MarsBars

It’s been a rather tumultuous year for some REITs such as Omega Healthcare Investors (OHI) due to concerns around some of its skilled nursing tenants’ ability to pay rent. While its current price appears to be attractive compared to historical valuations, there are plenty of uncertainties that remain.

As such, I find CareTrust REIT (NYSE:CTRE) to be far more enticing for investors who seek less drama and an overall healthier tenant base. CTRE’s stock price has fallen by a meaningful amount in recent weeks, and in this article, I highlight what makes it now an attractive income stock, so let’s get started.

Why CTRE?

CareTrust is a net lease REIT that specializes in the ownership, acquisition, and development of skilled nursing facilities, representing 75.5% of its annual base rent. In addition, CTRE also has exposure to multi-service campus and seniors housing which represent 20.7% and 5.1% of its ABR, respectively.

It was originally spun off in 2014 from the Ensign Group (ENSG), a skilled nursing operator. Since then, CTRE has greatly diversified its operator base. It currently owns 198 properties spread across 18 operators in 21 states. These properties support 21,537 beds and carry a fair market value of $1.75 billion.

CTRE has been rather strategic in shedding underperforming properties, as it’s disposed of 26 properties since the start of the year. It’s also strategically shifted away from seniors housing, which come with risks due to labor shortages coupled with a private pay (i.e. non-government supported) model. This is reflected by the fact that seniors housing made up 13% of CTRE’s portfolio ABR at the end of last year, as opposed to just 5% today.

However, CTRE isn’t entire immune to challenges in the senior care segment, as it received 93.9% of rents during the second quarter, and normalized FAD (funds available for distribution) declined by 1.7% YoY. Nonetheless, CTRE’s dividend remains well protected, at a payout ratio of 71% of normalized FAD.

Moreover, management is proactively working to de-risk the portfolio through asset sales and re-tenanting. In addition, CTRE is in a strong position to acquire quality assets compared to highly leverage private buyers who are now priced out because of higher interest rates. This is reflected by CTRE’s strong balance sheet with a net debt to EBITDA ratio of just 4.3x and a net debt to enterprise value of 30%. Management noted on these actions and strengths during the recent conference call:

Since we announced plans in February to derisk the portfolio, the world has changed quite a bit for us and for our operators. Surge in inflation, rising rates and daily talk of a recession have an impact. But for us in skilled nursing operators, it’s not all headwinds. For our disposition work, yes, the motivation and ability of some buyers in the market has softened, particularly those dependent on lenders. That’s okay. We adapt and run parallel paths of selling and re-tenanting and ultimately, will end up with a substantially derisk portfolio. We’re on track to close on most of that work in Q4.

For our investment activity, as rates continue to rise and lenders become more cautious, we would expect a couple of things to tip in our favor when it comes to growth. First, pricing should moderate and second, sellers should prefer the certainty buyers like ourselves at present.

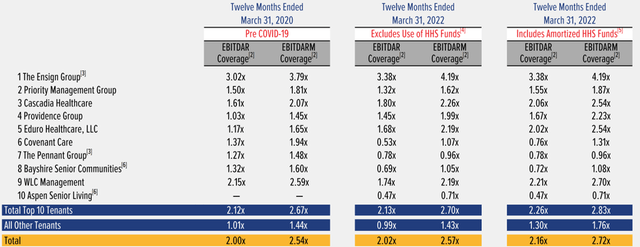

Furthermore, CTRE enjoys an overall healthy tenant base. As shown below, tenant rent coverage metrics are very close to that of pre-COVID times even when excluding use of HHS funds, and are even stronger when HHS funds are included.

(Note: tenant rent coverage is reported 3 months in arrears)

CTRE Tenant Rent Coverage (Investor Presentation)

Lastly, I see value in CTRE, especially after the recent drop, at the current price of $20.13 with a forward P/FFO of 13.4 and a 5.5% dividend yield. Analysts expect FFO per share growth to pick up starting next year, with 5% and 9% annual growth over the next two years, and have a consensus Buy rating with an average price target of $22.25. This translates to a potential one-year 16% total return including dividends.

Investor Takeaway

While there’s no doubt that CTRE has been adversely affected by COVID-19, management has taken quick and decisive actions to mitigate the impact. Moreover, CTRE is in a strong position to take advantage of opportunities that may arise from the current market conditions. Overall, I believe CTRE is a good long-term investment at the current price, especially after the recent drop.

Be the first to comment