Imgorthand/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Schwab U.S. Aggregate Bond ETF (NYSEARCA:SCHZ) as an investment option at its current market price. This is an ETF with a primary objective “to track the total return of an index that measures the performance of the broad U.S. investment-grade bond market”.

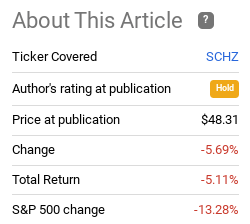

This is a fund I have been suggesting readers stay away from for a while simply because I saw little opportunity for upside. This sentiment was echoed in my review in June, and the performance since then has certainly vindicated that stance. The market as a whole has taken a beating, and SCHZ has also registered a drop in the interim:

Fund Performance (Seeking Alpha)

As the income stream keeps on rising from this ETF (among most passive bond funds), I am constantly evaluating when the moment to declare this a “buy” will emerge again. Unfortunately, I see many of the same issues lingering that make me hesitant to recommend positions here. Further, the continuation of bonds starting to trade in a more volatile and correlated fashion with stocks should have investors re-examining if this is the right exposure for their portfolio. Therefore, I am maintaining caution, and will explain why below.

Losses Keep Piling Up, Inflation Not Stopping

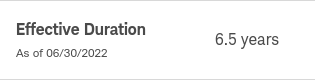

The first topic to touch on is the paramount root cause for SCHZ’s decline in 2022, which is inflation. This has been an issue all year, and has prompted the Federal Reserve to take a more aggressive stance in the second half of the year than many market participants expected (or at least hoped for). The problem is that SCHZ remains very interest rate sensitive. The duration of the fund (a measure of interest rate sensitivity) has fortunately gone down slightly since my June review. At that time it was 6.7 years now. But the drop was most, as SCHZ still has an effective duration above 6 years:

Duration (Charles Schwab)

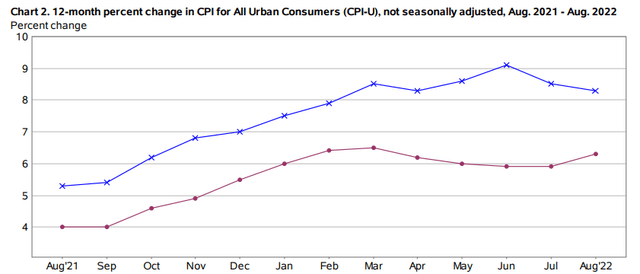

I won’t go into a lot of detail on this here, despite its importance, given how I discussed this more deeply in recent reviews. But it should suffice to say that as long as inflation remains high, the Fed will keep hiking, and this fund will remain under pressure. By this point in the year the market had expected inflation to at least start to cool, and while that trend may be emerging, it is “cooling” at an elevated level that is probably not sustainable long-term:

CPI Figure (U.S. Bureau of Labor Statistics)

The conclusion I draw is that as long as inflation remains in this trend of higher for long, bonds are a tough asset class to justify. This has been the case for most of 2022, and I don’t see that backdrop changing now.

The AGG Index Has Gotten More Volatile

I will now shift to a couple of relative concerns I have. What I mean by that is, bonds may be starting to look enticing purely from an income perspective. But I am concerned with the relative value I am getting from funds like SCHZ compared to other income ideas (i.e. dividend paying stocks, junk bonds, foreign assets, etc.).

What I am getting at is many investors are probably getting interested in bonds again now that prices have fallen so substantially. That has certainly been the case for me as well. Yields are up, stocks continue to come under pressure, and the Fed is bound to stop hiking rates at some point. This begs the question – why not buy now?

The answer for me goes beyond just continued interest rate risk. When I buy bonds I want reasonable stability too. The income stream may be going up, but in an inflationary environment a yield in the 3-5% range doesn’t cut it. But we can justify this return if bond prices are stable and therefore provide a bit of a hedge against other market forces. The problem here is this hasn’t been the case. The aggregate bond index, which SCHZ tracks, has been much more volatile this year than it has throughout history:

The takeaway for me is that bonds have not provided any protection from volatility, similar to other assets like stocks, foreign currencies, crypto, you name it. This doesn’t mean bonds are necessarily “worse” than any of those options, but they don’t appear to be better either.

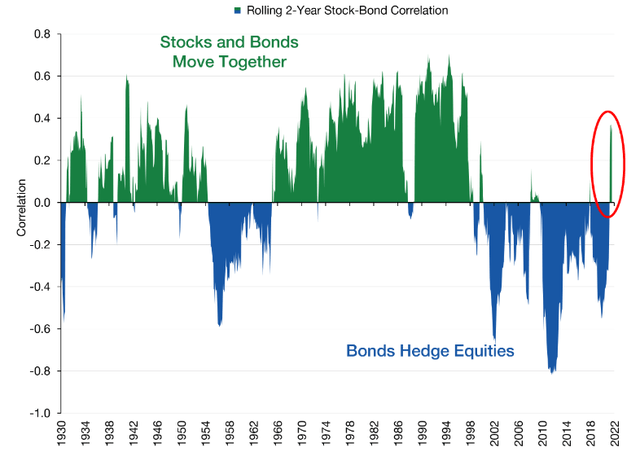

Correlation With Stocks Is Up

Expanding on the discussion above, I want to emphasize that my personal rationale for owning bonds at all is for income and stability. The yields offered in my investing lifetime (I am 36 years old) have generally not been enough to really entice me compared to other asset classes. But I have owned them over time because they tend to be more stable and also they tend to have a negative correlation with my primary holding base – U.S. stocks. The breakdown in both stability and correlation is why I have been questioning the merit to funds like SCHZ, and why I have suggested avoiding it over the past year.

To be clear, this is my personal outlook. Other readers may have different reasons for owning bonds. That is perfectly fine – we all have to do what is right for us. But I see higher, long-term returns for other asset classes so if bonds are not giving me the hedge or stability I want, I don’t see the use.

Case in point, throughout 2022 the correlation between stocks and bonds has been consistently positive. This makes sense because as stocks have been declining, so have funds like SCHZ (as the fund performance section in the opening paragraph showed). This is an unfavorable reaction to a rising interest rate environment, and is a stark divergence from what we have seen in the past:

Correlation (Stocks and Bonds) (Morningstar)

What I am getting at is that I own bonds because I want them to rise when equity markets are falling. That has been the case throughout most of this century and my investing career. Yet, right now that relationship has broken down. Investors are not getting much of a hedge from buying funds like SCHZ compared to equities. This doesn’t mean equities are a great buy here either, but it does make me question if I really need this ETF in my portfolio right now.

If You Expect The Fed To Pivot, Buying Makes Sense

My last topic wants to balance out this review a bit. I personally think SCHZ continues to be an avoid, but there is merit to owning if one has a slightly different outlook. For example, the Fed has been quite aggressive in its stance so far and markets have been paying the price. While this is “bad” in the interim, it could wind up being good if we see a return to normalcy. What I mean is, if inflation begins to cool as borrowing costs surge and the economy slows, then the Fed is going to moderate its rate hiking plans. This will almost certainly prove to be a boon to fixed-income, including SCHZ. The market is anticipating the Fed rate hiking cycle to continue into 2023 and if that winds up not being the case, bond prices should recover from having priced that in.

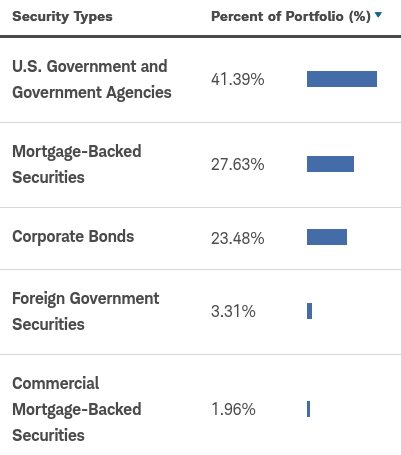

If that is indeed the case, SCHZ’s current yield nearing 4% will suddenly look a lot more attractive. Further, I expect this yield to see that 4% level soon as the underlying sectors of the fund continue to offer higher income streams. The Fed moving its benchmark rate higher has pushed up Treasury yields, and that happens to be the largest sector within the fund:

SCHZ’s Sector Breakdown (Charles Schwab)

Beyond just Treasuries, as SCHZ adds to its second largest sector by weighting, MBS, distributions should get a boost as well. Mortgage rates are heavily influenced by the Fed’s target rate and have risen dramatically in the past few months as expected:

U.S. Mortgage Rates (30-year fixed) (Yahoo Finance)

My thought here is as SCHZ buys up higher yielding assets, its income stream continues to get more attractive, all other things being equal. If the Fed sees its objective of lower inflation being met, it will take the foot off the gas, and yields from MBS in the 6% range are going to look a lot more enticing. For investors who have this outlook, there is a case to be made to front-run this eventuality and begin buying SCHZ now.

Bottom line

SCHZ continues to struggle and I can’t come up with a strong argument for diving in at these levels. The fund is not offering a hedge against equities, which would be a more preferred reason for owning it. While the income has risen, it isn’t high enough to guarantee a positive return if bond prices keep falling at the rate they have been. Ultimately, I must suggest continued caution with this product and maintain my “hold” rating at this time.

Be the first to comment