We Are/DigitalVision via Getty Images

The Company

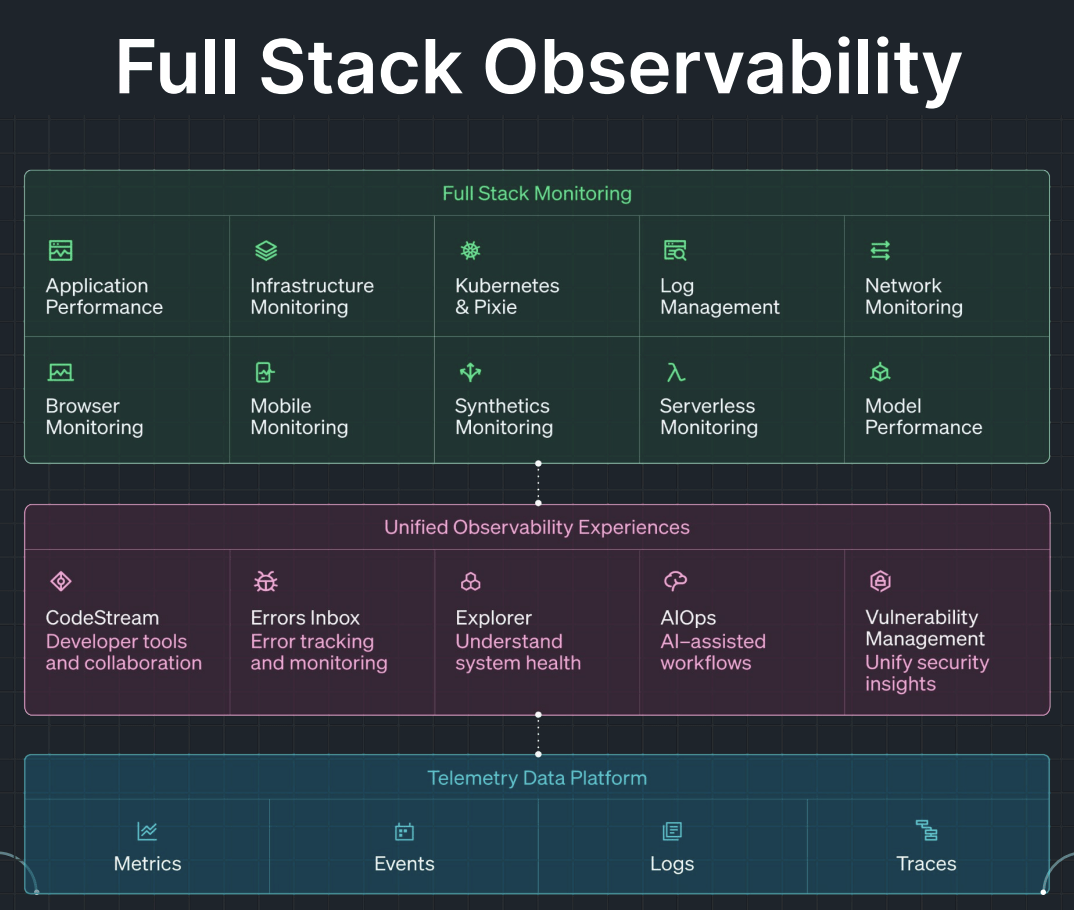

With New Relic, Inc.’s (NYSE:NEWR) software platform, businesses can cost-effectively centralize their telemetry data, from which actionable insights may be derived. Typically, “observability” is used to define this type of software.

Telemetry is the automatic recording and transmission of data from remote or inaccessible sources to an IT system in a different location for monitoring and analysis.

What is Telemetry? How Telemetry Works, Benefits, and Tutorial

Users of NEWR’s New Relic platform monitor and manage their digital infrastructure components to ensure a superior digital experience. By virtue of its unified front end, which was purpose-built atop the world’s most sophisticated telemetry data platform, the New Relic platform provides customers with a consolidated and uniform image of their digital estate.

Management’s expansion strategy, which targets the broader developer productivity market, is enabled by the fact that any engineer may utilize the platform. Currently, the bulk of observability technologies are geared for the “operate” phase of software development, which involves only a subset of the developer population. NEWR’s long-term objective is to reawaken the value of telemetry data for all software developers, despite the fact that this value has remained inactive for some time. Management has stated numerous times that they are staunch believers in the significance of telemetry data insights throughout the whole development lifecycle (from planning to deployment to ongoing operations).

Company Presentation

NEWR’s strategic growth and business model is grounded in three strategic technological pillars:

1. Serving all engineers: The New Relic platform is used by a wide range of engineers, including application developers, mobile developers, site reliability engineers (or “SRE”), network engineers, and many more. The ultimate goal of the strategic product road map is to democratize observability and make observability a daily habit for all engineers across the whole software lifecycle. The strategic product road map attempts to deliver solutions that fulfil this purpose at a continuous pace.

2. To support the entire software lifecycle: on the platform, production environment applications are not the only ones that can be debugged; other programs can also be debugged. Engineers utilize the New Relic platform in both live and test settings to ensure that applications are ready for public consumption prior to their release.

3. Deliver observability as a cohesive platform experience: Management views the New Relic platform as a true observability platform.

We saw increased platform adoption in Q1 as the number of customers using our top 4 capabilities, APM, infrastructure, logs and browser grew from 26% to 31% in the quarter. As customers adopt more of the platform, their consumption generally increases as does our revenue. The more of the platform our customers adopt, the more value they get… The growth in platform adoption speaks to the strength of our product offerings beyond our traditional APM product and the attractiveness of our all-in-one platform model.

Bill Staples, CEO

Company Presentation

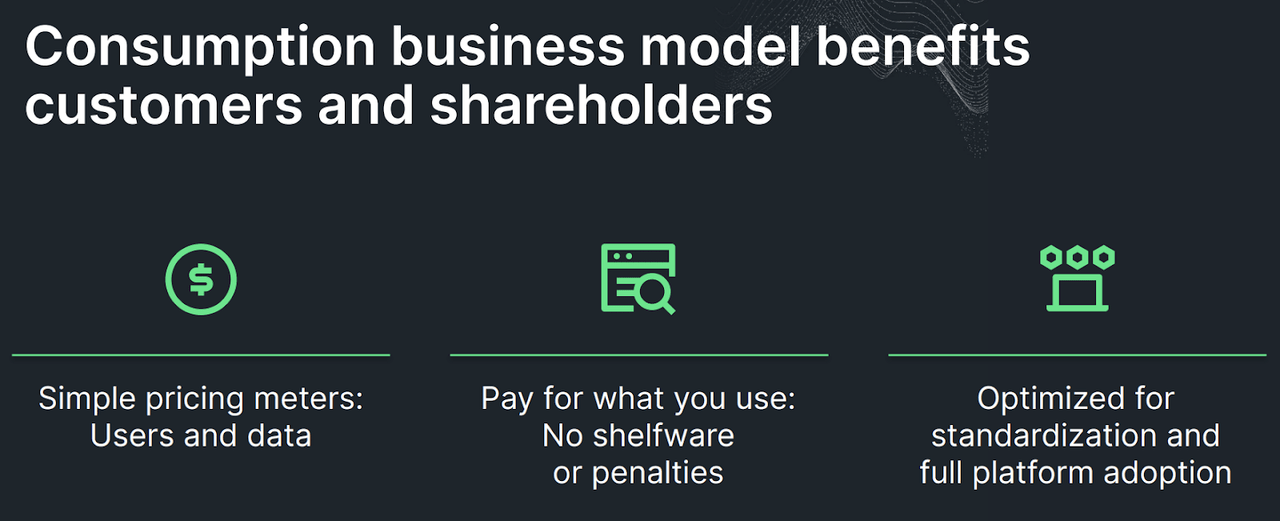

The consumption-based pricing model that NEWR implemented in 2020 lends support to these three strategic pillars. Users of the platform will have the ability, thanks to this model, to effectively manage their costs. This is essential for businesses to have when the economy is in a recession because they are looking for ways to cut costs. This effectively means that businesses can cut usage but will continue to use the software as needed:

And finally, we believe the consumption model, as I said, is the best alignment between us and our customers because if we’re not really great at helping our customers be successful, they won’t continue to consume. So we’re motivated to help them and they’re motivated to bring more of their spend to us.

Bill Staples, CEO

Company Presentation

Current State Of The Company

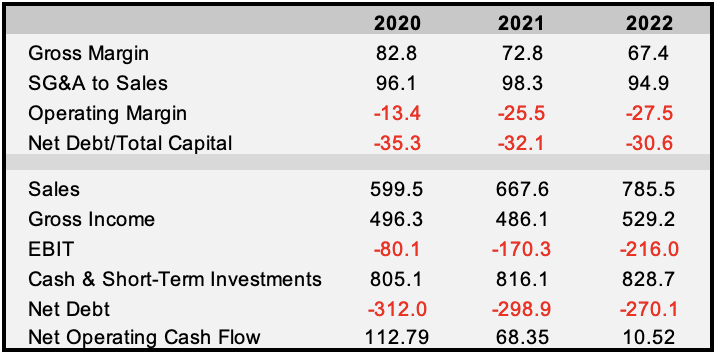

NEWR has continued to struggle with profitability, and inflation-driven cost hikes are negatively impacting the company’s profits. Gross margins continue to decline as a result of inflation since the firm cannot pass on rising expenses to its users. This is because the company is aiming to accelerate expansion by providing businesses with a more competitive product. Typically, this is achieved by giving competitive price.

We’ve also begun delivering on our third priority of accelerated account growth. Total active customer accounts are up nearly 300 in Q1, net of churn compared to a cumulative net increase of 700 accounts across the three fiscal quarters preceding it. I’m really pleased that we’ve added 1,000 paying customers to our base over the last year net of churn.

Bill Staples, CEO

NEWR continues to facilitate growth in its top line, but struggles with the bottom of the income statement. The balance sheet however is a beacon of hope, by ensuring that growth is not facilitated by the leveraging of the balance sheet, as made evident by the net debt position, this enables NEWR to “ride out the storm” into what can be a profitable future. This however must be considered with management’s inability to materialize sales growth into operating income and, therefore, free cash flow has continued to dwindle. The next fiscal year will be pivotal in shaping the growth of the company.

FactSet, Author’s Work

Valuation

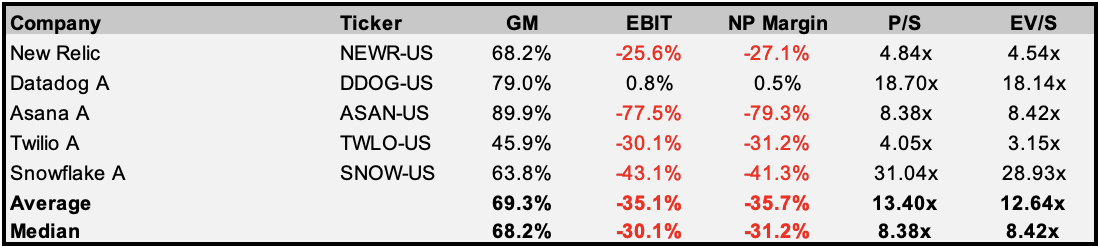

The stock price of New Relic has continued to fall, in accordance with the trends of many of the company’s competitors. While many of NEWR’s peers have better margins, NEWR facilitates much lower multiples. To the untrained eye, the multiple an investor is paying may seem reasonable in light of the company’s valuation and growth potential, but a savvy investor will recognize that this is a crowded industry with numerous offerings aiming to do the same thing.

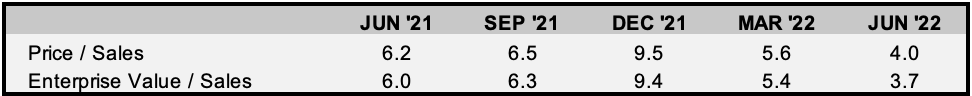

FactSet, Author’s Work

The current valuation for NEWR is significantly lower than its previous trading range. However, this is the result of a bubble popping and is, therefore, irrelevant as a point of reference. For the reasons I’ve stated above, I expect fiscal year 2023 to be far more damaging to the company’s foundations than fiscal year 2022 has been.

Author’s Work

Final Thoughts

New Relic has continued to demonstrate that the big tech bubble that occurred in 2022 expanded the valuation of firms that were not profitable beyond any measures that could be conceived. NEWR’s stock price dropped by around 45 percent in 2022, pushing it into the “overvalued” category. Previously, it was in the “bubble” category. The consistent resiliency of consumers, and by extension, the companies who are in the business of providing goods and services to those consumers, has been the primary component that has been responsible for the majority of the support for the stock price. If the consumer indicates signs of significant slowdown, this will continue to further hurt NEWR, which could see 2023 as a worse year fundamentally.

Be the first to comment