Chip Somodevilla

Warren Buffett has made some missteps over the years. For every Occidental Petroleum (OXY), there is a Kraft Heinz (KHC) that hasn’t worked out. For every Apple (AAPL), there is an IBM (IBM) that has failed to live up to expectations. We hope our readers view our work in a holistic way, much like they view Buffett’s.

By Valuentum Analysts

On November 5, Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B), the conglomerate run by Warren Buffett and company, reported third-quarter results. Berkshire’s quarterly reports are always rather muddy, as GAAP presentation requires the company to report unrealized gains/losses on its stock investments as investment gains/losses in net earnings (losses). Such accounting doesn’t tell the whole story as most of Berkshire’s equity positions are of the long-term variety, and quarterly swings in the market value of these positions shouldn’t necessarily impact one’s long-term thesis on the conglomerate. We continue to like shares of Berkshire Hathaway.

Operating earnings at Berkshire Hathaway during the third quarter of 2022 were solid, in our view, advancing to $7.76 billion from $6.47 billion in the year-ago period, as strength in utilities, energy and other controlled businesses offset weakness in insurance underwriting. The big driver in the quarter, which led to GAAP losses of $2.69 billion on a net basis, was a $10.45 billion investment and derivative loss, but again, this line item will swing wildly with the market and is generally not a good lens through which to view Berkshire’s performance in the period. Berkshire continues to buy back its own stock, allocating $1.05 billion in the quarter to share repurchases. It has now bought back $5.25 billion of stock so far in 2022.

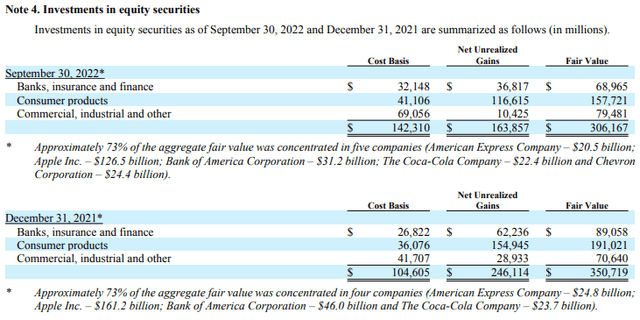

During the first nine months of the year, Berkshire hauled in $27 billion in operating cash flow and spent $10.9 billion in capital outlays, good for some serious free cash flow generation. At the end of the quarter, the firm had ~$109 billion in cash and short-term investments in U.S. Treasury bills and ~$116.5 billion in notes payable and other borrowings across its insurance, railroad, utilities and energy operations. American Express Company (AXP), Apple Inc., Bank of America Corp (BAC), The Coca-Cola Company (KO), and Chevron Corp. (CVX) account for roughly 73% of the fair value of Berkshire’s equity investment security portfolio.

Berkshire’s investments in equity securities. (Image Source: Berkshire Hathaway)

Berkshire has continued to build a position in Occidental Petroleum Corp, with the firm acquiring 17% of the company’s outstanding stock during the first half of the year and additional shares that put it over the 20% ownership mark (it currently has a 20.9% stake). We like outsized energy exposure in this market environment, as we “added” Exxon Mobil (XOM) and Chevron to the simulated newsletter portfolios last year and recently swapped out Digital Realty (DLR) for the Energy Select Sector SPDR (XLE) in the Dividend Growth Newsletter portfolio. But out of Berkshire’s top five publicly-held companies, we think investors would be better off with three changes that could be made.

Change Bank of America to the Financials Select Sector SPDR

To put it bluntly, we have a few issues with the banking sector. As we’ve seen more recently in the cryptocurrency markets, a “run on the bank” dynamic is not something of the past but rather it can happen anywhere and almost at any time during the worst of the credit cycle. Washington Mutual, for example, fell prey to a “run on the bank” dynamic during the Great Financial Crisis [GFC].

The problem with banks as opposed to operating companies is that it is extremely hard to tell which banks will suffer a crisis of confidence and a “run on the bank” by its various stakeholders in the event of a major economic recession or widespread panic in the banking industry. The GFC and the COVID-19 pandemic represent two recent examples of economic downturns that brought about serious concerns for the banking industry, but a down cycle or panic can in fact come in much worse than those events. Banks operate with significant financial leverage by their very business model. They borrow money to lend money. Most banks are levered approximately 10 times to 1.

If the loss content in the assets becomes large enough, and the revenues come under enough pressure, it is like everything is going wrong at once. This is especially true for banks that are only marginal during the good times. They are simply closer to the tipping point in terms of failure. The other undeniable fact is that perception can quickly become reality. Banks need their depositors to keep their funds in place. Banks need to rollover their market funding. If these conditions don’t hold, then a bank can face a liquidity crisis. Once a crisis of confidence starts, it is hard to arrest. In fact, without help from the U.S. Treasury and the Federal Reserve, the GFC could have led to many, many more bank failures and a full-blown depression (which is why fiscal and monetary authorities intervened so aggressively during the GFC and again during the COVID-19 pandemic).

So, investors at that time (during the GFC) were left guessing what the next regulatory response would be and whether the medicine would be strong enough to turn around the systemic infection. It is hard to “double down” on even the strongest bank stocks in an environment like that and one could even argue that it is not as logical as doubling down on strong operating companies with rock-solid balance sheets and strong free cash flows, where the risk of permanent capital impairment is often essentially non-existent. So instead of Bank of America, we include the Financial Select Sector SPDR (XLF) in the simulated Best Ideas Newsletter portfolio as broad diversification across the financials sector, so that the Best Ideas Newsletter portfolio is not exposed to the opaqueness of any one bank’s books, a valuable lesson that many investors learned following the Great Financial Crisis more than a decade ago now.

We’re not sure that Berkshire Hathaway will ever make a substantial transition to ETFs given the company’s individual business-like focus, but when it comes to financials, in particular, we think the XLF makes sense as a valuable risk-reduction tool relative to individual banking names that can never grow completely immune to “run on the bank” dynamics.

Change American Express to Visa

We prefer Visa (V) instead of American Express, and it comes down to a business model consideration more than anything else. Visa is the largest retail electronic payments network based on payments volume, total volume and number of transactions, and the company benefits from one of the strongest competitive advantages out there – the network effect. As more consumers use credit/debit cards, more merchants accept them, thereby creating a virtuous cycle.

Visa is not a bank and does not issue credit cards, however. Oftentimes, consumers see Visa and think they are the company taking on credit risk, but this isn’t true. Visa takes on no credit risk–unlike Berkshire’s American Express–yet both of these companies are an integral part of the growing cashless society, where everything is becoming digitalized. As you may have gathered from our thoughts on the banks above, we don’t like credit risk at all. We’ve learned a lot from the Great Financial Crisis, and we’d much rather prefer a company such as Visa, whose sales are primarily generated from payments volume on Visa-branded cards, not on the credit it extends to customers.

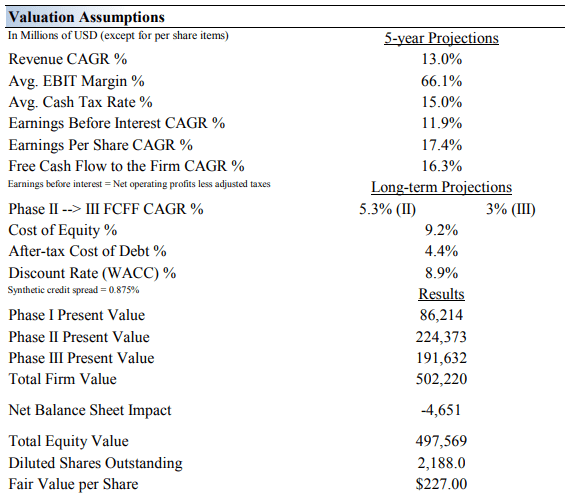

So, operating without that key risk, Visa is much better-positioned to capitalize on the ongoing shift towards a cashless society, and as with most payment technology providers, surging e-commerce demand represents a major growth opportunity for Visa. There may be some pressures in the near term that could surface, but headwinds from weakness in consumer discretionary spending may only be cyclical. Within our valuation model, we assume Visa significantly grows its revenues over the coming fiscal years, aided by secular growth tailwinds.

Our valuation assumptions of Visa. (Image Source: Valuentum)

Visa is a stellar company with a rock-solid cash flow profile, ample liquidity on hand, impressive operating margins, promising growth outlook and numerous competitive advantages. This company is one of the best operators in one of the strongest industries, and we think it is a much better fit for Berkshire Hathaway shareholders than American Express.

Change Coca-Cola to McDonald’s

We like McDonald’s (MCD) instead of Coca-Cola. Though both companies are fantastic, we have a hard time believing the consumer is going to continue to pay up for the Coca-Cola brand as budgets continue to be squeezed these days. Coca-Cola has been around for a long time, but we think that it will be challenged in the coming decade, not only for sugar content but also if inflation stays at elevated levels.

McDonald’s has a much better value offering for consumers, and even affluent customers are trading down to the Big Mac maker. But that’s not the only reason why we’re cautious. From where we stand, Coca-Cola’s shares are significantly overpriced, and while the company generates strong free cash flow, it holds a lofty net debt position that just doesn’t make sense in the context of its valuation, where Coca-Cola is trading at 25x this year’s earnings.

Typically, entities that are trading for 25x earnings are growing fast, have huge amounts of net cash on the books and are generating tremendous amounts of free cash flow. Coca-Cola only has the latter. Though McDonald’s is not unlike Coca-Cola in this regard, we think McDonald’s is much better insulated from inflation than the beverage maker, and this is primarily why we think it is a better fit for Berkshire’s shareholders.

Prices for cases of Coca-Cola at the grocery story are getting a bit out of hand, and we doubt the consumer is going to keep putting up with it. McDonald’s, on the other hand, has a fantastic value menu, where consumers can even get 2 sausage McMuffins for $2. Perhaps this deal is a loss leader for McDonald’s, but regardless, we think it is working for McDonald’s in this environment.

Concluding Thoughts

Warren Buffett has made some missteps over the years. For every Occidental Petroleum, there is a Kraft Heinz that hasn’t worked out. For every Apple, there is an IBM that has failed to live up to expectations. We hope our readers view our work in a holistic way, much like they view Buffett’s.

In the Best Ideas Newsletter portfolio, for example, where Meta Platforms (META), PayPal (PYPL), and Disney (DIS) haven’t lived up to expectations, other Best Ideas Newsletter portfolio “holdings” such as Exxon Mobil, Chevron, and Vertex Pharma (VRTX) are up huge so far this year, respectively.

We don’t think investors judge Warren Buffett solely on his missteps in Kraft Heinz and IBM (during a bull market no less), no more than we hope readers won’t judge our work solely on Meta, PayPal, or Disney (during a punishing bear market), particularly when other ideas are soaring.

We think Berkshire Hathaway is doing a great job, as it always has done, but we think that if it should make any changes out of its top three publicly-held positions, swapping out BAC for the XLF, AXP for V, and KO for MCD make a lot of sense for shareholders, in our view.

Within any investment portfolio though, there will be winners and there will be losers. It’s all part of investing. We think Buffett understands this. Valuentum understands this, and we hope you understand this, too!

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment