CHUNYIP WONG

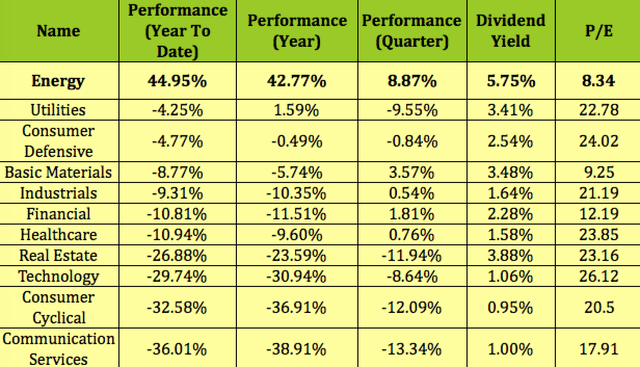

As we pointed out in our articles last weekend, the energy sector continues to dominate all other sectors by a wide margin in 2022 and over the past year, being the only sector with a positive return.

Even with that outperformance, the energy sector still has by far the highest dividend yield, and the second lowest P/E, hence its attraction for income investors:

Hidden Dividend Stocks Plus

There are various industries within this sector, but one of them, the Exploration & Production industry, has a small sub-industry of its own, commonly referred to as Royalty Trusts.

This article covers two of them, Dorchester Minerals LP (DMLP) and Black Stone Minerals LP (BSM), which we’ve owned off and on for years. While some energy royalty LPs merely profit off of a declining asset base and sometimes have a termination date. BSM and DMLP both acquire new properties to replace or increase their asset bases, which makes them much more interesting for unit holders.

Company Profile – BSM:

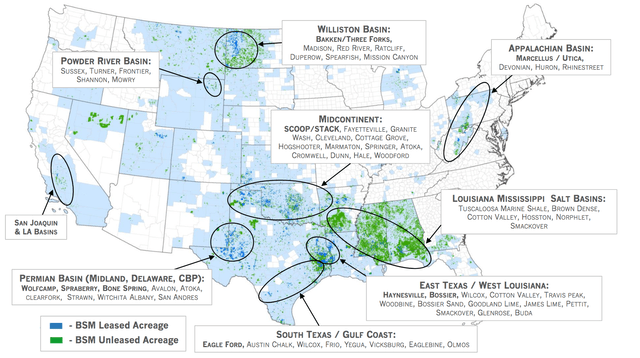

BSM is a limited partnership that owns oil and natural gas mineral interests, which make up the vast majority of the asset base. The Partnership’s assets also include nonparticipating royalty interests and overriding royalty interests. It owns mineral interests in ~20 million gross acres, nonparticipating royalty interests in 1.8 million gross acres, and overriding royalty interests in 1.7 million gross acres located in 41 states in the US. (BSM site)

BSM site

Company Profile – DMLP:

DMLP is a limited partnership that commenced operations on 1/31/03. Its business may be described as the acquisition, ownership and administration of Royalty Properties (which consists of producing and non-producing mineral, royalty, overriding royalty, net profits, and leasehold interests located in 592 counties and parishes in 28 states, and net profits overriding royalty interests (referred to as the Net Profits Interest, or “NPI”).

Recent Acquisitions:

DMLP acquired land in September 2022: “On Sept. 30, 2022, pursuant to a non-taxable contribution and exchange agreement with Excess Energy, a Texas limited liability company. The Partnership acquired mineral, royalty and overriding royalty interests totaling approximately 2,100 net royalty acres located in 12 counties across Texas and New Mexico in exchange for 816,719 common units representing limited partnership interests in the Partnership valued at $20.4 million and issued pursuant to the Partnership’s registration statement on Form S-4. We believe that the acquisition is considered complementary to our business.”

“On March 31, 2022, pursuant to a non-taxable contribution and exchange agreement with multiple unrelated third parties, the Partnership acquired mineral and royalty interests representing approximately 3,600 net royalty acres located in 13 counties across Colorado, Louisiana, Ohio, Oklahoma, Pennsylvania, West Virginia and Wyoming in exchange for 570,000 common units representing limited partnership interests in the Partnership valued at $14.8 million.” (Q3 ’22 DMLP 10Q)

BSM‘s last acquisition was in 2021: “In May 2021, the Partnership closed an acquisition of mineral and royalty acreage in the northern Midland Basin for total consideration of $20.8 million. The assets acquired consisted of $4.9 million of proved oil and natural gas properties, $15.6 million of unproved oil and natural gas properties, and $0.3 million of net working capital.”

Earnings:

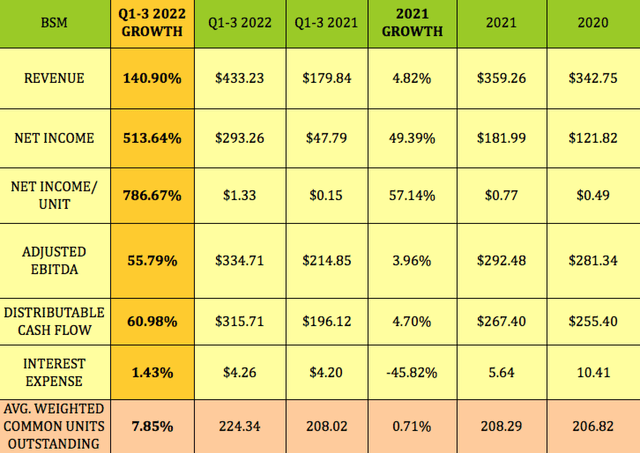

To say that the rise in oil prices has benefited both of the LP’s would be an understatement.

BSM‘s revenue rose 141% in Q1-3 ’22, while its net income jumped over 5X and EPU jumped nearly 8X. Adjusted EBITDA was up ~56%, and DCF rose 61%. Unlike DMLP, which has no debt, BSM had $60M in debt, as of 9/30/22, which produced slightly interest expenses in Q1-3 ’22. BSM’s unit count has risen 7.85% so far in 2022.

Hidden Dividend Stocks Plus

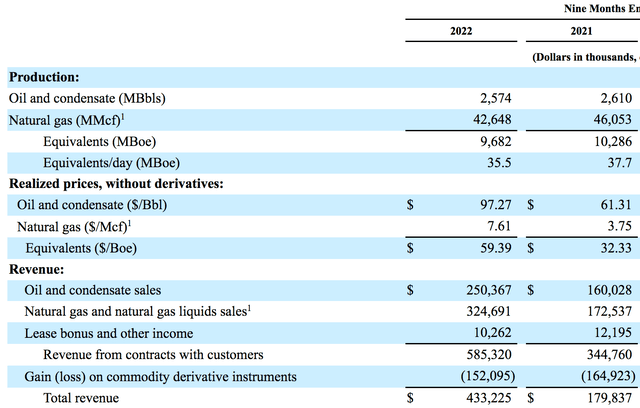

BSM’s product mix is skewed toward natural gas, which comprised ~73% of its production volume in Q1-3 ’22. Both oil and gas benefited from realized prices rising, with oil up ~59%, and natural gas up ~101%.

Even though volume was a bit lower for both oil and gas, revenues were up 56% for oil and 88% for natural gas, as a result of higher prices:

BSM site

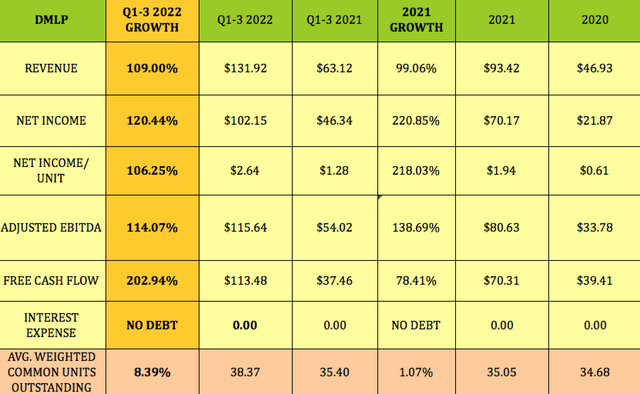

DMLP has also had a whiz bang time of it so far in 2022, with revenue, net income, EPU, and adjusted EBITDA all rising over 100%, and free cash flow rising just over 200%. DMLP’s unit count has risen 8.4% in 2022, similar to BSM’s.

DMLP’s full year 2021 growth eclipsed that of BSM’s, with 99% revenue growth, ~220% growth in net income and EPU, 139% EBITDA growth, and 78% FCF growth. As mentioned previously, DMLP carries no debt.

Hidden Dividend Stocks Plus

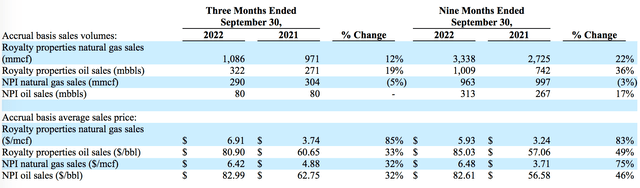

DMLP’s royalty properties’ natural gas sales volume rose 12% in Q3 ’22, and 22% in Q1-3 ’22. Its royalty properties’ oil sales volume rose 19% in Q3 ’22, and 36%.

Natural gas prices rose 85% in Q3 ’22, and 83% in Q1-3 ’22. Oil prices rose 33% in Q3 ’22, and 49% in 2021.

DMLP’s Net Profit Interest, NPI, for gas rose 32% in Q3 ’22, and 75% in 2021, while oil NPI rose 32% in Q1-3 ’22, and 46% in 2021:

DMLP Q3 ’22 10Q

Dividends:

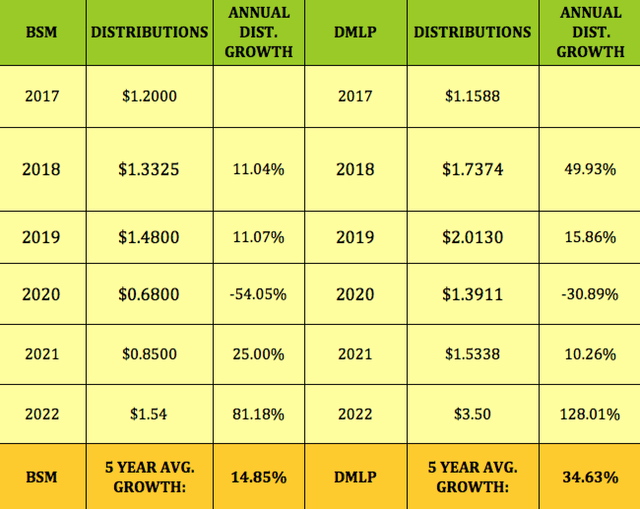

Pretty impressive sales and earnings growth numbers for both, especially DMLP. While both firms have variable distributions, looking back over the past six years shows DMLP with the edge for distribution growth, with a very impressive five-year growth figure of 34.63%, vs. a very good figure of 14.85% for BSM.

Both LPs had lower distributions in 2020, as the pandemic destroyed demand, with DMLP’s payout dropping -31% to $1.39, and BSM’s dropping -54%, to $.68. They both had better earnings in 2021, and increased their payouts, but it was this year, 2022, that really saw a major 128% increase from DMLP, and a big 81% increase from BSM.

Hidden Dividend Stocks Plus

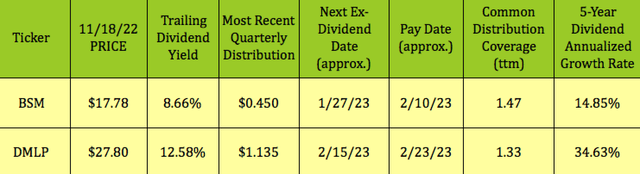

At its 11/18/22 price of $17.78, BSM’s trailing yield is 8.66%. Its most recent payout was $.45. It should go ex-dividend next on ~1/27/23, with a ~2/10/23 pay date.

DMLP’s trailing yield is much higher, at 12.58%. It should go ex-dividend next on ~2/15/23, with a ~2/23/23 pay date.

Hidden Dividend Stocks Plus

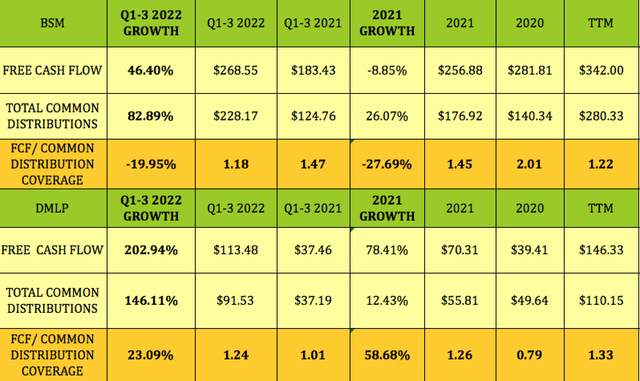

BSM had stronger distribution coverage than DMLP in 2020, when DMLP’s coverage was below 1X. That gap narrowed in 2021, when DMLP’s coverage factor hit 1.26X, vs. 1.45X for BSM.

So far in 2022, DMLP has a slightly higher coverage factor of 1.24X, vs. 1.18X for BSM:

Hidden Dividend Stocks Plus

BSM and DMLP both issue K-1s at tax time.

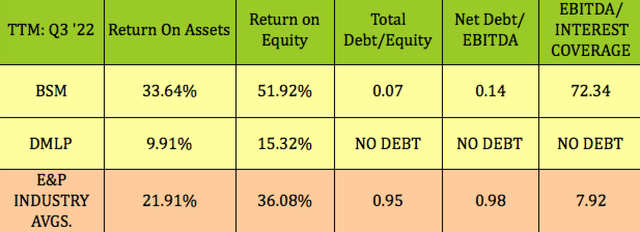

Profitability and Leverage:

BSM wins the race on ROA and ROE, with figures that are much higher than E&P industry averages. Although BSM uses leverage, it’s currently carrying a very low amount of debt, with subsequently low interest expenses and leverage figures.

Hidden Dividend Stocks Plus

Debt:

BSM has a variable Credit Facility, which is explained in its Q3 ’22 10Q:

“The Partnership maintains a senior secured revolving credit agreement, as amended. The Credit Facility has an aggregate maximum credit amount of $1.0 billion. The commitment of the lenders equals the least of the aggregate maximum credit amount, the then-effective borrowing base, and the aggregate elected commitment, as it may be adjusted from time to time.

The amount of the borrowing base is redetermined semi-annually, usually in October and April, and is derived from the value of the Partnership’s oil and natural gas properties as determined by the lender syndicate using pricing assumptions that often differ from the current market for future prices.

The October 2021 and April 2022 borrowing base re-determinations reaffirmed the borrowing base at $400.0 million. In October 2022, the Partnership revised and amended the Credit Facility to extend the maturity date from November 1, 2024 to October 31, 2027.

Concurrent with the Credit Facility amendment, the borrowing base under the Credit Facility was increased to $550.0 million and the Partnership elected to lower commitments under the Credit Facility from $400.0 million to $375.0 million.” (BSM (Q3 ’22 10Q)

DMLP has no debt.

Performance:

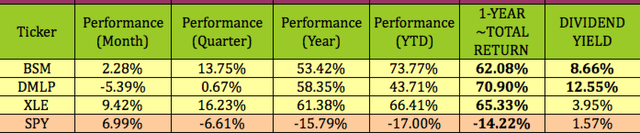

BSM and DMLP have both outperformed the S&P by wide margins in 2022 and over the past year. While BSM has outperformed DMLP so far in 2022, DMLP has a better one-year performance and ~total one-year return.

Hidden Dividend Stocks Plus

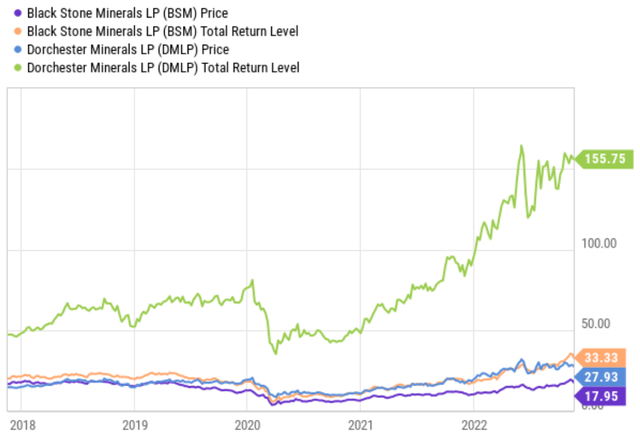

Looking back further, over a five-year period shows DMLP with a much higher total return than BSM.

YCharts

Valuations:

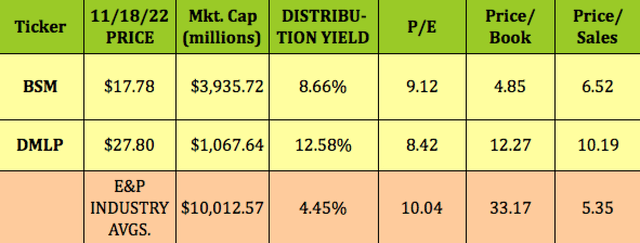

BSM is a much larger outfit, with over 3X the market cap of DMLP, and 677K in average daily volume, vs. 98K for DMLP.

While DMLP has a slightly lower trailing P/E, BSM has much lower P/Book and P/Sales valuations. DMLP has a higher trailing yield. Both LPs have much higher yields and lower P/Es than E&P industry averages.

Hidden Dividend Stocks Plus

Parting Thoughts:

Both BSM and DMLP have attractive attributes – the ability to replenish gas and oil properties is a big deal in our book.

Although it’s a much smaller LP, we favor DMLP somewhat over BSM, based upon its superior five-year total return.

But is now the tome to jump in? If the US does enter a recession in 2023, you may be able to buy either of these LPs at lower prices. Put them on your watch list.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment