EUR/USD started a recovery wave after a sharp decline post the US CPI release. USD/CHF is declining and might slide below the 0.9975 support.

Important Takeaways for EUR/USD and USD/CHF

· The Euro is slowly moving higher above the 0.9750 resistance zone against the US Dollar.

· There was a break above a major bearish trend line with resistance near 0.9700 on the hourly chart of EUR/USD.

· USD/CHF started a fresh decline after it failed to clear the 1.0075 resistance.

· There is a major bullish trend line forming with support near 0.9985 on the hourly chart.

EUR/USD Technical Analysis

This week, the Euro saw a major decline below the 0.9750 support against the US Dollar. The EUR/USD pair declined below the 0.9700 support level to move further into a bearish zone.

The pair formed a base above the 0.9640 level and recently started an upside correction. There was a move above the 0.9680 and 0.9700 resistance levels. There was a break above a major bearish trend line with resistance near 0.9700 on the hourly chart of EUR/USD.

The pair even broke the 50% Fib retracement level of the downward move from the 0.9926 swing high to 0.9631 low. The pair climbed above the 0.9750 level and the 50 hourly simple moving average.

An immediate resistance is near the 0.9815 level. It is near the 61.8% Fib retracement level of the downward move from the 0.9926 swing high to 0.9631 low. The next major resistance is near the 0.9850 level.

A clear move above the 0.9850 resistance zone could set the pace for a larger increase towards 1.0000. The next major resistance is near the 1.0050 zone.

On the downside, an immediate support is near the 0.9750 level. The next major support is near the 0.9720 level and the 50 hourly simple moving average. A downside break below the 0.9720 support could start another decline.

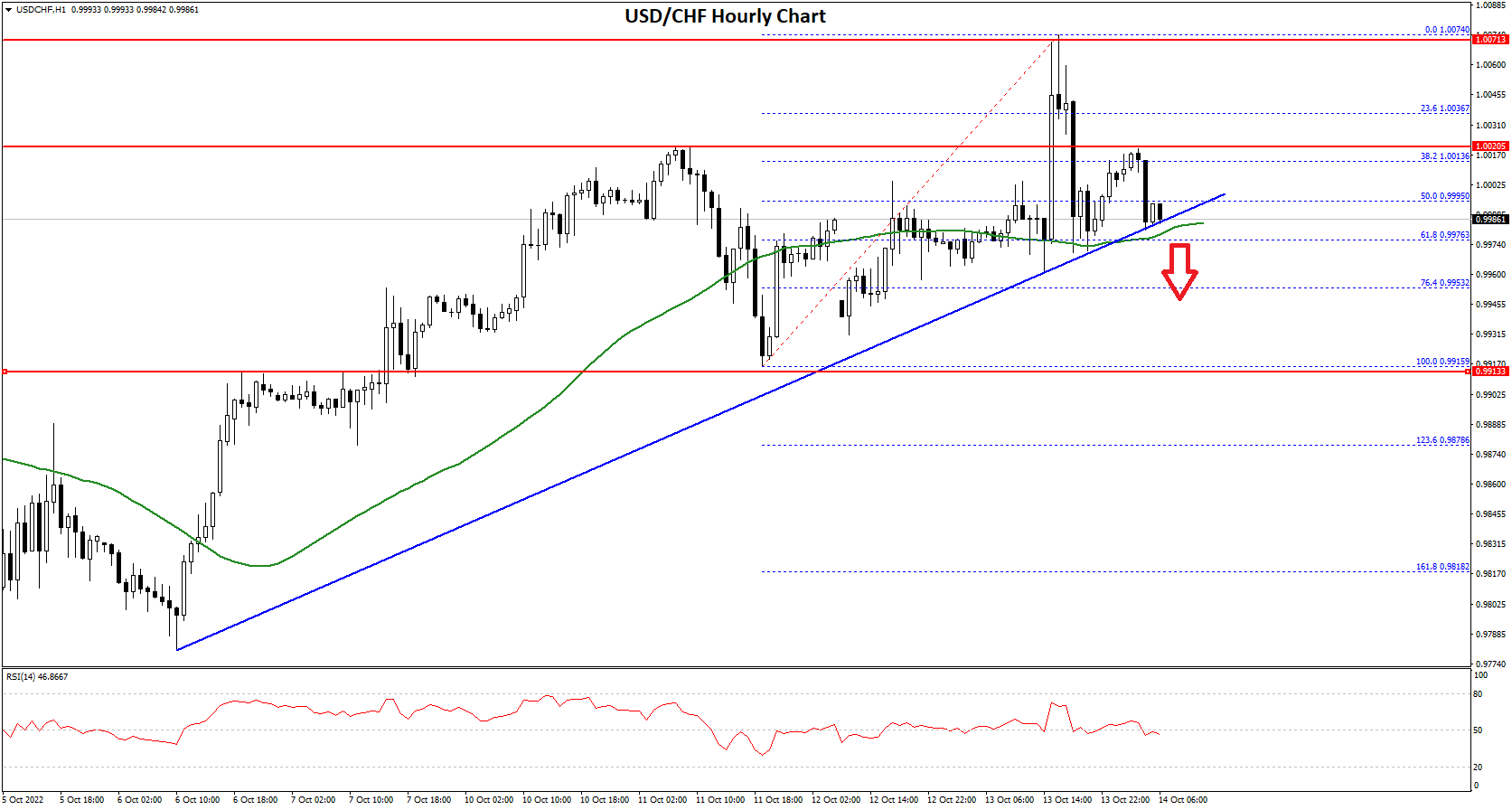

USD/CHF Technical Analysis

The US Dollar formed a support base near the 0.9915 and started a fresh increase against the Swiss franc. The USD/CHF pair traded above the 1.0000 level to move into a positive zone.

The pair even climbed above the 1.0050 level and the 50 hourly simple moving average. The pair climbed as high as 1.0074 and is currently correcting lower. There was a drop below the 1.0020 level.

The pair declined below the 50% Fib retracement level of the upward move from the 0.9915 swing low to 1.0074 high. The pair is now consolidating near 0.9985. On the downside, an immediate support is near the 0.9980 level.

There is also a major bullish trend line forming with support near 0.9985 on the hourly chart. The 61.8% Fib retracement level of the upward move from the 0.9915 swing low to 1.0074 high is just below the trend line.

Any more losses may possibly open the doors for a move towards the 0.9915 level. If not, the pair might rise again. An immediate resistance is near the 1.0020 level.

The next major resistance is near the 1.0050 level. If there is a clear break above the 1.0050 resistance zone, the pair could start another increase. In the stated case, it could test 1.0120.

This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

Trade global forex with the best ECN broker of 2021*.

Choose from 50+ forex markets 24/5.

Open your FXOpen account now or learn more about making your money go further with FXOpen.

* FXOpen International, best ECN broker of 2021, according to the IAFT

Be the first to comment