PALMIHELP

Summary

uniQure (NASDAQ:QURE) shepherded AMT-061 through two iterations and produced a best in class gene therapy for hemophilia B which may be FDA approved in November. After securing a licensing deal, uniQure is positioned to collect milestones and royalties potentially providing a revenue stream. Despite a setback with AMT-130, the company is on track to present proof of concept efficacy data in 2023. If positive, this could reset the valuation for uniQure. The AMT-130 program remains very high risk but the pipeline will expand in 2023 with 2 news INDs providing a backup plan. While AMT-130 may not pan out, should AMT-130 show efficacy, uniQure will be on track to produce the first disease modifying treatment for HD which may open up a $7B market and reset the valuation.

AMT-061

AMT-061, EtranaDez, has a PDUFA date in November and an EU decision will follow. Given the treatment met the primary endpoint and demonstrated non-inferiority in annualized bleeding rate compared to baseline Factor IX, approval is likely. uniQure is on track to receive a milestone payment of $175 upon commercial launch. The licensing deal with CSL entitles uniQure to $1.6B in milestone payments and royalties that reach as high as the low 20 percent range.

A draft ICER report noted that a gene therapy for hemophilia A provided significant benefit and a $2.5m price was warranted. The EU pricing of this gene therapy produced by BioMarin (BMRN) was announced to be approximately 1.5m Euros in the EU. While uniQure’s gene therapy is for hemophilia B rather than hemophilia A, it may command a similarly high price and royalty payments may be very significant given they can reach the low 20 % range.

AMT-130

The AMT-130 program seeks to deliver a disease modifying treatment for Huntington’s disease. This is uniQure’s lead program and it recently encountered a setback. The focus remains on whether the gene therapy will show efficacy in Huntington’s disease.

Huntington’s Disease

Huntington’s disease (HD) is a devastating autosomal dominant genetic disease. It is progressive, debilitating and inexorably fatal. Involuntary movements, impaired gait and posture, difficulty speaking along with mood and memory problems occur as the disease progresses. There are no disease modifying treatments for Huntington’s disease. Many people at high risk of having the disease chose not to be tested as there is no treatment.

Symptoms usually begin between age 30 and 50 and the cognitive and functional declines manifest over 15 to 20 years. There are approximately 30,000 people in the US diagnosed with Huntington’s disease and an additional 75,000 at risk of developing it. It is more prevalent in people of European ancestry and it is estimated there are 40,000 Europeans with the disease.

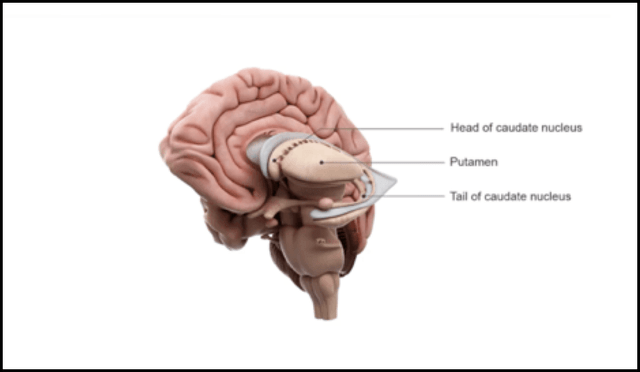

The biology underlying HD is poorly understood. The genetic mutations in HD results in mutant huntingtin protein, mHTT, aggregating in the brain. The disease manifests as the selective destruction of cells in the caudate and putamen. There is debate as to whether the disease and the symptoms are caused by the absence of functional wild-type HTT, (wtHTT) the presence of mHTT or a combination of both.

In addition, the accumulation of a short, potentially toxic fragment known as exon1 HTT protein may also be a cause of the disease. This fragment is only found in Huntington’s patients suggesting its causal involvement. Studies in mice show the presence of only HTT exon 1 results in all of the characteristic disease manifestations. Scientists writing in Nature noted that, “inhibiting the production of exon 1 HTT…might pose a very promising strategy in treating HD.”

A key question for developers of HD treatments is whether non-allele specific huntingtin lowering will benefit patients. While there is evidence that individuals lacking wtHTT can be healthy, debate remains as to whether reducing wtHTT could negatively impact clinical outcomes.

A Competitor Faces a Setback

Roche’s tominersen is an antisense oligonucleotide and has shown mHTT lowering in clinical studies. Roche announced results for the tominersen phase 3 trial that suggest that non-allele specific HTT lowering may not have a positive impact on patients. Unfortunately, the phase 3 trial was halted after a review concluded that patients receiving the higher dose of tominersen showed worse outcomes than placebo patients. While the reasons for these results were not clear, Roche recently decided to move forward with a new trial using lower doses and younger patients with less advanced disease.

Vicki Wheelock, director of the Huntington’s Disease Society of America Center of Excellence at University of California, Davis provided context on the results. “It doesn’t mean that [antisense medicines] or huntingtin lowering doesn’t work for Huntington’s disease…It means that in this study, in this population of patients, with this dose, at this interval, it didn’t work.”

The lack of understanding of the underlying biology in HD including the normal function of HTT protein has hindered progress in identifying drug targets. AMT-130 an extremely high risk program given it is unknown what an ideal drug needs to achieve to positively impact patients.

AMT-130

AMT-130, is a gene therapy candidate which utilizes an AAV5 that is designed to deliver a piece of micro RNA to silence the huntingtin gene. The goal of treatment is to non selectively inhibit the production of both mHHT and wtHTT proteins. AMT-130 differs from other treatment approaches in that it also targets the exon 1 HTT fragment.

In a phase I/II trial, AMT-130 was administered in a neurosurgical procedure directly to the striatum of early stage HD patients. One year results were announced for low dose AMT-130. The procedure was well tolerated with no SAEs in any of the 10 patients in the low dose (6x1012vg) cohort. Mean mHTT reductions of 53.8% were observed in the CSF in evaluable AMT-130 treated patients compared to a 16.8% decrease in placebo patients. This data suggests target engagement but there were no cognitive or functional measure of disease progression available. Whether the target engagement will result in clinical benefit is as of yet undetermined.

uniQure’s approach has some key differences from the tominersen trial. The AMT-130 trial only enrolled patients early in the clinical course of the disease. AMT-130 was distributed directly and exclusively to the tissues affected in the striatum rather than intrathecally. Lastly, AMT-130 targets HTT Exon 1 while tominersen does not.

uniQure announced on a recent call that regulators had been notified of SUSARs (suspected unexpected serious adverse reactions) which involved localized inflammatory responses in two patients and severe headache and other symptoms in another patient treated with the high dose AMT-130.

One patient of the 14 treated at the higher dose, developed motor and behavioral symptoms in the 12 day window after the procedure. After steroid administration the patient recovered but subtle deficits in verbal fluency, memory and attention relative to his preoperative state persisted.

A second patient experienced vomiting and raised intracranial pressure in the acute post-operative timeframe (12 days) and experienced relief after a lumbar puncture to remove 20 cc of cerebral spinal fluid was performed. The symptoms fully resolved.

A third patient experienced severe headache and vomiting symptoms soon after high dose AMT-130 administration. A blood patch, which is a procedure by which blood is injected into the spinal canal to patch a hole and prevent cerebrospinal fluid leaking was performed. Imaging revealed edema in the striatum and the infusion tracts, which largely resolved by the patient’s 30-day follow-up visit.

If AMT-130 demonstrates the ability to slow decline, the risk benefit analysis may still be favorable given the certain outcome if patients remain untreated. The most recent setback resulted in the pausing of dosing of only the higher dose of uniQure’s AMT-130 trial while the company and the IDSMC review these adverse events. An extensive review which will include CMC as well as a review of the administration and monitoring protocols will be conducted. Results should be available by Q422.

Data in 2023 will likely be “make it or break it” for AMT-130

By mid 2023, uniQure will release further data on the first cohort treated with AMT-130. There will be data provided for 16 patients who received the high dose. This cohort includes 10 patients who were treated and 6 control patients with one year follow up. There will also be data on ten patients who received the low-dose and 4 control patients with two years of follow-up.

This data readout will include functional and cognitive testing which can be compared to placebo patients and natural history data. This will be the first data on whether there is an efficacy signal. Importantly, volumetric MRIs will be conducted to assess brain atrophy. Imaging studies conducted in pre symptomatic and early stage HD patients have shown that quantitative measures of the striatum are accurate biomarkers measuring disease progression.

Finances

uniQure has $500.5 million in cash which they believe will be sufficient through 2025. Milestone payments may add an additional $175m further extending the company’s runway. Royalties will also be due. uniQure may never need to raise funds in the capital markets again given the revenue stream from the CSL licensing deal.

Conclusion

Given the Roche results, AMT-130 remains a high risk program. While AMT-130 may not pan out, uniQure will likely have a revenue stream and two early stage programs to redirect their scientific expertise to. Both programs- Fabry disease and refractory temporal lobe epilepsy (rTLE), represent significant opportunities where there is a high unmet need.

Should AMT-130 show efficacy, it would be an incredible breakthrough for the HD community and patient will likely be very grateful to finally have a potential disease modifying treatment. For investors, Raymond James analyst Danielle Brill quantified the market opportunity. She estimates there is a $7B market for HD medicines. Given this, investors would likely be extremely well rewarded if the data for AMT-130 shows proof of concept.

Should AMT-130 fail to demonstrate proof of concept, the company reverts to an early stage company with two INDs in programs where there is substantial unmet need. uniQure is likely to be able to fund these programs with cash on hand and the revenue stream from royalties and milestone payments from CSL. While suboptimal, and shares may fall, a failure of AMT-130 will not likely result in an existential business threat for uniQure.

Be the first to comment