Editor’s note: Seeking Alpha is proud to welcome Macro Realist as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Drew Angerer/Getty Images News

Hello everyone. This will be the first time I’ve published an article on Seeking Alpha. I’m hoping to provide relevant macroeconomic and financial commentary that will help in crafting thematic investing ideas that can generate profitable trades within the 12-18-month time horizon. In my experience, this is how long it takes for a macro thesis to play out generally (not that it can’t last longer in many cases).

As a macro trader, I typically apply substantial leverage to my trades and make them selectively. I DO NOT invest under a traditional portfolio theory framework which emphasizes diversification and constant investment. I believe that strategy is appropriate for retirement accounts and other long-dated investment accounts but for driving portfolio alpha I favor this strategy as it: A) allows me to capture greater upside on my high conviction ideas, and B) avoid downside/drawdowns that standard buy-and-hold investors have no chance of avoiding.

My investing framework is simple, robust and repeatable. While is it somewhat restrictive, it will provide reassurance against costly mistakes. It consists of three parts:

- Don’t fight the Fed – Don’t buy risk assets when the Fed is tightening monetary conditions and buy and hold when the Fed is easing

- Align investments with macro fundamentals – for instance, you should buy commodities when there is an imbalance of supply and demand and economic conditions favor continued demand surplus (i.e., 1H 2022)

- Trade in favorable technical environments – this is particularly important in bear markets where mean reversion is sharp and consistent but in all cases, when trading with leverage entry timing is important.

I will try to be as transparent as possible about my own positioning; however, I do not plan on posting portfolio breakdowns or detailed returns and thus recommend that readers use my commentary to inform their macro framework, not copy my trades.

With that, let’s jump into the analysis.

Macro Outlook

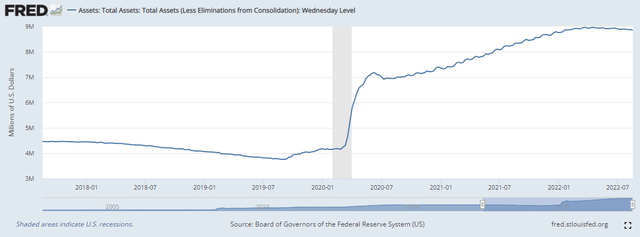

I will provide a more substantial analysis of the macroeconomic environment in the future; however, I will give the cliff notes here in an effort to not drag on too long in my first article. On the back of one of the quickest recession recoveries in modern history in 2020 and 2021, the economy was substantially boosted by a historically accommodative Fed policy and deficit fiscal spending.

Fed Balance Sheet

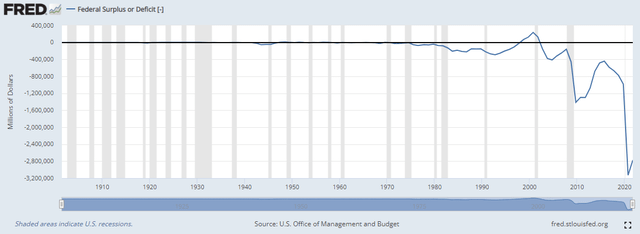

U.S. Fiscal Deficit

This combination of massive spending from both the Federal Reserve and U.S. Treasury resulted in a substantial boost in economic activity and risk asset prices. This spending (particularly the fiscal spending) also resulted in a large boost to inflation which has been more durable than most market participants expected at the beginning of 2022. The Fed has responded with appropriate tightening measures; however, the debate between the bulls and the bears has shifted to arguing over the timing of the Fed pivot/bailout. In my opinion, this is misguided.

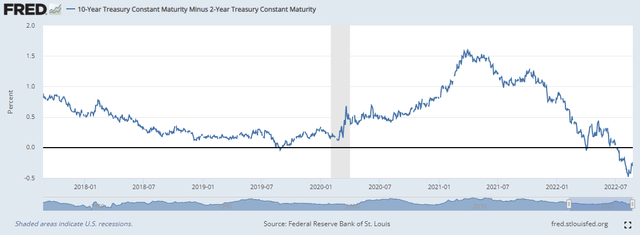

There are many economic factors which point to an impending recession in the US (if we are not already in one, I personally agree with NBER that we are not as of this exact moment) and I will discuss these in future articles. For now, let’s look at one of the simplest indicators which has a 100% accuracy track since the 1970s record in predicting recessions: the 2s/10s spread.

While this is not the Fed’s preferred market recession indicator, I will use it here for simplicity’s sake and because of its pristine track record. Bulls will try to make many arguments to hand-wave over the significance of yield curve inversion but the data has spoken conclusively: a recession is imminent. The next question is timing which I will address here.

Market Outlook

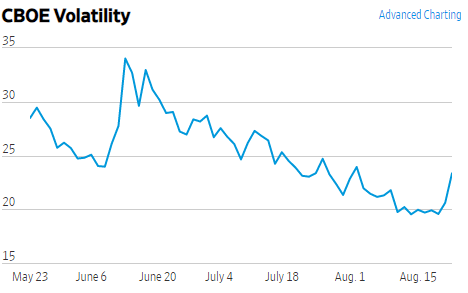

Since the middle of June, bull market optimism has resulted in a rally on risk assets (albeit on very low volume). VIX has steadily trended downward while US equities have grinded upwards, led by the NASDAQ.

WSJ

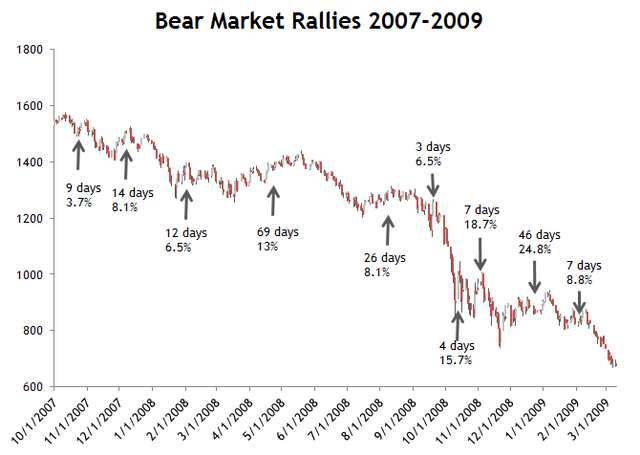

Referring back to my investment framework, I believe that we are clearly in a bear market given the continued hawkishness of the Fed combined with a deteriorating global macroeconomic environment. However, bear market rallies are notoriously prone to mean reversion.

QQQ performance during tech bubble crash of 2000

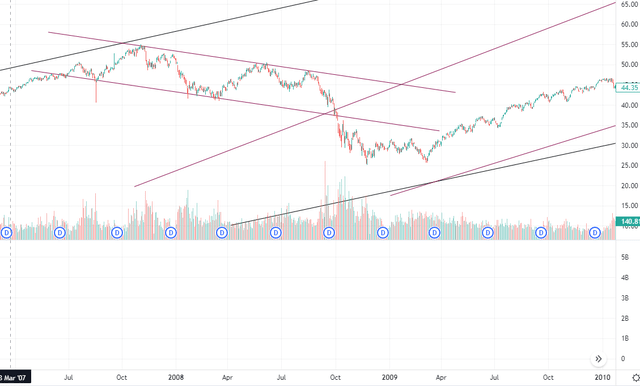

QQQ performance during 2008

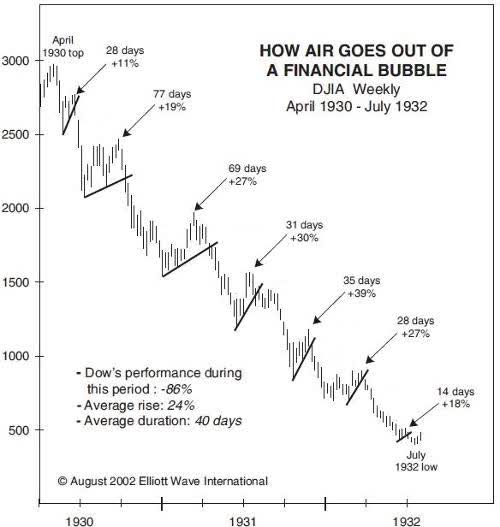

As you can see in both cases, there were substantial rallies within a distinctly downward channel in both cases. FOMO investor psychology combined with “long-term” investor frameworks and the simple fact that risk assets typically move up and not down lead to short-squeezing rallies in almost every recession. The average BMR (“Bear Market Rally”) since the 1950s lasts roughly a month and results in a 15% rise. This is simply a fact of life in bear markets.

investing.com Elliott Wave International

I’ve seen quite a few bulls argue that “the recession has been priced in” (Raoul Pal comes to mind). The simplest refutation of this claim can be seen in high yield credit spreads performance during previous recessions (as indicated by the grey bars below). High Yield OAS has peaked above 8.5% in each of the last three recessions; however, spreads currently sit at 4.6%, far below the peaks seen in the last three recessions. Why would this recession be different – it is not reasonable to believe that there will be substantially less credit risk in this recession than past recessions, particularly given the sharp rise in rates.

Technical Analysis

The S&P 500 has been displaying a classic bear market descending channel pattern since roughly December of 2021. I believe that we have just hit the top of the channel (near 4350) and will begin the descent to the bottom of the channel.

The fear and greed index has displayed roughly the same channel dynamics and has been a great oscillator thus far in this bear market.

With this in mind, I am currently positioned short, favoring riskier assets and equities with more credit risk (high yield credit, unprofitable tech, crypto). I believe that these assets will underperform not only in the near term but also over the next 12 months as the recession is priced in. The less risky approach here would be to hold cash which has been a winner in 2022 thus far and should continue to outperform risk assets in the short to medium term. In either case, do not get caught chasing the FOMO bear market rally.

Be the first to comment