z1b

A significant drop in Crescent Capital’s (NASDAQ:CCAP) share price in the past few months has created one of the best entry points since a pandemic-related selloff in early 2020. The drop in its share price is temporary since its fundamentals are strengthening, thanks to investments in growth opportunities, a diversified recurring income portfolio, and the ability to pay high dividends in the coming quarters. Additionally, its liquidity position is strong enough to meet debt maturity of $150 million in June 2023, and there are no further maturities until 2026. Overall, the attractive entry point, double-digit dividend yield, and potential for steady income growth make it an ideal dividend investment.

Panic Selling Created a Buying Opportunity

Crescent’s Stock Price (Seeking Alpha)

Despite one of the worst broader market selloffs in the first half of 2022, Crescent’s share price remained steady in the range of $17 to $19. However, lower-than-expected net adjusted income for the second quarter erased around 25% of its stock price in September. Its third-quarter results also failed to restore investor confidence as its adjusted net income once again fell significantly from GAAP earnings. The unrealized loss was blamed on the poor performance of one of its portfolio companies, which it acquired through the Alcentra merger. Its adjusted net investment income for the third quarter was $0.42 per share compared with GAAP earnings of $0.52 per share.

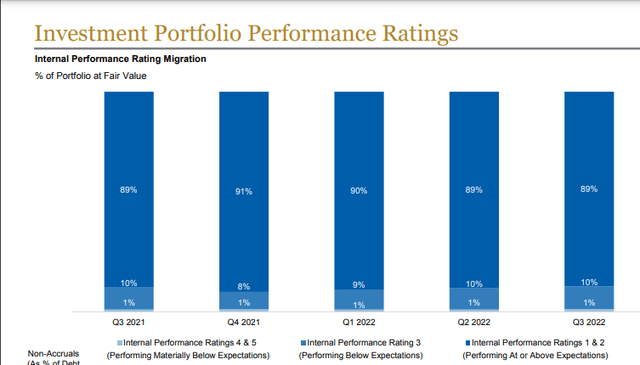

Investment Portfolio Ratings (crescentbdc.com)

I believe the negative impacts of economic and credit market trends have already been factored into Crescent’s portfolio and share price performance. The risk of further downside appears limited since unrealized losses were not due to portfolio deterioration. This is reflected in its internal portfolio ratings, which are consistent with prior quarters. As of the end of September, roughly 90% of its portfolio holdings were performing above expectations while only 1% of holdings were below expectations. Additionally, 25% of its portfolio consists of senior secured loans, 64% is unitranche first liens, and only 5% is unsecured. Equity and LLC investments make up 6% of the portfolio.

A steady growth in its income also demonstrates the portfolio’s strength. The company generated $29 million in net investment income in the September quarter, up 8% from the previous quarter and increased 13% from last year. In the fourth quarter and next year, its income is likely to increase due to two factors. The first is its strategy of making 99% of its debt investments on floating rates. In the earnings call, President and Chief Executive Officer Jason Breaux stated that the company hasn’t yet fully realized the benefits of higher market rates that have already occurred in the past two quarters due to monthly or quarterly repricing of portfolio base rates. The company estimates that a 100 basis point increase in short-term rates will increase its annual earnings by around $0.20 per share.

The second reason for steady earnings growth is the company’s shift from a non-recurring revenue model to an income-producing portfolio. Previously, the company generated significant income from fees, and dividends, and accelerated amortization of OID through its Alcentra merger and joint ventures. The drop in its net adjusted income in the past two quarters was also attributed to a decline in non-recurring income. In the third quarter, the company’s recurring revenue, which grew 18% year over year, made up 93% of its total investment income of $29 million.

Valuations

Based on Seeking Alpha’s quantitative system, the stock received an A plus grade on valuation, which indicates a buying opportunity. Currently, its shares are trading around 7.68 times trailing earnings and 7.96 times forward earnings, significantly below the sector median of 10.33 and 10.32 times, respectively. The stock also looks undervalued based on a price-to-book ratio of 0.69, down around 47% from the sector median. Additionally, even if the stock follows an upward trend in the quarters to come, sustainable revenue and earnings growth will support valuations. Further, its current stock price of $14 is substantially below the net asset value of $20 a share.

Crescent Capital’s Dividend Growth is Safe

The next step after evaluating a buying opportunity is to determine whether the company’s high yield is sustainable or just a high-yield trap. In 2022, Crescent maintained a regular quarterly dividend of $0.41 per share. In addition to its regular dividends, the company paid a supplementary dividend of $0.05 per share in the past quarters. In 2023, the prospects for dividend growth or supplementary dividend are high as Crescent’s annual earnings are likely to increase to $1.88 per share compared to an annual dividend of $1.64 per share in 2022. The significant gap in earnings and dividends offers room for a dividend increase in the next year. Besides earnings per share growth, the company’s healthy liquidity position also permits it to return more cash to investors in the following quarters. As of the end of the September quarter of 2022, the company had $22 million in cash and cash equivalents with the expectation to receive additional cash from winding down its joint venture. Moreover, the company’s $197 million of undrawn capacity is enough to fund the $150 million maturity of its 5.95% unsecured notes in July of 2023. After that, there are no remaining maturities until 2026.

Final Thoughts

Crescent’s share price selloff was the result of panic selling rather than deteriorating fundamentals or debt portfolios. However, the company’s strategy of increasing its focus on recurring revenue from its portfolio-originated assets would enhance its income growth potential in the future. In addition, the company appears well-positioned to increase its cash return in the next year due to a big gap in projected earnings and dividend payments. Overall, it appears that Crescent’s share price drop has opened up a long-term investment opportunity for dividend investors.

Be the first to comment