MediaProduction/iStock via Getty Images

Thesis

On September 7, 2022, BioVie (NASDAQ:BIVI) reported what I believe to be the second-best data on cognition ever from an open label study in Alzheimer’s disease (AD). In a letter to shareholders of October 4, 2022, the company highlighted some data and compared its cognition reporting to that presented by other competitors.

The company will present further data at the Clinical Trial in Alzheimer’s Disease (CTAD) annual conference to be held November 29-December 2, 2022.

The company will present NE3107’s Phase 2 data for Parkinson’s by the end of 2022. The company seems positive about that data, which could be logical as neuroinflammation is an underlying cause in Parkinson’s disease as well. Topline data of its Phase 3 trial before mid-2023.

I believe few investors were actually giving the company a serious chance to bring good news beforehand, though scientifically the reported cognition data makes sense.

In light of an at-the-market offering and depressed market sentiment, BioVie’s results may have gone unnoticed.

Though the company does not have a following like others in the space, I believe its data are equally impressive. I believe the next twelve months hold the potential of tremendous investor returns for the company. The risks to that investment will be set out below as well.

Introduction

BioVie is a biotech company focused on finding treatments for Alzheimer’s disease (AD), Parkinson’s disease (PD) and refractory ascites.

I have covered the company twice before, on June 7, 2022, and on September 6, 2022. In my first analysis, I have set out the scientific rationale for why I believed that BioVie may be successful in AD. At the time, I wanted to cover BioVie for its similarities to INmune Bio, but without seriously expecting success for lack of biomarkers or sufficient preclinical results to go on. And last month I mentioned how I interpreted BioVie’s recent actions as possibly setting up for a successful readout in AD.

The day after that coverage, on September 7, 2022, BioVie reported what I believe to be the second-best cognition data ever reported from an open label study in AD. The company additionally presented findings consistent with that data which, I believe, went largely unnoticed. In a letter to shareholders of October 4, 2022, the company highlighted some data.

The Scientific Rationale to NE3107’s Potential Breakthrough Success

Introduction

Alzheimer’s is a multifactorial disease, meaning that many and sometimes different triggers may be involved in the process of reaching the later stages of the disease, which involve noticeable loss of cognition. The rationale behind NE3107’s potential success is that it is targeting two pathways of Alzheimer’s disease that may lead to reduction or even reversal of the neurodegenerative process in Alzheimer’s disease. Those are neuroinflammation and insulin-resistance, with neuroinflammation seemingly the primary target.

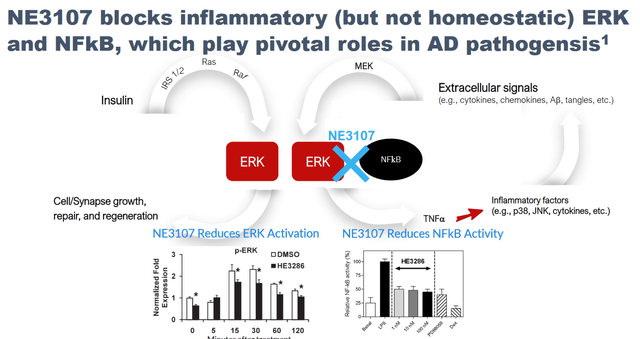

Mechanism of Action Slide (Corporate Presentation)

In its September 7, 2022 press release, the company considered itself (own underlining):

AD research has largely focused on Amyloid Beta (AB) and phospho-tau (p-tau) for decades and has resulted in a large number of trials targeting these mechanisms. More recently, however, research focus has shifted towards targeting neuroinflammation, as evidenced by the 23 disease-modifying agents listed in clinicaltrials.gov in 2021 investigating inflammation or the immune system. NE3107 is the only molecule in this group that is pursuing a two-pronged approach targeting both neuroinflammation and insulin resistance. Furthermore, NE3107 is the only molecule in the group that is conducting a potentially pivotal Phase 3 trial (NCT04669028) that is currently underway in mild- to moderate-AD patients with co-primary endpoints of cognition, as measured by the Alzheimer’s Disease Assessment Scale-Cognitive Subscale (ADAS-Cog12), and function, as measured by Alzheimer’s Disease Cooperative Study-Clinical Global Impression of Change (ADCS-CGIC), whereas 17 other agents are in Phase 2. This Phase 3 trial is expected to provide topline results in mid-2023.

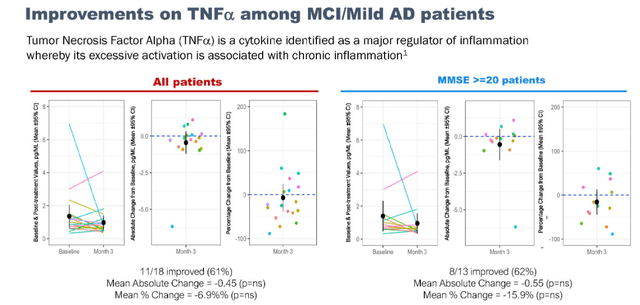

Tumor Necrosis Factor Alpha (TNFa) is a cytokine identified as a major regulator of inflammation given that its excessive activation is associated with chronic inflammation. It is considered to be the central mediator of inflammation due to its role at the top of the biochemical pathway that leads to the production of other inflammatory factors such as various cytokines (e.g., IFNg, IL-1b, IL23, IL-4, IL-17), neurotoxic Aβ peptide oligomers, activation of IKK and JNK (that leads to insulin resistance), and others. A large retrospective study analyzing the electronic medical records of 56 million unique patients demonstrated the linkage between TNFa and AD by showing that patients with rheumatoid arthritis and psoriasis taking TNF blocking agents had significantly lower AD risk. Preclinical studies showed NE3107 is a modulator of TNFa production through its ability to modulate the activation of the Extracellular Regulated Kinase (ERK) and Nuclear Factor kappa B (NFkB). By down regulating the activation of ERK and NFkB, NE3107 has been shown to reduce the production of TNFa.

I comment on some of those statements below.

AD research has largely focused on amyloid beta and phospho-tau

On September 28, 2022, Eisai reported that mild AD patients on amyloid-beta antibody lecanemab showed a 27% reduction of cognitive decline on the clinical dementia sum-of-boxes rating scale. 12.5% of treated patients showed signs of ARIA, with 2.8% percent showing symptoms. ARIA stands for amyloid-related imaging abnormalities, a common serious side effect of amyloid-targeting therapies. Though this reporting was generally praised as is the first phase 3 trial of an Alzheimer’s drug in a generation to successfully slow cognitive decline, others were more skeptical. Rob Howard, a psychiatrist at University College Londen, stated that it’s a really tiny and almost unnoticeable difference from placebo.

Research focus has shifted towards targeting neuroinflammation. TNFa is a master regulator of inflammation. Patients on TNFa-blocking medication have a significantly lower risk of AD.

Targeting neuroinflammation has already shown promising results in several neurodegenerative diseases. I have considered this across several of my articles at this point. Results seem to improve over time, making the case for truly disease-modifying treatments. BioVie’s reporting builds on a well-established scientific framework. Scientific publications on chronic neuroinflammation and detrimental activity of the resident immune cells of the brain in neurodegenerative diseases are released on an almost daily basis. Recent scientific work suggests that AD is an autoimmune disease.

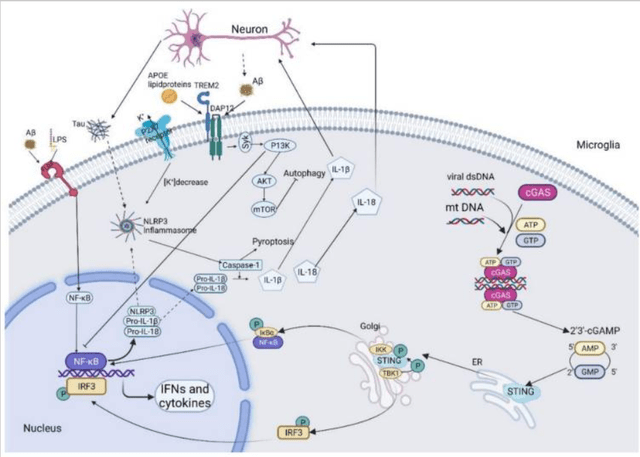

Neuroinflammatory pathways in AD (Cells, June 2022)

This is an illustration from an article in Cells that appeared in June 2022, which show how amyloid-beta and other factors may trigger the neuroinflammatory NF-kB pathway and the upregulation of pro-inflammatory cytokines. The brain’s immune cells themselves also contribute to neuroinflammation through their M1 phenotype.

The use of traditional TNF inhibitors, which are not approved for treatment of diseases of the central nervous system, has been shown to correlate with significantly reduced risk for Alzheimer’s disease. While inflammatory diseases normally correlate with an increased risk of Alzheimer’s disease, a retrospective study of 56 million patients on traditional TNF inhibitors has shown the opposite in patients treated with TNF inhibitors. On September 20, 2022, a similar report came out. In that sense, the scientific background behind BioVie’s NE3107 is remarkably similar to that of INmune Bio’s (INMB) XPro, in my view the most promising drug candidate for AD and other neurodegenerative diseases. Both companies differ essentially in that BioVie’s NE3107 targets both soluble and transmembrane TNFa, whereas INmune Bio’s XPro targets soluble TNF alone.

The Cognition Data

I see the full data including a presentation and explanatory webinar presented on September 7, 2022 as follows.

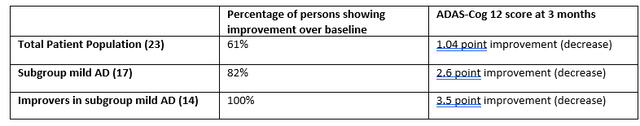

Cognition Data BioVie (Own Work)

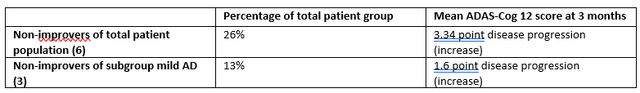

According to my own calculations, the above reporting would mean that 39% of patients are not improving, divided as follows:

Non-improving population BioVie (Own Work)

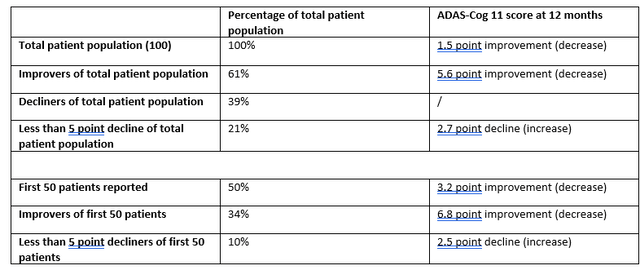

With Cassava Sciences often being considered to have presented the best open label data in Alzheimer’s disease so far, I am summarizing two datasets at twelve months as reported by Cassava Sciences below, both from a group of 100 patients and from an earlier group of 50 patients. Of note, Cassava Sciences also only included patients on the mild to moderate AD spectrum.

Cognition Reporting Cassava Sciences (Own Work)

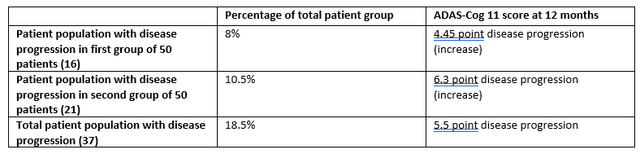

According to my calculations, that would mean the following for the non-improving patient population:

Non-improving patient population Cassava Sciences (Own Work)

There are several similarities between both datasets. The same percentage of patients show decline in reporting of both companies, namely 39%. Both datasets show improvement in the overall population. That overall improvement is within the same range (1.04 point improvement at 3 months vs. 1.5 point improvement at 12 months), also taking into account that Cassava Sciences’ results seem to be improving with time, which BioVie expects as well. Declines in both companies’ less or not responding patient populations seem in line with normal decline in AD patients, which I believe to be important as it could indicate that their drug candidates probably don’t do anything negative for possible non-responders.

Further Data Confirms The Potential Of Success And Disease-Modification

There were no drug-related adverse events. That is consistent with earlier findings, but in contrast with lecanemab and other amyloid-targeting antibodies.

BioVie also reported about nine sets of confirmatory data, which I find indicative, some of which were still in the early stages.

Correlation between two rating scales

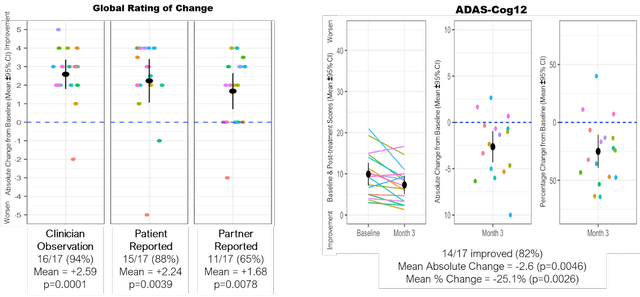

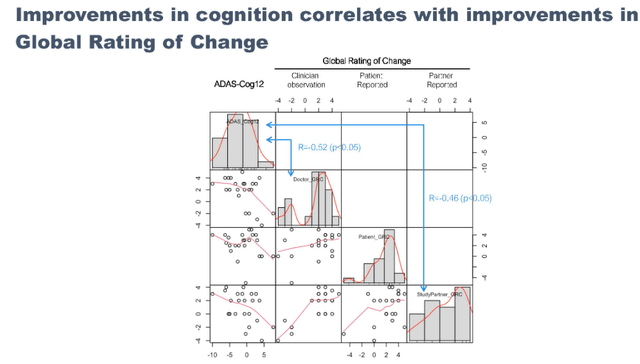

A similar pattern of improvements as seen with ADAS-Cog was seen in MCI/mild AD patients when assessing the ADCS-CGIC Global Rating of Change scale.

ADAS-Cog and ADCS-CGIC correlation (September 7 presentation) Global Rating of Change Correlation (September 7 presentation)

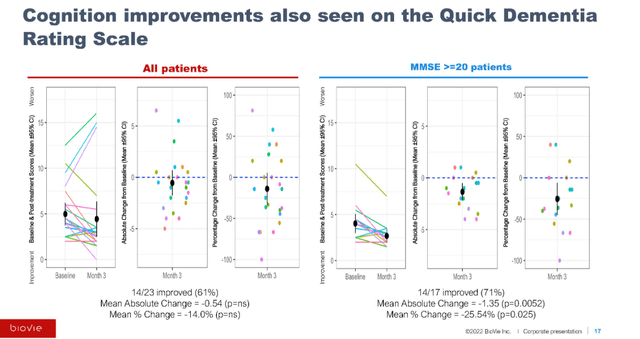

A similar pattern of improvement was also observed using the Quick Dementia Rating Scale – QDRS, with 71% of 17 MCI/mild AD patients improving with a mean change of -1.35.

Quick Dementia Rating Scale Correlation (September 7 presentation)

Correlations with inflammatory and oxidative signaling

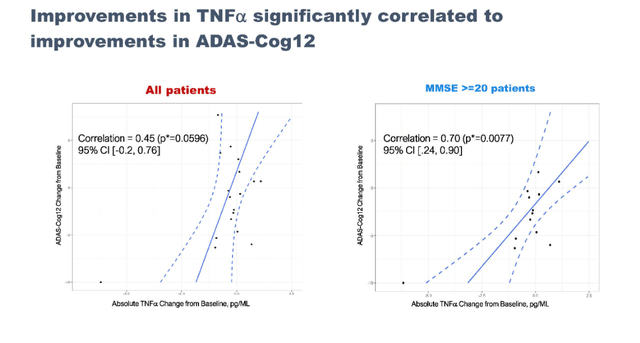

Reductions in TNFa after NE3107 treatment are significantly correlated with improvement in cognition.

TNF signaling correlation (September 7 presentation) TNF improvements in mild AD patients (September 7 presentation)

This could yet again be seen as a confirmation that the neuroinflammatory hypothesis is successful in Alzheimer’s. To me, the percentage of around 60% and significant correlation between cognitive results and reduction of TNF could indicate that the drug’s anti-inflammatory action has clear effects in about that number of patients, which is consistent with how INmune Bio sees its targeted patient population.

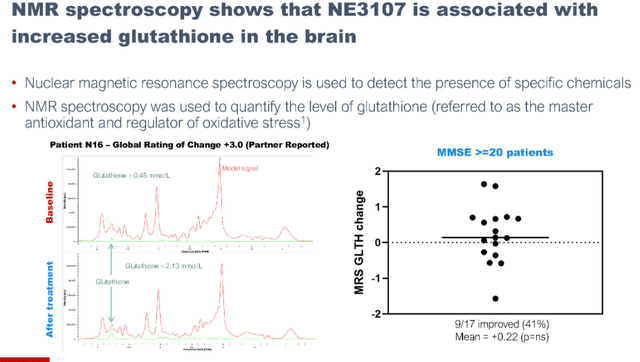

NE3107 also appears to be associated with increased glutathione, a master antioxidant and regulator of oxidative stress.

Glutathione reporting (September 7 presentation)

Correlations with the ratio of p-tau to amyloid-beta

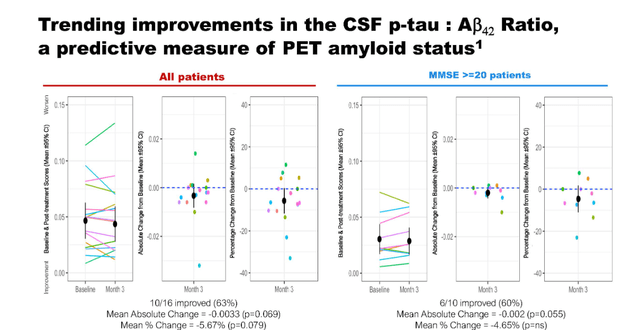

NE3107 treatment was associated with trending improvements in the ratio of p-tau:Ab. The ratio of p-tau to Ab42 could predict PET Ab status.

P-tau to Ab correlation (September 7 presentation)

Improvements in the traditional biomarkers and hallmarks of Alzheimer’s disease

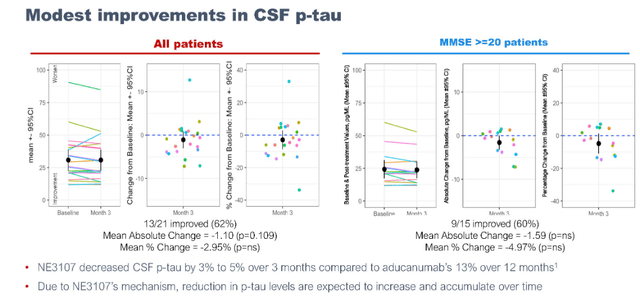

Improvements in p-tau values in the range of 3% to 5% were reported, with improvements stronger in milder AD patients. BioVie adds that it expects these increases to improve over time.

P-tau improvements (September 7 presentation)

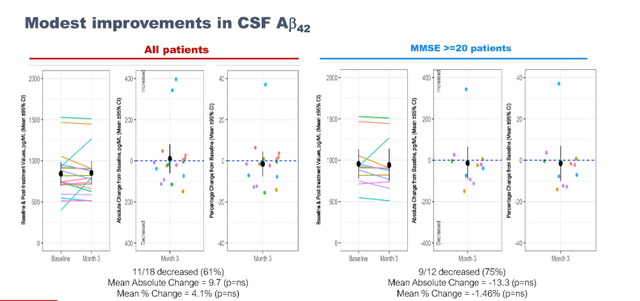

Modest improvements in CSF Aβ42were also reported.

AB42 modest improvements (September 7 presentation)

For reference, Cassava Sciences’ simufilam had reported an increase of that measure of 14%/17% after 28 days, and 84% after six months of treatment.

Early blood flow and oxygen-dependency imaging

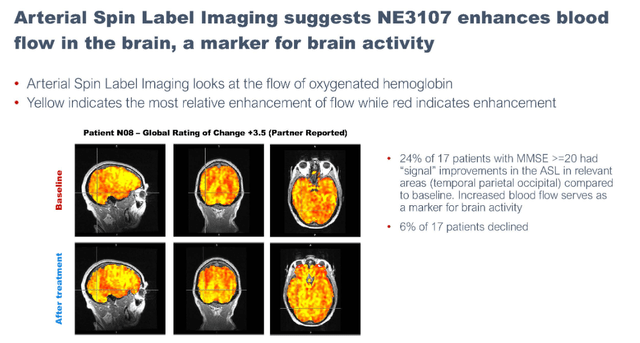

Arterial spin labeling imaging suggested NE3107 enhances blood flow in the brain

Blood flow imaging data one patient (September 7 presentation)

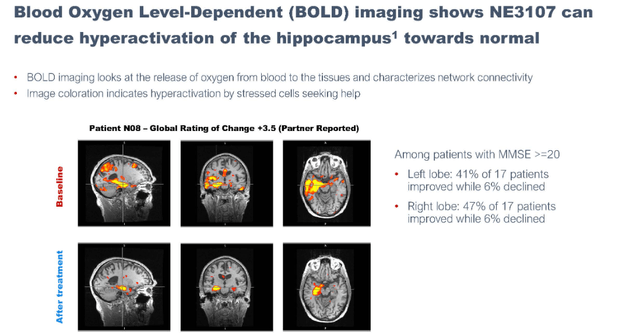

BOLD imaging shows NE3107’s potential to normalize a hyperactive hippocampus.

Oxygen dependency imaging (September 7 presentation)

Summary

The above data, which I believe to have been largely ignored as it was contained in an extensive slideshow accompanying the press release, could be seen as initial confirmatory proof that NE3107’s open label ADAS-Cog12 cognition data does not stand alone, but is consistent with other measures. Reporting not only included measures of different rating scales, but also TNF as a master neuroinflammatory biomarker and glutathione as a master antioxidant. Linking cognition improvements to reduction of TNF is consistent with the drug’s mechanism of action. In other words, the drug seems to work as it’s supposed to.

For me, in a few months’ time, BioVie went from a very risky to a more de-risked potential investment in an Alzheimer’s cure. It’s still a bit risky, but I feel comfortable having a long position at this time, given the potential upside in light of how I would define success.

The Potential Upside And How I Define Success In Alzheimer’s Disease

The potential upside to its current market cap of about $70 million is huge, and I compare that with the recent market reaction on Eisai’s news on lecanemab.

The market reacted to that news by adding 58% to Eisai’s and 40% to Biogen’s (BIIB) value. In the latter case, that meant adding more than $11 billion in market value. Other companies with drug candidates targeting Ab followed suit, such as Eli Lilly (LLY), Acumen (ABOS) or Prothena (PRTA). Analysts gave positive recommendations and set sales targets on the basis of a total addressable market of over $60 billion, based on a treatment price of $20,000 per patient and a market of 3 million patients.

An analyst at Mizuho expects lecanemab will bring in $8 billion in worldwide peak sales, noting this is pre-50/50 profit split between Biogen and Eisai. Further, the analyst suggested the total addressable market (TAM) for lecanemab could be over $60 billion, assuming there are 3 million mild Alzheimer’s patients who would be candidates for the drug, and that the treatment is priced somewhere around $20,000 per patient.

With more than 6 million Alzheimer’s patients in the US alone and over 40 million people worldwide, I believe those numbers are realistic. I would assume a $20,000 treatment per patient for a disease-modifying drug that does better than lecanemab to be realistic.

It would be safe to see the potential upside is +100%. But if one were to take the 11 billion market cap gain of Biogen for reference, we are closer to a potential 157,000%.

Success at this time could be defined as outperforming the market’s current benchmark, i.e. doing better than 27% slowing of decline. In light of the data shared above, stabilization of cognition may seem within reach. Of note, that is also INmune Bio’s outspoken goal with XPro. Anavex could still raise that bar when it will present its Phase 3 trial data.

To be clear, though cognition data from an open label study should be interpreted with a grain of salt, those results do exist and the confirmatory markers reported on indicate to me that NE3107 has a considerable chance of outperforming Eisai’s lecanemab.

Four Potential Value-Drivers Ahead

There are four potential catalysts ahead.

CTAD 2022 Conference

In about a month and a half, BioVie will report detailed results of its Phase 2 study at the CTAD 2022 Conference. That conference will be held on November 29 -December 2, 2022. Biomarkers expected to be reported there are arterial spin label imaging, hippocampal blood oxygen level-dependent imaging, brain NMR spectroscopy measuring glutathione, and peripheral TNF reduction. Further scoring on the basis of imaging data may also be presented, and review of imaging scans.

Parkinson’s Data By End Of Year

By the end of 2022, BioVie will report on Phase 2 trial results in Parkinson’s Disease in patients treated with NE3107 for 28 days. BioVie has already mentioned that it is seeing an efficacy signal. So NE3107 has the potential to improve standard of care in Parkinson’s, in synergy with levodopa as standard of care.

Phase 3 results in principle by mid-2023

By mid-2023, BioVie expects to report on its potentially pivotal Phase 3 trial in Alzheimer’s disease. That trial is half enrolled, and the treatment duration is six months. If the FDA’s data safety monitoring board would require the trial to enroll 400 patients instead of the current 320, then results could be delayed by a quarter at the most according to the company.

Refractory ascites Phase 2b trial results by mid-2023

Also by mid-2023, BioVie expects to report on its Phase 2b trial for BIV201 in refractory ascites. I have considered before that, with that trial being so de-risked, that trial alone is worth the investment in BioVie.

Risks

The possible further need for cash

I believe the biggest con for BioVie over the past few months has been its apparent need for cash. As of June 30, 2022, BioVie had cash of approximately $18.6 million and working capital of approximately $14.6 million. Its cash burn for 2021 approximately $27.3 million. In December 2021, it had reported that it had secured a $25 million debt facility that should allow it to get through the catalyst-rich year 2022. In my previous coverage, I had already mentioned different finance-related filings. A SEC filing of July 15, 2022 mentioned that BioVie had entered into a securities purchase agreement for the private placement of 3,636,364 shares at $1.65 per share, and a warrant to purchase 7,272,728 shares of common stock at $1.82 over the term of five years, for an aggregate purchase price of $6 million, with the holding company of its major shareholder Terren Peizer. I believe that BioVie’s stock not continuing to soar after the news on September 7, 2022, may have had to do with an at-the-market offering agreement allowing BioVie at any time to sell shares of its common stock for an aggregate offering price of up to $20,000,000, as filed on August 31, 2022. Surely, depressed market sentiment did not help. On September 30, 2022, there was a filing mentioning that through September 12, 2022, BioVie had sold 1,544,872 shares of common stock for total net proceeds of approximately $5.9 million. That filing mentioned that BioVie was now limited to sell stock at-the-market up to an aggregate offering price of up to $8,100,000. The possible downward pressure from the need for additional cash should end at a certain moment.

Risks associated with the Phase 3 trial

Another risk associated with investing in BioVie is related to its Phase 3 trial being in mild to moderate Alzheimer’s patients, which may include patients that were not responding to therapy. I have mentioned this before, and believe that the reported early results may confirm that view. I see that risk is fairly limited in light of the benchmark set by Eisai’s lecanemab. Other companies also report that some patients respond less, or not at all. To be successful, BioVie does not need to report improvement or even stabilization of cognition. A statistically significant result, and more than 27% slowing of cognitive decline will do.

Risks associated with the competition

Another risk could be related to the competition. As mentioned, Anavex may soon set a new bar in its upcoming reporting of Anavex 2-73 in Alzheimer’s disease. In light of recently changed primary endpoints of that trial to reduction in cognitive decline from change in cognition, I consider it unlikely that Anavex will report an improvement or stabilization of cognition.

For the reasons I have set out in my coverage on that company, I expect INmune Bio’s XPro to eventually outperform NE3107 in Phase 2 trials that may be pivotal and could lead the way for approval. Due to its trial enrichment strategy selecting only patients with inflammation, INmune Bio may not suffer from non-responders, and its results in cognition could come in much higher than BioVie’s. Also, only INmune Bio selectively inhibits soluble TNF, which may be essential to remyelination. Cassava’s Simufilam has reported probably the best results in an open label study, but its Phase 3 trial topline readout is not expected before 2025, and it is unclear whether the company can apply for a faster approval pathway.

Risks associated with the company

Some negative remarks I have picked up on BioVie relate to its major shareholder Terren Peizer, the company’s office not being located at the typical biotech hotspots, or the Phase 2 trial being investigator-initiated. A drug does not discriminate. NE3107’s scientific rationale is sound and well corroborated.

Conclusion

Though the science made sense, I have initially been skeptical about this underfollowed company’s potential success. I subsequently saw BioVie possibly setting up for success, and that turned out to be correct.

BioVie’s recent reporting of cognition was one of the best ever having been reported in an open label study in Alzheimer’s disease. It is suggestive of success in its Phase 3 trial in Alzheimer’s disease, with success being defined as outperforming a 27% slowing of cognitive decline. As a drug targeting neuroinflammation and insulin-resistance, NE3107 may be disease-modifying, and results may improve over time.

The coming months will be particularly telling. By the end of November 2022, further biomarker data will be reported. By the end of 2022, Phase 2 Parkinson’s data from the same drug will be presented, and preliminary results show an efficacy signal there too.

Though BioVie is still far from as de-risked as my highest-conviction neurodegenerative play, I have made the case for a potential +100% upside in case of successful reporting. And there may be much more upside than that. If one were to look at 40 million worldwide patients in Alzheimer’s alone and take a drug a price tag of $20,000, there is obviously a much larger potential, as set out above. And BioVie does not come with NE3107 alone.

There are surely other, possibly better and perhaps equally de-risked drug candidates with potential success in the pipeline of other companies. But I do not see one that comes cheaper than BioVie, with so much short-term potential. For me, the risks and potential cons do not outweigh the potential gains.

I am therefore reiterating my Strong Buy rating on the company’s stock.

Be the first to comment