grandriver

Published on the Value Lab 11/17/22

Costamare (NYSE:CMRE) is mainly a containership owner, but it also has dry bulk ships. Therefore, it is an excellent barometer of general goods commerce, and the state in logistics. With logistics being such an important bottleneck to these recent supply chain issues, the evolutions here give us a lot of information about cost-push inflation. The incidence of declines in charter rates last quarter have continued, and are likely a leading indicator of what will happen with CPI figures over the next couple of quarters. Thankfully for CMRE, these declines are in spot rates, so the long duration of charters at more favorable prior rates has the company gliding. Performance is likely to decline but earnings have been smoothed. Trading at a very compressed multiple seems excessive, although it does reflect the danger of negative profits for fleet owners.

Q3 Breakdown

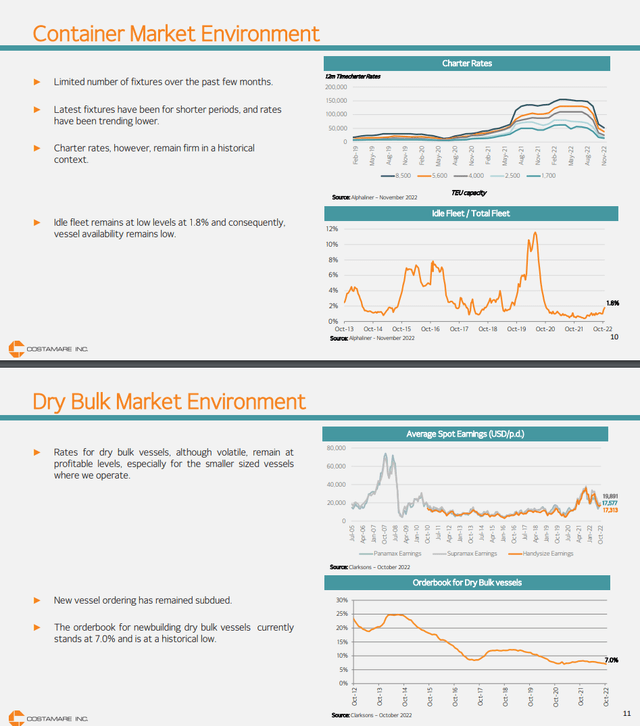

There is definitely pressure on some major trade lanes and the goods boom has been oppressed into a recessionary direction by higher rates and higher energy costs in Europe especially. Charter rates have fallen for both CMRE’s dry bulk vessels as well as for their containerships. Dry bulk has been a source of more earnings erosion but not because spot rates have declined more, but because commodities declined before the trouncing of the goods boom and duration of dry bulk charters were much shorter, all operating in the spot market.

In fact, charters for containerships have fallen more precipitously as of late compared to dry bulk on the spot market. But CMRE’s containerships are already well engaged for long durations. The same cannot be said for dry bulk, which is not operating as much in forward markets.

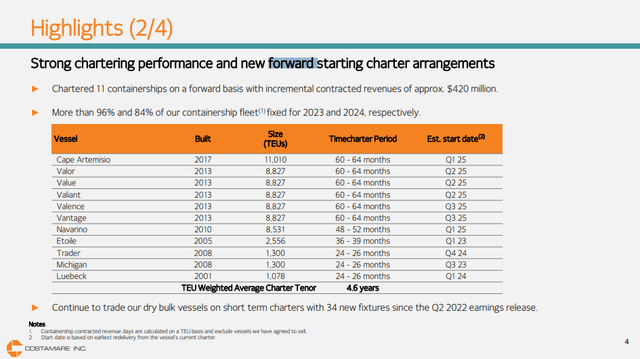

The new charters begin between 2023 and 2025 for the latest. Our revenue days are 100% fixed for ’22, over 96% fixed for ’23, and 84% fixed for ’24. We do continue to charter all our dry bulk vessels in the spot market, [indiscernible] 24 ships since our last earnings release.

While forward rates are going to be below the more peak spot rates we were seeing about 4-6 months ago, they are unlikely to be as shot as the current spot rates, since interest and inflation expectations were more optimistic some months ago when these forward agreements were likely struck. In other words, CMRE has successfully smoothed earnings in their larger containership fleet. Remaining charter duration is about 4.4 years, which is very long.

Bottom Line

Even at spot market rates, dry bulk vessels are still being chartered properly, but fleet owners have gone into the red periodically in down cycles. This is a very cyclical industry with immense operating leverage. Markets naturally do not appreciate this and the CMRE multiple is in the dirt based on trailing figures with a 2.48x multiple, and on forward earnings at 2.86x. This implies a run rate 33% earnings yield, not considering that the yield will fall as income does over the next couple of years unless the cycle reverses. We think that earnings yields will not erode so quickly thanks to duration in the containership markets. Earnings have been really smoothed – despite a more than 50% decline in spot rates, net income is actually flat YoY. Moreover, CMRE’s charter rate data is a leading indicator for us that supply side pressures are yielding even more. If declines continue, inflation should also subside and peak interest rates can be in sight which could reverse the cycle, although rates will likely continue to rise.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment