Ekaterina Chizhevskaya/iStock via Getty Images

In recent weeks, we have seen a significant increase in turbulence within the U.S. mortgage market. Mortgage rates have risen dramatically throughout the year, but accelerated even quicker in September to roughly 7% for 30-year fixed. On the one hand, higher mortgage rates mean higher yields for most mortgage lenders. Conversely, a spike in interest rates devalues older assets, creating immense book value strain for most lenders. Accordingly, the iShares Mortgage REIT ETF (REM) has declined by a staggering 23% this month and is currently down around 36% this year.

Not all mortgage REITs carry the same exposure to interest rates. Some use derivatives to hedge Treasury interest rate moves, while a minority use mortgage-servicing-rights to hedge mortgage rates directly. In general, mortgage REITs with agency-backed assets, such as agency mortgage-backed securities, carry higher interest rate risk due to their lower yield. Other mortgage REITs with more significant credit-risk assets (bridge loans, commercial mortgages, construction loans, etc.) typically carry less interest rate duration risk and greater credit risk. A few examples of agency-centric mortgage REITs include Annaly (NLY), AGNC Investment Corp. (AGNC), Orchid Island Capital (ORC), and ARMOUR Residential REIT (NYSE:ARR), all of which carry 10-20% TTM yields following their recent decline.

As the economy slows and strain grows on credit risk assets, agency mortgage REITs may seem like a good option, particularly considering the 10-20% yields found in these companies. Of course, there is rarely such thing as a free lunch in markets, particularly when it comes to high-yielding investments due to their immense popularity today. Last month I covered Orchid Island Capital in “Orchid Island Capital: Insolvency Risks Grow As Fed Considers MBS Sales.” and noted significant bankruptcy risks in that company. ORC has declined 35% since then – far more than others due to its lack of substantial Treasury market derivatives.

The sell-off in the Treasury bond market has not significantly impacted ARMOUR Residential REIT, ARR, due to its significant Treasury hedges and lower exposure to long-maturity assets. Still, ARR has declined 47% this year and 27% over the past month, giving it a staggering TTM yield of 22.2%. The stock trades nearly 40% below its Q2 book value and has avoided dividend cuts. I covered the stock in August of 2021 in “Armour Residential: Looks Cheap, But Tapering May Result In A 30-40% Decline,” and it has fallen 50% since (43% after dividends). My core thesis that the Fed’s MBS tapering would shock mortgage spreads has proven quite accurate and extended past my previous expectation. Looking forward, ARR may be supported by its low valuation and high mortgage spreads. That said, recent market volatility has pointed toward a more considerable spike in spreads, potentially related to risks in Fannie Mae’s (OTCQB:FNMA) and Freddie’s (OTCQB:FMCC) ability to guarantee MBS assets.

Mortgage Market Mayhem

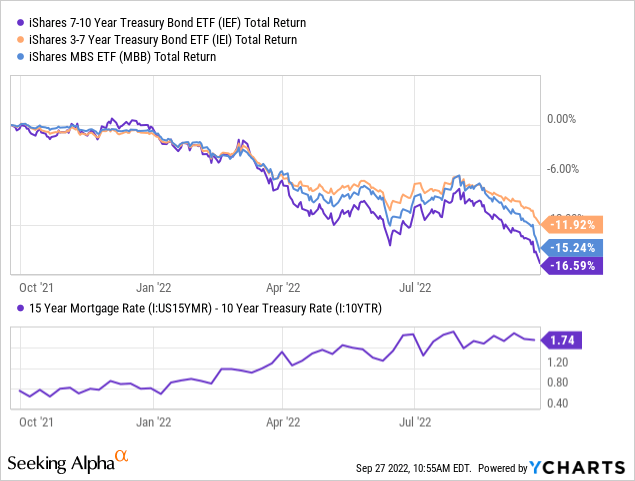

The past month has seen immense volatility in the mortgage-backed-security market – particularly in recent days. Most of this volatility stems from the rapid Treasury bond market decline. Mortgage rates have risen dramatically, but not by too much more than have Treasury rates. The agency-backed MBS ETF (MBB) is a rough approximation of most of the assets in ARMOUR’s portfolio. MBB has declined by nearly as much as the 7-10 year Treasury ETF (IEF) over the past year and more than the 3-7 year Treasury bond ETF (IEI). The spread between the average 15-year mortgage rate and the 10-year Treasury rate (a proxy for the “mortgage spread”) has also risen by ~150 bps. See below:

MBB’s weighted-average maturity is currently 8.4 years, nearly the same as IEF’s. MBB’s maturity can fluctuate depending on its manager’s asset allocation strategy and was lower when I covered the fund before. Accordingly, MBB’s performance compared to Treasury bonds is only a rough indication of moves in the mortgage spread. Additionally, the “proxy” mortgage spread above uses weekly updated data, so its 1.74% level does not reflect the most recent spike in interest rates. However, considering IEF and MBB have declined by roughly the same extent, ~3% over the past week, I do not believe the mortgage spread has changed materially.

Rising mortgage spreads are ARR’s chief risk factor today. The company’s last quarterly report stated that a 25 bps increase in mortgage spreads would cause a 10.8% expected shareholder equity decline. In comparison, a 100 bps rise in Treasury rates would cause a 6.2% decline. These exposures are not linear, and, as we’ve seen with Orchid Island, many REITs have asymmetric exposure for more significant moves in the Treasury market due to a lack of tail-risk hedges. For example. Given ARMOUR’s +100 bps sensitivity is far lower at 6.2%, its +200 bps sensitivity is likely far below Orchid’s; however, because the company does not state its tail exposure to Treasury rates, its true net sensitivity is largely unknown.

The 10-year Treasury rate was ~2.6% at the end of Q2 but is 3.97% today. This extreme ~140 bps rise in Treasury rates is outside ARMOUR’s sensitivity analysis table, so we do not know its impact on the company’s book value. That said, given its 6.2% book value sensitivity to a +100 bps move and the asymmetric nature of duration risk, I expect the +140 bps move lower ARR’s book value by at least 10% from Q2’s level. Mortgage rates have risen nearly as much as Treasury rates, so I do not believe ARMOUR has suffered additional losses from mortgage spreads.

Assuming the rise in interest rates has caused ARMOUR’s equity to decline 10%, I believe its book value per share today is likely around $7.80. The stock rarely trades at its book value and is usually at a price-to-book around 0.75X. Thus, I estimate its fair value is $5.85 per share (75% of its estimated book value). Given ARR is trading at $5.20 at the time of writing, I believe it is around 11% below its “fair value.” Combined with its 22.2% yield, it may be a speculative bullish opportunity, mainly if mortgage spreads reverse and greatly benefit its book value. However, if growing market volatility causes mortgage spreads to decouple from Treasuries, ARMOUR would have material bankruptcy risk.

Red Flags Rise With Interest Rate Volatility

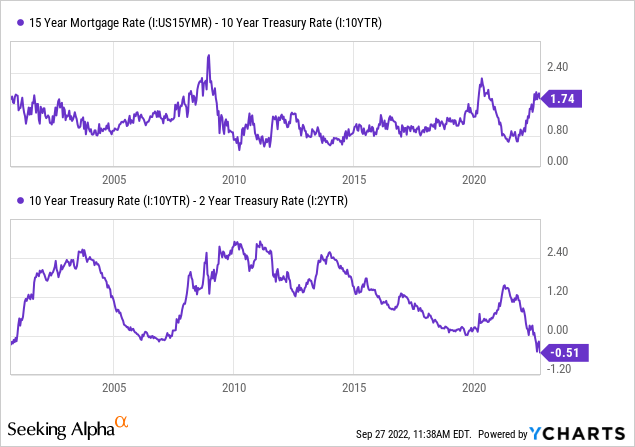

Generally speaking, mortgage spreads are high today, with the difference between the average 15-year mortgage rate and the 10-year Treasury rate at ~175 bp. The spread was about as high in early 2020 as MBS assets sold off on economic fears but declined dramatically as the Fed accelerated its Q.E. program by buying trillions in agency MBS assets. The Fed is now offloading its MBS assets and will do so at an accelerated pace from September onward.

With ~$95B being eliminated every month via Q.T., it is no wonder interest rates are surging, and bond prices are collapsing. That said, the spread between mortgage rates and Treasuries has stabilized since the end of Q2. The difference in yields between long-term and short-term Treasuries has collapsed, with the yield curve becoming the most inverted in decades. See below:

The sharp decline in the yield curve negatively impacts ARMOUR’s net interest margins as borrowing costs rise. In Q2, ARMOUR was borrowing short-term at a rate of around 1.5%, but this figure has likely grown to ~2.7% given the Fed’s rate hikes since. Given much of ARMOUR’s assets were purchased when interest rates were lower, the company may struggle to generate positive cash flows as borrowing costs rise. In my view, there is a considerable risk that continued interest rate hikes will force ARMOUR to cut its dividend due to negative cash flow and income burdens.

Since mortgage spreads are well-above historical norms, it would seem unlikely spreads widen further. Indeed, the company’s ~10.8% sensitivity to a 25 rise in spreads is a significant risk since a large mortgage market shock could cause mortgage spreads to widen by an additional 50-100 bps, likely impairing a substantial portion of the firm’s equity value. In my view, mortgage spreads would only widen to such as extent if the market discounts Fannie Mae and Freddie Mac’s ability to guarantee agency assets.

ARMOUR’s credit risk exposure is hypothetically minimal because these (government-owned) companies are required to guarantee mortgage losses. However, Fannie and Freddie operate at essentially 50-100X debt-to-equity and have minimal “cushion” in the case of a national rise in mortgage defaults. With real estate prices slipping, sales collapsing, and the economy slowing, the risk of a considerable rise in mortgage defaults is seemingly growing. As stated by FINRA, contrary to popular views, GSE-sponsored MBS assets have “real credit risk” because the Federal government is under no legal obligation to bail out GSEs (as they had in 2009). Given political gridlock and monetary risks with rising inflation, I generally believe it is unlikely the government will bail out Fannie and Freddie if history repeats.

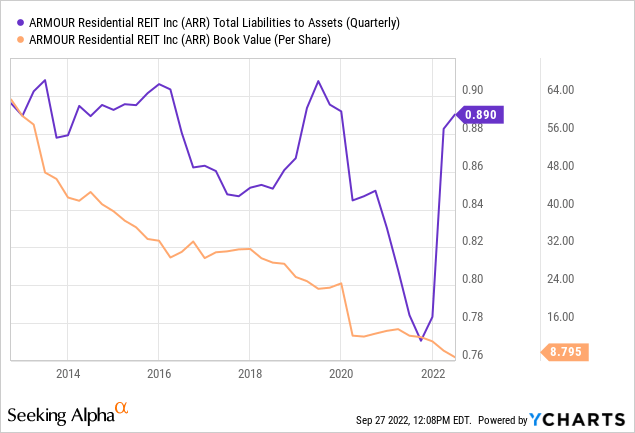

If banks, investors, or other MBS holders begin to discount GSE-sponsored MBS assets due to credit risk, then mortgage spreads could widen further. ARMOUR operates at a nearly 10X debt-to-equity and has expanded its leverage over the past 18 months. Such high leverage is relatively suitable for assets that lack credit risk, but ARMOUR’s book value could rapidly decline to zero if that changes. As last seen in 2020, a crash in MBS assets can trigger margin calls, creating a temporary “doom loop” for mortgage REITs.

The Bottom Line

On the one hand, ARR is likely trading well enough below its present Net-Asset-Value that it may be discounted on a short-term basis. Combined with its high yield, I understand how it may be viewed as a bullish opportunity. If you strongly believe that interest rate volatility will subside, then ARR could be a way to generate strong returns as mortgage spreads and the yield curve normalize.

Despite its potential, I remain bearish on ARR and believe it is more likely to be another “value trap.” While its downside risk is far lower than Orchid Island’s, it has the same core negative risk factors. Given my bearish economic outlook, I believe ARMOUR’s equity value may eventually be jeopardized – particularly if the mortgage spreads widen. ARR’s book value per share has consistently declined over the past decade. With its leverage back at a high level, its book value risk is heightened. See below:

In the short run, there may be value in purchasing a financial stock if it is well below its book value. However, if its book value consistently declines, its core business model must be questioned. Consider if mortgage spreads widen, then ARMOUR loses book value. If the mortgage spreads thin, ARMOUR often loses to higher repayment and refinancing. Thus, it is often stuck in a “lose-lose” dynamic that causes seemingly unending equity value erosion.

Today, the shock risk of higher mortgage spreads seems low unless U.S. property market risks rise substantially. Risks relating to a rise in Treasury rates are very high given the massive string of declines in bonds; however, this risk factor is partially hedged. Still, immense yield curve inversion will likely pressure the company’s net interest margin over the coming months, potentially forcing another dividend cut. I believe ARR is likely to decline in value despite its low price-to-book ratio. In my view, these risks are not large enough to warrant shorting ARR, but are significant enough that investors may want to avoid the stock – particularly until it becomes clear how the U.S. residential property market will react to higher interest rates and a slowing economy.

Be the first to comment