marchmeena29

This title is derived from James Truslow Adams’ bestselling “Epic of America” written in 1931. It is about the belief that success can be achieved by hard work, not through birth status, sheer luck, or social class. Thus, it is possible for people to move up the social ladder through hard work with one of the symbols of the American dream being homeownership together with education.

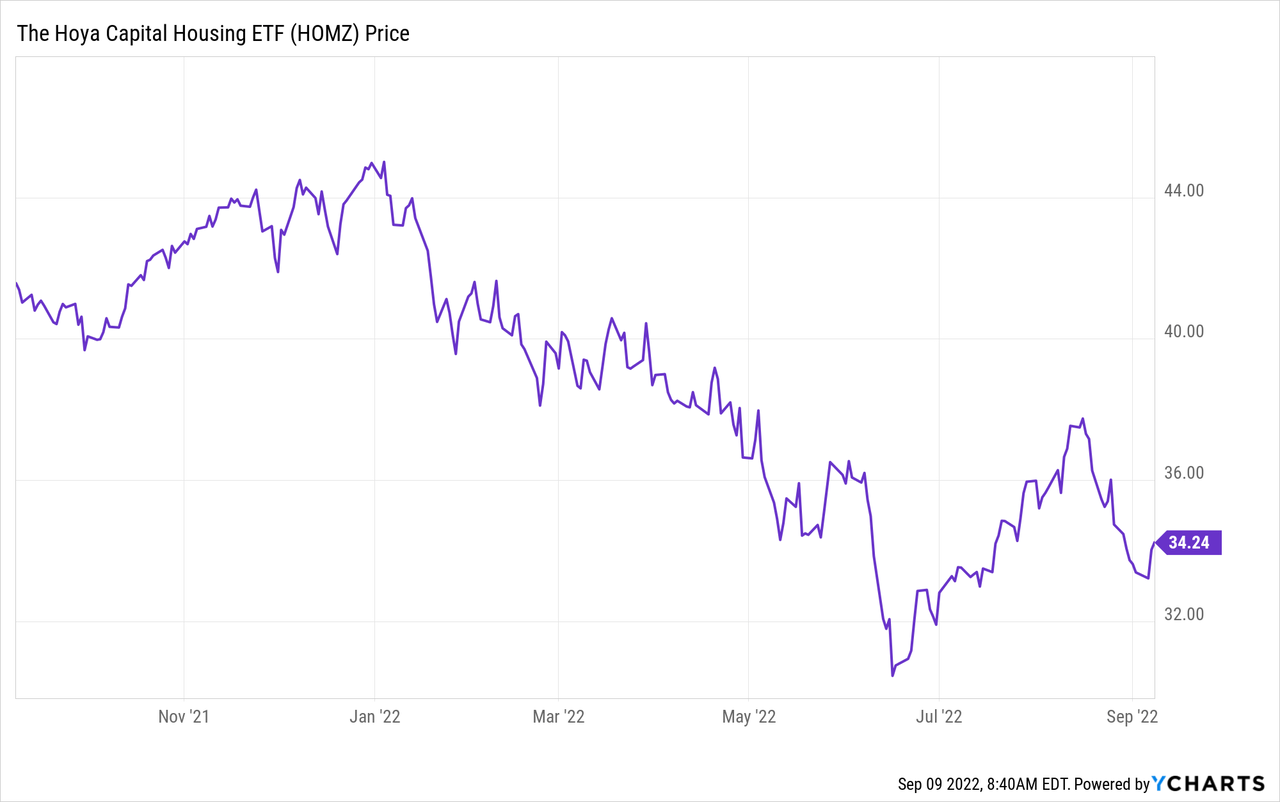

However, with the dark macroeconomic clouds hanging low on the horizon, the aim of this thesis is to assess whether the Hoya Capital Housing ETF (NYSEARCA:NYSEARCA:HOMZ) can enable investors to profit from homebuilding, especially after the fund’s one-year downside of nearly 18%.

I start by providing an overview of market conditions including the different economic indicators, which are not necessarily aligned.

Uncertainty Prevails but the Housing Industry has not Capitulated

First, the Federal Reserve is no longer aiming for a neutral monetary policy, but a tighter one in order to moderate the demand for credit, and ultimately prices. At first sight, this increases the risk of recession in view of oil prices remaining high, but, on the other hand, the labor market shows few signs of weakness. Still, there are doubts that business activities, in general, can improve as the world economy struggles with a lingering energy crisis and major central banks focus on monetary tightening.

In this respect, the manufacturing PMI still points to the slowest growth in factory activity since mid-2020 despite being revised slightly higher in August. Moreover, according to the National Association of Realtors’ Housing Affordability Index, buying a home has never been so unaffordable in more than 30 years, after the value of homes increased steeply since the start of Covid with want-to-be owners facing record prices.

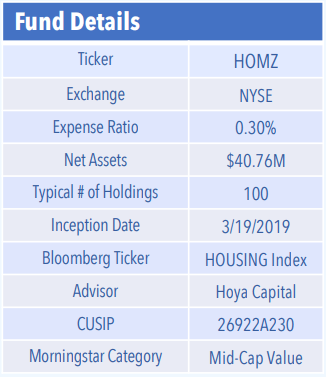

Such an economic environment could spell trouble for HOMZ which seeks to invest in one hundred of the fastest-growing real estate companies as its holdings may find it hard to continue growing their revenues.

HOMZ Factsheet (www.hoyaetfs.com)

Still, amid the morosity of the real estate sector, U.S. consumer sentiment rose in early August, after more signs that inflationary pressures may be easing. At the same time, there was an unexpected rise in the volume of loan applications, by 1.2% in the final week of July according to the Mortgage Bankers Association. Now, this period coincided with a fall in mortgage rates as measured by Freddie Mac, but, still, this indicates that the housing industry has not yet capitulated and is ready to bounce back to take advantage of any reduction in the cost of borrowing.

However, there are other reasons to be optimistic.

Business Segment Exposure and Downside Risks

First, we should not forget that with the savings rate skyrocketing due to travel restrictions during Covid as people saved more money, there is more disposable income to spend on housing needs. Also, despite some saying that the real estate sector is already in recession, there is a high probability that you will see a new building in construction or an existing one undergoing renovation if you look around your neighborhood.

Moreover, while the office REIT industry is more prone to economic cycles, houses and apartment blocks are more related to demand and supply. One example is illustrated by the first-timer buyers group, which accounted for 34% of all homebuyers in 2021. Also, last year saw an increase in homeownership rates, at 65.5%, up from 65.3% in 2020. This is no big increase, but, it has surely helped to halt the downtrend in the number of homeowners since 2004 when the figure was at 69%. Moreover, this rise shows that the American dream of owning a physical home is still alive despite the new generation called Genz (born between 1997 and 2012) being more skewed towards virtual reality.

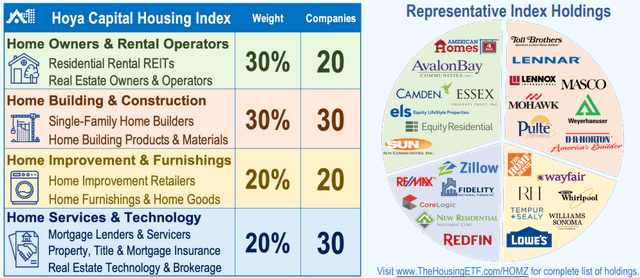

On the downside, there has been a decrease in the percentage of adults who own homes, namely by 10% between 1960 and 2017. They have instead shown a preference for renting. This trend may persist with Covid having encouraged more mobility in the workforce as with your laptop, you can work virtually anywhere. Still, HOMZ benefits from this work-from-home trend as it includes 30% of residential rental REITs, including owners and operators.

Exposure to the four housing segments (www.hoyaetfs.com)

Thinking aloud, with the trend in remote work persisting as many employees are now allowed to work 2-3 days away from the office, there should be continued demand for home improvement retail products.

Coming to home building and construction, this segment includes thirty related companies which constitute 30% of HOMZ’s overall weight as shown in the above table. Moreover, its aim is to target areas within the U.S. where there is a housing shortage as well as those age groups that are most likely to buy a house.

This brings us to one of the advantages of using the ETF option to invest in homebuilding stocks instead of painstakingly looking for individual stocks, and for their efforts, the fund managers charge 0.3% as fees. For this purpose, the Hoya ETF tracks the Hoya Capital Housing 100 index which targets home builders as well as products and materials.

The next step is to provide more precision as to the holdings.

The holdings and Comparison with Peers

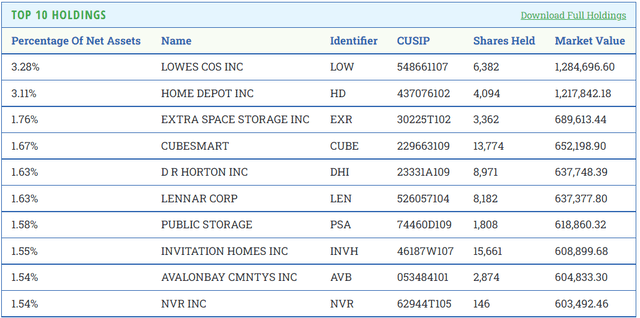

As social animals used to comfort, we tend to renovate our homes or apartments, sometimes at the insistence of our wives or partners. Thus, it comes as no surprise that Home Depot (HD) which constitutes 3.11% of HOMZ’s assets has managed to sustain growth at 3.75% in the June quarter, much better than the pre-pandemic regression of -2.68% in 2019, after the Covid surge of 24% in 2020. Growth has also slowed down because of higher wage inflation and supply-induced costs. Thus, the stock has suffered by more than 25% since its December 2021 peak, but Home Depot is adjusting its product mix to changing lifestyles, different consumer profiles, and supply constraints.

HOMZ Top Ten holdings (www.hoyaetfs.com)

On a more positive note, the consumer discretionary sector which includes Lowe’s Companies (LOW) was the top gainer among all the eleven sectors of the S&P 500 last week. Moreover, with 100 holdings, whose individual weight does not exceed the 3.28% mark, HOMZ accounts for low concentration risks by providing broad industry exposure.

However, on the cautionary side, the construction industry remains exposed to economic cycles, and compared to their large-cap counterparts, the smaller and mid-capitalization stocks which form part of the Hoya ETF may be more volatile during periods of economic uncertainties.

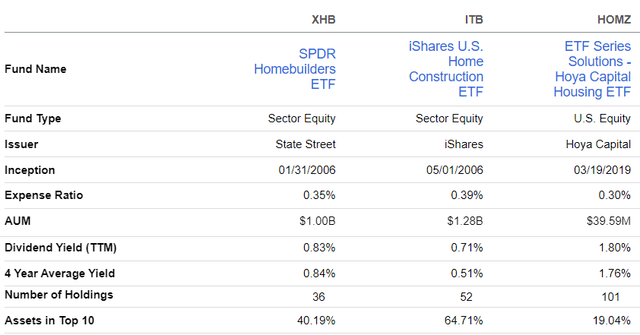

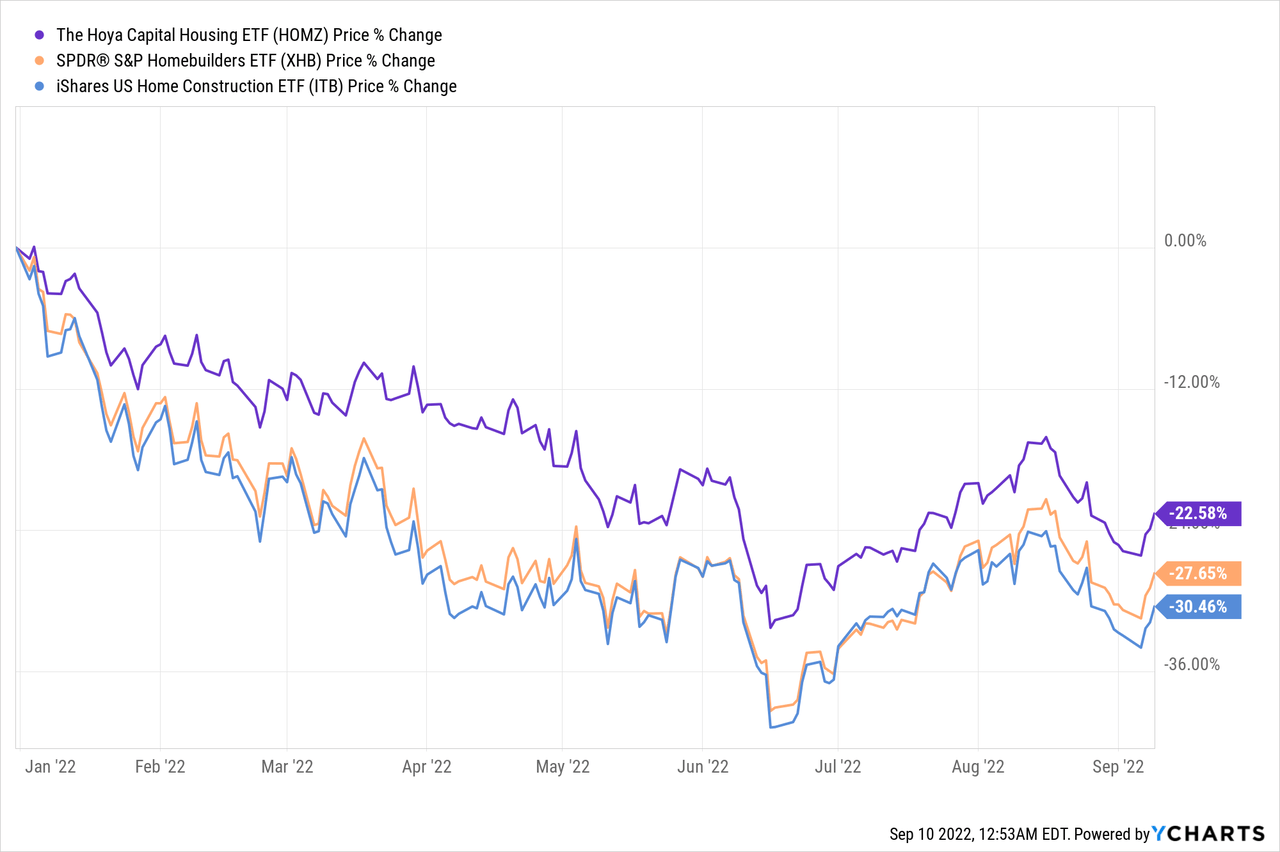

Still, a comparison with two other home builder ETFs reveals that HOMZ, despite suffering from a 22.6% downside, has outperformed both the SPDR S&P Homebuilders ETF (XHB) and the iShares U.S. Home Construction ETF (ITB) on a year-to-date basis as shown in the charts below.

This implies that since the start of acute market turbulence HOMZ is a better choice for those contemplating an investment in homebuilding despite the fact that the underlying fund manages much fewer assets than peers as per the table below. As a matter of fact, as of September 8, HOMZ’s total asset under management was at $39.41 million with a NAV of $34.27, which is slightly below its share price of $34.81.

In addition to outperforming its two peers on a price-performance basis, HOMZ, which targets real estate companies with the highest dividend growth, also pays the best yield of 1.8% as shown in the chart below, while charging less fees.

Comparison with peers (www.seekingalpha.com)

Discussion and Conclusion

Thus, based on the fact that the housing market has not capitulated, segment exposure, and market performance with respect to peers, I consider HOMZ to be a long-term buy with momentum indicators pointing to a potential bounce to the $36 level. However, do not expect a sustained upside this year.

Here, investors will note that my optimism is not due to speculation that the Fed may get less hawkish, but instead view real estate more as a hedge against economic downturns. For this matter, looking at the first half of 2020 when Covid hit, people did not suddenly start adopting apocalyptic views and stop building homes. Furthermore, businesses did not cease to invest, but, on the contrary, took advantage of the momentary pause in activities to renovate or upgrade their facilities.

Now, some will argue that interest rates were near zero with the Fed injecting a massive amount of liquidity into the system, but, even with the reverse monetary policy in force, people will not stop building homes, and patiently wait for the Fed to change its policy. In this respect, many realize that with deglobalization and the Eastern European war lingering, high inflation is here to stay and with homeownership being a priority, people are likely to cut down on other expenses like traveling abroad in a world where health is now at the top of people’s minds.

Moreover, economic slowdowns are not powerful reasons enough to stop people from dreaming and eventually becoming homeowners. To help them in this task is the fact that, compared to other countries, the U.S. is safer geopolitically and enjoys more of a temperate climate with abundant natural resources, including oil and arable land to produce food for its people. Furthermore, with onshoring of supply chains whereby more manufacturing is done domestically, it is likely for more people to relocate to the U.S. in turn keeping up demand for housing. Alternatively, for overseas investors, parking their money in ETFs like U.S-based HOMZ is viewed as a “safe haven” investment.

Finally, the American dream of homeownership is a powerful enough catalyst for the residential housing industry to continue growing, with HOMZ providing exposure to the fastest-growing real estate plays and paying a decent yield while you patiently wait for the upside.

Be the first to comment