DenisTangneyJr

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 18th.

Real Estate Weekly Outlook

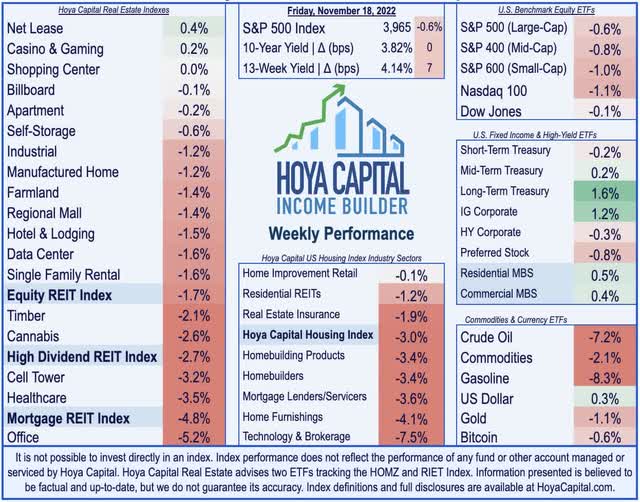

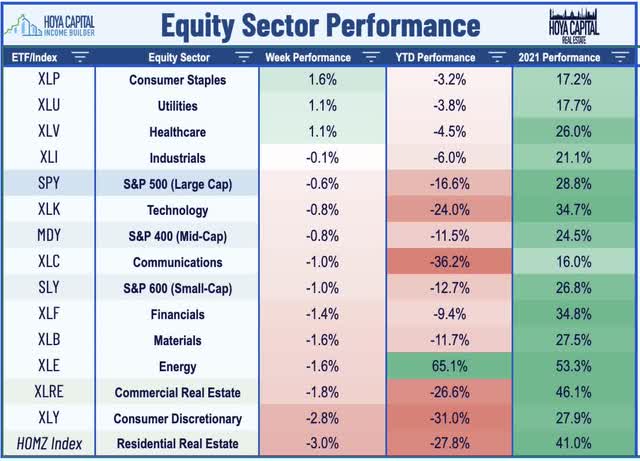

U.S. equity markets finished modestly-lower this past week – but consolidated most of last week’s post-CPI rebound – as investors assessed Federal Reserve commentary, mixed earnings reports, and lukewarm economic data including another cooler-than-expected inflation report. Fed officials throughout the week pushed back on an imminent “pivot” across a handful of public speeches but conceded that it’s seeing signs of cooling price pressures and softening economic growth, summarized by comments from Fed Vice Chair Brainard who noted that it would “soon” be appropriate to slow the pace of rate hikes, but emphasized that there was “additional work to do” to bring down inflation.

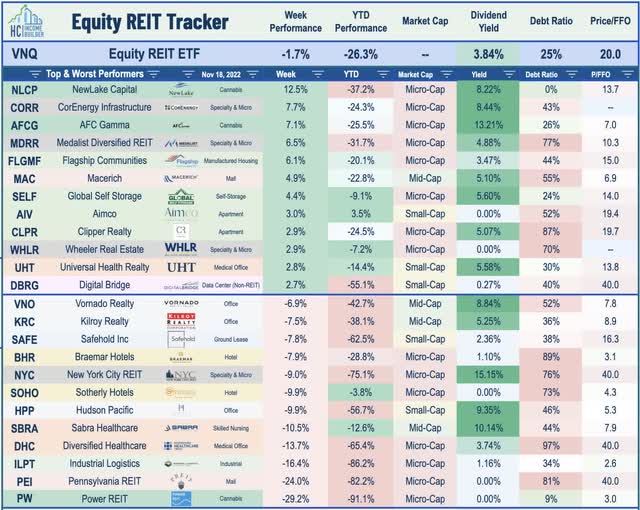

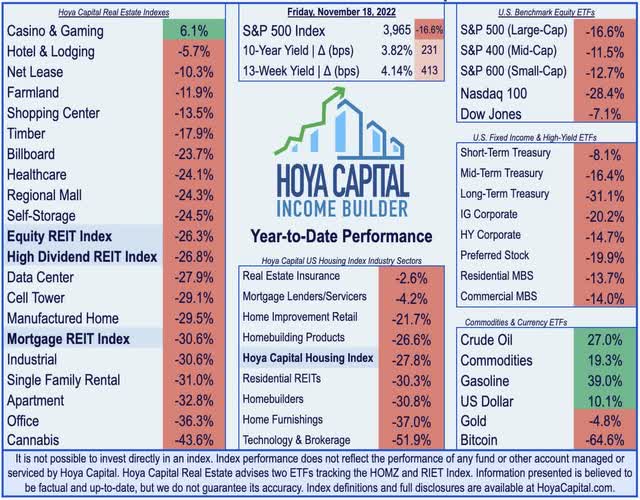

Following its best week of gains since June, the S&P 500 retreated by 0.6% this week – a relatively quiet week after four straight weekly moves of at least 3% – while the tech-heavy Nasdaq 100 finished lower by 1.1%. Real estate equities – one of the more highly-sensitive sectors to a potential Fed pivot – were among the laggards in the week after leading the rally last week. Following gains of over 6% last week, the Equity REIT Index finished lower by 1.7% this week with 15-of-18 property sectors in negative territory while the Mortgage REIT Index dipped 4.8%. Homebuilders, meanwhile, dipped more than 3% as another slate of downbeat housing market data was partially offset by the largest weekly decline in mortgage rates in over four decades.

Bond markets posted mixed returns, meanwhile, as the 10-Year Treasury Yield ended the week essentially unchanged at 3.82% – well below its recent highs last month above 4.30%. Reflecting mounting recession fears combined with expectations that the Fed maintains a high tolerance for some “economic pain,” the 10-2 Treasury Yield Curve widened to its most inverted level since 1982. Economic growth concerns – particularly in Europe and Asia – weighed on commodities this week with Crude Oil dipping over 7%. Bitcoin, meanwhile, continued its dip amid the continuing fallout from the implosion of FTX, one of the largest crypto exchanges. Consumer-tech focused stocks were among the laggards this week on reports that Amazon (AMZN) plans to fire 10,000 workers, the largest layoff in the company’s history, which follows a wave of announced layoffs this month from major tech companies.

Real Estate Economic Data

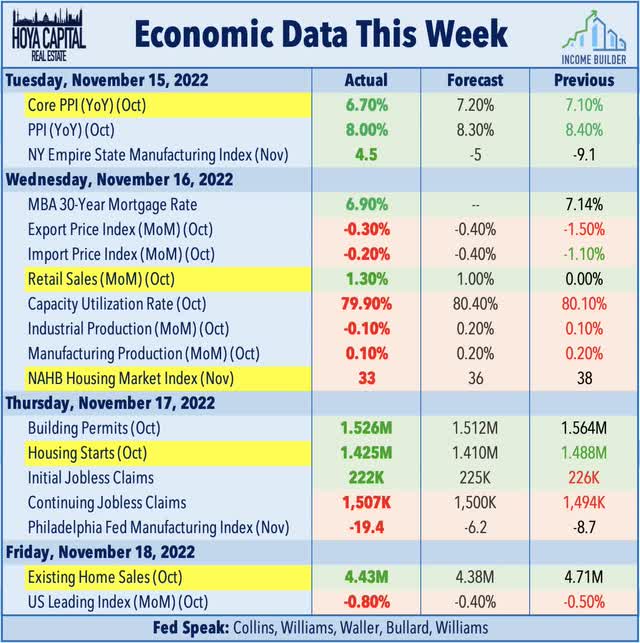

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

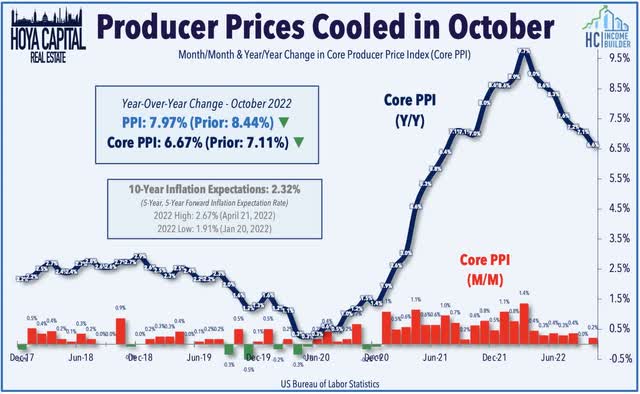

Following the cooler-than-expected Consumer Price Index report last week, Producer Price Index data this week showed similar trends of waning inflationary pressures in wholesale prices. The Producer Price Index for final demand increased just 0.2% in October – pulling the year-over-year back under 8% for the first time in 15 months. Notably, over the past four months, the Headline PPI has averaged 0.0% compared to a 12% annualized rate in the four previous months. The Core Producer Price Index, meanwhile, was flat in October on a month-over-month basis – below expectations of a 0.3% increase. Also of note, services prices fell 0.1% in October, which marked the first decline since November 2020. Goods prices rose 0.6%, but 60% of the increase was due to higher gasoline prices, which have declined in November.

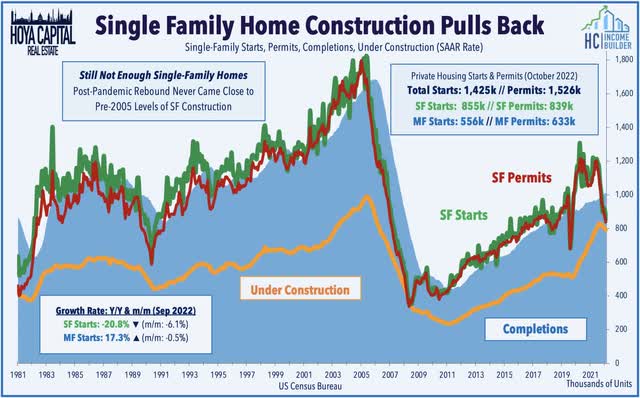

The U.S. housing market was also in focus this past week – the industry shouldering the brunt of the burden of the historic surge in interest rates this year as multi-decade-high mortgage rates have rapidly turned the single-family market from red-hot to icy-cold. Gross Domestic Product data last month showed that the U.S. economy just barely avoided a third-straight contraction in the third quarter, but Residential Fixed Investment – which took 14 years to recover to its pre-GFC level – remained a significant drag on GDP growth. Housing Starts and Building Permits data this week showed that new groundbreakings for single-family homes tumbled to the lowest level in more than three years in October while the NAHB’s Housing Market Index showed the lowest level for homebuilder confidence since September 2012 excluding the brief dip during the “shutdown months” in April and May 2020.

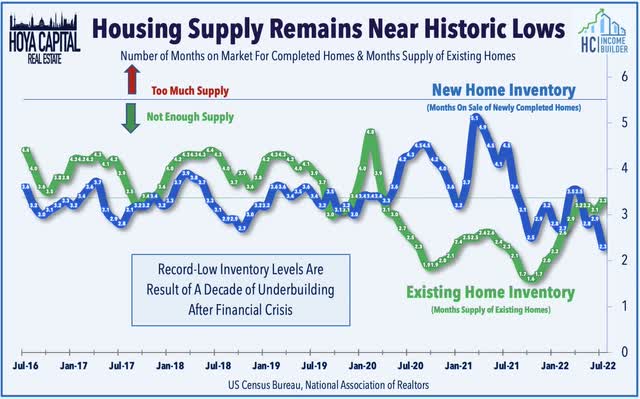

Meanwhile, the National Association of Realtors reported this week that Existing Home Sales declined for a ninth-straight month in October, dipping 5.9% from the prior month to a seasonally adjusted annual rate of 4.43 million – the slowest sales pace since 2011 excluding the brief dip during the pandemic shutdown. Helping to offset the downward pressure on home prices, however, is the lingering undersupply of single-family housing – an issue that is certainly not helped by the recent sharp decline in home construction activity. Remarkably, despite the ninth straight monthly decline in home sales, housing inventory level declined to just 1.22 million homes – down 1% from last year, representing just 3.3 months of supply at the current sales rate. Sixty-four percent of homes sold in October 2022 were on the market for less than a month and properties remained on the market for 21 days in October, up from 19 days in September and 18 days in October 2021.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

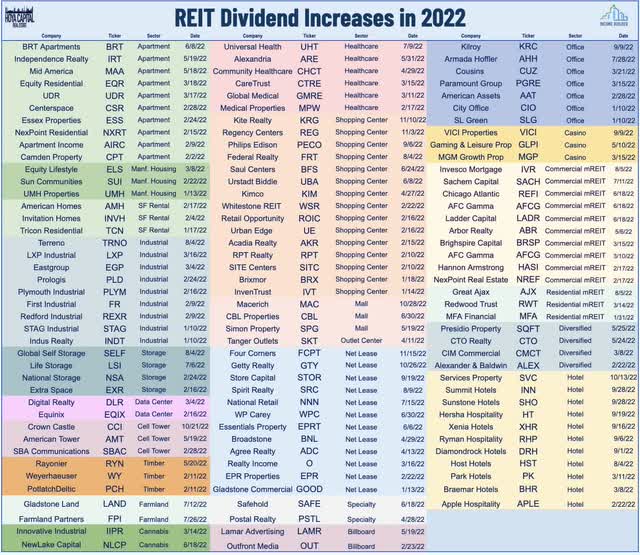

Another week, another REIT dividend hike. Net lease REIT Four Corners Property Trust (FCPT) was among the better-performers this week after it hiked its quarterly dividend by 2.3% to $0.34/share, becoming the 120th REIT to boost its dividend this year. This week, we published our State of the REIT Nation Report which analyzed high-level commercial real estate fundamentals through the recently-released NAREIT T-Tracker data. Of note, REIT dividends increased 15.5% in Q3 compared to the prior quarter and 18% from the prior year, fueled by a wave of mid-year dividend hikes. REIT’s Funds From Operations (“FFO”) per share, meanwhile, was higher by 13.7% from the prior year. REIT dividend payout ratios averaged 73% in the third-quarter – up from the near-record-low rate in the prior quarter – but still well below the longer-run averages of around 80%.

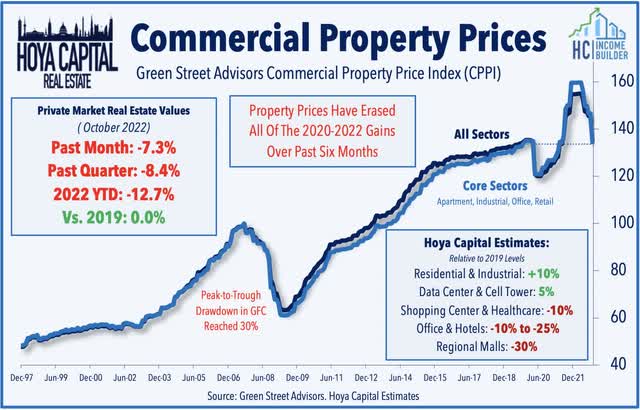

Also of note in the State of the REIT Nation report, we analyzed Green Street Advisors’ data published last week showing that private-market values of commercial real estate properties have dipped nearly 13% over the past six months after a historically sharp 8% decline in October alone – a decline in values that has been reflected in the public REIT markets for several quarters already. To private owners’ credit, property-level fundamentals have actually strengthened across most property sectors this year despite stagnant economic growth. Due to conservative balance sheet management over the past decade, however, REITs have been able to “hunker down” during this period of rising rates and can afford to “wait out” the Fed tightening cycle – a luxury earned through conservative balance sheet management, but many more-highly-levered private market players can’t say the same.

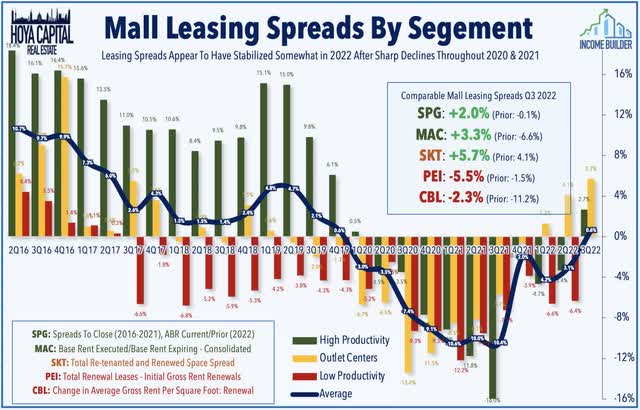

Mall: Small-cap CBL & Associates Properties (CBL) – which emerged from a brief bankruptcy last November – rounded out earnings season with a decent report highlighted by improving occupancy rates and leasing spreads, driving a boost to its full-year FFO outlook. CBL recorded spreads on new and renewal leases of +5.2% driven primarily by a jump in new lease rates, which offset a 2.3% decline in renewal rates. As noted in our Real Estate Earnings Recap, results from mall REITs have shown that downward pressure on rents and occupancy rates may finally be subsidizing. Earlier in earnings season, Simon Property (SPG) hiked its full-year guidance along with its quarterly dividend driven by an uptick in occupancy rates and a stabilization in rents. Tanger Factory Outlet (SKT) also reported better-than-expected results and raised its full-year outlook, driven by its strongest quarter for rental rate spreads in a half-decade at 5.7% – its third straight quarter of positive spreads following a streak of eight straight quarters of negative growth.

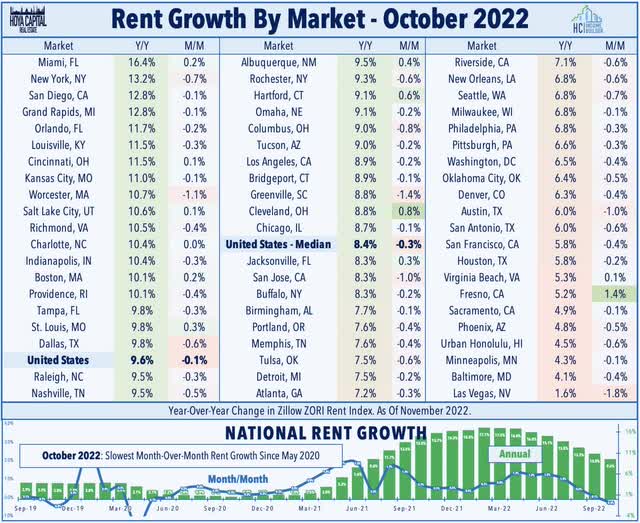

Apartments: Brokerage firm Redfin (RDFN) reported this week that residential rents continued to moderate in October, rising at their slowest annual pace in over 14 months. The median U.S. asking rent in October rose 7.8% year over year to $1,983, the smallest annual increase since August 2021. It was also the fifth-consecutive month in which annual rent growth decelerated, with rents rising at about half the pace they were six months earlier. Rents declined 0.9% on a month-over-month basis. The report was generally consistent with reports from apartment REITs over the prior three weeks and with data from Zillow (Z) earlier this week which showed that 48 of the top 60 markets recorded a sequential monthly decline in rents in October – a typical pattern following the peak summer leasing season – but notable given the streak of positive month-over-month rent increases seen from June 2020 through August 2022.

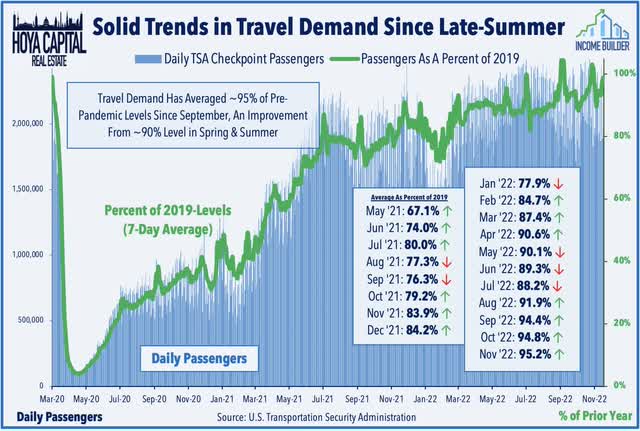

Hotel: Xenia Hotels (XHR) slipped about 2% on the week despite announcing an expanded share buyback program, increasing the total repurchase authorization to $173M. Elsewhere, Apple Hospitality (APLE) – which we own in the REIT Dividend Growth Portfolio – advanced more than 3% after holding its monthly dividend steady at $0.08/share, representing a forward yield of nearly 6% – the highest in the hotel REIT sector. Recent TSA Checkpoint data has indicated that domestic travel throughput has remained quite strong into the critical Holiday travel season as a recovery in business travel has offset a moderation in leisure demand in recent months.

Mortgage REIT Week In Review

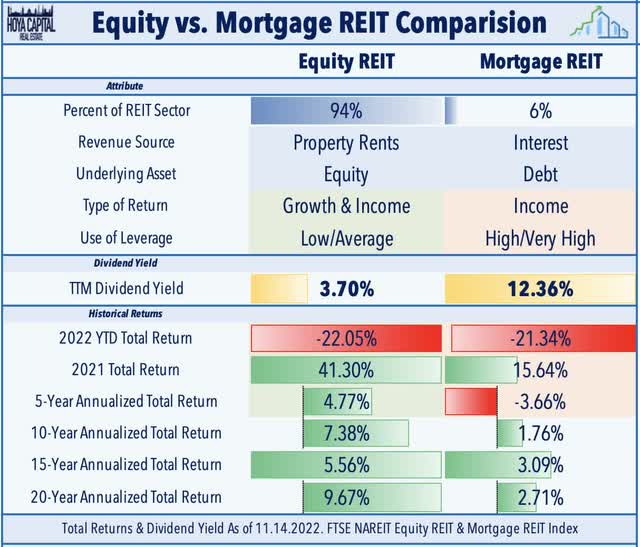

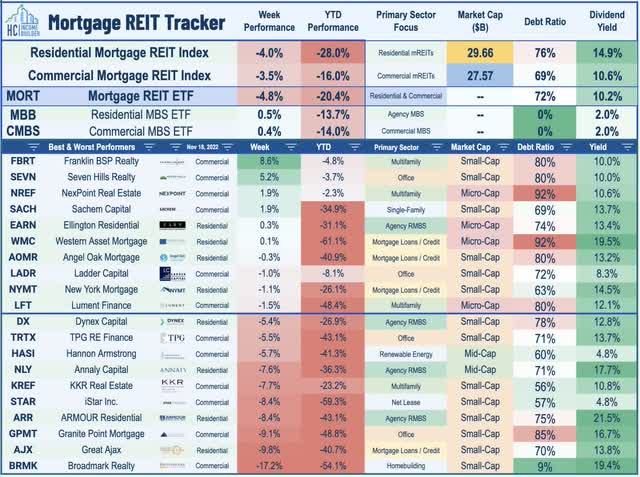

This week we published Mortgage REITs: High Yields Are Fine, For Now. Mortgage REITs – which were left for dead amid a historically brutal year across fixed-income markets – have posted an impressive recovery in recent weeks amid a long-awaited bid for bonds and after earnings results were not as weak as feared. Mortgage REITs are now outperforming Equity REITs for the year on a total return basis, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio. Despite paying average dividend yields in the mid-teens, the majority of mREITs were able to cover their dividends as improved earnings power from wider investment spreads offset book value declines, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

One such REIT we flagged was Broadmark Realty (BRMK), which slumped more than 17% this past week after reducing its monthly dividend by 50% to $0.35/share. Elsewhere, Ellington Financial (EFC) finished lower by 5% on the week after reporting that its estimated book value per share was $14.86 as of Oct. 31, 2022, down about 2% from the end of Q3. Arlington Asset (AAIC) also lagged by about 4% after wrapping-up mREIT earnings season with a mixed report, noting that its Book Value Per Share increased about 1% in Q3, but indicated that does not yet plan to restore its dividend – one of two mortgage REITs that do not currently pay a dividend. More broadly, mortgage REITs gave back some of their recent gains this past week, however, with the iShares Mortgage Real Estate Capped ETF (REM) slipping nearly 5%.

2022 Performance Check-Up

Heading into the Thanksgiving week, Equity REITs are now lower by 26.2% on a price return basis for the year – their second-worst YTD performance for the REIT Index on record through this date behind 2008 – while Mortgage REITs are lower by 30.6%. This compares with the 16.6% decline on the S&P 500 and the 11.5% decline on the S&P Mid-Cap 400. Within the real estate sector, just one property sector is in positive territory on the year – Casino REITs – and five property sectors are lower by more than 30%. At 3.82%, the 10-Year Treasury Yield has surged 231 basis points since the start of the year, but is well below its 2022 highs of 4.30%. Despite the rebound this past week, the US bond market is still on pace for its worst year in history with a loss of 13.7% on the Bloomberg US Aggregate Bond Index, which is 4x larger than the previous worst year back in 1994 (-2.9%).

Economic Calendar In The Week Ahead

The economic calendar slows down in the week ahead in the Thanksgiving-shorted holiday week. On Wednesday, we’ll see New Home Sales data for October which is expected to show similar trends of slowing as seen in the Housing Starts and Permits data seen this past week. We’ll also see a handful of Purchasing Managers Index (“PMI”) reports on Wednesday from S&P Global and the Institute for Supply Management. Each of these major surveys is expected to post readings below the breakeven-50 level, indicating that the Manufacturing and Services sectors were contracting in early November. We’ll also be watching Jobless Claims data on Wednesday given the recent wave of thousands of announced layoffs from major technology companies. Markets will be closed on Thursday for Thanksgiving and will have a shortened session on Friday with the NYSE Closing Bell at 1pm.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment