Ryland Zweifel/iStock via Getty Images

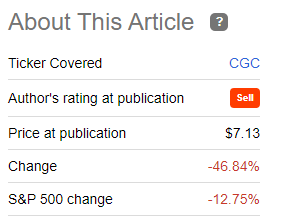

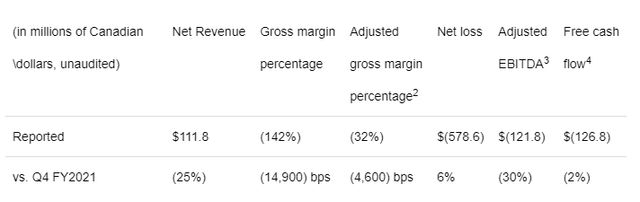

When we last covered Canopy Growth Corporation (NASDAQ:CGC) we did not expect it to be around in its current form within two years. That was perhaps a bold statement but one we felt was justified based on the facts of the situation. The stock has given a nod to our bearish view and dropped by about 50% since then.

Can Wana Save The Day? (Seeking Alpha)

The bulls might see this as an opportunity. We see this point as just another entry from where, again, you could lose 100% of your money. We tell you why below.

Hangovers Are No Fun

A really bad set of investors were spawned in the 2020-2021 timeframe. They latched on to revenue growth, “gross profits excluding everything” and every other metric that only made sense if you were investing in kindergarten. But, and here is the but, it worked for a while. The incredible dual fiscal and monetary stimuli firing off at the same time, made everyone believe the insanity was sustainable. CGC was a prime beneficiary. While its primary boom was pre-COVID-19, it did attain a rather remarkable 50X sales in 2021.

While that multiple has come down, it is nowhere near enough and here is why.

Growth Be Gone

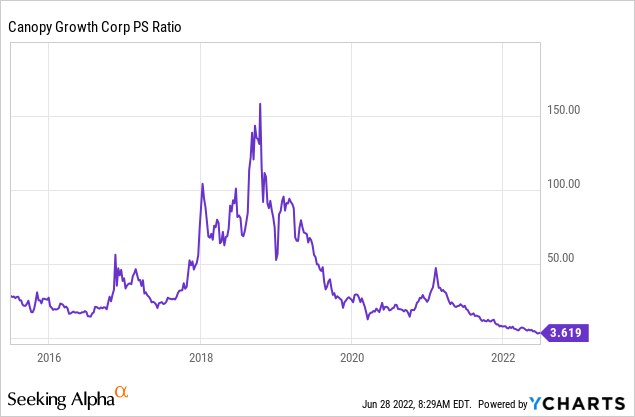

CGC took away the last pillar of hope for investors in the most recent quarter (10-K). Revenue declined year over year by 5%.

Revenues (CGC 10-K)

That might have been a shock to the growth crowd, but those were just the annual numbers. The last quarter numbers were absolutely horrific. Revenues of $111.8M were 25% lower than last year. That works out to about a $450 million run rate. As a reminder, investors should keep in mind that CGC had predicted a $1 billion sales run rate all the way back in 2019.

What About Profits?

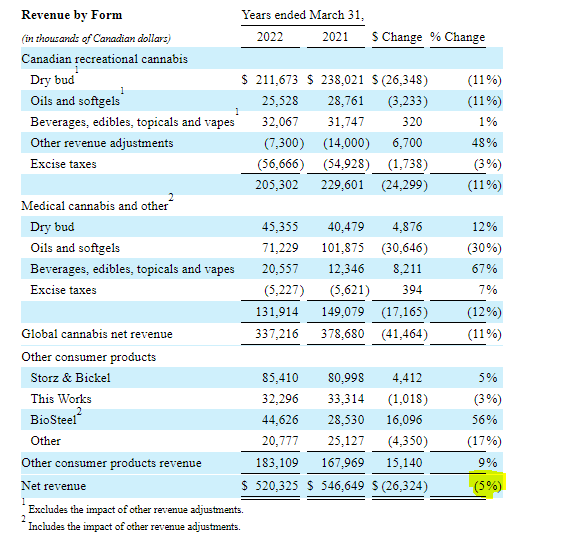

Reverse engineering profits is generally very difficult in companies where the idea was to grow to the point of profitability. So when sales go down and the company has been investing to grow for years, total chaos ensues. CGC was no different and adjusted gross margins looked to have appeared right out of a nightmare.

CGC Press Release

An adjusted gross margin of negative 32% is so bad, that we doubt anyone would fund this even as a startup today.

Free Cash Flow

The one bright spot in the report was that the cash burn was just $121.8 million. We are not being facetious here. Just based on the top line numbers, we would have expected this number to be miles ahead of last year. But CGC was able to control capital expenditures and squeeze at a tight quarter for cash burn.

Let’s Look At That Timeline

Over the last fiscal year, CGC has gone through almost a $1 billion of cash.

Cash and Short-term investments amounted to $1.4 billion at March 31, 2022, representing a decrease of $0.9 billion from $2.3 billion at March 31, 2021 reflecting EBITDA losses, capital investments and the upfront payment made as consideration for the option to acquire Wana Brands upon federal permissibility of THC in the U.S.

Source: Canopy Press Release

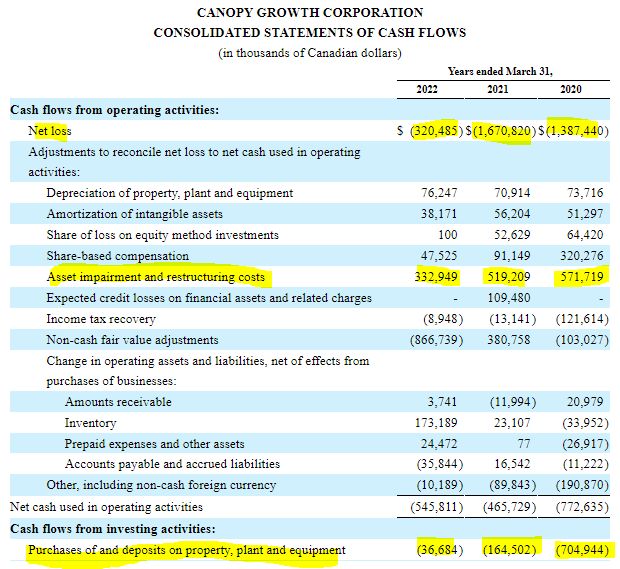

Over the last three years, CGC has had losses of about $3.4 billion. It has reported asset impairments and restructuring costs in each of the last three years.

Cash Flows (CGC 10-K)

Only by cutting back its investing (see last highlighted line above), was it able to keep cash burn modest.

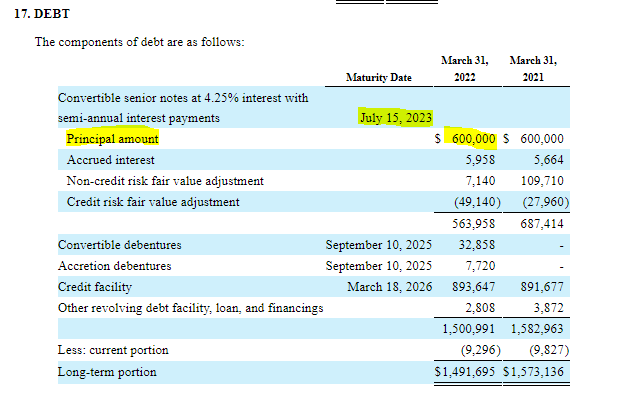

The first hurdle for CGC here is the July 2023 notes. As can be seen below, CGC has adjusted net debt based on the market price of those notes.

Debt (CGC 10-K)

They are actually now trading even lower than that, at 88 cents on the dollar. So your yield to maturity on those one-year (approximately) notes is about 19%. That shows just how bad the market thinks the risks are over here. We have five quarters from the above reported numbers till those notes are due and even a modest $100 million burn rate per quarter (total $500 million) and paying off the $600 million, will leave almost all of its cash wiped out. Let’s not forget that its credit facility is based on LIBOR plus 8.5% and all those rate hikes that Powell is throwing into the ring to fight inflation, will have big consequences. The risk is even more than that as a slightly more aggressive burn rate will prevent pay off of the loan. Remember that the credit facility requires a minimum of $200 million of liquidity at all times. So paying off the loan from cash is not feasible and there is only one realistic choice.

Verdict

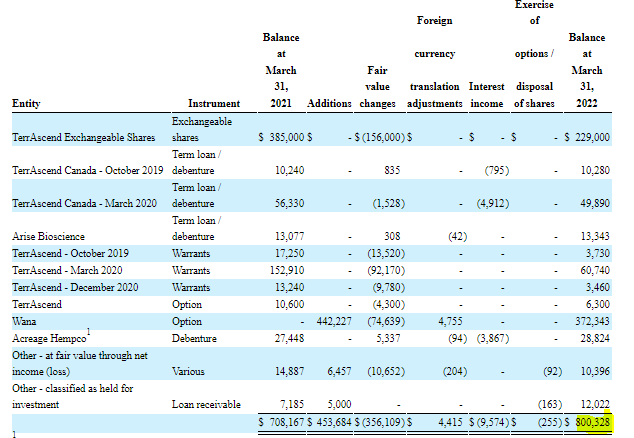

CGC will need to start monetizing its investments. In this market, we would expect a best case of a 50% haircut versus what they paid for it and at least 30% below what they are marking it at on March 31, 2022.

Other Investments (CGC 10-K)

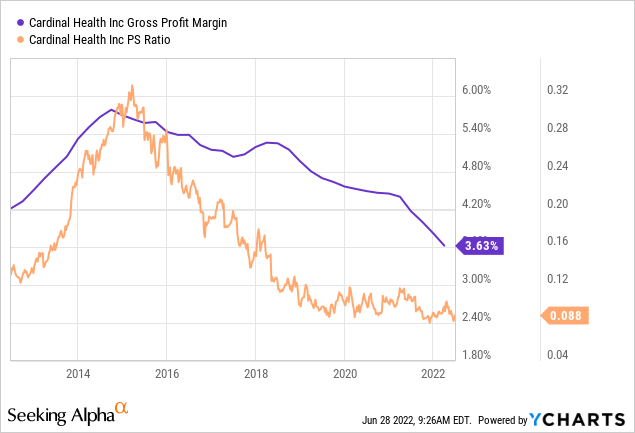

Even a distressed sale and pay off of debt would buy CGC about two years of cash burn at current rates. The stock remains incredibly expensive at 3.6X sales. We say that because our really best case is an extremely low margin business which can eek out tiny amounts of profits. If only we had someone like that who makes very small amounts of profits per dollar of sale. Oh wait, we do. Cardinal Health Inc. (CAH) is a superbly profitable company but makes very tiny amounts of profits (3.63% gross margins) per dollar of sale.

It is a dividend aristocrat and valued at 0.088X sales. If CGC miraculously turned their negative gross margins to reach 3.63% and somehow wiped out most of its debt, a 0.1X sales multiple would look good on them. That gets us to about 10 cents a share.

Be the first to comment