bjdlzx

(Note: This article was in the newsletter on September 18, 2022.)

So much has been made of the purchases of Warren Buffett and his followers pushing the price of Occidental Petroleum (NYSE:OXY) common shares “too high” compared to much of the industry. But Warren Buffett is not one to pay too much for stock. He has been known to make a mistake or two. But the overall record of Berkshire Hathaway (BRK.A)(BRK.B) is one of a lot of right decisions that far outweighed the other decisions.

If that is the case this time around, then there is every chance that Occidental Petroleum common is not overpriced even if the valuation is ahead of some in the industry. It would appear to not make sense to imply that Occidental Petroleum is either overpriced or imply that the only return from current levels is any potential dividend.

Clearly, this company is recovering from the panic caused by the commodity prices of fiscal year 2020. Included in that recovery is a potential restoration of the dividend down the road and lots of appreciation now that the market is no longer concerned about the company finances.

Warren Buffett’s success as an investor has attracted a lot of followers. In this case he has been purchasing a lot of common stock of Occidental Petroleum.

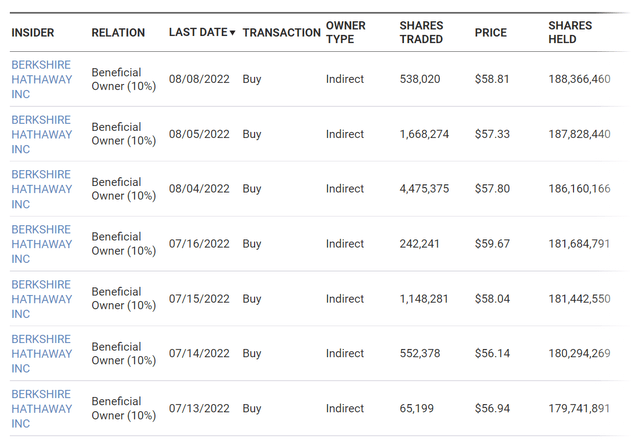

Berkshire Hathaway Purchases Of Occidental Petroleum Common (NASDAQ Website September 17, 2022)

Interestingly, the market is so caught up in the purchases by Berkshire Hathaway that there are few comments about the sales made by officers. Normally insider sales raise a red flag among investors. In this case that was overridden by the massive number of purchases shown above.

This of course was followed by a formal filing that happened to mention that if the warrants held were exercised, that Berkshire Hathaway would hold about 26% of the common shares outstanding plus the preferred stock that the company holds.

Generally, Warren Buffett is known for not interfering with the operations of companies that his investment vehicle takes significant positions in. However, he is adamant about properly planning for succession. That part should not be an issue for Occidental Petroleum.

Given that, then one needs to ask why he would purchase so much stock at one time as to make a major difference in the price level of the stock. The size of the company that he runs will need to make large investments to “move the needle”. So, what exactly about the future of the company would have interested someone like him to the extent he was willing to “pay up” to benefit from the company future?

One of the “sure things” has to be that Occidental is known as a good operator who is surely better at operations than the acquired company ever was. Fellow author Laura Starks and I both wrote about incidents when Anadarko was independent that Occidental has surely made sure such things will not be happening in the future. Avoiding those kinds of things can save a lot of money.

Similarly, superior operations are also a good way to save money. However, a massive acquisition like the one Occidental made often shows benefits over a few years. Inferior well production does not just disappear simply because there is a new operator. Instead, oftentimes, the new operator fixes what it can and then maximizes cash flow from the rest. Superior practices will show as new production comes online to overshadow the older production. Most likely there will be a declining capital need due to a better decline curve, higher initial well production rates, and of course longer production lives.

Warren Buffett will also likely look at the reserve report. Probably the numbers that would catch anyone’s attention is the 3.5-billion-barrel equivalents in the reserve report combined with the more than 800 million upward adjustments. As operating costs decline and oil prices rise, more oil in the ground becomes commercially productive. That results in the adjustment shown. Also as operations improve and technology advances, there is likely to be more upward adjustments in the future.

Now the reserve report alone does miss some key operational issues like risk factors. But a healthy cash flow tends to support the reserve report whereas a dismal cash flow during the better part of the cycle would tend to make the reserve report suspect. Occidental, of course has an excellent cash flow level during this recovery. The reserve report tends to demonstrate that the cash flow is likely to improve as the cyclical recovery proceeds.

Another source of future value gain has to be the 10 million unexplored acres that Anadarko had listed in the 10-K report before the acquisition. Not all of those acres will be valuable or even productive. But it will not take a whole lot of value per acre to make the acquisition of Anadarko an absolute steal. Occidental can joint venture the acreage, sell it while retaining an overriding royalty interest, or choose to develop the acreage itself. To some extent management has already begun this process of doing something with the acreage.

Additionally, Occidental still has other assets like midstream that it can choose to monetize while using the results to repay debt or reinvest into core assets of the business. So, there is a lot the company can do to increase profitability from this point.

This is what separates Occidental from a lot of companies that are similar in size. Clearly, Warren Buffett did not pay the prices for the stock he owns, nor did he accept the conversion price for the warrants he owns, because he thinks the only return from those prices is the dividend (at most). His public record through Berkshire Hathaway indicates that he is looking for a far better return than that.

That does not mean that the stock will go “straight up” from current price levels. Nor does it mean that Warren Buffett is automatically correct. But it does strongly imply an undervaluation of the company remains even when the large purchases of the stock cease by Berkshire Hathaway.

There has been talk about the rest of the industry being even more undervalued. I follow a bunch of these companies. So, on a company-by-company basis, that may be correct.

There are still more assets to Occidental that an article cannot begin to cover including potential ventures into carbon recapture. Occidental is already one of the largest, if not the largest secondary recovery operator in the nation. If anyone can use carbon dioxide for recovery (not including to store the gas), this is the company. Of course, water injection is also another method. With greenhouse gases a hot topic, we will have to see how this unfolds in the future (as opposed to currently publicized plans).

The future of Occidental Petroleum remains enticing even including the recent runup in price. The acquisition has given the company the means to increase earnings probably in excess of production growth for the time being because Anadarko had a less than stellar operating record. Occidental management mentioned several times that they could run the Anadarko properties better (or at least as good) as anyone else. That is probably the key to a better than average future.

The market is going to wait for some proof that the superior operational management will be evident. But that should not take a whole lot of effort on the part of a management that has been long regarded as operationally excellent. The key is that large acquisitions take time for the benefits to show just due to the sheer logistics of a large acquisition. While some of the superior operations may begin to become apparent. More will over time. From current levels, this stock should at least double in value over 5 years.

Given the track record of Berkshire Hathaway, that could prove to be very conservative. Berkshire Hathaway has a record of doing very well with its acquisitions as the stock has shown for some time. That is no guarantee that will happen this time. But there are good indications that Occidental stock has a lot going for it in the future.

Be the first to comment