anatoliy_gleb/iStock via Getty Images

Value Drivers Vs. Cash Flow Woes

ChampionX Corporation (NASDAQ:CHX) benefits from Production Chemicals’ business growth, especially after the Ecolab merger. The adoption of its modular fit-for-purpose technologies has accelerated among the operators. Improved productivity in the Chemical Technologies and Artificial Lift businesses can expand the operating margin in 2022. Evidently, the pricing traction looks to outweigh the cost inflation.

However, CHX’s cash flow from operations turned negative in Q1 2022 due to a steep rise in working capital requirements. Nonetheless, relatively low leverage reflects low financial risks. The stock is reasonably valued at the current level. Investors might want to hold the stock for a modest return in the near to medium term.

Pricing Traction

The solid secular growth in North America and the additional opportunities in the international markets should drive CHX’s growth in the near term. In particular, the company will benefit from the growth momentum in the Production Chemicals business following the increased adoption of the modular fit-for-purpose approach. In the near term, the company asserted its pricing traction could outweigh the commodity and non-commodity raw material inflation. It also plans to build on the productivity initiatives. I discussed the company’s long-term strategic priority in my earlier article.

In Q1, CHX generated $34 million in cross-sales to Ecolab. The cross-sales to Ecolab are part of the post-merger supply agreements. The chemical business was boosted when it acquired Ecolab’s upstream energy business, which expanded its artificial lift and chemical businesses. However, Ecolab sales are likely to decline through midyear 2023.

Q2 2022 and FY2022 Outlook

In Q2, CHX’s management expects revenues to increase by 2.8% (at the guidance mid-point) compared to Q1. The rising chemical selling price and the synergy initiatives following the Ecolab acquisition will drive the growth. On top of higher revenues, lower costs, and improved productivity are expected to raise EBITDA by ~12% in Q2 versus Q1.

The company will benefit from the price hikes and improved productivity in the Chemical Technologies and Artificial Lift businesses in 2022. As the topline increases, its EBITDA margin can expand by 180 basis points compared to the 2021-exit rate.

Industry Indicators And Their Implications

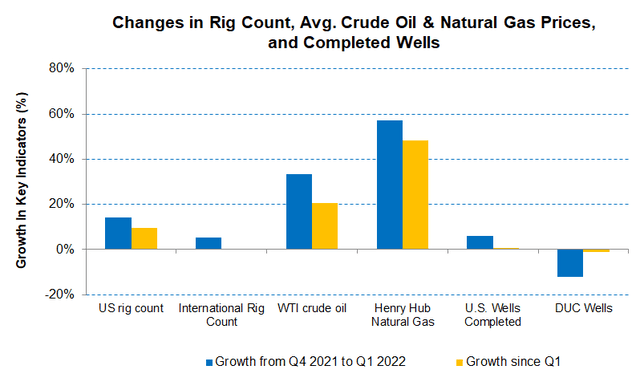

EIA and Baker Hughes’s rig count data

The short-term industry indicators have been steady so far in Q3. The average crude oil price rise remained stable in Q2 (21% up since March) after zooming 33% in Q1. The US rig count growth has been healthy (9% up, year-to-date), while the international energy activity remained unchanged. The completion activity has been holding up, suggesting that energy production will maintain its course, thus keeping CHX’s performance robust in the short term.

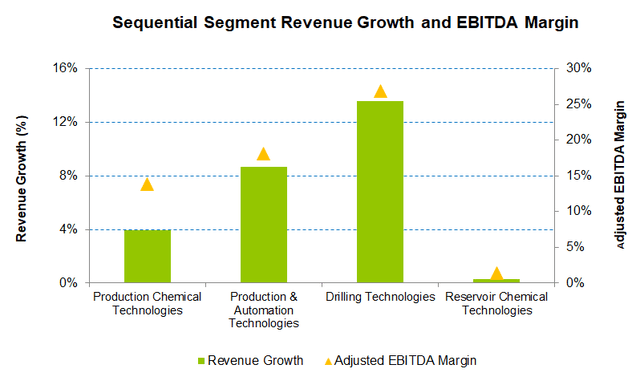

Segments: Performance And Outlook

In Q1 2022, CHX benefited from the 5% and 6% revenue growth in North American and international operations, respectively. During Q1, its Production Chemical Technologies segment revenues increased by ~9% compared to Q4 2021. Its modular fit-for-purpose technologies saw increased demand because they lower operators’ cost structures and drive efficiencies. Higher sales volume and increased share of higher-margin products led to a 14% higher EBITDA in Q1. In Q2, the management expects strong revenue growth in this segment.

Higher E&P capex and sales volume resulted in 9% quarter-over-quarter revenue growth in the Production and Automation Technologies segment. Development in the company’s digital portfolio and the acquisition of the emissions monitoring business led to the topline increase. However, the adjusted EBITDA margin contracted marginally due to the cost inflation. In Q4 2021, the management expects the operating margin to improve as the selling price hikes.

The Drilling Technologies segment (14% revenue up) outperformed the other segments in Q1. The segment EBITDA margin was 30.5% in Q1, translating into a 400-basis point sequential improvement.

The Production Chemical segment saw a relatively modest revenue rise (4% up) in Q1. In FY2022, the management expects pricing realization to improve in this segment, increasing sales by a mid-teens percentage. Driven by volume and pricing improvement, the segment EBITDA margin can reach an exit rate of ~18% in FY2022.

Cash Flow Decline And Debt

In Q1 2022, CHX’s cash flow from operations (or CFO) turned negative compared to a healthy CFO a year ago. Despite higher revenues in the past year, cash outflows due to inventory procurement and increased accounts receivable led to higher working capital requirements. Negative cash flows, in its turn, led to negative free cash flow (or FCF) in Q1 2022.

CHX’s debt-to-equity ratio was 0.40x as of March 31, 2022. It had $540 million in liquidity as of that date. Since the Ecolab merger, it paid nearly 33% of its total debt. It also initiated a $250 million share repurchase program. Its financial risks are limited because it has ample liquidity despite the free cash flow drain.

CHX’s forward dividend yield is 1.32%. Cactus (WHD) has a forward dividend yield of 0.95%, while Flotek Industries (FTK) does not pay dividends.

Linear Regression Based Forecast

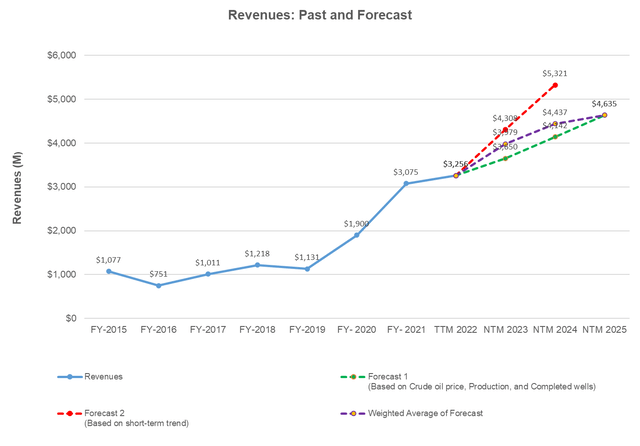

Author created, Seeking Alpha, Baker Hughes, and EIA

Based on the historical relationship between crude price, US crude oil production, completed well counts, and CHX’s reported revenues for the past seven years and the previous eight-quarters, I expect revenues to increase sharply in the next 12-months (or NTM 2023). The growth rate, however, can decelerate in the following two years.

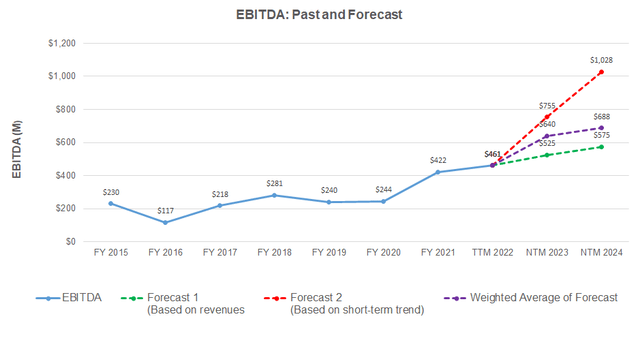

Author created and Seeking Alpha

The model suggests that its EBITDA will increase in the next two years. However, in NTM 2024, the model means the EBITDA growth rate will fall.

Relative Valuation And Target Price

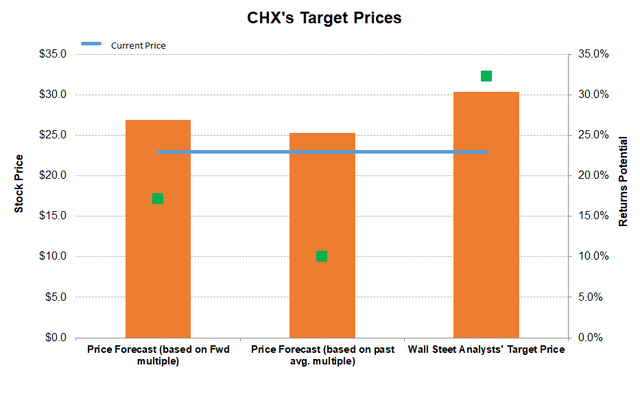

Author created and Seeking Alpha

Returns potential using the price forecast based on the forward multiple (9.6x) is higher (17% upside) than the return potential using the past average (10% upside). The Wall Street analysts’ estimates (32% upside) are higher. I think the stock has upside potential in the short term.

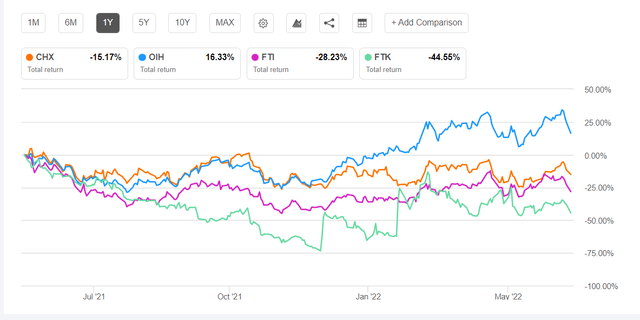

The stock is reasonably valued at the current level. The stock’s EV/EBITDA multiple is lower than its peers’ (WHD, FTI, and FTK) average of 16.5x. I estimated the relative valuation based on CHX’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA and compared it to peers.

What’s The Take On CHX?

ChampionX is set to spring from the foundation laid out in the Production Chemicals business following the increased adoption of the modular fit-for-purpose approach. Its topline and EBITDA margin can expand significantly in 2022 compared to the previous year. On top of that, the Ecolab merger’s cost reduction initiatives and revenue synergies will push its bottom line higher.

Relatively low leverage reflects low financial risks on its balance sheet. However, CHX’s negative cash flows may disrupt its debt reduction target. Also, Ecolab sales are likely to decline through 2H 2023. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. I think the stock price will remain range-bound in the near term.

Be the first to comment