SARINYAPINNGAM/iStock via Getty Images

Tricida (NASDAQ:TCDA) has been doing wonderfully lately, over the last 12 months, but it is down considerably from its PDUFA highs. That was from two years ago, when I used to cover the stock. I recall buying some TCDA, making good money, and then losing some money on the shares I held on to, because their lead asset veverimer was handed a CRL.

The stock is up these days not because the CRL was resolved, but because of a number of other small and large things. Let’s first discuss the CRL, though. Then we will see what has been responsible for the stock’s sudden buoyancy.

Veverimer is targeting metabolic acidosis in CKD or chronic kidney disease patients. In an earlier trial, after 12 weeks of treatment, TRC101 or veverimer was able to increase blood bicarbonate level of at least 4 milliequivalents per liter (mEq/L) or achieved a blood bicarbonate level in the normal range of 22 to 29 mEq/L in 59.2% patients, compared with 22.5% of them in the placebo group (p< 0.0001).

However, one of veverimer’s major problem is the standardly used therapy for this indication, which you can buy in a bottle from a grocery store for a few bucks. This is bicarbonate of soda, and while there have been no industry-sponsored trials for obvious reasons, it has long been used by doctors to treat metabolic acidosis. Its problem is that too much sodium content in the blood can cause heart diseases, which is where veverimer has a great deal of utility with its completely different mechanism of action.

However, the FDA was not convinced, and it issued a CRL, asking for, among other things:

-

Additional data regarding the magnitude and durability of the treatment effect of veverimer on the surrogate marker of serum bicarbonate.

-

Whether the demonstrated effect size would be reasonably likely to predict clinical benefit.

I discussed all this in an earlier article from two years ago. A summary of the CRL from the company management was here:

“According to the CRL, the FDA is seeking additional data beyond the TRCA-301 and TRCA-301E trials regarding the magnitude and durability of the treatment effect of veverimer on the surrogate marker of serum bicarbonate and the applicability of the treatment effect to the U.S. population. FDA also expressed concern as to whether the demonstrated effect size would be reasonably likely to predict clinical benefit,” Tricida said.

This was an accelerated approval, and the company was already conducting VALOR-CKD at that time as a confirmatory trial. After the CRL, they said that interim data from this trial could be used to provide the data required by the FDA. This trial was supposed to enroll ~1500 patients and topline in 2023-24.

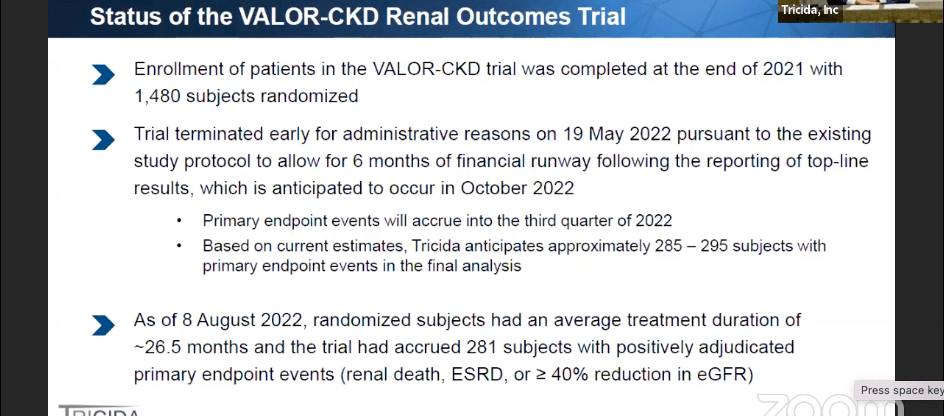

In May, the company did an “administrative stop” to this trial after enrolling 1480 patients last year, and after 237 patients reached a primary endpoint event — end-stage renal disease, renal death, or greater than or equal to 40% reduction in eGFR or estimated glomerular filtration rate — in the renal outcomes study. This was done to conserve their cash reserve, which will be near depleted this quarter. Moreover, the FDA seems to have agreed that this may work. As Phil Nadeau at Cowen explained:

Assuming a true hazard ratio (HR) of 0.70, the trial would be 78% powered at 250 events. Switching from power to observed HR, VALOR-CKD could be successful at 250 events if the observed HR is 0.78. There is only a modest increase to 0.79 observed HR should 300 events be in the final analysis. This calculation on the observed HR required for significance is based on 300 simulations on trial outcomes.

What this means is that the company is going for an all-or-nothing scenario by stopping the trial early. They are hoping that the shortened trial will be adequately powered and still provide them with enough data to resubmit their NDA. With between 250 and 300 events at this time, they will need an HR of .78 to .79 to achieve statistical significance. Prior studies cited by the company, although single arm and small, have shown HRs that have been much, much better than this.

This trial will read out by the end of this year, so they will resubmit their NDA by Q2, and expect a PDUFA date by the end of next year. That will give them a launch in 2024. Given that some analysts consider veverimer a potential blockbuster drug, this probably explains the stock’s recent strong movement.

Latest data available is from their presentation at the HC. Wainwright conference on September 6. I listened to the presentation. VALOR will topline in October. There are approximately 4,300,000 CKD US patients afflicted with metabolic acidosis. 700,000 of these, the nephrologist-treated patients, is the target population. Veverimer is room temperature stable, and it is taken once a day as an oral suspension. It has a safe drug-drug interaction profile, which is important for CKD patients who have to take 9-13 different medications per day. Below is the current status of the VALOR-CKD trial:

Valor data (HC Wainwright)

Financials

TCDA has a market cap of $621mn, a cash reserve of $98.7mn, a short interest of 16%, and although they have $200mn in debt, these are 3.5% Senior Convertible Notes due only in 2027. Thus, cutting the trial short gives them another 2 quarters of cash lifeline, which they are hoping will see them through an approval. If the trial does succeed, then I am guessing they can raise funds from a position of strength.

Bottomline

TCDA is at the cusp of a major binary event and looks very interesting right now. The stock has done well by me in the past. I am strongly considering picking up a few TCDA shares for a one-month run.

Be the first to comment