Jaskaran Kooner/iStock via Getty Images

It’s been about 21 months since I put out my bullish article on global logistics company Expeditors International of Washington Inc. (NASDAQ:EXPD), and in that time, the shares are up about 46% against a gain of ~33% for the S&P 500. Obviously I want to take a victory lap here, because I so rarely have the opportunity to do that, but I want to look at the stock again to see if it makes sense to buy, sell, or hold at this point. I’ll make that determination by looking at the most recent financial history and by looking at the stock as a thing distinct from the underlying business.

There are a select group of readers on this site who might want more than a title and few bullet points, but much, much less than a usual “Doyle rant”, and it’s to those people that I offer the “thesis statement” paragraph. This paragraph hopefully sits in that goldilocks “not too short, not too much Doyle” middle ground that gives you as much as you need and no more. Here goes. I’m of the view that the hack that some people were making a big deal about back in late February was a “nothing burger” as the young people say. Apart from some dilution, I can find no fault with the financials here. The company continues to grow like the proverbial weed and the capital structure is rock solid, with cash representing over 50% of total liabilities. In spite of the fact that the dividend is growing rapidly, it remains very well covered in my estimation. Layer over this the fact that the valuation is even more attractive now than it was 46% lower ago, and I’ve decided I’m going to buy the shares. For those people who are more risk averse than I am at the moment, and want to sell puts, I offer what I consider to be a reasonable trade on that front, too. Although I won’t enter this trade myself, because I prefer to buy more shares, I offer the short put trade because I can imagine that some of my readers want such a trade idea and I’m absolutely obsessed with giving my readers what they want.

About Expeditors International’s Business

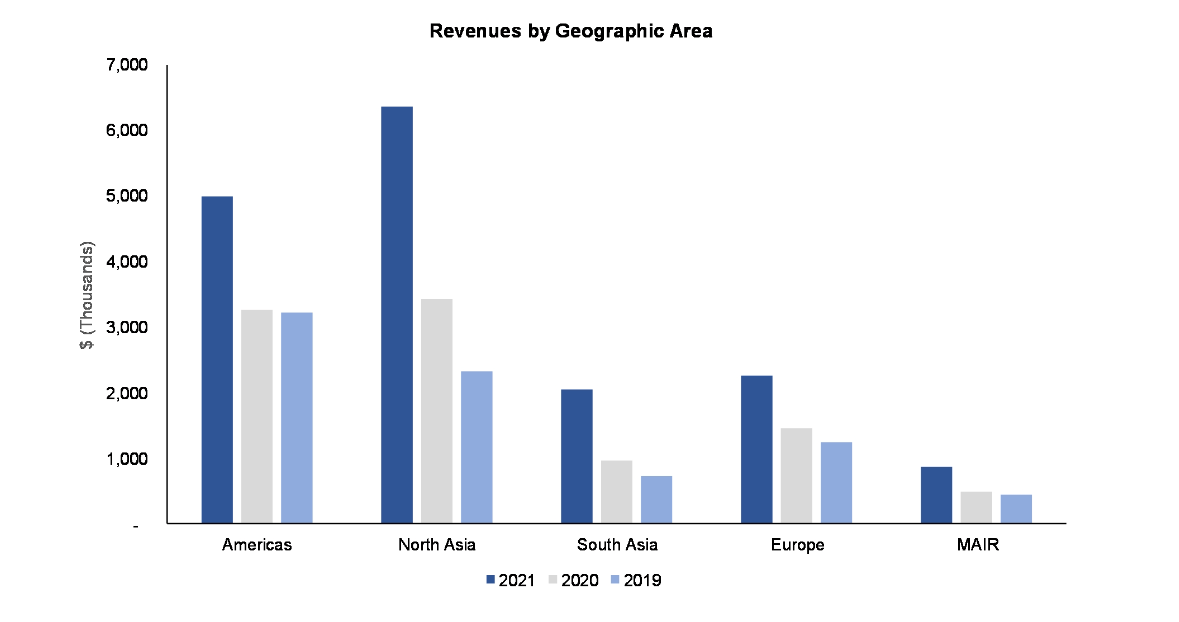

In case you’re unfamiliar with it, I would recommend going to check their website or reading the MD&A section of their latest 10-K. If you can’t be bothered with any of that, though, I’ll give you a brief summary. Expeditors is an asset light, 3rd party logistics company that has, over the past 43 years grown to be a global powerhouse. Specifically, it forwards freight by air, sea, and land from over 300 locations globally. The company is relatively well geographically diversified, per the following plucked from the pages of their latest 10-K for your enjoyment and edification.

Expeditors Geographic Breakdown (Expeditors International 2021 10-K)

They’re an obvious beneficiary of increased freight traffic throughout various global supply chains.

Financial Snapshot

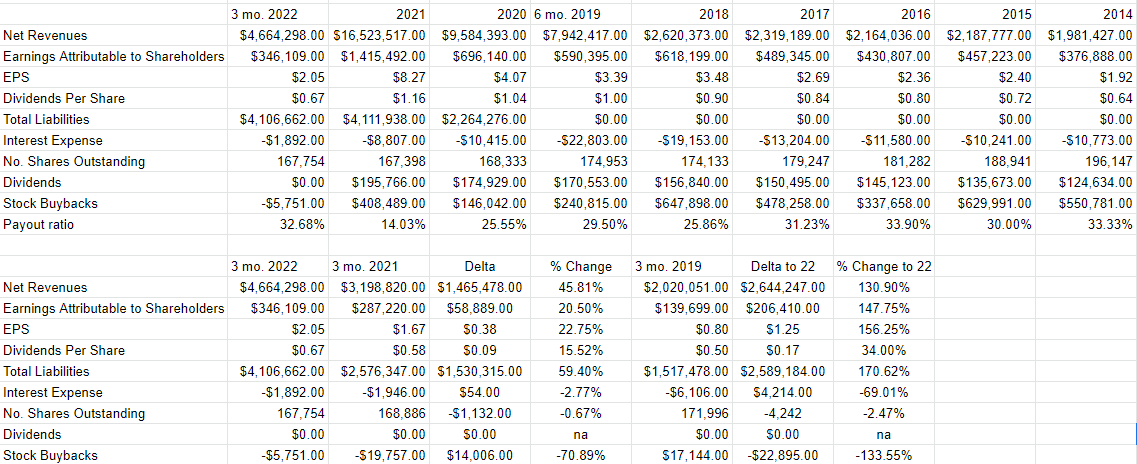

In some sense, this is a new enterprise, so any comparisons to the past should be taken with a grain of salt. For instance, the company acquired Fleet Logistics’ Digital Platform. That said, I think the latest financial results have been quite good, especially in light of the cyberattack the company suffered in late February.

Specifically, revenue was up by about 45.8%, and net income was up by about 20.5%. The company continued its tradition of rewarding shareholders with another dividend increase, up 15.5% from $0.58 to $0.67. The dividend remained well covered for the quarter, with a payout ratio of just under 33%. In addition, the capital structure remains very strong, as evidenced by the fact that cash on hand represents fully 52% of total liabilities. Financial performance during the most recent quarter looks even better when compared to the same period in the pre-Covid era. Revenue and net income are now higher by 131%, and 147.75% respectively.

It’s not all animated bluebirds and delicious taste sensations over at Expeditors, though. The one thing that’s keeping me from characterizing this company as “near financially flawless” is the fact that the share count keeps growing. Dilution is a problem in my estimation, because it’s not really necessary. The company obviously has sufficient cash to fund operations, so selling shares at current valuations (see below) is troublesome in my estimation.

That said, there’s nothing here that would dissuade me from buying more shares. Now that the stock’s down a bit for the year, I’d be happy to buy more at the right price.

Expeditors International Financial History (Expeditors International investor relations)

The Stock

I think the behavior of the stock after the cyberattack of February 20 is interesting. Specifically, I am intrigued by the fact that the stock is only down about 3% since the attack. I remember talking to some fellow investors about this cyberattack, and these gentlemen seemed to be full of sound and fury, but in the end their worries signified nothing. In my view, this speaks to the robustness of the business, and is some evidence that the market is willing to look past short term, though severe, problems. This adds further weight to the idea that I’d be willing to buy more of this at the right price.

If you’re one of my regulars, you may have blanched a bit at the phrase “at the right price.” This is because you may have heard me drone on about the fact that just because a company is very profitable, doesn’t make it a good investment. This gets to the heart of why I consider the stock and the business to be distinct things. I’ve made this point so often that I’ve likely veered into “tedium” territory. Now that I’m in “tedium territory”, I may as well lean into it and play to my strengths and be tedious again, so here goes. A business is different from the stock that supposedly represents it. A business buys a number of inputs, performs value adding activities to those, and sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. The crowd changes its views very frequently which is what drives the share price up and down. The crowd may also drive a stock up or down based on results of a different company in the same industry. For people interested in challenging this idea or learning more about it, I would research the concept of “Mr. Market.” Finally, the stock may be whipsawed by the crowd’s changing perspectives on the overall stock market, or “stocks” as an asset class. All this leads me to conclude that the stock is sometimes a poor proxy for the underlying business.

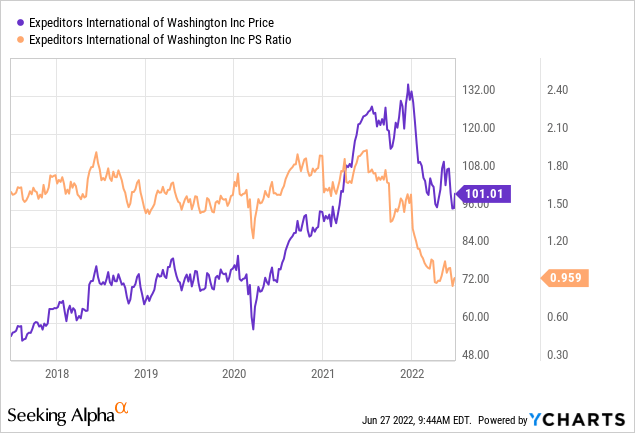

Finally, in my experience, the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. Anyway, as my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Before getting too excited about an investment, I want to see the stock trading at a discount to both the overall market, and to its own history.

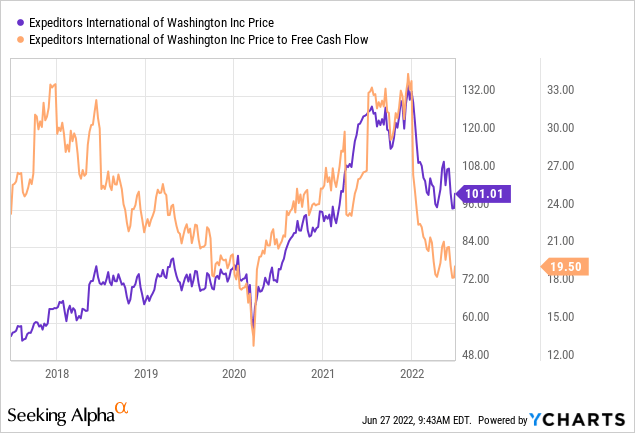

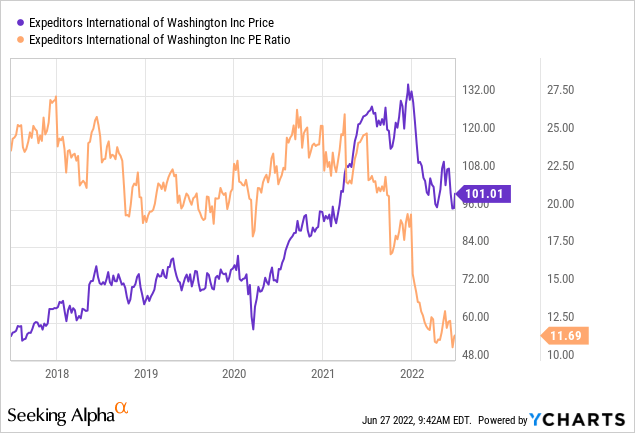

When I review the valuation here, I become as giddy as I ever do about a stock. This is because the shares are actually about 9% cheaper on a price-to-free cash flow basis today than they were when I last reviewed the name, per the following.

At the same time, price-to-sales, and price-to-earnings ratios are at multi year lows.

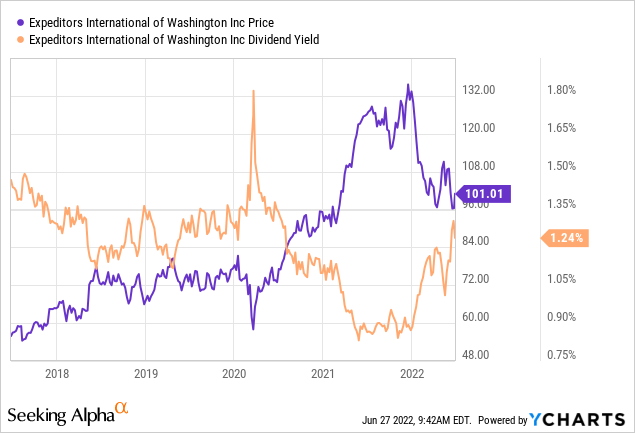

While investors are paying less, they’re currently getting more than they have in about two years.

Given the above, I’d be happy to buy more shares at current prices. While I understand that freight will likely slow over the coming quarters, I think the share price reflects that possibility, so I’m willing to buy.

Options As An Alternative

For those who like this company, but may be nervous about buying at current prices because they are nervous about a drawdown in stock prices, I think selling put options makes some sense at this point. While I like the current stock price, I couldn’t argue against the possibility of buying at an even cheaper price, which is where short put options come in. Selling puts creates what I consider to be a “win-win” trade. Either the investor buys a company they like at a price they like, or they collect some premium. Neither outcome is terrible in my estimation.

In terms of specifics, I’d sell the November puts with a strike of $75, which are currently bid at $.85. So, if the shares drop below $75 over the next several months, you’ll be obliged to buy, but will do so at a price that lines up with a dividend yield of about 1.67%, and a PE of about 8.7 times. If the shares remain above $75, you’ll pocket a reasonably decent premia for what can only very loosely be called “work.”

I should also point out some risks associated with this strategy because you may be unaware of the fact that everything comes with risk. Here goes. Broadly speaking, I’d say there are two types of risk associated with this strategy, the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices, I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. Take my word on this one, as it’s informed by painful history.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that Expeditors stock price goes to $200 per share between now and the expiration of the put contract. Sure, the puts will expire worthless, which is a great outcome in some ways, but you won’t catch any of the upside from the stock. This can be emotionally painful, but we need to remember that this is a lower risk trade than buying the stock, and lower risks come with lower rewards.

Secondly, it can be emotionally painful when the shares crash below your strike price. So far whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of this phenomenon.

If you understand these risks and can tolerate them, and don’t want to buy the stock at the moment, I would recommend that you sell puts in lieu of sitting around and waiting. I think they enhance the return on the stock and lower the overall risk of the investment.

Conclusion

I like the combination of the multi-year low cheap valuation, resulting in a multi-year high dividend yield here. Although there’s a significant chance that freight volumes will drop over the coming years, I think that eventuality is already baked into the price. I’d remind investors that you do well over time if you buy at a time when others are fearfully selling. For those interested in the chance of buying at an even deeper discount, I think the puts described above make the most sense. I don’t think there’s much chance that the shares will fall that far, so I’ll just buy the stock, but the short puts offer a viable lower risk (lower return) alternative in my estimation. However it’s manifested, I think investors would be wise to take a bullish position here before price rises to match value here.

Be the first to comment