Vertigo3d

Connected TV (CTV) refers to streaming of content via connected and dedicated devices — such as smart TVs, gaming consoles or streaming devices — hooked into a big screen, such as a home television. CTV contents are normally full-screen, immersive, long-form, and not-skippable. Popular CTV platforms include Roku, Apple TV, YouTube TV, Hulu, and Amazon Fire TV, etc.

CTV Ad is budget-friendly as advertisers can decide how much to spend per month, use audience targeting, choose flexible pricing (e.g. CPM, CPCV, etc.), adjust campaign performance, and shift budget from non-performing or low-performing campaigns to top-performing campaigns.

This article begins with an overview of the rapidly growing CTV Ads market, followed by a brief introduction of key CTV Ad metrics, and wraps up with a discussion of several high-performing stocks with meaningful exposure to CTV.

CTV Ads Growth

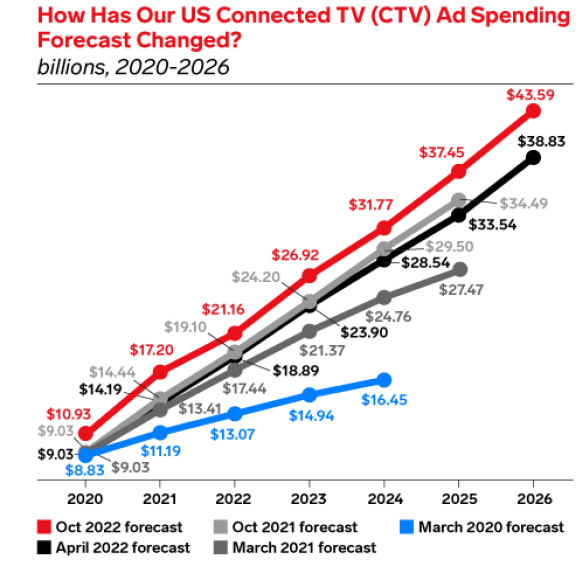

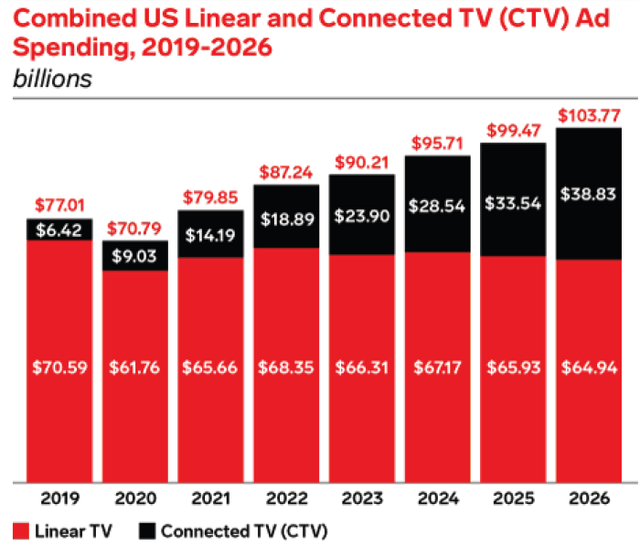

CTV is gaining popularity across the world, and is the only way to reach two critical audiences on the household’s biggest screen: Cord-cutters (91 million in US in FY22) and Cord-nevers (34 million in US in FY22) according to eMarketer. In the US today, 56% of viewers watch video content through connected TV apps, and by 2023, that number is expected to reach 82% (data source: tvScientific). The CTV Ad spend in US is $19B in FY22, growing to $39B in FY26 (’22-’26 CAGR of 20%)

Another interesting chart is how has eMarketer forecast of CTV has changed since 2020. If we compare the forecast from Mar. 2020 with the recent forecast, it’s nearly doubled every year.

eMarketer

Key CTV Ad Metrics

Unlike traditional TV, CTV Ads have detailed reports available in real-time with all the data about ad delivery and campaign performance. In this section I want to orient investors with the key CTV Ad metrics, and then transition to the next section of CTV stocks. Companies that are capable to optimize on these metrics will set themselves apart from others.

Reach – The total number of unique audience exposed to a campaign

Video Completion Rate (VCR) – % of times when a CTV ad is viewed entirely

Ad Viewability – % of impressions when an ad is watched for a few seconds and appears on more than 50% of the screen

Cost Per Mille (CPM) – cost of one thousand impressions

Cost Per Completed View (CPCV) – the total cost of a campaign divided by the total number of completed views

Cost Per Acquisition (CPA) – the total cost of a campaign and the total number of user acquisitions

Return on Ad Spend (ROAS) – This measures how much value advertisers get from a campaign, which is a ROI measurement from an advertiser perspective

Brand Safety Violation Rate: % of impressions that do not comply with brand safety. “Brand safety measures are designed to protect a brand’s online reputation by restricting it from associating with negative and inappropriate content.”

Brand Suitability Violation Rate: % of impressions that do not comply with brand suitability. “Brand suitability means brands making decisions based on their needs and what’s right for them, and it is one aspect of brand safety. Consider that you are a publisher in the finance niche. Your inventory is perfect for banks to show their ads. However, if stories related to banking malpractice start making the news, the same banks will avoid putting their ads on those articles”

Fraud Rate: % of impressions from Ad fraud activities. “Ad fraud is the practice of inflating impressions, clicks or conversion data for financial gain, wasting the advertiser’s budget in the process. Fraud tactics include Click Fraud, Domain Spoofing, SDK Spoofing, Ad Injection, Ad Stacking, Pixel Stuffing, and Geo Masking.”

Ads Share of wallet (SOW): % of an advertiser’s spend that goes into a particular ad platform (company)

Average revenue per user (ARPU): measures how much revenue the average user generates

Win rate: % of impressions won over impressions bid

CTV Stocks

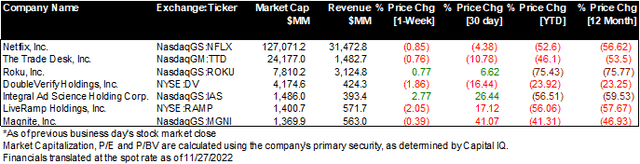

The following stocks all have significant exposure to the growth of CTV and have strong presence in the CTV Ads ecosystem (CTV platform – Netflix, Roku; CTV measurement – DoubleVerify, IAS; CTV DSP – The Trade Desk; CTV SSP – Magnite; and CTV DMP – LiveRamp). This article serves a high-level overview. I will follow up with research articles for each of the following stocks.

The Trade Desk (TTD) generates $6.2B gross spend ($1.2B net revenue) in FY21. TTD operates an omnichannel platform with a global reach. It uses bid factor-based technology (as compared to line items as the industry norms) that enables over 200 performance measures and over 300 measurable variables. Its CTV reach is over 90 million households and over 120 million CTV devices. In Q3-22, TTD’s revenue mix by channels is as follows, and CTV led the growth of the quarter. Video (incl. CTV) revenue mix is around a low 40’s%, and continues to grow; Mobile represents a high 30’s%; Display accounts for low teens; and Audio is about 5% (Data source: TTD’s Q3-22 earnings results).

Netflix (NFLX): as of Q3-22 Netflix has 223 million paid subscribers worldwide. It recently announced its launch of an ad-supported subscription plan (which costs 20%-40% below standard pricing, and ~5 mins of advertising per hour) to tap into ~$140B of brand advertising spend across TV and streaming, or over 75% of the global market(November 1 in Canada and Mexico; November 3 in Australia, Brazil, France, Germany, Italy, Japan, Korea, the UK, and the US; and November 10 in Spain) as stated in NFLX’s Q3-22 earnings results.

NFLX also announced the deal with Microsoft as the exclusive technology and sales partner.

Although this is just a starting point, NFLX’s future CTV ad monetization will be like Number of ad-supported subscribers * ARPU. For reference, Roku’s ARPU is ~$40 in FY21.

Roku (ROKU):

Roku is the No. 1 TV streaming platform in the U.S., Canada, and Mexico by hours streamed (Hypothesis Group, Oct 2021). In Q3-22 ROKU has 65.4 million active accounts (+16% YoY) with 21.9 billion streaming hours (+21% YoY). Its ARPU has also increased from $40 to $44, +10% YoY. ~88% of ROKU revenue is generated from its TV streaming platform comprised of both its 1P Roku channel, and its 3P channels such as Paramount+, Discovery+, Peacock TV, and Apple Music, etc. (Data source: Roku Q3-22 earnings results)

DoubleVerify (DV) and Integral Ad Science (IAS): DV and IAS are two major Ads Measurement and Analytics players offering very similar pre-bid and after-bid services around Fraud, Brand Safety and Suitability, and Viewability to both demand-side (dominant) and supply-side (a fraction of total) customers. Both companies generate revenue with significantly higher growth rates than the Digital Ads industry growth. Both companies serve a variety of large customers in the Ad Tech space. As TV budget continues to shift to CTV, advertisers face increasing challenges and opportunities in terms of audience targeting and campaign performance optimization, and DV and IAS are the enablers. Also as a reminder, IAS acquired Publica, a leading CTV ad platform (transacted at $220MM) in Aug. 2021.

Magnite (MGNI): previously known as Rubicon, is the largest independent supply-side platform. MGNI revenue ex. TAC was $128MM, +12% YoY in Q3-22. Revenue ex. TAC attributable to CTV was $56MM, +29% YoY, and accounted for 44% of total. MGNI partners with most of the large DSPs on the market, Agencies such as GroupM, CTV platforms such as Disney and Fox, and Retail Media advertising partners such as Kroger Precision Marketing (KPM).

LiveRamp (RAMP): LiveRamp is a DMP that runs its Authenticated Traffic Solution (ATS) at global scale. It serves 65+ SSPs and 75+ DSPs, as well as over 1,500 publishers. Among its top publishers, 80% of the top 30 Comscore publishers and 78% of the top 50 Comscore publishers have adopted RAMP’s ATS.

Conclusion

As advertisers continue to pursue higher ROAS I believe the CTV Ads (with sophisticated capabilities in audience targeting and campaign optimization) will continue to enjoy the long-term secular growth as more TV budgets shift away from linear TV. Fraud, Viewability, and Brand Safety and Suitability remain challenges that CTV tech innovators will continue to address.

I am overall bullish about this sector. I would recommend investors to pick the CTV stocks with the lens of 1) their established (or growing) scale in the Ad Tech ecosystem; 2) differentiated tech capabilities; 3) values created for advertisers and publishers; and 4) strategic partnerships to create win-win opportunities.

Be the first to comment