AJ_Watt

Life Storage, Inc. (NYSE:LSI) is a real estate investment trust (“REIT”) focused on acquiring and managing self-storage facilities. Their properties are located in 36 states, with nearly 40% of their wholly-owned portfolio in 20 of the top-25 fastest-growing markets in the U.S., particularly in the Sun Belt region, which accounts for approximately 60% of the company’s portfolio presence.

Historically, the overall sector has proved to be one of the most resilient property types even through turbulent market conditions. Despite the negative impact on rents and move-in volumes during the initial months of the COVID-19 pandemic in 2020, for example, LSI still grew adjusted funds from operations (“FFO”) by nearly 6% during the year and still ended the year with record levels of same-store occupancy.

The highly fragmented nature of the industry, where approximately 80% of the core self-storage facilities in the United States are owned by numerous small, local operators, also provides significant growth opportunities for operators such as LSI with proven management systems and sufficient capital resources necessary in capitalizing on consolidation opportunities arising out of the inherent scale limitations of small operators and the scarcity of capital available to them.

Following a decade of outperformance in relation to other real estate sectors, the sector could be poised for further strength in the years ahead. A spike in spending in durable goods over the past two years has resulted in many households having too much for their current living spaces. And as priorities shift to more service-related activities, much of these goods will likely need to be stored away on a temporary or permanent basis.

With many being locked out of the housing market due to interest and price-related affordability constraints, there is a greater likelihood that more will turn to self-storage to free up space in their existing living arrangements as opposed to moving out completely.

Additionally, with homes sitting on the market for longer, staging will likely figure more into the selling process for those currently in the market, resulting in the probable relocation of existing furnishings to temporary storage facilities.

Solid industry fundamentals and LSI’s strong positioning in the fragmented market make it a quality portfolio holding for long-term investors. This is supported by their concentration in top U.S. markets, leading pricing power, and strong financial profile. Reasonable middle-of-the-pack share pricing with over 20% upside potential may also prove attractive to prospective investors. For those in the market for self-storage, LSI is one worth further attention.

Concentration In Top U.S. Markets

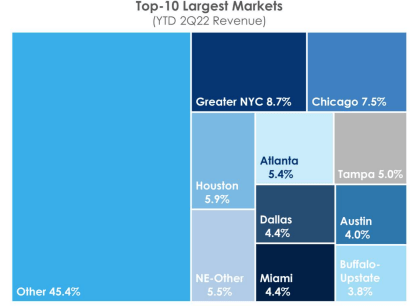

LSI has an interest in over 1,000 properties that are located throughout the U.S. Operations, however, are concentrated in the Sun Belt region of the country. Texas and Florida, for example, account for about 30% of total revenues. Though this poses an elevated level of concentration risk, attractive demographics and better rent growth potential are two compensating benefits.

September 2022 Investor Presentation – Summary Of Top-10 Largest Markets

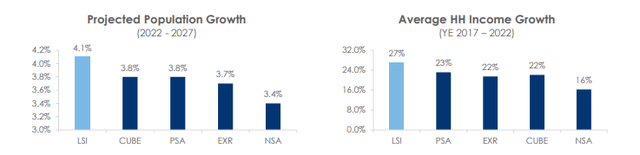

These benefits are clearer when compared against the peer set, with both population and income growth projected to increase the greatest in LSI’s markets. In fact, the company has already realized gains in recent years via increased inbound migration into Texas and Florida. As growth in these regions continues in the years ahead, LSI should continue to have an edge over their competitors in pricing power.

September 2022 Investor Presentation – Projected Demographic Growth Rates In LSI’s Markets

Leading Pricing Power

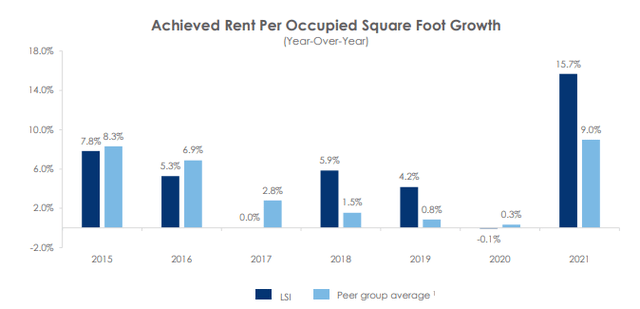

Since 2018, LSI has outperformed their peers in reported growth in rent per occupied square feet. And this outperformance was particularly notable in 2021, when LSI reported growth of 15.7% versus a peer average of 9%.

September 2022 Investor Presentation – Average Rent Growth Reported By LSI Compared To Peers

In the most recently ended quarter June 30, 2022, the company reported continued strength in pricing that reflected their 21st straight month of positive rent roll-up that resulted in same-store YOY revenue growth of 20%. Similarly, net operating income (“NOI”) was up over 20% for the fifth consecutive quarter, resulting from higher rents and superior expense control.

Though rising rents are beginning to be met with some pushback, as evidenced by flattish occupancy gains that came in just 40 basis points (“bps”) higher over the last quarter, most customers have been adequately able to absorb the continuous price hikes.

With occupancy holding at peak levels and the acquisition market bound to slow due to pricing uncertainty, lease-up activities will figure to be an important contributor to future earnings growth. Currently, LSI has 45 properties that are in lease-up with an estimated stabilized NOI of +$42.4M, representing approximately +$0.09 in incremental NOI per share as of June 30. Combined with the potential opportunistic acquisition and opportunities that may arise in later periods, LSI should retain a solid runway for growth.

Strong Financial Profile

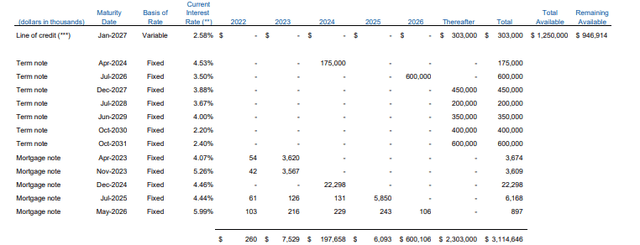

Supporting LSI’s growth initiatives is their strong balance sheet that consists of about +$1.0B in total liquidity comprised of cash and availability on their revolving credit facility, which was recently refinanced and increased from +$500M to +$1.25B.

While they did take a drawdown on the facility last quarter, resulting in variable debt exposure, over 90% of their total debt outstanding is a fixed rate. Their exposure to rate volatility, therefore, is limited.

Also, with net debt at just 4.6x recurring EBITDA, their overall leverage is manageable and at levels that are down from last year, where it was around 5.0x. Furthermore, interest coverage remains strong, and the company is at no risk of violating any of their existing covenants.

Their overall debt ladder is also weighted towards later years, with their nearest significant maturity being in 2024. Debt composition that is essentially unencumbered is also a credit positive that enables the company to retain their investment-grade credit rating from two out of the three major rating agencies.

Q2FY22 Investor Supplement – Debt Maturity Schedule

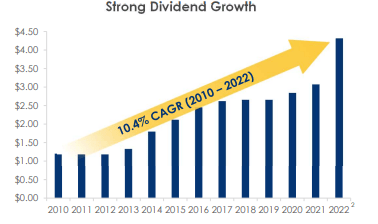

For income investors, shares in the stock offer a quarterly payout of $1.08/share, which reflects a recent increase of 8% from prior levels. While the yield of just over 4% is unappealing in the current environment, the payout is growing at double-digit compound rates. This is indicative of the company’s cash flow strength and earnings potential. And at an adjusted payout of just around 75%, investors can remain assured that the payout is safe for the foreseeable future.

LSI Has Over 20% Upside Potential

LSI is one of the few large operators in the highly fragmented self-storage industry that is well-positioned to continue capitalizing on the consolidation opportunities presented within the sector. Already, the company has experienced significant portfolio growth over the past 10+ years, with growth of 44% from 2010 through 2015 and over 100% growth from 2016 through the present.

While growth is likely to slow, the industry will continue to benefit from favorable demand drivers, such as a slowing housing market, which will tempt buyers and sellers alike to self-storage solutions in order to store the goods that have outgrown their current living quarters in the case of prospective buyers and to relocate existing furnishings for staging activities in the seller’s case.

Continuing strength is reflected in LSI’s operating results, which have seen over 20 straight months of positive rent roll-up and a same-store revenue growth rate of over 20% YOY on occupancy levels that remain at record levels of around 94%.

Though the appeal of the dividend payout has declined due to current rates on alternative risk-free investments, the company recently increased the quarterly payment by 8%, bringing the payout to a level that is over 40% greater than last year. While not the most attractive yield, it is indicative of LSI’s cash flow strength. And since 2010, the dividend has grown at a compound rate of 10.4%.

September 2022 Investor Presentation – Dividend Growth History

Using a 5-YR discounted dividend growth model with a CAPM-derived cost of equity of approximately 9% and an estimated long-term dividend growth rate of 4% yields a target price of approximately $130, which would represent an upside of about 25% from current levels. For investors seeking a defensive addition to their long-term portfolios with above-average upside potential, LSI is one to have on any real estate screener.

Be the first to comment