John Kevin/iStock via Getty Images

Should you buy stocks as the Nasdaq 100 (QQQ) and the S&P 500 (SPY) hit 2022 lows? A war in Europe, sky-high inflation, rising interest rates, and a dampening economic outlook have put a lot of fear into the stock market.

I tend to listen to Warren Buffett’s advice in such cases:

Be fearful when others are greedy, and be greedy when others are fearful.

It could be too soon, but who knows when the bottom is in. During the fast coronavirus selloff, the bottom occurred a lot sooner than a lot of people expected. I’m not going to attempt to time the bottom. Waiting also leads to large cash positions, and no money has ever been made on the sidelines.

That’s also why I prefer to invest in stocks over exchange-traded funds (“ETFs”). A stock with good fundamentals keeps the same intrinsic value and is easy to hold through rough times.

I recently wrote about “Stocks To Buy and Hold Forever,” discussing these ten stocks:

- Alphabet Inc. (GOOG, GOOGL)

- Apple Inc. (AAPL)

- ASML Holding N.V. (ASML)

- Best Buy Co (BBY)

- BlackRock (BLK)

- Costco Wholesale Corporation (COST)

- The Home Depot (HD)

- Mastercard Incorporated (MA)

- Microsoft Corporation (MSFT)

- Pool Corporation (POOL).

I also added an article with a couple of lesser-known stocks that match the criteria:

I’m going to visit the same type of stocks for you today.

Selection Method

These are my criteria for selecting buyable stocks:

- Strong revenue growth per share and good profitability are essential.

- Buybacks and/or dividends are signs of shareholder-friendly management. All companies on the list regularly return cash to the market through buybacks, dividends, and often both.

- Reasonable valuation based on EV/FCF and PE ratios relative to the growth profile.

- I look for sturdy balance sheets that aren’t too leveraged.

- The last one is subjective. I look for a strong story behind the company. A sound strategy and clear goals make the investment case more attractive.

These criteria make sure I select quality companies with strong past growth at a decent valuation. I also look for good potential growth. A sound strategy often fuels future growth in line with the past.

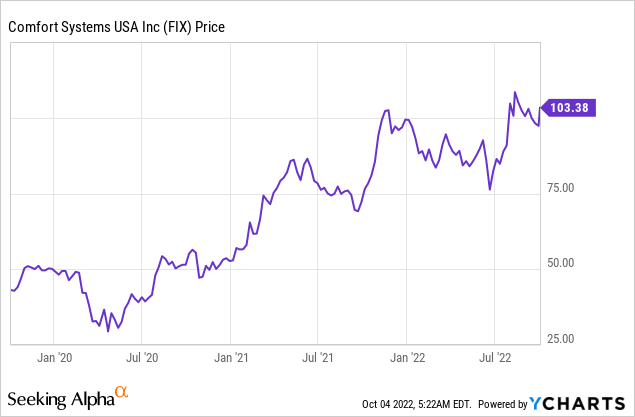

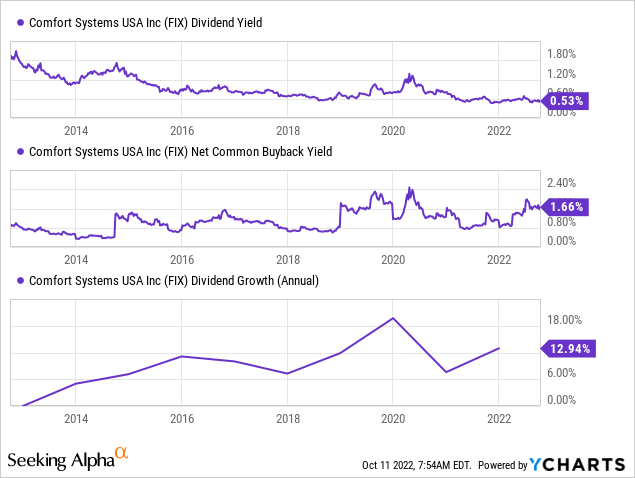

Comfort Systems USA, Inc. (FIX)

Comfort Systems is a building and service provider for mechanical, electrical, modular, and plumbing building systems. It’s composed of more than 37 operating companies and regularly acquires new companies. The buy-and-build strategy of FIX increases its revenues steadily.

FIX Shareholder Returns

Its shareholder-friendly management returns cash with a growing dividend and regular buyback programs.

Comfort Systems’ dividend yield is rather low at 0.53%. It makes up for its low yield with sturdy financials and double-digit dividend growth.

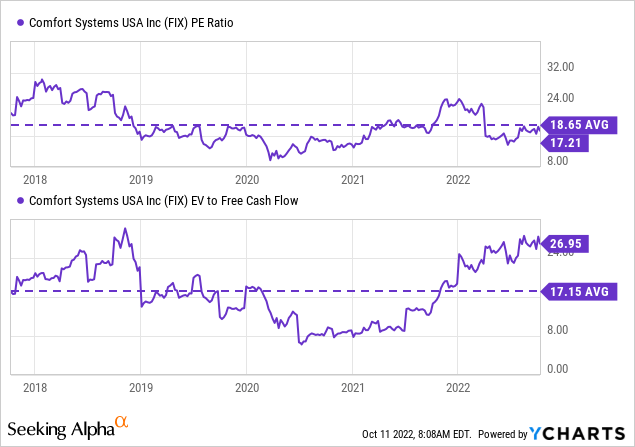

FIX Valuation

FIX is reasonably valued to its historic P/E multiple. FCF stayed behind on net earnings due to an increase in receivables. Over time, I expect FCF to get in line with net earnings again.

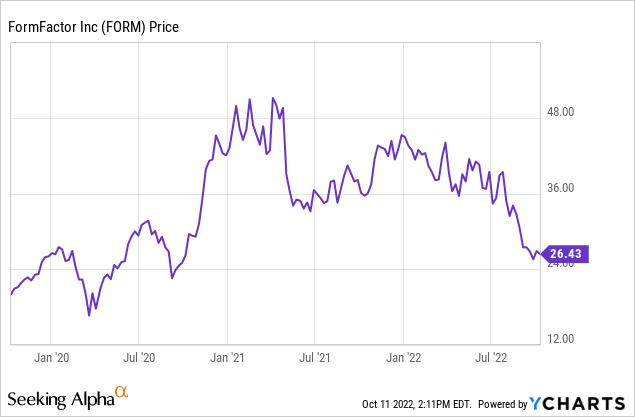

FormFactor, Inc. (FORM)

FormFactor provides essential semiconductor test & measurement technologies. It experienced stable and profitable growth over the past decade despite the cyclical nature of semiconductors. It manages to grow through the cycle. FormFactor often leads the semiconductor cycle. The testing of semiconductors should grow at a faster pace than the industry due to increasing complexity.

FORM Shareholder Returns

FORM regularly repurchases shares since it became consistently free cash flow positive in 2014. It doesn’t pay dividends. It repurchased ~3.5% of stocks outstanding over the past twelve months. Buybacks accelerated in Q2 2022 with $45M repurchases in comparison to ~$9M in previous quarters.

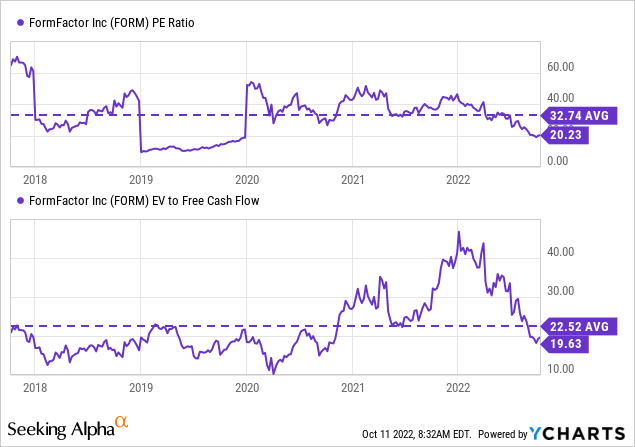

FORM Valuation

FORM isn’t overly cheap, but is valued in line with its history. The cyclical nature of semiconductors could affect earnings and make the company look more expensive in the next year.

Microsoft Corporation

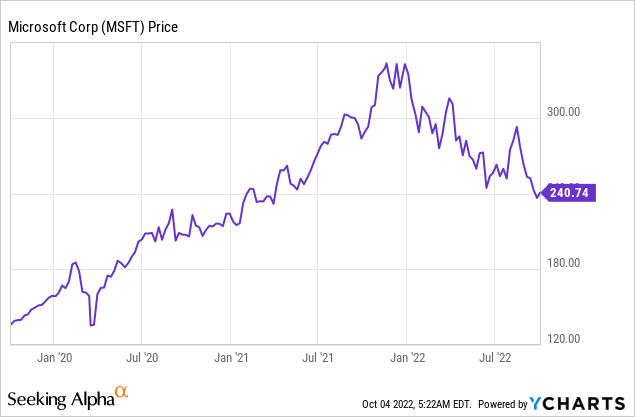

I rated Microsoft as “hold” the last time I wrote about the stock in August. The price has dropped another 18% since then and the valuation has become more reasonable, so I believe it’s time to review my take on MSFT. The company has everything going for it: revenues grow, dividends increase, and it repurchases shares regularly.

Microsoft profits from continuous trends in digitization, online collaboration, gaming, artificial intelligence, and so on. It’s close to a monopoly in retail operating systems. These attributes provided fast growth in the past that will continue.

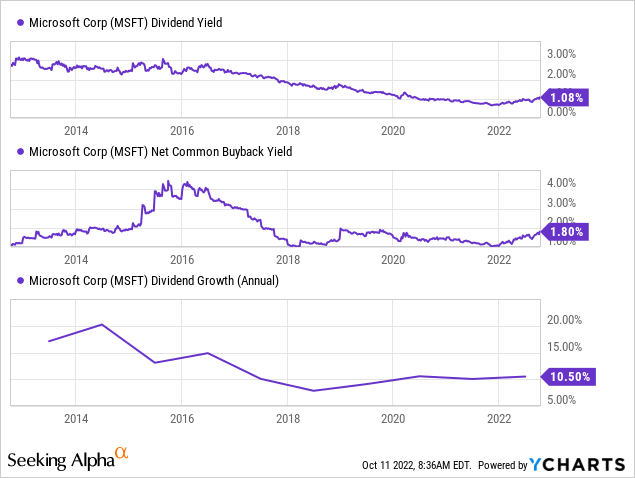

MSFT Shareholder Returns

Microsoft steadily returns cash to shareholders with both dividends and buybacks. The steady dividend growth reassures of higher future dividends.

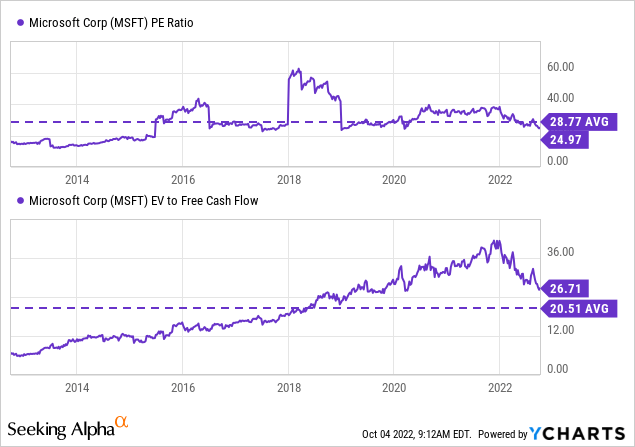

MSFT Valuation

Microsoft’s valuation is finally in line with its history after looking expensive for a long time. The steady past growth looks set to continue in the future and will drive the stock price as well.

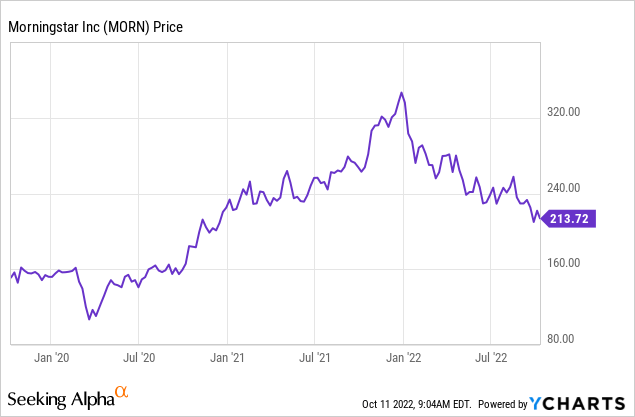

Morningstar, Inc. (MORN)

Morningstar provides financial data for investors. Its ratings are used by individuals and professional investors. Its revenues are mostly recurring. Increased interest in investments during the pandemic boosted Morningstar’s revenues. It should be able to hold a lot of those recurring subscriptions as investors look for guidance through troubled times.

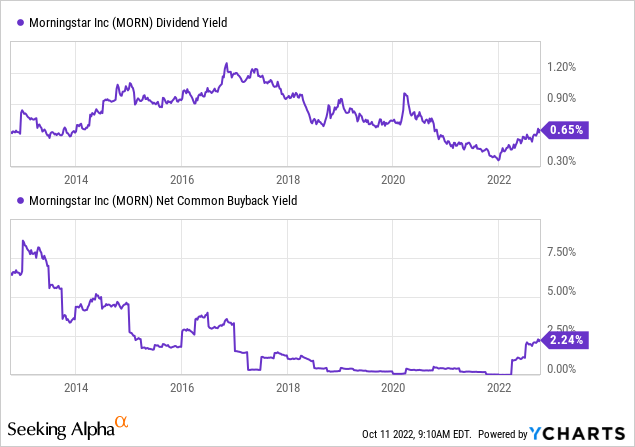

MORN Shareholder Returns

Morningstar continuously returns cash to shareholders through dividends. It uses buyback programs when the shares’ valuation lowers as shown by the reinstatement of buybacks in 2022.

Its dividend grew by 14.2% in 2022.

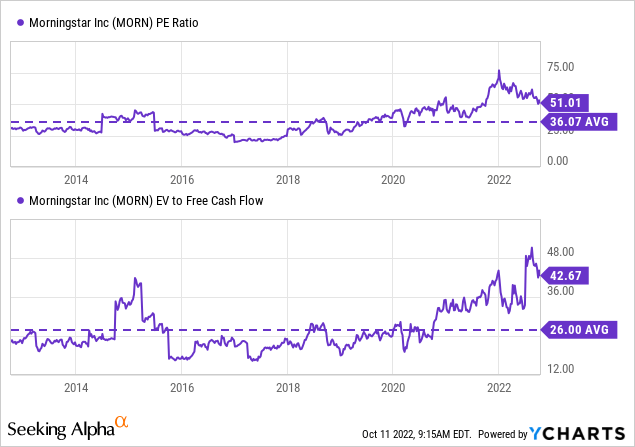

MORN Valuation

Morningstar doesn’t look cheap on the surface. Despite a recent drop in share price, P/E and EV/FCF are well above historical levels.

Investments in CAPEX and increased expenses lowered Morningstar’s margins recently. As these expenses pay off, Morningstar should be able to increase its net income and free cash flow.

A return to a “normal” net margin of 15% would put the P/E ratio around 33, reasonable for a fast-growing company. FCF conversion has been better than net earnings and EV to FCF would be around 24.

Conclusion

These stocks are good ideas for long-term investors. These are proven companies with positive earnings and cash flows that weathered previous storms. Their earnings certainly could fall back over the next couple of quarters as the economy takes a hit. I’m pretty sure they will come out stronger than before.

These companies operate in different industries. I look to build a diversified portfolio in stocks that I can buy and hold.

Be the first to comment