ktsimage

Shares of Ginkgo Bioworks (NYSE:NYSE:DNA) have sharply corrected in Q1 2022 and Q4 2021. Rate hikes and inflationary pressures have recently compressed multiples for companies with distant free cash flows, resulting in an adverse macroeconomic environment for growth stocks. This provides investors with a significant opportunity, as Ginkgo exhibits some of the key features of a market leader and industry disruptor.

The Case for Ginkgo

Ginkgo improves the speed, reduces the cost, and augments the probability of success of cell programming. To quote the firm’s 2021 annual report:

We are astounded by the diversity and potential impact of the cell programs that our customers are developing, which include (…) animal free meats for Motif, cannabinoids made by fermentation for Cronos, gene therapy improvements for Biogen, and even improving the brightness of glowing petunias for Light Bio!

The firm’s progress is reflected in its 2021 results. As per the 10-K:

We exceeded all of our public targets in 2021, even after raising our outlook mid-year. We launched 31 new cell programs for customers-up 72% from 2020-and we generated $113 million in Foundry revenue-up 91% from 2020. … We scaled our Biosecurity business from $17 million to $201 million of revenue in one year…

Furthermore, a cash balance at the end of Q2 2022 of approximately $1.4 billion (compared to $1.5 billion at Q4e 2021) demonstrates the firm’s ability to minimize cash burn, a key competitive differentiator. Archrival Amyris (AMRS) has had to contend with repeated cycles of negative operating cash flows and stock dilutions to build an otherwise promising business. Amyris now seems committed to non-diluting existing shareholders via a combination of upfront technology payment, non-equity financing, and technology earnout revenue from preexisting deals. The pursuit of positive cash flow and non-dilutive financing might signal a major turn in fortune for Amyris and its shareholders (no wonder CEO John Melo initiated his first purchase of shares in the open market recently).

In addition, the cash balance provides the resources Ginkgo needs to invest as it pursues profitability.

Platform Foundation, Scale Economics, and Compounding Opportunities

The foundation of Ginkgo’s platform includes two core assets that execute a wide variety of cell programs for customers according to their specifications.

One, the Foundry wraps proprietary software and automation around core cell engineering workflows-designing, writing, testing, inserting DNA into cells – and leverages data analytics to inform each iteration of design. The platform drives a strong scale economic. Key to compounding is Knight’s Law, after Ginkgo co-founder Tom Knight, which stipulates that Ginkgo has roughly tripled the output of its automated labs while reducing costs by 50% every year (with the exception of 2020 due to COVID-19).

Two, the Codebase includes both physical (engineered cells and genetic parts) and digital (genetic sequences and performance data) biological assets, and accumulates as Ginkgo executes more cell programs on the platform. Every program, whether successful or not, generates valuable Codebase and helps inform future experimental designs, making them more efficient.

As the platform improves with scale, it drives more scale, which drives further platform improvements, etc. A virtuous cycle between Foundry, Codebase, and the value delivered to customers creates a positive feedback loop. Ginkgo thus has a powerful engine that allows for true wealth compounding, and the stock may accrue shareholders significant net worth as the business grows.

In order to maintain exponential growth and innovate for scale over long periods of time, Ginkgo also leverages acquisitions. For instance, there’s the recent acquisition of Zymergen, which adds new capabilities to the platform. And Ginkgo has key relationships with suppliers such as Twist.

Maintaining Knight’s Law and creating significant value require a long-term orientation, which stock ownership incentivizes. Ginkgo thus weighs its employee compensation toward equity rather than cash, and has implemented a multi-class stock structure that permits all employees, not just founders, to hold super-voting common stock.

Ubiquity, Versatility, Market Opportunity

Cell programming has the potential to be as ubiquitous in the physical world as computer programming has become in the digital world. Biology is programmable and offers the tools to transform how humans manufacture or produce. Better products might be more sustainable, have more resilient supply chains or higher quality, or require lower economic and environmental costs of manufacturing.

Pharma and Biotech

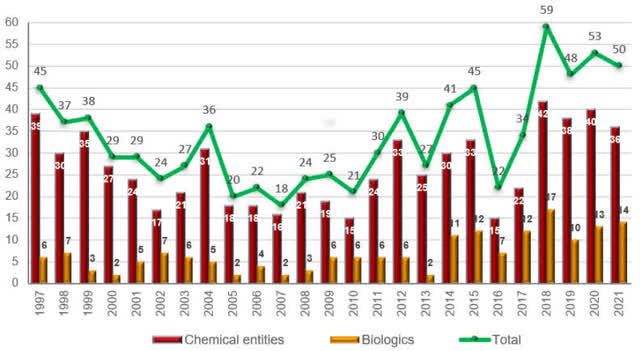

Biopharma has been a nexus of tremendous innovation in cell programming and synthetic biology. As illustrated below, biologics now account for slightly more than 25% of all drugs approved by the U.S. Food and Drug Administration (FDA).

Drugs (New Chemical Entities and Biologics) approved by the FDA in the last 25 years (The Pharmaceutical Industry in 2021. An Analysis of FDA Drug Approvals from the Perspective of Molecules by Beatriz G. de la Torre and Fernando Albericio, Diego Muñoz-Torrero, Academic Editor)

Ginkgo contributes its cell programming platform to various biologics or gene-based campaigns, thereby delivering innovations across a range of disease areas. These include helping develop “living medicines” (Synlogic (SYBX)), meet COVID-19 vaccine production requirements (Moderna (MRNA)), pursue novel antibiotics (Roche (OTCQX:RHHBY)), etc.

Industrials and Environment

The world must innovate new manufacturing methods in order to not only meet demand, but also clean up the environment and address climate change. Through various collaborations and the formation of Allonnia, a company targeting environmental remediation, Ginkgo helps customers create cell programs that enable cost-efficient, renewable, and sustainable production of chemicals and materials.

Food and Agriculture

Cell programming can likewise be leveraged to improve food availability or decrease the environmental impact of food production. Ginkgo helps leading multinational agriculture companies, including Bayer (OTCPK:BAYZF) and Corteva (CTVA), develop cell programs that can make crop production more efficient and sustainable, reducing nitrogen fertilizer and pesticide usage. Ginkgo recently announced plans to expand platform capabilities in agricultural biologics and launched a flagship partnership with Bayer.

Global Opportunity

For several decades, software ran in local environments: companies deployed and managed their own servers and customized their applications. The dominance of software-as-a-service and cloud computing over the past decade has demonstrated the value in having common architectures, resulting in higher efficiency, scalability, and innovation. Ginkgo might usher in a similar transition in cell programming.

Given the breadth of application areas and the potential of biology, the end markets for bioengineered products seem enormous. According to McKinsey & Company, a pipeline of about 400 use cases is already percolating with a potential direct economic impact of $4 trillion a year over the next 10-20 years. Taking into account new applications yet to emerge and additional scientific breakthroughs, the full ramifications could be far larger.

Fee Structure

For each of the cell programs it launches, Ginkgo generates economic value in two ways. First, it charges usage fees for foundry services, in much the same way that cloud computing companies charge usage fees for utilization of computing capacity.

Second, Ginkgo negotiates a value share with its customers, typically in the form of royalties, milestones, and/or equity interests. The idea is to align Ginkgo’s economics with the success of the programs its platform enables. As Ginkgo adds new programs, the portfolio of downstream value potential enablers grows. Because Ginkgo typically incurs no downstream costs (e.g., manufacturing or marketing, which customers manage), these value share payments flow through with approximately 100% contribution margin. To quote Ginkgo’s 10-K (linked above):

This flexible business model allows for more predictable near-term revenue while not sacrificing the company’s ability to create long-term value with asymmetric upside.

Of course, rival Amyris gets cents per ml when selling squalene as an ingredient, but dollars when selling it in Biossance direct to consumer; the margin difference thus justifies Amyris’ keenness on building brands. The critical idea here is that both Amyris and Ginkgo’s business models, while radically different, have significant appeal. It’s likely that we’re seeing the birth of not one but two industry leaders in synthetic biology. In a similar vein, Apple (AAPL) and Microsoft (MSFT) rose to prominence in their industry and coexist to this day. The stocks of both synbio players could enjoy similar fortunes.

Foundry Usage Fees

The first stage of a cell program consists of R&D work being performed on Ginkgo’s platform, leveraging its Foundry and Codebase. Customers regard R&D as a cost to be incurred regardless of success. Ginkgo provides a very efficient platform to conduct this R&D work, encouraging companies to adopt it. The unit costs of its cell engineering services are several times less expensive on average than a customer doing equivalent R&D in house by hand. Ginkgo typically earns usage fees tied to the increments of work that it performs on behalf of its customers. As its platform matures, Ginkgo steadily increases the portion of R&D costs covered upfront by customers; new programs are structured to fully offset its direct costs, which will eventually enable Ginkgo to earn a slim margin.

Per the annual report (linked above):

Foundry usage fees provide a strong foundation of predictable revenue that is independent of any commercialization efforts by our partners. As we continue to scale the Foundry and build Codebase, we expect to drive further efficiencies and decrease our average unit costs. … We pass these efficiencies on to our customers, increasing the number of shots on goal and, therefore, the likelihood of program success given a fixed budget. … The right choice for long-term value creation is to pass the savings to our customers, reducing the barriers to adoption and driving increased demand for our platform.

The multiyear nature of an average cell programming project means that usage fees are predictable and recurring in nature. Additionally, given the lead times inherent in developing technical plans as part of a sales process, Ginkgo has good visibility into new Foundry usage fee bookings. This provides a strong foundation for the business.

Downstream Multipliers and Value Share

As the key enabling technology for its customers’ products, Ginkgo is able to earn a share of the value of the products created using its platform. Ginkgo has structured a variety of value sharing mechanisms, including royalties, equity, and lump-sum commercial milestone payments. Because the economics should be identical, Ginkgo is agnostic on which form of downstream value capture it receives. The decision is contingent on customer size and preference.

Because Ginkgo will have completed the program (and received associated usage fees) prior to realizing downstream value and incurs minimal to no costs once the strain is commercialized, cash flows from the downstream value capture component generally fall straight to the bottom line. This dynamic may enhance long-term returns as its clients successfully commercialize products generated on its platform.

Ginkgo’s Sustainable Competitive Advantage

Ginkgo benefits from significant historical investments, a virtuous cycle that grows with scale, and a strong business model aligned with customers’ outcomes. It might have taken Ginkgo over eight years of investment and iteration to reach cost parity with “by hand” cell programming. Its software and data infrastructure cannot be easily replicated without deploying a number of rare, specialized skillsets. These provide a strong sustainable advantage and likely establish Ginkgo as an industry standard.

Only Amyris, which took just about as many years to reach maturity, boasts similar capabilities, with the difference being that Amyris has also developed a major manufacturing arm (Barra Bonita, etc.). Again, the pursuit of different business models, both valid, is in play. Ginkgo has no interest in manufacturing products itself. Amyris chooses to target direct-to-consumer markets in specific industries and vertically integrate into products to capture high margins and maximize value creation. This requires incurring higher costs (manufacturing and marketing) and at times burning cash. Now that Amyris has built the foundational infrastructure, however, it is entering a new stage; the stock likely is at an inflection point.

Per Ginkgo’s 10-K (linked above):

This has a tendency to overfit the capabilities of [Amyris’] R&D team to their targets. [Ginkgo’s] continued scaling and investment in flexible tools that can apply to a broad range of end markets helps us drive efficiencies in the Foundry and Codebase across our diverse programs.

Conflicts of interest

An advantage worth pondering is Ginkgo’s systematic avoidance of conflicts of interest. Amyris might leverage its technology platform to develop superior end products in certain vertical industries (say, skincare), but then a subset of skincare companies might find it more challenging to entrust work of any kind to a potential competitor on related fronts. Put another way, why would Givaudan use Amyris’ fermentation tanks to more efficiently produce rare molecules typically extracted from plants if Amyris can leverage the very same platform to build similar products that may ultimately compete? Granted, a number of non-compete and similar arrangements could delineate fronts of coexistence, but given the choice, certain firms may prefer to deal with a pure-play platform and agnostic multi-industry contributor.

Biosecurity Revenue

In the second quarter of 2020, in response to the pandemic, Ginkgo launched its commercial offering of COVID-19 testing products and services for businesses and other organizations. Ginkgo generates product revenue through the sale of various diagnostic test kits and service revenue through that of its end-to-end COVID-19 testing services, including sample collection kits, physician authorizations, onsite test administration, outsourced laboratory PCR analysis, and access to results reported through a web-based portal. Beginning in the first quarter of 2021, Ginkgo launched its pooled testing initiative, which focuses on providing end-to-end COVID-19 testing and reporting services to public health authorities, K-12 schools, and airports through its partnership with XpresCheck and the CDC. Critically, Ginkgo believes that testing services might in the future 1) thrive internationally, and 2) target other use cases including wastewater and air monitoring.

Recent Business Highlights Demonstrate Growth Potential

Top Line

Full-year 2021 total revenue of $314 million is up from $77 million in 2020, an increase of 309%. Full-year 2021 foundry revenue of $113 million is up from $59 million in 2020, an increase of 91%. Full-year 2021 biosecurity revenue of $201 million beats outlook of $110 million.

Quarterly results are unsurprisingly more volatile. Q2 2022 total revenue of $145 million is up from $44 million in Q2 2021, an increase of 231%, but down from $168 million in Q1 2022, up itself from $44 million in Q1 2021 – an increase of 282%. COVID-19 biosecurity demand might be receding but the emergence of variants and other factors could keep it volatile.

Q2 2022 foundry revenue of $44 million is up from $22 million in Q2 2021, an increase of 105%. The firm added 13 new cell programs, representing 86% growth. It added 11 cell programs in Q1 2022, representing 175% growth over Q1 2021. Q1 2022 foundry revenue of $21 million, which did not include material downstream value share payments, was down from $23 million in Q1 2021.

Q2 2022 biosecurity (Concentric) revenue of $100 million is down from $147 million in Q1 2022. An expected slowdown in COVID-related activities is likely responsible for the sequential deceleration. Concentric hopes to expand the range of biosecurity applications by piloting new modalities, including wastewater and air monitoring.

Ginkgo continues to expect to add 60 cell programs to the Foundry in 2022. It further revised its total revenue expectation from $375-$390 million to $425-$440 million in 2022. Ginkgo continues to expect Foundry revenue of $165-$180 million in 2022. While Biosecurity remains an uncertain business, based on strong year-to-date performance Ginkgo expects Biosecurity revenue in 2022 of at least $260 million.

Bottom Line

The full-year 2021 loss from operations of $1.8 billion, inclusive of a planned “catch-up” SBC (stock-based compensation) expense of $1.7 billion, compares to -$137 million in 2020. However, 2021 adjusted EBITDA of -$106 million improved from -$121 million in 2020. Similarly, Q2 and Q1 2022 losses from operations of $647 million and $675 million, respectively (inclusive of SBC expense of $607 million and $659 million, respectively), compares to a loss from operations of $60 million and $57 million in Q2 and Q1 2021.

But Q2 and Q1 2022 Adjusted EBITDA of -$23 million and -$2 million, improved from -$38 million and -$51 million in Q2 and Q1 2021, respectively. The SBC expense primarily relates to the GAAP accounting for the modification of restricted stock units issued prior to becoming a public company (as detailed below).

Stock-Based Compensation

In recent quarters, Ginkgo recognized billions of dollars of stock-based compensation expense. Prior to becoming a public company in September 2021, Ginkgo granted restricted stock units (RSUs) with both a service-based and a performance-based vesting condition, defined as a change in control or an initial public offering.

As previously disclosed, on Nov. 17, 2021, the board of directors modified the vesting terms of RSUs, such that Ginkgo’s business combination with Soaring Eagle Acquisition Corp. was deemed to have met the performance condition for vesting. This resulted in a catch-up adjustment of $1.5(+) billion of incremental SBC expense in Q4 2021.

As of June 30, 2022, there was under $1.2 billion of unrecognized stock-based compensation expense related to the catch-up adjustment for those RSUs not yet vested – to be recognized over a weighted-average period of one year.

Valuation

The shares of synthetic biology stocks have declined by around 75% on average in Q4 2021 and Q1 2022, way more than sector proxy SPDR S&P Biotech ETF (XBI), down 28%. Rate hikes and inflation prospects have compressed multiples for companies with distant free cash flows. It is thus best to adjust risk premiums to valuations and embed higher discount rates for the future cash flows of long duration names like Ginkgo.

Ginkgo should be valued based on the downstream value share as it constitutes the wealth capture model for the company and frames the investment rationale. The downstream value share-based DCF model depends upon the average value of each cell program and the number of cell programs Ginkgo can launch.

The company has stated that the average equity value of its cell programs is US$15 million. Assuming this holds, a portfolio of approximately 35 major programs would have a current equity value of over US$500m. Further, management has an aggressive goal of landing 500+ new cell programs by 2025. Let’s assume a more realistic target of 350 programs.

For the DCF valuation, it might be reasonable to add a 5% risk premium to DNA’s cost of equity, assume a 5% terminal growth rate, a risk free rate of 2.0%, an equity risk premium of 3%+, a beta of 5.5, cost of debt of 5-7%, a target equity to debt ratio of 70:30, and a tax rate of 25%. Some of these values are straightforward, but others are subject to interpretation.

In one scenario, the additional risk premium could raise Ginkgo’s cost of equity to 25% (resultant WACC approaches 20%). This leads to a present value of US$18 billion for Ginkgo’s future cash flows. Adding the cash on Ginkgo’s balance sheet ($1.4B) and the existing portfolio’s equity value ($.5B+), we arrive at an equity value of US$20 billion, implying a target price of US$11.2. This, in turn, suggests a 253% upside from current levels around $3.17 as of the close on Sept. 12, 2022.

HSBC analyst Sriharsha Pappu initiated coverage on Ginkgo with a buy rating and a close-enough price target of $14.00 on Sept. 21, 2021. The more conservative Bank of America argues that Ginkgo shares will struggle to outperform in the current environment given the lack of clarity over downstream value creation opportunities, which, according to the bank, are outside the company’s control. It might take time for users to ramp on DNA’s platform and commercialize end-products.

Furthermore, BoA points out that EV/sales multiples of Ginkgo’s peers have dropped (at the time to a median of 4.0x 2023 EV/sales). An increased discount rate in the DCF valuation model (WACC raised to 14%) results in a price target for the stock of $3 (down from $6) and a downgrade from neutral to underperform.

DCF analyses might assume different cell program values/volumes and costs of equity, debt, and resulting WACC, and analysts arrive at vastly different price objectives. But the current average target price of $9.29 is still roughly three times the current price.

Top Institutional Holders

Key ownership stakes by Baillie Gifford, General Atlantic, ARK, and Viking (which owns 9.7%, as reported on July 1, 2022) suggest top investment firms also believe in the shares’ appreciation potential.

| Holder | Shares | Date Reported | % Out | Value |

|---|---|---|---|---|

| Baillie Gifford and Company | 205,327,786 | Jun 29, 2022 | 18.67% | 548,225,204 |

| ARK Investment Management, LLC | 87,358,057 | Jun 29, 2022 | 7.94% | 233,246,018 |

| Vanguard Group, Inc. | 86,735,032 | Jun 29, 2022 | 7.89% | 231,582,542 |

| General Atlantic, L.P. | 69,435,733 | Jun 29, 2022 | 6.31% | 185,393,412 |

| Anchorage Capital Group, LLC | 69,158,354 | Jun 29, 2022 | 6.29% | 184,652,810 |

| Senator Investment Group, LP | 46,015,343 | Mar 30, 2022 | 4.21% | 122,860,969 |

| Morgan Stanley | 39,213,029 | Jun 29, 2022 | 3.57% | 104,698,790 |

| Blackrock Inc. | 32,353,263 | Jun 29, 2022 | 2.94% | 86,383,214 |

Source: Yahoo Finance

Risk Factors Summary

Ginkgo might incur net losses a while longer and need additional capital in the future in order to fund its business. But $1.4 billion of cash on the balance sheet coupled with well-controlled cash burn, R&D, and SG&A costs could go a long way.

Ginkgo owns equity interests in other operating companies; consequently, it has exposure to the volatility and liquidity risks inherent in holding their equity. However, when the market’s appetite for longer duration growth stories returns, Ginkgo and its portfolio of investments will likely benefit.

Decline in COVID-19 testing might harm Ginkgo’s results in terms of operations, but investigations into other biosecurity opportunities (monitoring of wastewater and air) could more than outweigh these risks. Concentric is piloting new modalities; this, in my view, constitutes one of many key drivers of potential upward revisions later on.

Ginkgo’s multi-class stock structure entitles only its employees/directors to acquire/hold Class B common stock, which has a greater number of votes per share than Class A. Issuing Class C stock may increase concentration of voting power in Class B stock, which could discourage potential acquisitions of Ginkgo. Both risks could be detrimental to Class A stock price.

Additional risks pertain to deals and mergers (but these cut both ways – think game-changers like Bayer), competition (which remains limited to Amyris in a market so huge that there sure is room for both firms to thrive), market behaviors (always best to invest in a bear, though), intellectual property, regulatory challenges, and product liability.

There are a number of upside risks, as well. Ginkgo might see the average value of its cell programs exceed the $15 million mark or the number of cell programs launched yearly blow expectations, as the market develops full awareness of the powerful market opportunities synthetic biology promises (in our view, one of the single most important potential factors of outperformance). The realization of more meaningful downstream milestones, royalties, and equity investments, also constitutes key drivers of potential upward revisions later on.

Conclusion

Ginkgo might constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- a technology incubator endowed with scaling economics and strong network effects, targeting a multiplicity of applications and verticals in rapidly expanding markets,

- a wealth compounder benefiting from a strong business model aligned with customers’ outcomes; and

- an industry leader with a solid institutional ownership profile and management leery of cash burn.

Solid appreciation potential exists within the next five years. But adverse market conditions for growth stocks make it difficult to call a bottom; it’s likely close enough.

Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for greater visibility into Ginkgo’s future cash flow (especially after the shares’ recent flareup) – might want to dollar average. I have more than 80% of my desired full position deployed at this juncture.

Be the first to comment