LeventKonuk/iStock via Getty Images

Thesis

British American Tobacco (NYSE:BTI) stock has been moving within a consolidation range since its COVID bottom, as the market has de-rated after its pre-COVID surge to its 2018 highs. BAT has struggled to recover its revenue growth cadence as it tackles the secular decline in cigarette growth while penetrating reduced risk and oral products.

Therefore, we assessed that the market remains tentative over its execution, which is likely to keep BTI within its current consolidation zone. Notwithstanding, the company has demonstrated tremendous pricing leadership in H1’22, as it continued to gain market share in its reduced-risk products.

BTI has underperformed the market significantly on a total return basis over the past five to ten years. Notwithstanding, it has outperformed the market in 2022, spurred by the recovery in its recovery cadence and robust dividend yields.

Our valuation analysis indicates that BTI remains reasonable at the current levels, given the potential for further improvement in its earnings growth. Furthermore, we gleaned that BTI has fallen back to a critical support zone that should proffer robust buying support to help sustain its recovery.

Therefore, we revise our rating on BTI from Hold to Buy.

British American Tobacco Demonstrated Its Pricing Leadership

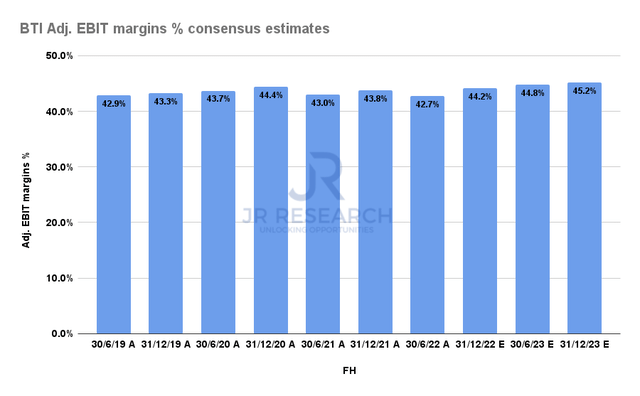

BAT Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Despite the worsening macro headwinds globally, BAT’s adjusted EBIT margins remained robust through H1’22, indicating the company has tremendous pricing power. Also, the company highlighted that it raised prices in its e-cigarette segment, given the success of its market share gains. Management highlighted in a recent September conference:

The strategy was very simple. We need consumer trial. We were up [against] a very dominant player at that time. So, we discount[ed] on device. We always knew that the offer that we had was very competitive and more compelling than the current leader. And so, this has translated into our ability to attract more and more consumers. And as we go along, we have reduced the level of discount on device and we have increased the price on the consumables. (Barclays 2022 Consumer Staples Conference)

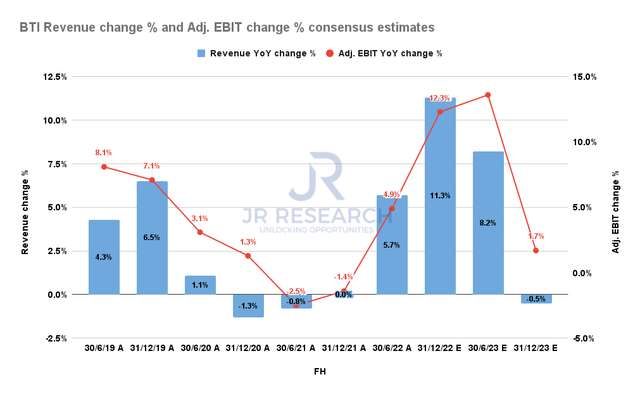

BAT Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

Accordingly, the consensus estimates (very bullish) indicate that BAT’s recovery cadence in its revenue and adjusted EBIT growth should accelerate through H2’22. The company also telegraphed its confidence in meeting its FY22 guidance at its H1 earnings call.

Notwithstanding, management cautioned that BAT is not immune to the macro headwinds. However, the company observed a broad-based recovery in H1 across its geographic segments, with the US (up 6.7% YoY) and Europe (up 4% YoY) posting solid growth.

Therefore, we believe these estimates are credible. However, we suggest investors remain cautious about chasing rapid surges in BTI, as macro headwinds could worsen, impacting its optimistic guidance.

Is BTI Stock A Buy, Sell, Or Hold?

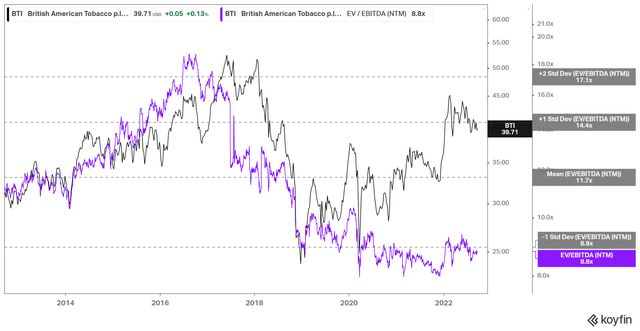

BTI NTM EBITDA multiples valuation trend (koyfin)

We gleaned that BTI has been de-rated significantly from the frothy levels seen in its highs in 2016-18. However, the market has remained tentative about re-rating BTI, despite its massive collapse from its pre-COVID highs. Given substantial execution risks, we postulate that the market is still assessing the company’s long-term strategy in transitioning away from its regular tobacco products.

Therefore, we deduce that the de-risking in BTI’s valuation is justified. Notwithstanding, BTI’s NTM EBITDA multiples last traded close to the one standard deviation zone below its 10Y mean. Hence, we postulate that its reward-to-risk profile seems reasonable.

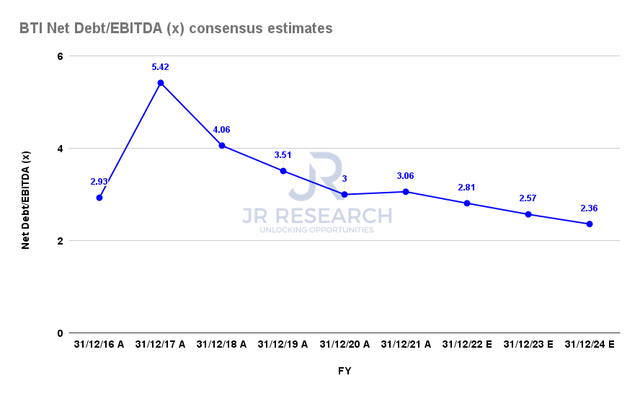

BAT Net debt/EBITDA consensus estimates (S&P Cap IQ)

Furthermore, BTI’s NTM dividend yield of 6.94% should continue to offer robust valuation support at the current levels. Moreover, the company has a £2B buyback program to support its valuation further. Investors should note that the company is expected to continue deleveraging, which should also undergird BTI’s valuation.

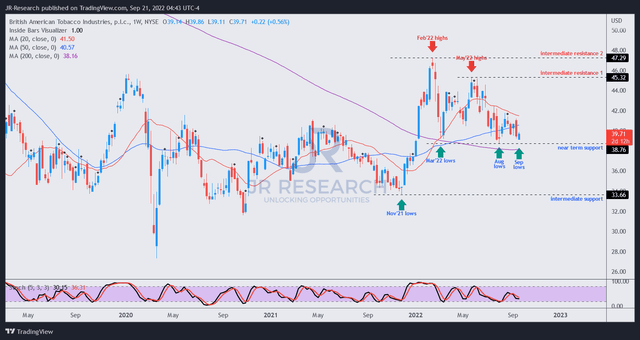

BTI price chart (weekly) (TradingView)

Furthermore, we observed that BTI appears to find robust support at its near-term support ($38.5) since March 2022. Therefore, if BTI can continue to sustain its consolidation zone, it augurs well for the stock to regain its medium-term bullish bias moving ahead.

Coupled with a battered valuation and several valuation support drivers discussed earlier, we are satisfied that the reward-to-risk profile at the current levels seems reasonable.

As such, we revise our rating on BTI from Hold to Buy.

Be the first to comment