monsitj

Thesis

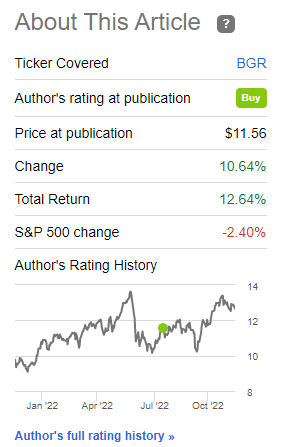

BlackRock Energy and Resources Trust (NYSE:BGR) is a closed-end fund focused on energy equities. We covered this CEF earlier in the year, when we assigned it a Buy rating. The fund has done well since:

Author Rating Performance (Seeking Alpha)

While some investors are hardened buy-and hold individuals, others like to actively adjust their portfolios. For the active retail investors, we believe now is the time to take some profits on BGR and trim the exposure. Long-term, this is a great CEF to own, but we believe there is a pull-back to be had in the short term.

Oil markets have acted as a leading indicator as of late, and they are retracing in the face of the upcoming recession and demand destruction. In the “Where is WTI headed?” section below, we discuss our house view of WTI heading towards a $65 support price level. While oil prices and energy equity prices have decoupled this year (and rightfully so), they are not entirely uncorrelated:

The longer the time period spent by WTI at lower levels, the higher the “drag” effect for energy shares. Coupled with an expected sell-off in the wider risk markets, energy equities will experience a down-leg in the next near future. Long-term, a rinse lower in WTI is healthy for the industry (we discuss this below) and it bodes well for the long-term performance of energy equities.

Where is WTI headed?

There has been a curious move in WTI in the past few months. Despite a helpful macro environment and an ongoing multi-year energy super-cycle, WTI continues to grind lower:

We believe the oil market is anticipating the recession and associated lower demand by selling off. The equity market (and implicitly energy equities) are not there yet, still mired in a bear market rally. They will eventually get there.

From the above chart, courtesy of TradingView, we can see the long-term support and resistance provided by the $65 price level. We can see multiple historic bounces off this level, as well as resistance being hit here. Even during the great post-Covid energy rally, this level acted as resistance first, and then support. In our minds, we are going to revisit that level, this time as a strong support.

Long-term, a WTI selloff is actually healthy. Why? Because it will prevent irrational exuberance. Large energy companies are now extremely profitable, and usually capitalistic economies tend to allocate more resources and investment capital where money is made. In the past, energy companies would have started drilling more and allocating more Capex towards pumping out more oil. But as the old adage goes “once burned, twice cautious”, the Covid crisis and historic negative prices in WTI have taught management a stern lesson – drilling more when the market does not reward you for it (via higher P/E ratios) is uneconomical long-term. Management is now moving from fixing balance sheets to return of capital via dividends and share buy-backs. A charged political environment with talks about windfall taxes and a disdain for old-school energy is removing any fringe incentives to substantially increase production. A lower WTI level will just remind management teams that fortunes can change very fast in this business, and higher capital allocations towards increased volumes in the future is just not rewarded presently.

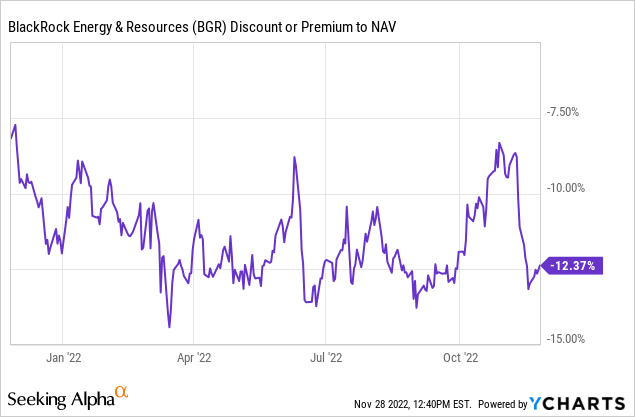

Premium / Discount to NAV

It is interesting to look at the CEF’s discount to NAV move:

Unlike other equity CEFs, BGR’s discount to NAV has widened, even as the wider markets have rallied. We are currently at the same levels seen during the September sell-off. Why? Because a certain slice of the investor base is anticipating a short-term pullback in the fund’s price.

Conclusion

BGR is a closed-end fund focused on energy equities. Earlier in the year, we penned an article where we assigned the CEF a Buy rating. The fund is up over 12% on a total return basis since our rating. Long-term, we are bullish BGR, but we are expecting a short-term pull-back. WTI is now negative on a year-to-date basis, and despite a partial decoupling with energy equities pricing, there is a substantial “drag” to be had at lower oil price levels. We believe WTI is moving to a long-term support level of $65, given the upcoming recession, and the next leg down in the wider equities markets is going to drag BGR down as well. With the fiscal year end coming up, an active retail investor should trim some of the positioning in the CEF and expect a lower, better entry point in the near future.

Be the first to comment