Based on 2019 data, pinners have created roughly 240 billion pins to over 5 billion boards which represent the pinner’s passion, taste, and project. Through time, Pinterest’s AI models should constantly improve and find the most relevant results for each user. Moreover, most Pinners are authentic users with few fake accounts or bots. In this regard, Pinterest may have the best quality data on consumer tastes. I personally have used Pinterest for years, I believe Pinterest has the best photo recommendation systems. I found the more I use it and invest time in it, the better it understands my interests and tastes. I’ve never felt disappointed using Pinterest.

Better relevancy and automation will make Pinterest more effective to reach the target audience and create a win-win situation for advertisers. As users are constantly planning their next projects or events, relevant ads play an important role to make projects happen. A great example from a previous conference call is

For example, Q4’s football season, a lot of people create boards to plan game watching or tailgating parties, and it’s actually helpful if you’ve seen that for a food company like Frank’s RedHot Sauce with game-day recipes for dips and wings.

Therefore, ads are not annoying on Pinterest at all but inspiring and helpful which is very rare in other platforms.

Next giant on shopping?

Pinterest is not just a niche platform for artists and hobbyists. It is actually shoppable. In 2019, Pinterest partnered with Shopify and other retailers to build a large product catalog and self-serving tools for advertisers and retailers. The goal is to provide credible retailers and payment options when users see something inspiring.

This year, the company noted that users will soon be able to complete transactions through Checkout (a native tool for Shopify merchants). A new API will be created to automate uploading and updating catalogs for merchants. A new shopping concierge feature will also be offered to users later in 2022.

According to the company, shoppers on Pinterest make 100% more orders and are more open to new brands. As a result, the pace of monetization in the last 2 years is very satisfying. 2021 US average revenue per user is 2.35 times of 2018 while the 2021 international average revenue per user is 6.33 times of 2018. However, this is still in the early stage. There is a lot of uncertainty until the company reveals more data to illustrate the return of its eCommerce investment.

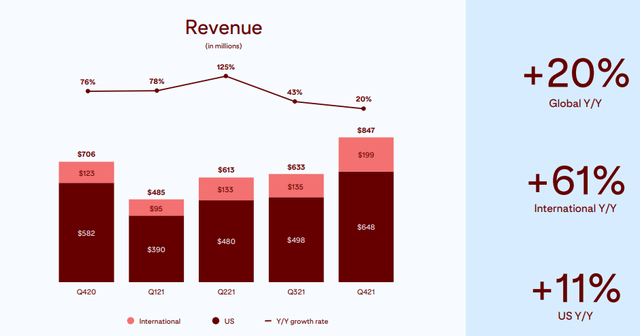

Revenue composition (2021 Q4 earnings presentation)

Sales and earnings

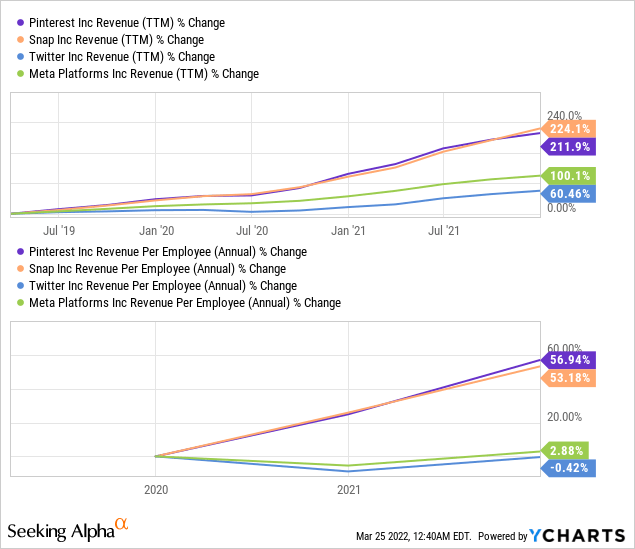

Although Pinterest has been growing its sales at a staggering CAGR rate of 40%, it has not compromised any profitability. From the chart below, Pinterest’s revenue per employee has grown 50% from 2020.

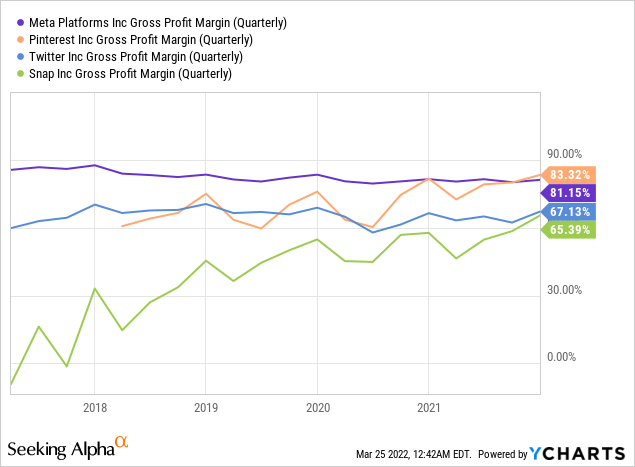

Pinterest’s gross margin keeps improving and outperforms its peer group as shown in the chart below.

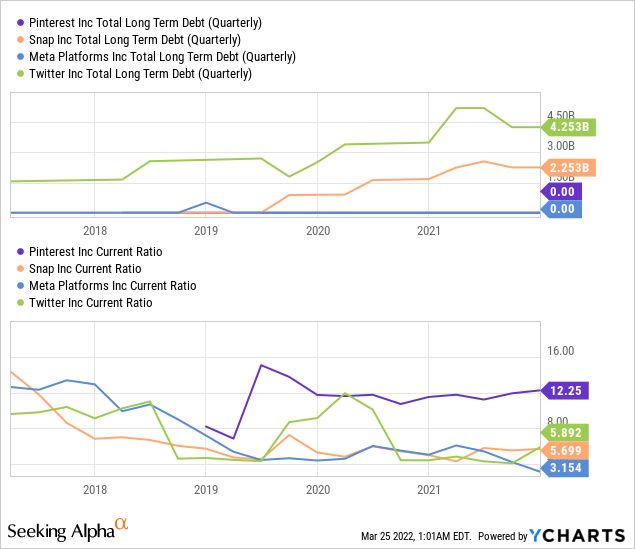

The company also has an extremely asset-light model as its business expansions are not coming from debts or CAPX. No material long-term debts were seen. Total current assets count for 90% of total assets with 2.48B total cash and short-term investment.

Headwinds and Outlook

During the recent conference call, Pinterest revealed that

U.S. monthly active users were approximately $86.6 million and global monthly active users were approximately $436.8 million. On the revenue side, we expect Q1 revenue to grow in the high teens on a percentage basis year-over-year.

This is a good sign, as the 2022 Feb MAU is higher than the 2021 Q4 which indicates a recovery of platform attraction. However, it is obvious that the huge COVID tailwind is gone and the MAU trend starts to normalize. Moreover, a recent Google algorithm change has impacted 3% of MAU users which also happened before on Q2 2018. PINS has successfully recovered from that algorithm change, I think they should do well this time again.

The new creator and ideal pins program just got started which has already cost PINS mid-single digits on revenue growth (according to CEO). Building a creator ecosystem is difficult, painful, and long. However, PINS has seen some early signs between Creator and their audience.

On the other hand, the company is accelerating its investment on multiple fronts in advertising, AI, shopping, and internationalization. Pinterest is projecting a 40% growth of its operating expenses during 2022 which should likely affect operational profitability since sales were only projected to grow in the high teens (lower than the growth of operating expenses).

Evaluation is cheap with a long-term time horizon

With 2.58B revenue and 400M users, PINS already has a large business to base on. 2.5B cash and short-term investments offer ample liquidity for future growth and stability. The improving gross margin is (79% on Q4 2021) since the IPO indicating strong pricing power and monetization capabilities. The current net income profit margin is only 12.3%, but this is mostly because 65% of revenue was not spent on current operations but on investment for RD and marketing.

Assuming PINS’ real operating expenses are at a similar level with other matured tech companies such as Adobe(ADBE), Google (GOOG), etc. A 30% of net income profitability could be estimated which leads to 0.76B earnings power. Using 0.76B as the starting point, 17% as the growth rate for the first 5 years, and 10% as the growth rate for the next 5 years, PINS is expected to collect 11.3B discounted net income for the next 10 years (using 7% as the discount rate). At year 10, we estimate a discounted net income of 1.3B.

Conclusion

Investing in Pinterest is a little easier for me since I have used it for years. I have also seen many professionals in the design and creativity industry relying on it for their daily work. Pinterest is really the only platform for creativity and inspiration available. It has great tools and is big enough to support a social network. There are still high uncertainties around their investments in the shopping platform and creator tools in which successes are not guaranteed. However, the pins and boards as the core will continue to be there and attract new users.

This is a high-quality business that fulfills the unique and intangible needs of humans. Its data collection on consumer tastes is priceless. If execution is strong, the business will definitely be bigger and stronger ten years from now. The current stock price is very attractive. Given the seasonality nature of the business, investors could also add more positions by taking advantage of future volatility.

Be the first to comment