Rex_Wholster/iStock via Getty Images

The cannabis market doesn’t even care about financial results of U.S.-based multi-state operators (MSOs) anymore. Jushi Holdings (OTCQX:JUSHF) continues to build the business into a leading cannabis company, yet the stock just keeps falling to new lows. My investment thesis remains ultra Bullish on the MSO stock, but investors have to realize the market just doesn’t care right now.

Plan Coming Together

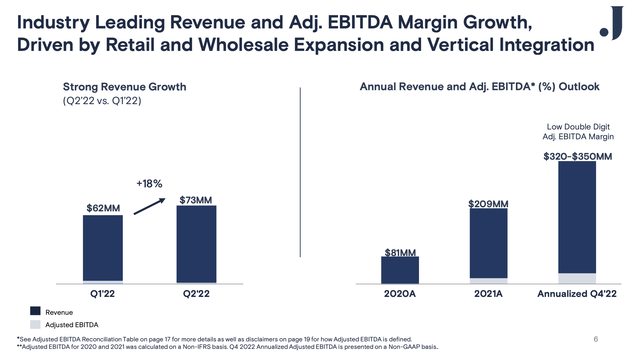

Back in late August, Jushi reported Q2’22 revenues jumped 52% to reach $72.8 million. The MSO completed a major acquisition in Nevada to help boost growth bringing the NuLeaf cultivation assets and brand focus to the business.

The majority of the revenue growth was related to the acquisitions with comp sales store growth listed as ~4% in the earnings call. Jushi ended Q2 with 33 retail locations and added two key retail locations in the Virginia markets of Alexandria and Fairfax.

The MSO is now positioned for substantial growth in the Virginia market over the next couple of years. The state recently relaxed medical cannabis regulations with 0.5% of the residents using the product likely surging to 3%+ in a short time. In addition, the state is expected to launch recreational cannabis in 2024 allowing consumers to bypass the medical cannabis requirements of obtaining a prescription from a doctor.

Jushi is well positioned with 4 medical dispensaries now open during Q3 with plans to reach 6 stores in the state. The MSO has 93K sq. ft. of cultivation capacity in Virginia to feed these stores.

The company now has vertical assets in key markets like Ohio, Pennsylvania and Virginia with plans for going from medical to recreational cannabis in the next few years. In addition, Jushi has strong operations in Illinois, Massachusetts and Nevada where bolt-on acquisitions are possible with smaller operators struggling in the current tough macro environment.

The MSO has relatively small margins due to a previous lack of product causing the MSO to obtain more product from third parties. The new cultivation facilities will help Jushi shift a current market low of internal branded product sold at their stores of only 21% in Q2 to something closer to industry standards around 65%.

For this reason, Jushi barely had positive EBITDA in Q2’22. The company only reported gross margins of 38.2% in the quarter

Not So Dire

Jushi forecasts ending 2022 with annualized revenues at a $335 million rate. The company would need to generate Q4’22 revenues of ~$84 million to hit that goal.

Source: Jushi Sept. presentation

The MSO hit revenues of $73 million in Q2 and would only need to generate $11 million in additional revenues in the 2H to reach such a goal. The company has added 2 additional stores in Virginia with management suggesting the first store was already running at a $3.5 million annual rate when the company reported results at the end of August.

More importantly, the adjusted EBITDA is set to reach a double-digit rate during Q4. The company would have a base EBITDA target for 2023 in the $40+ million range.

Remember, these are all the baseline amounts to start 2023. Analysts have the company reaching 2023 sales of $400 million and EBITDA margins will jump with revenues growing some $65 million over the Q4’22 run rate.

Considering the stock only has a valuation of $360 million based on 291 million diluted shares outstanding, the market clearly doesn’t believe Jushi can actually reach these rather meager growth targets. Considering the expanding opportunity in Virginia and expansion in other states such as Nevada, Illinois and Pennsylvania, the financial targets actually appear conservative.

The MSO has a cash balance of $43 million with debt at ~$200 million. The company expects to end cultivation expansion this year limiting any major capex spending in 2023. Jushi has plenty of unencumbered assets providing easy cash to fund operations.

Takeaway

The key investor takeaway is that Jushi is far too cheap here. The market doesn’t care making the stock hard to buy and hold, but the MSO will ultimately rally when the economy improves or the federal government finally legalizes cannabis.

Investors on the sidelines will have to be nimble to participate in the upside.

Be the first to comment