David Ramos/Getty Images News

While US markets have been hit hard recently, especially in the tech space, one name that’s held up quite well is IBM (NYSE:IBM). Big Blue reported decent results back in April, so investors have been quite happy to hold the name in this tough environment. Unfortunately, a couple of major items are trending in the wrong direction, which seems likely to mean that IBM will need to cut its yearly guidance at next month’s earnings report.

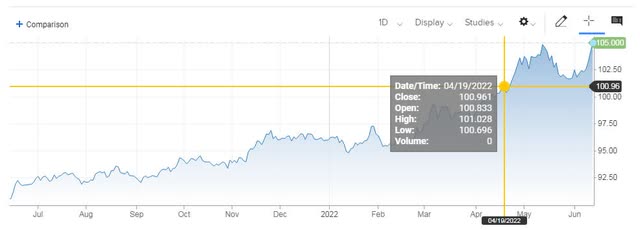

Perhaps the biggest thing I’d like to focus on today is the stronger US dollar. When the company reported results roughly two months ago, management called for constant currency revenue growth at the high end of the mid-single digit range. Overall, currency was expected to be a three-to-four-point headwind for revenues. However, as the chart below shows, the Dollar Currency Index (“DCI”) has rallied more than 4% since then.

With the Fed likely to raise rates this week and quantitative tightening starting this month, I don’t see the DCI significantly pulling back anytime soon. IBM’s segment results showed “non-Americas” revenue representing about half of the company’s total in Q1, but there are obviously non-US countries that make up the Americas segment. Based on currency movements alone, it seems likely that the yearly forecast will have to include at a minimum another point or two of currency headwinds. That will bring down reported revenues, part of which will flow to the bottom line and cash flow.

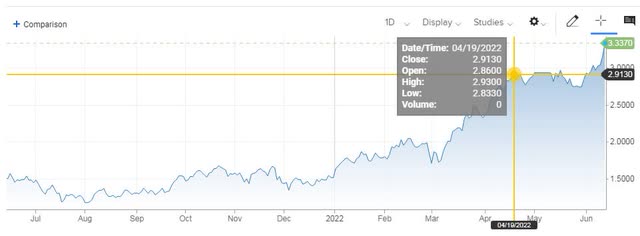

The US Dollar isn’t the only thing that’s moved higher lately that will impact corporate results. With inflation fears continuing to rise, especially after last week’s stronger than expected CPI report, treasury yields have also looked to set new multi-year highs. As the chart below show, the US 10-Year Yield is up more than 40 basis points since IBM’s April report.

I bring up the notion of rising yields because IBM is not like other technology giants that have huge net cash piles. With the company having made some large acquisitions in the past decade, especially Red Hat, the balance sheet isn’t in the greatest of shape. As the Q1 earnings release detailed – IBM ended the first quarter with $10.8 billion of cash on hand (which includes marketable securities), up $3.2 billion from year-end 2021. Debt, including IBM Financing debt of $12.2 billion, totaled $54.2 billion, up $2.5 billion since the end of 2021. In the company’s 10-Q filing, it listed the following pre-swap annual contractual obligations of long-term debt outstanding for the next couple of years as of March 31, 2022:

- Rest of 2022: $5.668 billion.

- 2023: $4.807 billion.

- 2024: $6.364 billion.

- 2025: $4.7 billion.

That’s over $21.5 billion in debt coming due in the next roughly three and a half years. A good portion of these borrowings were low rate debts, like a sub 2% 10-year offering coming due this August. Refinancing that debt now would likely cost twice the amount in interest. While IBM has enough free cash flow that will make it able to pay back some maturing notes, a debt pile of this size that is refinanced at say two percentage points higher could add a few hundred million in annual interest costs, lowering long term profitability and cash flow generation.

IBM management may also need to lower its forecast just because of the current business environment. Fears of a recession have risen recently, and the Atlanta Fed GDP Now Tracker is calling for less than 1% growth in Q2. We’ve heard a lot of comments in the tech space about job cuts and reductions in spending lately, and I don’t think IBM will be immune here.

The current average price target on the street is over $144, implying a little more than $7 of upside from here. That upside value nearly matches the stock’s 52-week high, whereas the yearly low was below $115. Should IBM pull back, I wouldn’t start looking at the name until about $123.66. That is where shares of the company currently yield 200 basis points more than the 10-Year US Treasury, based on the latest small dividend raise. Given the uncertainty in the tech space and the potential for a guidance cut, that 2 percentage point premium is where I’d start to look at an income producing name like this.

When IBM reports its Q2 results in about a month, investors should likely be preparing for a guidance cut from management. At a minimum, the stronger dollar will result in added currency headwinds. It remains to be seen if the ex-currency forecast also has to be cut in this current weak tech environment. Rising interest rates will also pressure the bottom line as more debts come due. The combination of these major headwinds could also result in the yearly free cash flow forecast coming down, limiting debt repayments in the short term. IBM shares have held up well recently, but if they start to pull back, I wouldn’t buy unless investors can get in with a decent amount of risk premium built in.

Be the first to comment