Spencer Platt

Thesis

Tencent Music Entertainment (NYSE:TME) stock surged after the company reported a much better than expected September quarter – with the stock being up more than 25% since the earnings announcement.

TME stock has gained about 45% since I initiated coverage with a ‘Buy’ recommendation and my $5.84 target price has been surpassed. Thus, I think it is a good time to reconsider the TME investment opportunity versus alternatives.

Although I slightly upgrade my EPS expectations through 2025, I believe TME stock is now trading in line with fundamentals. I lower my recommendation to ‘Hold’.

Better Than Expected September Quarter

During the period from July to end of September, TME generated total revenues of $1.04 billion, which compares to $980 million for Q2 2022 (6% quarter over quarter expansion) and to approximately $975 million estimated by analyst consensus ($65 million beat). Net profit for the period came in at $154 million, which compares to approximately $ $133 million for Q2 (22.5% qoq expansion) and $120 million estimated by analysts ($32 million beat) respectively.

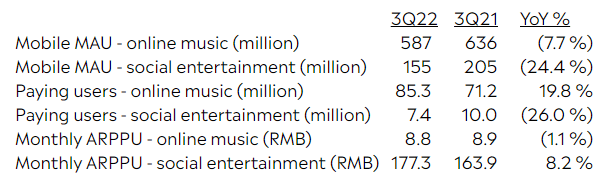

Although user metrics were somewhat disappointing, the company managed to push for higher monetization. In the September quarter, TME’s monthly user base for online music and social entertainment contracted by about 7.7% and 24.4% respectively, as compared to the same period one year earlier. Paying users for the online music segment, however, increased by 19.8% year over year, to 85.3 million, while a falling paying user base in the social entertainment segment (26% year over year contraction) was partly offset by stronger ARPPU (8.2%year over year expansion).

Tencent Music Q3 2022 results

TME’s Executive Chairman Cussion Pang commented:

As we are employing a balanced approach to grow paying users and ARPPU, revenues from online music services increased at a healthy pace in the third quarter, driven by year-over-year gains in subscriptions. Meanwhile, effective cost optimization measures and improved operating efficiency led to increased profitability amid challenging macro conditions this quarter

On the product innovation space, TME remained focused on developing more immersive experiences and leveraging the Tencent (OTCPK:TCEHY) ecosystem for content and promotion:

Propelled by our innovative spirit, we introduced numerous immersive and connective product upgrades in the third quarter. Users now have even more unique ways to interact with our content and with one another as they listen, watch, sing and play

Today, we cater to more diverse music tastes and nuanced user demands than ever before. Improved experiences, together with more privileges, translate into new, attractive monetization opportunities for us to actively tap into, such as TME Live, TMELAND, Super VIP Membership, Artist Subscription and more. To supplement our expanding world of music content, we also introduced a number of tech-supported tools to facilitate long-form audio podcast creation. Our deepened connection with Tencent’s broader ecosystem has continued to bolster our content production, promotion and monetization capabilities. Finally, developing music experiences with resounding positive influence is the backbone of our company. As we nurture these strengths, we continue to bring more social awareness and value to our music-empowered charity programs while supporting music and its evolution.

Strong Balance Sheet With More Shareholder Distribution Optionality

As of September 2022, Tencent Music had repurchased over $860 million of stock, pursuant to the $1 billion share repurchase program which the company started in 2021. Notably, this translates into an annual shareholder yield of close to 10%.

Personally, I am confident to believe that once the current share repurchase program is completed, TME will announce an additional $500 – $1,000 million to be executed in 2023 and 2024.

Investors should consider that TME’s financial position continues to be very strong: the company closed the quarter with approximately $2.7 billion of cash and short term investments, against total debt of only $856 million. Moreover for the trailing twelve months, Tencent Music managed to generate $816 million of operating cash flow.

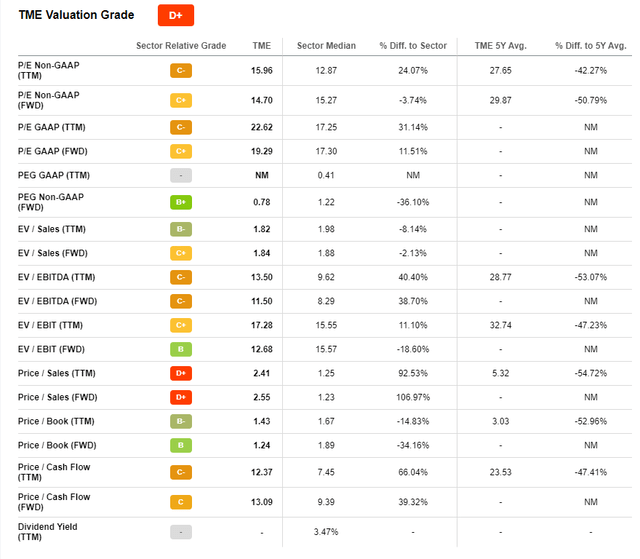

Valuation Approaching Fair Value

Following an aggressive price appreciation of approximately 50% within less than 2 weeks, I believe TME has re-rated to the company’s fair implied value.

Target Price Estimation

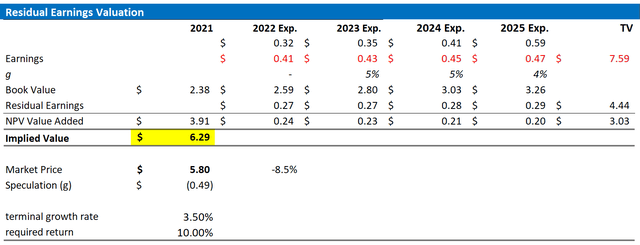

I update my EPS estimates for Tencent Music through 2025. However, I continue to anchor on an 10% cost of equity and a 3.5% terminal growth rate (about one percentage point higher than estimated nominal global GDP growth).

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $6.29 (versus $5.84 prior)

Analyst Consensus; Author’s Calculation

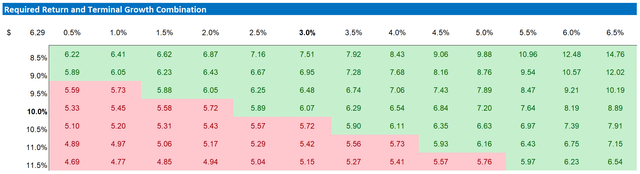

Below is also the updated sensitivity table.

Analyst Consensus; Author’s Calculation

Risks

As I see it, there has been no major risk-updated since I have last covered TME stock. Thus, I would like to highlight what I have written before:

First, the online music entertainment market in China is arguably quite mature. Although TME currently claims the lion’s share of the market, increased competition might pose a risk to TME’s profitability. A few weeks ago, NetEase sued TME for ‘unfair competition’.

Second, TME’s scope of competition is not limited to music. As the company is operating like a social media company, TME is also impacted by changes in user behavior and competition with video-streaming platforms.

Third, as TME is based and operating in China, the company is exposed to heightened political risks as the CCP aims to regulate tech/internet companies. Forth, Tencent Music Entertainment is exposed to IP licensing risks and loss of bargaining power with music labels and artists.

Finally, negative investor sentiment against China equities might cause the stock to trade at unreasonable low multiples until confidence improves – if ever.

Conclusion

After TME stock appreciated sharply, more than 50% within less than two weeks, I think it is an opportune time to take some chips off the table. Although I continue to like having some exposure to Tencent Music, I believe the company is now valued relatively in line with fundamentals. Although I slightly raise my base-case target price of $6.29/share, as a function of valuation I downgrade TME to hold/ equal weight.

Be the first to comment