Kameleon007

The Federal Reserve adopted a remarkably hawkish policy in 2022. The rapid ascent of interest rates has generated some investment opportunities in the fixed income space. Moreover, the treasury yield curve is more inverted now than at any time in the past 41 years. Last week, the yield on the 10 year treasury fell 0.78% below the two year yield.

Investor interest now centers on the short end of the yield curve. My last article on the topic pointed out the newly attractive risk and return profile of short term corporate bonds. This category of bonds typically has an average duration of 2 to 3 years. For those averse to credit and duration risk, there is yet another option. Floating rate Treasury notes now offer an expected return that exceeds inflation expectations with very low demonstrated volatility.

Background of Floating Rate Treasurys

Floating rates notes (FRN) are a recent innovation of the US Treasury. First issued in January 2014, they have coupons that periodically reset using 3-month Treasury bill rates. Like U.S. government bonds, these securities are backed by the full faith and credit of the U.S. government. Treasury FRNs are issued with a two year maturity on a quarterly basis. The math is simple. At any time, there are about 8 different notes outstanding.

Treasury FRNs pay interest based on the highest accepted discount rate of the most recent 90 day T-bill auction, which occurs each Monday. The treasury adds or subtracts a fixed spread to the prevailing rate on the T-bill for the life of each FRN. This spread is based on demand and the latest reading was +0.14%.

In short, the rate of interest accrual resets every week thereby eliminating almost all duration risk. The accrued interest from the resets is paid out quarterly.

Recent History

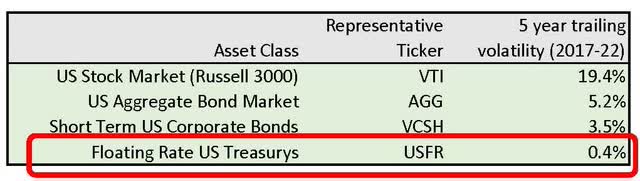

Low duration risk is not just a theoretical conjecture. The historical volatility of floating rate notes has been substantially lower than the broader bond market. The following table considers four major investable asset classes as represented by a benchmark ETF. The fourth aggregate is our subject. WisdomTree’s ETF consisting of floating rate Treasury notes serves as the proxy for the FRN space. Floating rate notes have demonstrated much low volatility than other bond and stock benchmarks.

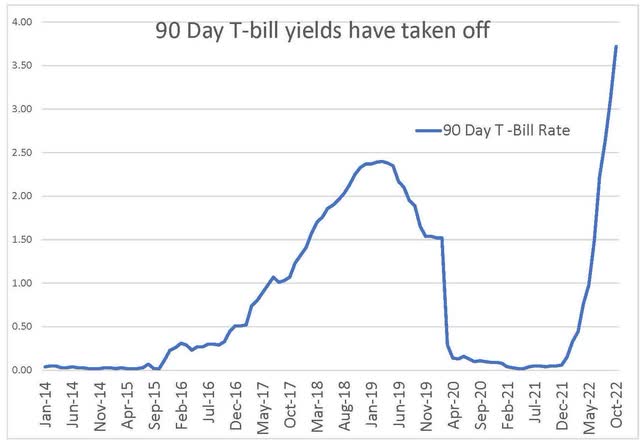

Despite the low volatility, there has been little interest in FRNs… for good reason. The yield has not been there. Since their inception in 2014, the Fed had kept short term rates anchored near zero. Expected returns were low. That changed in 2022. The index to which Treasury floating rate notes reset is the 90 day T-bill. The chart below illustrates the recent spike in the 3 month rate.

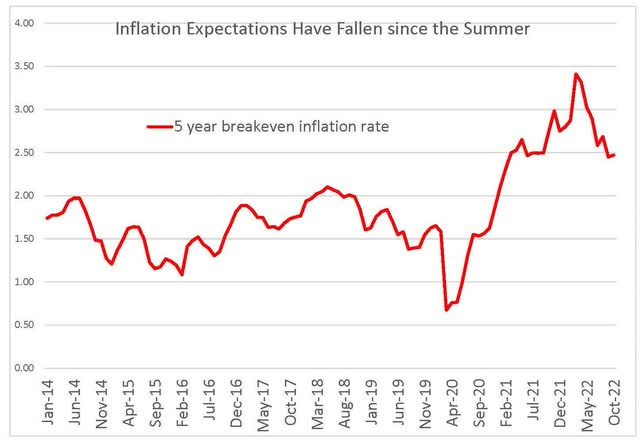

The increase in the short end of the yield curve has coincided with a decline in inflation expectations. Despite the high year-on-year inflation headlines, the month-on-month increase in price levels has quiesced since the summer. Moreover. forward looking measures of inflation have fallen.

The expected inflation rate is implied by the spread between TIPs yield and traditional treasury securities. Basically, the yield on TIPs is subtracted from fixed rate Treasurys of the same maturity to reveal the expected or “breakeven” inflation rate. This rate has fallen considerably since the summer months.

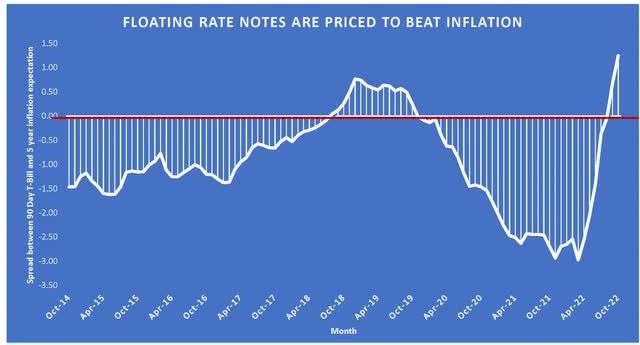

Let’s put it all together and evaluate the current yield of Treasury FRNs against expected inflation. After offering paltry returns since their inception, FRNs have recently started to show promise. The following chart shows the difference between expected yield of FRNs less expected inflation over the next 5 years. Note that the spread turns sharply positive in the last few months.

Investment Considerations

Treasury FRNs can be ordered through the Treasury Direct website. The interface is similar to that for savings bonds and fixed rate treasury securities. The investor opens an account directly with the Treasury. The notes are held in electronic form only.

Most investors will prefer the convenience of marketable securities purchased through a brokerage firm. First – a cautionary note. There are a number of FRN ETFs in the marketplace. A majority of them consist of corporate FRNs. As such, they have credit risk and other features that distinguish them from Treasury FRNs. Be aware that their performance may diverge significantly from government notes.

Neither Treasury FRNs nor TIPs are part of the Aggregate Bond Index. Thus, it is not sufficient to buy a fixed income index to include these bonds. They need a separate dedicated allocation.

The market value for Treasury FRNs is substantial and increasing rapidly. Issuance has grown from $15 billion in 2014 to $626 billion as of September 30, 2022. The total market value of marketable U.S. Treasury debt is $23.7 trillion, while FRNs comprise about 2.6% of the total.

WisdomTree and iShares each offer a low cost ETF that provide exposure to the Treasury FRN space. Both charge 0.15% in annual management fees and their performance is predictably similar. There is not a lot of “security selection” here as there are only 8 eligible Treasury FRNs outstanding at any one time.

They are not quite as liquid as the major ETFs such as SPY, However, buy and hold investors can safely place market orders. Daily bid/spreads in the range of 0.02%. The table below summarizes key attributes.

| Recent Bid/ask Spread | Recent divergence from NAV | Management Fee | |

| USFR | 0.02% | +0.00% to +0.05% | 0.15% |

| TFLO | 0.02% | +0.05% to +0.10% | 0.15% |

Source: ETF.com

Summary

For over a decade, coordinated financial repression among the world’s central banks denuded the financial landscape of attractive fixed income options. The selloff in the bond market this year has shifted some expected value back to bond investors. We have an inverted yield curve attributable to a central bank hell bent on curbing inflation. Investors should consider tilting their portfolio towards some of these short duration opportunities. Floating rate notes from the Treasury can be part of that allocation.

Be the first to comment