Leon Neal/Getty Images News

Moderna’s (NASDAQ:MRNA) stock price dropped by 28% during the past month. Despite increased revenues, the company’s net income decreased by 21% YoY in the second quarter of 2022. Due to lower demand for its COVID-19 vaccine, I expect the company’s 3Q 2022 revenues to be lower than in 3Q 2021 and 2Q 2022. However, as a result of the timing of authorizations, the company’s COVID-19 vaccine sales may bounce back in the fourth quarter of the year. Moreover, the company has four infectious disease vaccines in Phase 3 trials and has increased its R&D expenses significantly in the second quarter of 2022. Thus, the future of the company is bright. However, in the short term, the stock is a hold.

Moderna’s 2Q 2022 highlights

In its 2Q 2022 financial results, Moderna reported revenues of $4.7 billion, compared with 2Q 2021 revenues of $4.4 billion, up 7% (due to increased COVID-19 vaccine sales as a result of the higher average selling price). The company’s total operating expenses increased from $1.3 billion in 2Q 2021 to $2.3 billion in 2Q 2022. Moderna’s research and development expenses increased from $421 million in 2Q 2021 to $710 million in 2Q 2022 due to higher clinical trial expenses, personnel-related costs, and consulting. Moderna reported a 2Q 2022 net income of $2.2 billion, or $5.24 per diluted share, compared with a 2Q 2021 net income of $2.8 billion, or $6.46 per diluted share. Moderna reiterated advance purchase agreements for expected delivery of about $21 billion in 2022. Moreover, the company announced it has a $3 billion share repurchase plan. “Despite the slowing economy and challenges in the biotech industry, Moderna is in a unique position: a platform to drive scale and speed in research of new medicines, a strong balance sheet with $18 billion of cash, and an agile, mission-driven team of over 3400 people and growing,” the CEO commented.

The market outlook

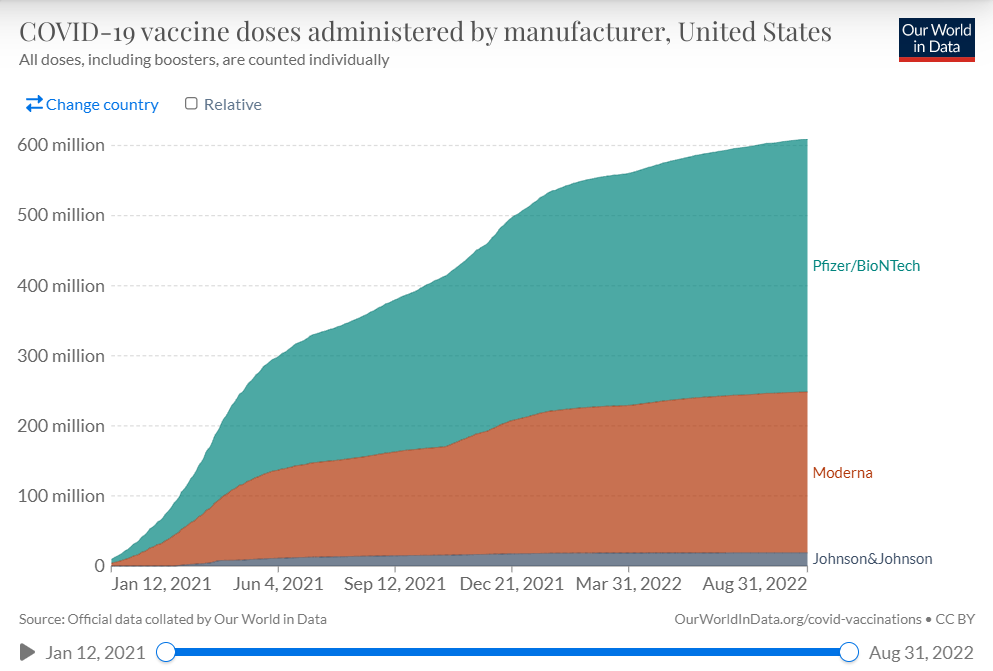

The demand outlook for Moderna’s COVID-19 vaccine is not as strong as before. 68% of the world population has received at least one dose of the COVID-19 vaccine. Only 21% of people in low-income countries have received at least one dose of the COVID-19 vaccine. However, as a result of the COVAX program, the demand for MRNA vaccines from low and middle-income countries has declined. Figure 1 shows that in the first two months of 1Q 2022, 14.67 million MRNA COVID-19 vaccine doses were administered in the United States. In the first two months of 2Q 2022, 6.05 million MRNA COVID-19 vaccine doses were administered in the United States. Finally, in the first two months of 3Q 2022, 4.82 million MRNA COVID-19 vaccine doses were administered in the United States. In the European Union, the number of COVID-19 vaccine doses administered increased just by 0.7% from 151.32 million on 30 June 2022 to 152.41 million on 30 August 2022. Thus, I do not expect the company’s COVID-19 vaccine sales to drop in the third quarter of 2022.

On the other hand, recently, Health Canada has authorized the use of Moderna’s Omicron-targeting bivalent COVID-19 booster vaccine in individuals 18 years of age and older. Moreover, Moderna has received authorization from the U.S. Food and Drug Administration (FDA) for emergency use of the Omicron-targeting bivalent COVID-19 booster vaccine for adults over 18 years. Thus, due to the timing of authorizations and regulatory approvals of its updated COVID-19 vaccines, Moderna expects its 4Q 2022 sales to be higher than in 3Q 2022.

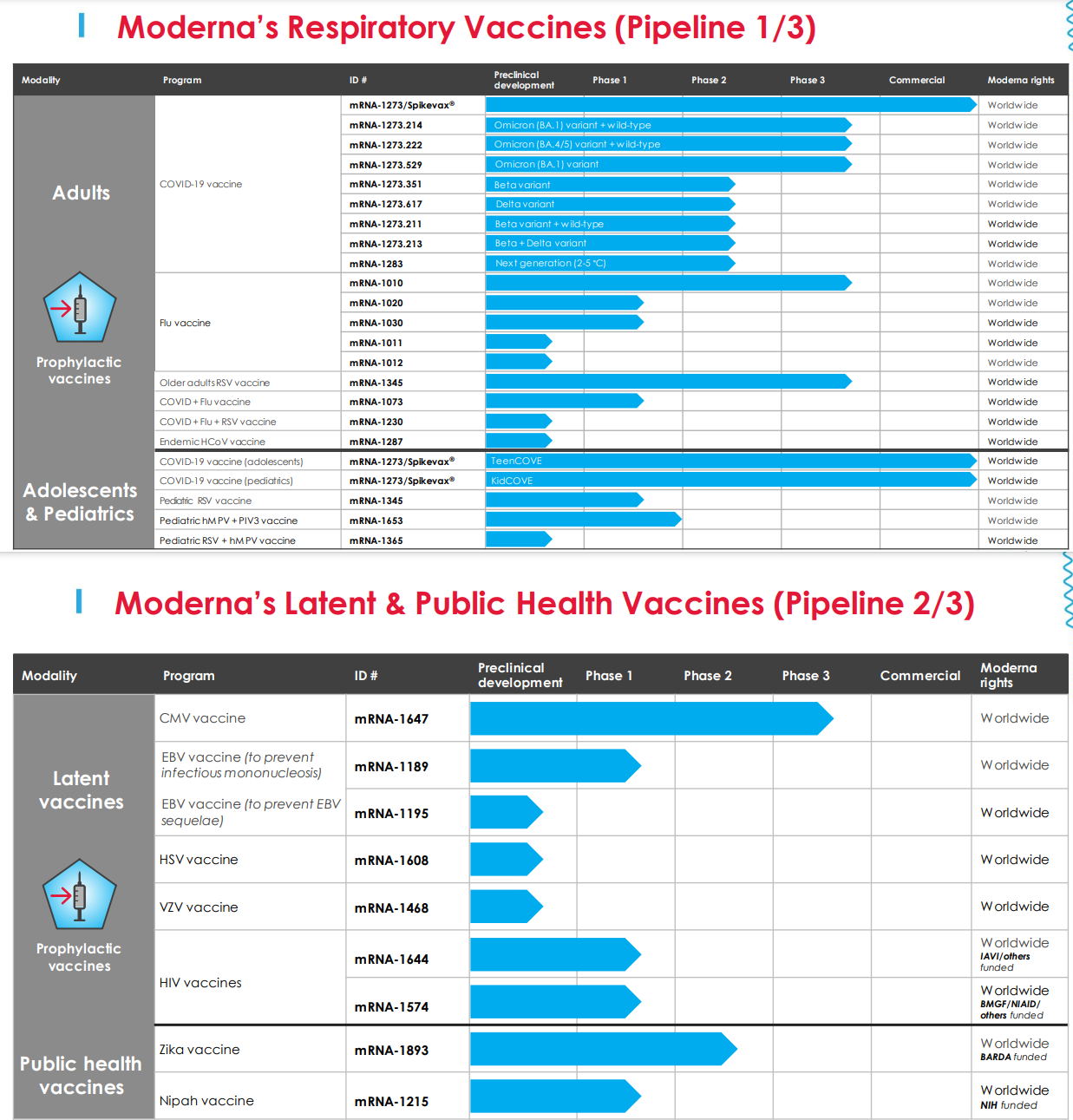

Moderna has four infectious disease vaccines in Phase 3 trials and expects important data from proof-of-concept studies in rare diseases and immune oncology. “We will continue to invest and grow as we have never been as optimistic about Moderna’s future,” the CEO said.

Figure 1 – COVID-19 vaccine doses administered in United States by manufacturer

ourworldindata.org

Figure 2 – Moderna has four infectious disease vaccines in Phase 3 trials

2Q 2022 presentation

Performance outlook

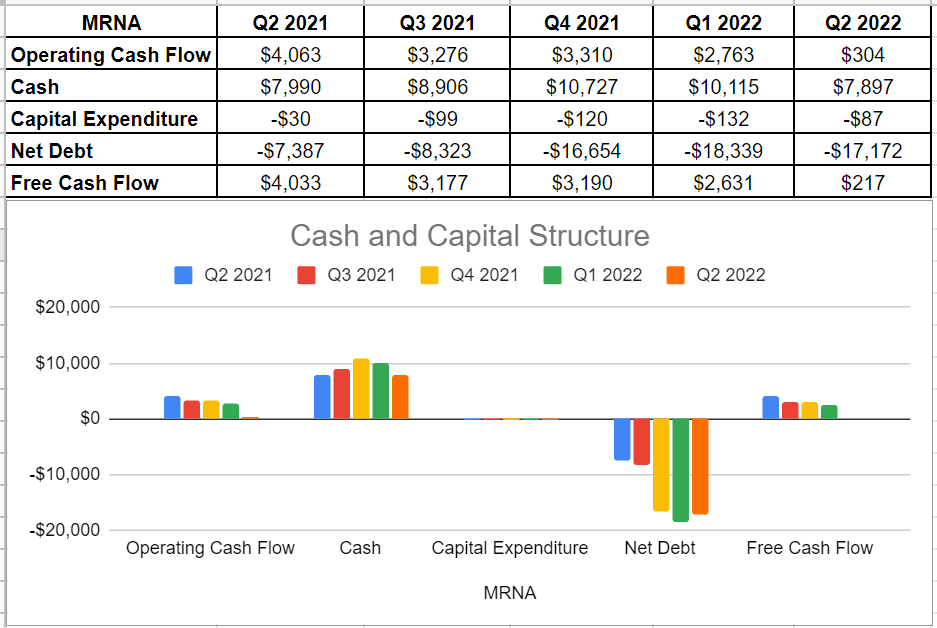

Updating and analyzing Moderna’s cash and capital structure in the recent quarter and comparing it with the previous ones indicate that MRNA’s operating cash flow dropped to $304 million in Q2 2022 from its amount of $4,063 million in the second quarter of 2021. This plunge in the cash from operations led to a decline in free cash flow generation, decreasing from $2,631 million in the last quarter to $217 million in Q2 2022. Albeit its cash balance declined to $7,897 million in Q2 2022 from $10,115 million in the previous quarter, its cash and equivalents amount is almost the same as its level of $7,990 million during the second quarter of 2021. On the other hand, MRNA’s negative net debt amount could bring a scope for more debt financing in the future (see Figure 3).

Figure 3 – MRNA cash and capital structure (in millions)

Author (based on SA data)

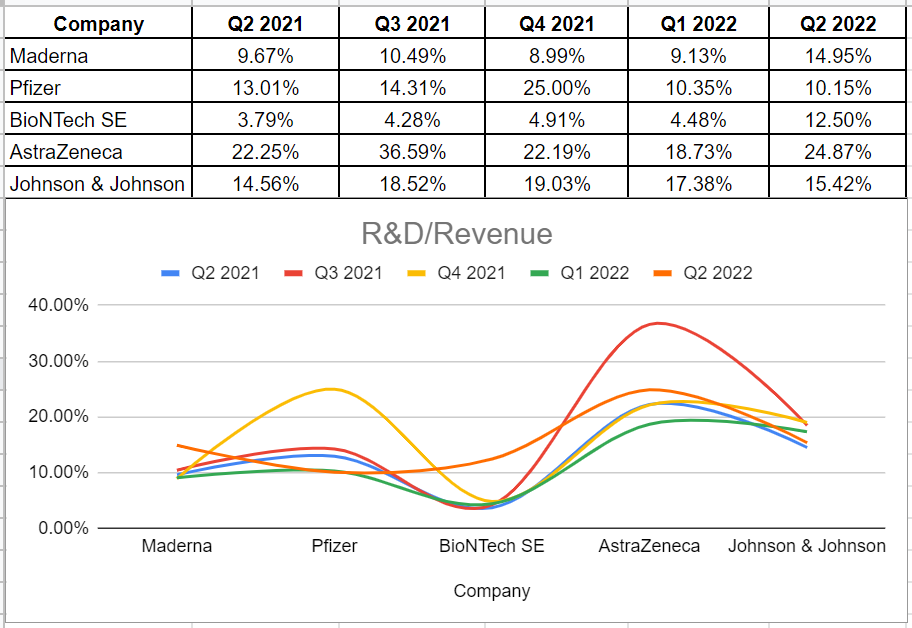

Analyzing Moderna’s R&D to revenue ratio through the preceding year and comparing it with some of its peers, we observe that after BioNTech (BNTX) and Pfizer (PFE), MRNA has the lowest amount, 14.95%. This ratio measures the amount of revenue that is related to research and development expenditures. The trends of R&D spending versus revenue could not easily be interpreted as good or bad. To shed some more light, based on the company’s pipeline, apart from COVID-19 vaccines, Moderna has three drugs in phase 3: the seasonal flu vaccine, the RSV vaccine, and the CMV vaccine. Although the company may gain a great amount of profit if prosper in launching these drugs, this may happen 3-4 years later. Thus, they may have to expend more R&D expenses and earn less revenue growth in the future. (see Figure 4).

Figure 4 – MRNA’s R&D/Revenue ratio vs. its peers

Author (based on SA data)

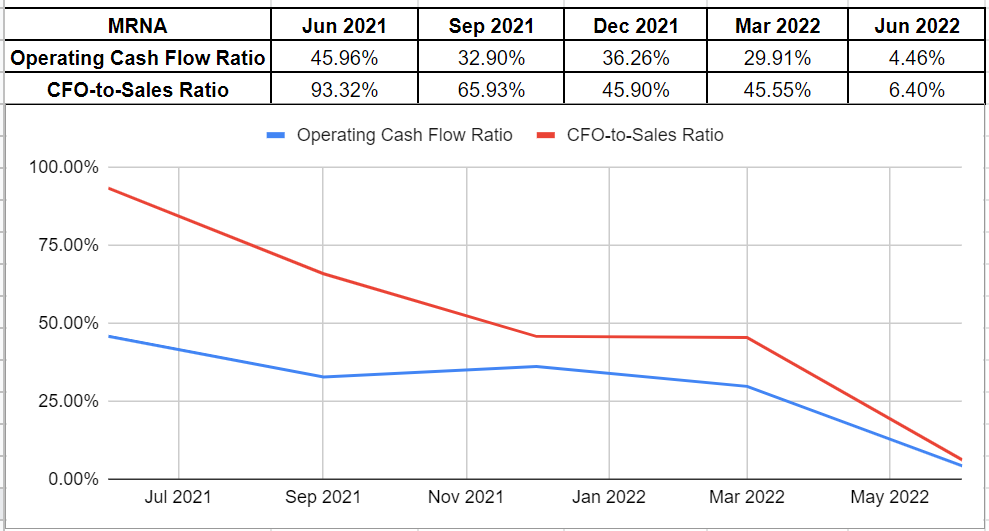

To analyze the company’s liquidity and performance conditions, I investigated MRNA’s operating cash flow and CFO-to-sales ratios. MRNA’s operating cash flow declined gradually during the recent quarters, while it dropped deeply by 2545 bps to 4.46% in Q2 2022 compared with the first quarter of 2021, which was 29.91%. This ratio indicates how well the company is able to pay off its current liabilities with the cash flow generated from its business operations. Thus, at the end of the second quarter, Moderna could cover its current liabilities 4.46x over. Furthermore, MRNA’s CFO-to-sales ratio declined by 3915 bps to 6.4% compared with its 45.5% in the last quarter (see Figure 5).

Figure 5 – MRNA’s ratios

Author (based on SA data)

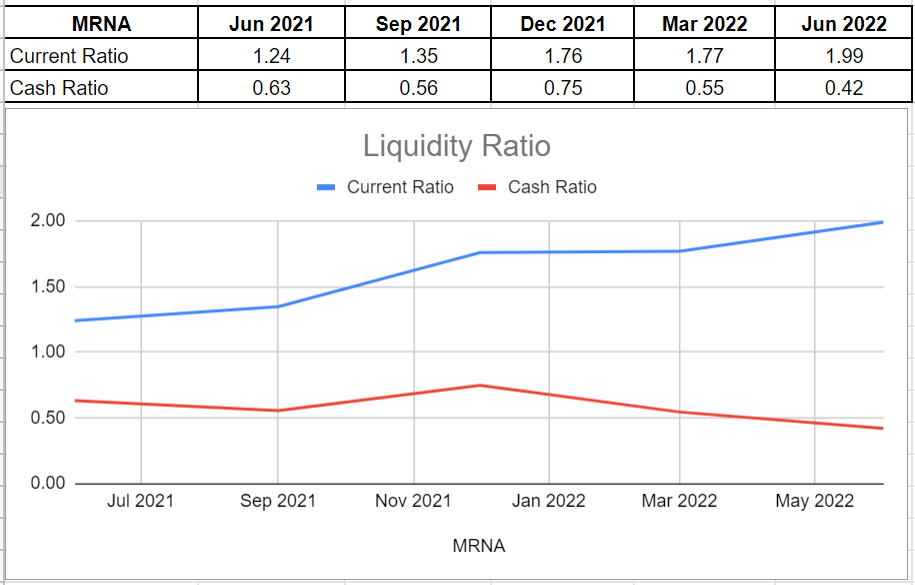

A decline in the company’s current liabilities is reflected in a quiet improvement in its current ratio. Moderna’s current ratio in Q2 2022 sat at 1.99x compared with its amount of 1.77x at the end of last quarter. Its current ratio has increased by 60% versus the same quarter in 2021. On the other hand, since 2022, their cash amounts declined faster than their current liabilities, so the MRNA’s cash ratio embarked decreasing and sat at 0.42x in Q2 2022 compared to 0.75x at the end of 2021, down 44% (see Figure 6).

Figure 6 – MRNA’s liquidity ratios

Author (based on SA data)

In short, Moderna presented a variety of different results regarding its financial condition in the second quarter of 2022. Some of the financial metrics and their cash and capital structures were not as strong as before, while their recent agreements and contracts like the US army contract to supply boosters and their current drugs pipeline provide a good prospect for the company. However, based on the recent financial condition, I believe that the stock is a Hold.

Summary

According to SA ratings, Moderna stock has a low price target of $74 and a high price target of $506. We can see that the difference between the price targets of bullish and bearish analysts is a lot. I see a bright future for Moderna as it has increased its research and development expenses to produce more vaccines. It is worth noting that the company already has four vaccines in Phase 3 trials. However, as most of the company’s revenues come from COVID-19 vaccine sales and the demand outlook for its COVID-19 vaccines is not as strong as before, in the short term, the stock is a hold.

Be the first to comment