ryasick

Co-produced by Austin Rogers.

Be greedy when others are fearful and fearful when others are greedy.

This is perhaps the most famous quote from Warren Buffett. Most investors have heard it repeated ad nauseum. It’s a truism of contrarianism at this point.

But that doesn’t make it any less true.

The oldest wisdom that gets repeated over and over again is often the truest. Buy solid, time-tested companies with competitive advantages, skilled and shareholder-aligned management teams, strong balance sheets, and commitment to paying a dividend, then wait.

It’s simple, but not necessarily easy. Both picking good companies and waiting can be very difficult, for some reason or another. But it’s a tried-and-true method of generating wealth over time.

Usually, this type of investing produces returns of 8-12% per year – higher some years, lower others. But during bear markets, such as the one we are in now, certain once-in-a-decade or once-in-a-generation buying opportunities present themselves. Successfully identifying and investing in these opportunities can generate massive returns for investors.

In what follows, we identify two such opportunities that we find very interesting. These two deep value dividend stocks not only offer high yields but also have the potential of doubling in the next two years. Let’s dive in.

Verizon Communications Inc. (VZ)

Everyone in the U.S. knows Verizon, one of the big three mobile communications providers. And by now, probably everyone knows that the next big thing in wireless communications is the rollout of 5G technology.

VZ boasts a commanding and growing market position in premium plan subscribers, who tend to be stickier and more reliable customers. These are also the type of customers most likely to be willing to pay higher rates for access to 5G.

Though there have been some eye-popping costs reported as part of the 5G rollout, CEO Hans Vestberg recently reaffirmed that 2022 will be Verizon’s peak year for network investments, representing about $22 billion in total capex. Going forward, capex spending should decline.

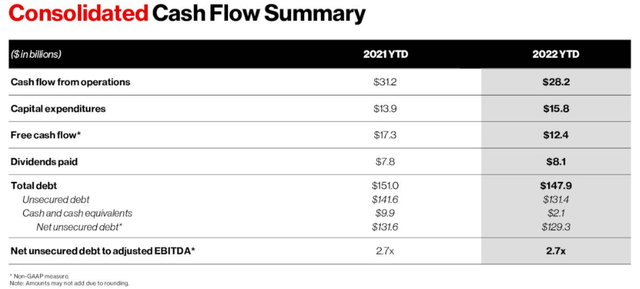

To illustrate, VZ’s capex spending jumped from $13.9 billion in the first three quarters of 2021 to $15.8 billion in the first three quarters of 2022. That contributed heavily to the decline in free cash flow from $17.3 billion to $12.4 billion.

However, we would point out three things.

First, dividends of $8.1 billion are still well-covered by free cash flow (“FCF”) at a 65% cash payout ratio, even in the company’s peak year of capex spending. VZ is a cash-generating machine with a high degree of fundamental stability and, therefore, dividend safety.

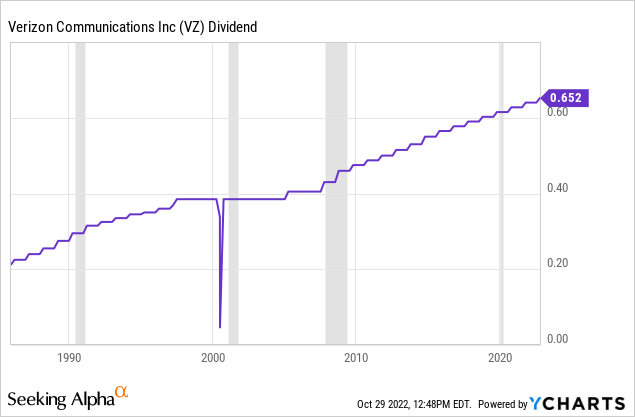

That is why the telecom company’s dividend history looks like this:

Though VZ has only increased its dividend for the last 16 consecutive years, that dividend payout has gone uninterrupted and without a cut for the last 38 years, a time period that has included four recessions and a variety of macroeconomic backdrops.

Second, despite heavy spending on upgrades to VZ’s network to solidify its market position, net unsecured debt to adjusted EBITDA is flat year-over-year at 2.7x. And that is with adjusted EBITDA down 0.4% YTD. In other words, VZ has managed to make these huge investments in network upgrades without over-leveraging its balance sheet.

As such, the company should be able to maintain its BBB+ credit rating going forward.

Third, it’s important to point out that VZ’s primary competitors, AT&T (T) and T-Mobile (TMUS), have been competing aggressively for market share this year by offering bigger discounts and better monthly rates than VZ. That explains their subscriber gains against VZ this year.

But VZ has some hidden strengths that go largely unnoticed:

- VZ’s focus is on “attracting and retaining high-quality consumers in a disciplined and measured approach.” This type of customer base makes VZ more recession-resistant and able to pass through rate increases.

- VZ still has roughly 20 million more postpaid mobile subscribers than either AT&T or T-Mobile. As such, it has more to lose than they do in a highly mature and saturated market. But with size also comes scale benefits.

- Despite losing 16K postpaid mobile subscribers on net YTD, VZ’s wireless service revenue growth is expected to be around 9% this year due to the absorption of a rate increase.

- Due to VZ’s aforementioned capex for network upgrades and 5G rollout, it is steadily transitioning subscribers into higher-cost premium plans: 53% of consumer users are now on 5G, but only 42% of are on a premium plan. The share of subscribers in premium plans continues to rise, as 60% of new subscribers immediately go with a premium plan.

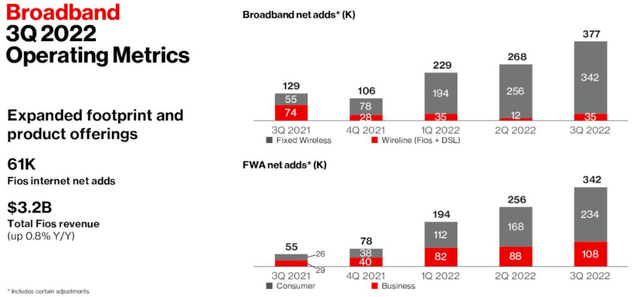

- VZ is ramping up its broadband and fiber customer bases:

We think VZ has performed so badly this year (down ~30%) for two main reasons:

- Slight net losses in wireless subscribers while competitors have made gains

- Rising interest rates.

Our thesis for VZ doubling from here in two years is as follows. It is widely anticipated at this point that the U.S. economy will slump into a recession in 2023. If this does occur, it will very likely bring inflation and interest rates down rapidly, as recessions have an excellent historical track record of doing so.

This would simultaneously alleviate fears about VZ’s debt load and make its dividend more attractive compared to bonds again.

The lowest dividend yield VZ has traded at in the last decade was about 3.5%. If sentiment comes back in VZ’s favor, perhaps as subscriber gains even out among peers and the market comes to appreciate the higher quality of VZ’s customer base, it’s possible that VZ’s stock price could rise to lower its dividend yield to that level again within two years.

A 3.5% dividend yield today would put VZ’s stock price at ~$75, based on the current dividend. That’s roughly double the current stock price of ~$37.50.

Whirlpool Corporation (WHR)

The well-known large appliance maker, WHR, is suffering a whipsaw to the downside after enjoying a record-breaking year in 2021. Last year, new home construction starts surged, leading builders to buy lots of new Whirlpool products, while a wave of cash-rich homeowners decided to renovate their homes.

This year, upcycle has definitively shifted into a downcycle.

WHR’s sales are dropping (expected to be down ~9% YoY in 2022), the company has reduced production volume by 35%, and free cash flow dropped into negative territory at -$24 million during the third quarter.

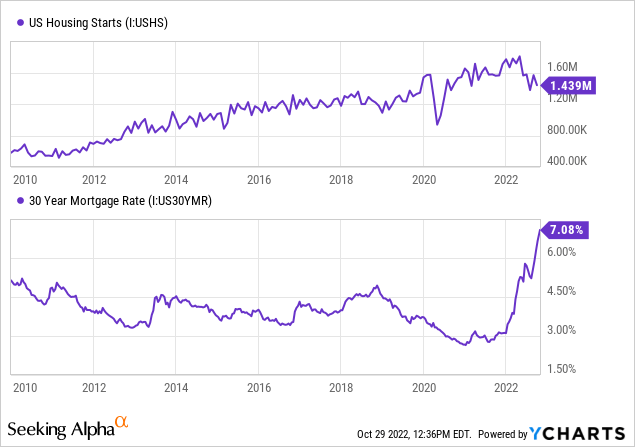

With mortgage rates surging over 7% and new home starts dropping, the macro backdrop for WHR appears set to remain weak through at least the first half of 2023.

But there is some good news for the appliance maker.

First, WHR is getting closer to selling its entire EMEA (Europe, Middle East, and Africa) segment, with two “potential strategic investors” in their final phase of evaluation. This strikes us as a great move for WHR to free up some inefficiently allocated capital. The EMEA business accounts for about 1/5th of sales but only about 4% of 2021 operating income.

Second, WHR also recently divested from its Russia business while investing in a much stronger and more stable alternative: the industry-leading garbage disposal brand, InSinkErator.

In August, the company announced the $3 billion acquisition of InSinkErator from Emerson Electric (EMR). The transaction values InSinkErator at 18.1x TTM EBITDA and 20.3x pre-tax earnings. While this is by no means a cheap valuation, it is a fair one, as InSinkErator commands a leading share of over 70% of the garbage disposal market. Like Whirlpool, it enjoys the most respected brand name in its space.

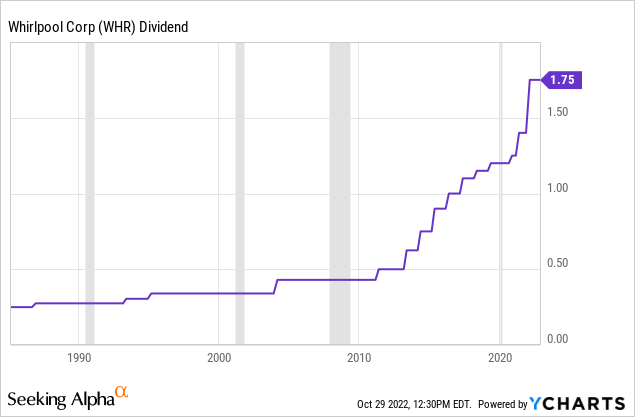

Third, the dividend remains well-covered by free cash flow. WHR expects to generate $1.5 billion in operating cash flow and $950 million in FCF in 2022, providing plenty of available cash to cover its ~$430 million dividend. This should allow WHR to maintain its dividend, which has increased by ~45% over the last two years, even through a difficult environment.

Fourth, net debt to EBITDA has dropped significantly in recent years.

Long-term debt fell from $4.93 billion at the end of 2021 to $4.72 billion at the end of Q3 2022. Unfortunately, EBITDA has also fallen as a casualty of the rapid slowdown in the housing market and inflationary input cost increases, dropping from around $3 billion in 2021 to around $1.4 billion in the last four quarters, putting WHR’s gross debt to EBITDA ratio at about 3.4x. (The acquisition of InSinkErator should only raise gross debt to EBITDA to about 3.5x.)

However, WHR also enjoys a comfortable cash cushion of about $1.8 billion, which brings its net debt to EBITDA ratio down to 2.1x.

So, in our view, here are the long-term tailwinds for WHR:

- Input costs are coming down and should drop further in the year ahead, which should allow margins to rebound.

- Though high mortgage rates have destroyed homebuyer demand for now, millions of Millennials are entering their prime homebuying years of life and should provide sustained demand ahead once mortgage rates come back down.

- WHR enjoys strong product quality and brand recognition, putting it in a good position to capture a big share of appliance replacements.

- Strong product quality and brand recognition also help to maintain pricing power as demand drops.

- The sale of the EMEA business should allow WHR to further deleverage and perhaps also make some higher-margin investments.

WHR’s 5% dividend yield is attractive for income and dividend growth investors alike. Moreover, given the level of pent-up demand for homes in the U.S., it would not at all be surprising to see WHR’s stock price double in the next two years, if demand rebounds as we expect it to by then.

Bottom Line

What are the odds of either VZ or WHR doubling in the next two years? Frankly, we don’t know.

But both high-yield stocks make very interesting and compelling opportunities in today’s market. Both are deep value names that have been pummeled to low prices based on temporary headwinds.

The market has grown exceedingly fearful about VZ and WHR, and it may be time for investors to get greedy.

Be the first to comment