sefa ozel/E+ via Getty Images

Shares of Myovant Sciences (NYSE:MYOV) plunged this week after the company and partner Pfizer (PFE) announced the receipt of a deficiency letter from the FDA related to the sNDA submission for Myfembree for the treatment of endometriosis. The PDUFA date is May 6, but the agency identified “deficiencies that preclude discussion of labeling and/or post-marketing requirements and commitments at this time.”

This comes as a major surprise considering the good efficacy and safety data of Myfembree in this patient population, its availability for the treatment of uterine fibroids and prostate cancer (under a different brand name – Orgovyx), and the availability of Oriahnn (elagolix), a drug with the same mechanism of action, for the treatment of endometriosis.

At this point, we do not know what the issues are, and neither do Myovant and Pfizer. The FDA may have some safety concerns, or there could be some bureaucratic or technical deficiencies in the application that the FDA is not comfortable with.

Not receiving approval for endometriosis could lower the peak sales potential of Myfembree, but while endometriosis is a large market, sales of the other GnRH receptor antagonist Orilissa have fallen well short of expectations.

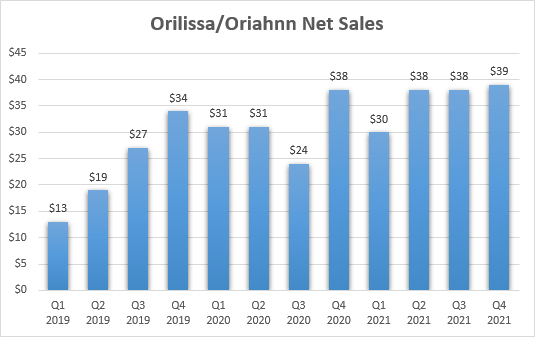

AbbVie (ABBV) appears to have given up on the significant promotion of Orilissa/Oriahnn, or just cannot get traction in this market. The product was initially launched for the treatment of endometriosis in late 2018 under the brand name Orilissa, and it was approved for the treatment of uterine fibroids in mid-2020 under the brand name Oriahnn. As you can see, the growth of the two brands has flatlined near $40 million a quarter in late 2020.

Orilissa/Oriahnn sales growth (AbbVie’s earnings reports)

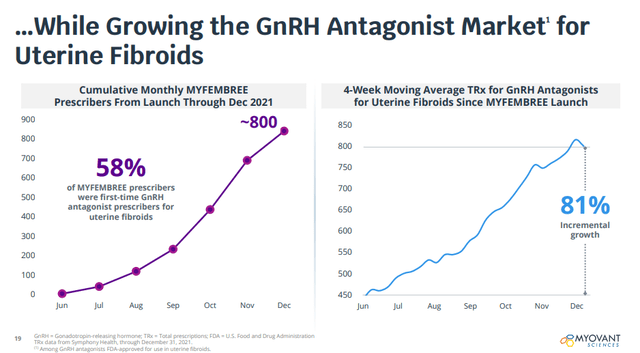

And in uterine fibroids, Myfembree is already gaining traction – in just over two quarters, the new-to-brand market share of Myfembree has reached 45% and Myovant and Pfizer have been successful in broadening the prescriber base. However, for all the effort, net sales in Q4 2021 were only $2.4 million.

Early launch metrics for Myfembree (Myovant Sciences investor presentation)

This and the growth trajectory of Orilissa suggest endometriosis has greater upside potential for Myfembree and it should be key to get this product to what could be close to or more than half a billion in annual net sales.

I’m more optimistic about Myfembree’s sales potential in the two indications than I am about Orilissa/Oriahnn because Myovant and Pfizer seem properly motivated (though Myovant is obviously more so than Pfizer) and because it appears AbbVie has all but given up on growing their product. It’s not just about the lack of sales growth. AbbVie has stopped mentioning the brand altogether after initial optimism on earnings calls and there were rumors last year that AbbVie wants to sell its women’s drug portfolio.

I also should mention that the long-term potential of Myfembree could be enhanced if the phase 3 SERENE trial is successful. The goal of the trial is to demonstrate the contraceptive efficacy of this combination tablet. In the phase 1 trial, it inhibited ovulation in 100% of patients from the first cycle and the effect was quickly reversed upon treatment cessation.

Orgovyx is the key growth driver for Myovant

Regardless of what happens with Myfembree in endometriosis in the near term and with the contraceptive efficacy longer term, I believe Orgovyx in advanced prostate cancer is the key driver for Myovant in the near term and in the long run.

This is an established market and Orgovyx is differentiated enough to drive significant revenue growth in the following years – it’s a once-daily oral pill vs. a three-month intramuscular injection for the main competitor Lupron (leuprolide), it was non-inferior against Lupron in a head-to-head trial (and numerically superior), it achieved superior testosterone suppression at days 4 and 15, and superior confirmed PSA response rate at day 15. It also demonstrated rapid recovery of testosterone levels after treatment cessation versus the long-acting Lupron. And lastly, Orgovyx had less than half the major adverse cardiovascular events in the head-to-head study and it adds to its appeal versus Lupron.

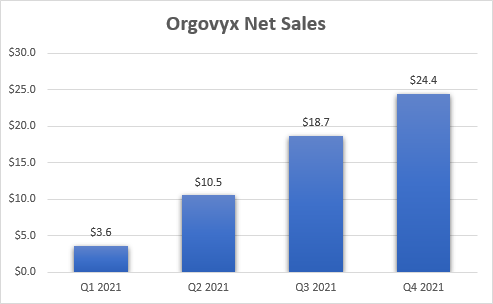

The launch of Orgovyx is off to a strong start and net sales reached $24.4 million in calendar Q4 2021 with 11,000 cumulative patients treated since launch. Coverage is already very good with 81% of commercial lives covered and 99% of Medicare lives.

Orgovyx net sales since launch (Myovant Sciences earnings reports)

Source: Myovant earnings reports (calendar quarters, Myovant’s fiscal year ends in March 2022)

And the opportunity in the U.S. market is substantial. Myovant estimates that approximately 300,000 men in the U.S. will be treated with androgen-deprivation therapy in 2022 and that approximately 100,000 men will initiate therapy. This translates to an addressable market of more than $3 billion based on an estimated net price of $11,000 to $12,000 per patient per year (from a list price of more than $25,000, adjusted for discounts, rebates, and adherence to therapy).

Based on the early success, I think it is reasonable to assume that Orgovyx can reach 25-30% market share in 4-5 years and that annual sales could reach at least $800 million and potentially more than $1 billion.

If I add $400 million to $500 million for Myfembree in uterine fibroids and endometriosis (if approved), the combined annual sales estimate range would go up to $1.2 billion at the low end of the range and up to $1.5 billion at the high end of the range.

Accounting for the 50:50 profit split with Pfizer, the valuation range would be between $22 and $30 per share (model available to subscribers). International sales represent modest upside to these estimates, but these are not products with significant ex-U.S. sales – Lupron’s ex-U.S. sales accounted for 23% of its total net sales in 2021, and sales of Orilissa/Oriahnn outside the U.S. are negligible.

Financial overview

Myovant ended 2021 with $528 million in cash and equivalents and $41.8 million available under the $400 million loan agreement with majority owner Sumitomo Dainippon. The company is well-capitalized, but cash burn is still on the high side – cash used in operations in the first three quarters of fiscal 2021 was $168 million, and the mentioned loan needs to be paid back in late 2024. But I have no concerns about the company’s financial condition and the increasing revenues should lead to reduced cash burn in the following years.

Risks

The obvious near-term risk is Myfembree receiving a complete response letter from the FDA. Though the market appears to have almost priced in this possibility, the stock could still fall if this happens. The negative impact on my valuation would be between $4 and $6 per share, but only assuming Myfembree cannot be approved at all for endometriosis instead of its approval being delayed and Myovant and Pfizer working to address the deficiencies identified by the FDA.

The other significant risk is Orgovyx and Myfembree sales falling short of mine and the market’s revenue estimates. The low end of my valuation range is based on $1.2 billion in net sales in 4-5 years and the current Street consensus for 2026 is $1.42 billion. If sales underperform expectations in the following quarters, the stock could continue to slide lower.

Conclusion

Myovant looks attractive after this week’s plunge, and the stock could be a long-term winner even if Myfembree is not approved for the treatment of endometriosis. The upside could be lower if that is the case, but still respectable and the company would need to rely on Orgovyx in advanced prostate cancer and Myfembree in uterine fibroids, but I do not know why Myfembree would not be approvable for endometriosis.

And lastly, I should mention that Myovant could be acquired by majority shareholder Sumitomo Dainippon. Sumitomo already owns 54.3% of shares outstanding and it could take advantage of the depressed valuation to propose a buyout, similar to what it did with Urovant Sciences in late 2020.

Be the first to comment