Vladimir Zakharov

As the name suggests, the Voya Emerging Markets High Dividend Equity Fund (NYSE:IHD) is a close-end fund (“CEF”) that seeks to meet the requirements of income-chasing investors looking for exposure to emerging markets (“EM”). Using in-house quantitative models, the fund manager of IHD looks for EM stocks across various geographies that exhibit above-average dividend yields with stability. To supplement the income profile of the fund, IHD also resorts to some level of call writing of these securities, so long as the underlying value of such calls represents anything between 15%-50% of the total value of the portfolio.

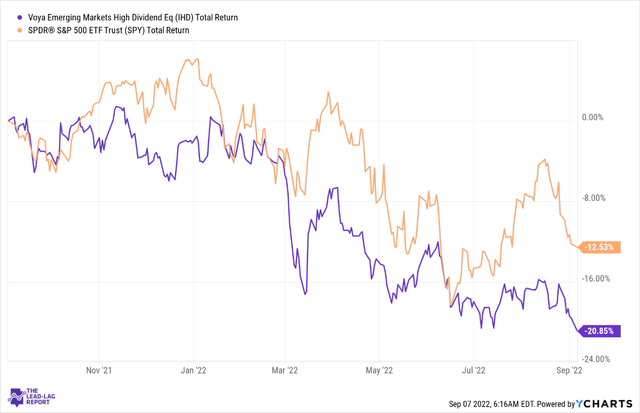

Unsurprisingly, like most EM-themed products, IHD has faced a challenging twelve months (-21%) and has not proven to be a useful source of alpha for those looking for some diversification away from domestic stocks (-12%). However, as I’ve repeatedly noted in The Lead-Lag Report, the concept of mean reversion is something that has stood the test of time, and IHD may well look to make up for lost time.

I’m fairly neutral about this product’s prospects, but I’ll pick out a couple of notable themes that interested investors should be aware of.

Notable themes

As pointed out in the Leaders/Laggards section of my paywalled research, there hasn’t been a great deal of uniformity in EM returns with different packs picking up the baton at different points in time. Currently, whatever little momentum we can see is being driven by the Latam pack. Sadly, China still continues to remain subdued and this would be a concern for holders of IHD as the portfolio is heavily dominated by Chinese stocks.

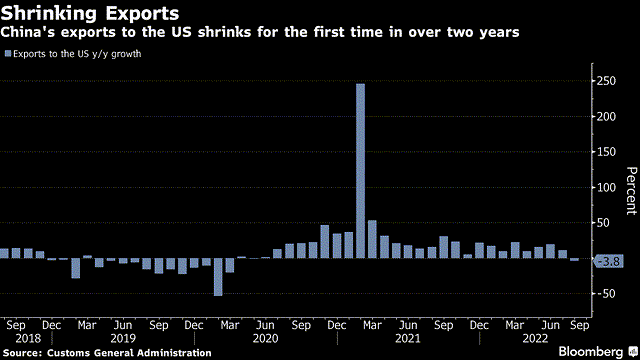

Much has been written about the real estate crisis and the associated impact on Chinese banks which are seeing their asset book rapidly deteriorate (bad loans which were 2.6% at the end of last year will more than double by the end of this year) but also consider the pronounced effects of a global slowdown on China’s trade position, something that has generally stayed resilient for long periods of time. Factory activity contracted recently, coming in below street estimates of 50.2 at 49.5, even as the pace of export growth (particularly volumes) continues to decline.

Longer term as well, owners of this close-ended fund should also note that China will not quite be able to live up to its high growth track record. In fact Oxford Economics believes that the economy will likely only deliver average economic growth of 4.5% for the rest of the decade. That figure is something you would associate with a developed market rather than an emerging market.

The other important factor to consider is what happens with the currency. As noted in the “Leaders/Laggers” section of this week’s report, there has been a massive migration of forex traders into the dollar, sending it not just higher, but sharply higher. It’s worth noting that over the past 50 years, the dollar index has only traded around the 110 level twice; in the 1980s and the 2000s, and both those periods were marked by economic crises.

Whilst some of the dollar’s recent strength is a function of the safe haven allure of the U.S. dollar, much of it is being driven by the inflation narrative and the Fed’s ongoing desire to tighten the belt aggressively.

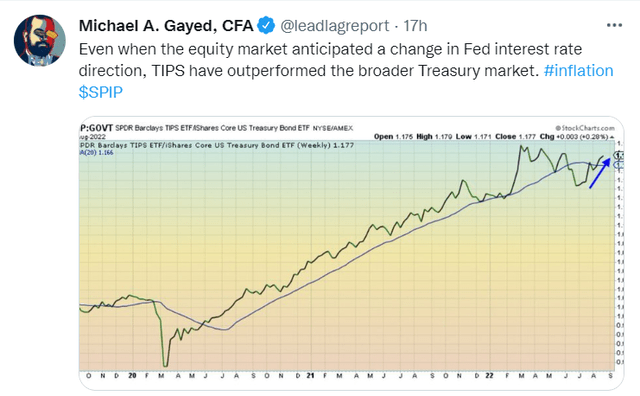

Whilst the equity markets have been quick to pre-empt inflation peaks and thus get burnt in the process, the trajectory of TIPS continues to signal that we’re unlikely to see a shift in the status quo.

Worryingly in my chat with Vincent Deluard on Lead-Lag Live, we also explored the possibility of growing recessionary conditions doing little to dampen the inflationary effect.

We’ve seen in recent weeks that Powell has decided to nail his colors to the inflation mast rather than recession so expect rate hikes to persist for the foreseeable future (potentially even front-loaded). You can only imagine how tasty this will make the dollar look but conversely, this is likely to be a disaster for emerging market stocks who I believe are most susceptible to a potential global debt crisis. Subscribers of The Lead-Lag Report would note that a few weeks back, I wrote a macro piece highlighting how much external debt these EMs have amassed and if the dollar continues to trend up, I worry about their debt servicing abilities.

Separately also note that Yuan is on the cusp of breaching the $7 mark vs the dollar and this is primarily being driven by a potentially slower trade surplus; recently one saw exports to the U.S. slump for the first time in 2 years.

Conclusion

At only 8x P/E, IHD’s valuations will no doubt make the bargain hunters look up, but I would urge still some caution for those looking to take a punt on this product.

As noted in The Lead-Lag Report, my proprietorial inter-market signals have done well this year to flag risk-on and risk-off conditions. Currently, two out of the three signals point to heightened volatility ahead.

Last week, we saw market volatility spike to its highest level since the first half of July and I’d like to think that this could stay elevated given what the signals are telling me. This means it would pay to go defensive and go easy on the high-beta EM products such as IHD. Some of my Twitter followers have wondered about the number of times these signals have pointed to false positives, but even if they haven’t always been right, they do a good job of triggering those seat belts before a potential catastrophe. I’d like to think there’s some merit in that.

Anticipate Crashes, Corrections, & Bear Markets

Anticipate Crashes, Corrections, & Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment